- Short Squeez

- Posts

- 🍋 Yale Fumbles the Bag

🍋 Yale Fumbles the Bag

Plus: A $12B valuation for the pre-revenue startup founded by OpenAI’s former CTO, Bill Ackman to donate $10M after his tennis debacle, and the Chainsmokers raise $100M.

Together With

"We’re going to be involved in both JPMorgan deposit coin and stablecoins to understand it, to be good at it.” — Jamie Dimon

Good Morning! JPMorgan notched a surprise 7% jump in banking fees, signaling a dealmaking rebound even with tariff headwinds. Jamie Dimon publicly backed Jerome Powell in a rare dispute with Trump.

Blackstone is investing $25 billion in AI data centers. Bill Ackman will donate $10 million to the Tennis Hall of Fame after his tournament debacle. Apple struck a $500 million rare earth deal, and another key Tesla exec departed.

Plus: Ex-OpenAI CTO closed a $2 billion round at a $12 billion valuation for her pre-revenue company, the Chainsmokers’ VC firm just raised $100 million, and step counting might actually be making you feel worse.

Want a summer with fewer midnight and weekend “pls fix” emails? See how Macabacus can make that a reality.

SQUEEZ OF THE DAY

Yale Fumbles the Bag

When you sell the dip, you better not miss. Looks like Yale lost out big time by (accidentally) selling its stake in Circle, one of the year’s hottest crypto IPOs.

Last month, Yale’s $41 billion endowment decided to offload billions in private investment stakes. Usual suspects like Blackstone and HarbourVest lined up for the scraps. But the real winner? California’s $556 billion state pension giant, CalPERS, which scooped up about $550 million of Yale’s assets at under 90 cents on the dollar, a steeper discount than other buyers managed.

Among Yale’s offloaded goodies was a General Catalyst fund stake that held shares in crypto company Circle. The only problem? The marketing documents Yale circulated valued the fund as of December 31, totally missing the fireworks about to come.

Circle went public on June 5, and its stock price exploded 480%, gifting CalPERS a swift $100 million+ paper profit.

That payday helped juice CalPERS’ private equity returns to +14.3% for the year ended June 30, a nice rebound for a fund that’s spent years trying to shake off a “lost decade” of lagging returns and leadership churn.

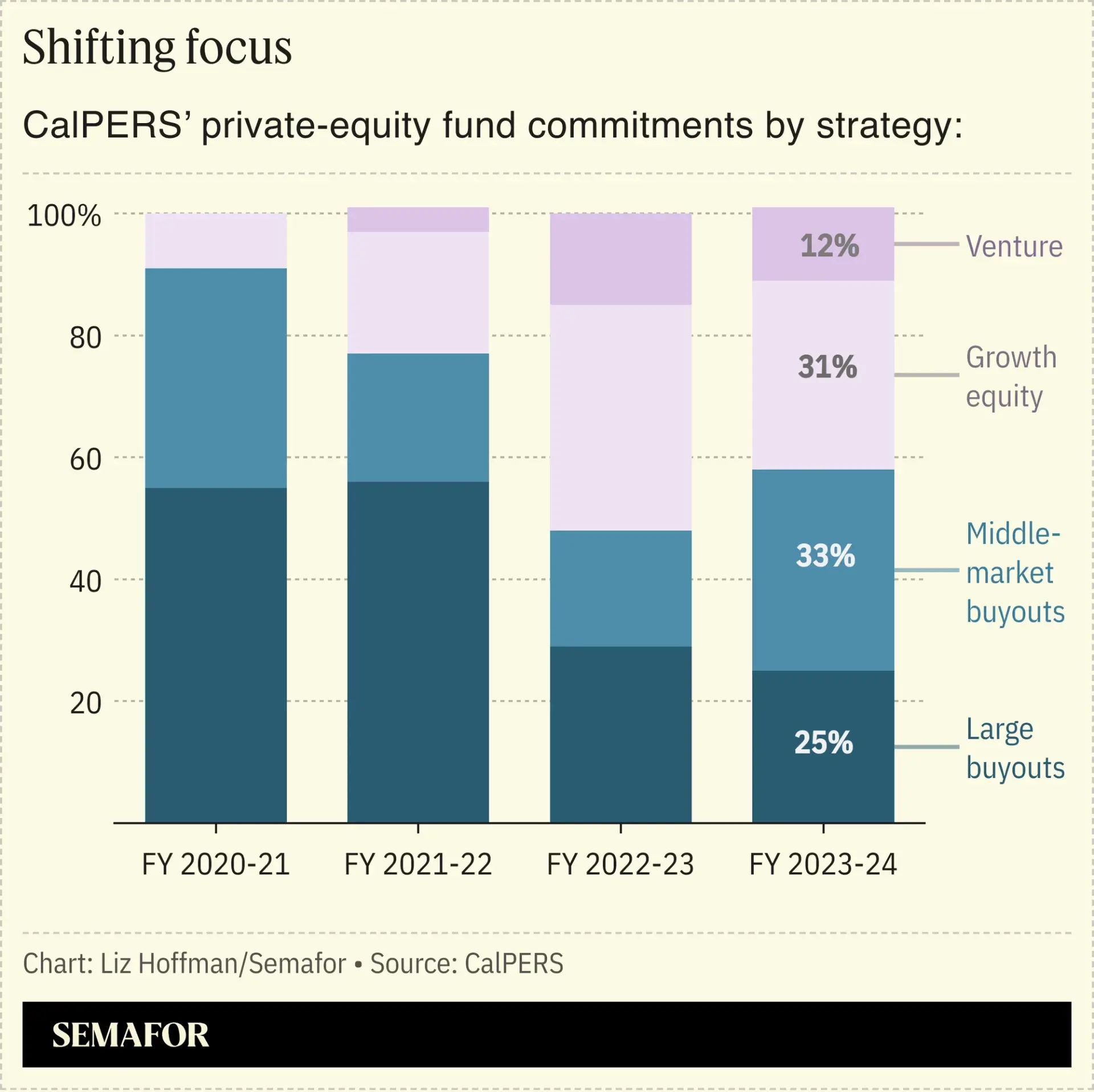

Under new PE boss Anton Orlich, CalPERS has pivoted away from mega buyout funds and toward venture and growth equity deals, sometimes elbowing other investors aside for direct co-investments.

Takeaway: This is the kind of headline that’s probably getting someone at Yale’s storied endowment fund fired. Ivy League schools have been quietly dialing back their private equity exposure, while many, including CalPERS and state universities, are buying the dip, and for now it looks like they’re the ones having the last laugh.

HEADLINES

Top Reads

JPMorgan Chase tops estimates on stronger-than-expected investment banking (CNBC)

Big banks say business is humming along (Axios)

CalPERS pushes further into private equity after best results in 4 years (FT)

Jamie Dimon backs Jerome Powell over Trump in Fed fight (Guardian)

Jamie Dimon says the rush into private credit may have peaked (BB)

How a British private equity firm became a $100bn tech success (FT)

Blackstone to invest $25B in AI data centers and energy (Axios)

Google commits $28B to power AI (CNBC)

Bill Ackman gives $10M to tennis hall of fame after tournament fiasco (FOS)

Trump touts billions in investments to create AI hub in PA (WSJ)

U.S. inflation reaches 2.7% as Trump tariffs hit (Axios)

SMFG considers boosting Yes bank investment by $1.1 billion (BB)

Unilever bets $1.5B on soap, squatch, and Sydney Sweeney (Buysiders)

Sandwich chain Jersey Mike’s to raise $40M in ABS sale (BB)

Tesla’s top North American sales executive leaves amid slump (WSJ)

Why tariffs won’t kill corporate earnings (Axios)

Trump’s tax law sweetens secondary deals in VC (WSJ)

Apple strikes $500M rare earth deal (CNBC)

Chainsmokers' VC firm raises $100M in fresh funding (BB)

Mira Murati's AI startup Thinking Machines valued at $12B (Reuters)

PRESENTED BY MACABACUS

Turn New Hires into Financial Modeling Machines

Deal flow doesn’t slow down so you can babysit slides. Macabacus turns new hires into model-and-deck machines, right inside Microsoft Office.

Excel ↔ PowerPoint Linking: tweak the model once, every linked chart & table in the deck updates.

Formula & Precedent Tracer: catch #REF chaos before your model ships; analysts and interns learn best practices as they click.

Shared Libraries: centralized access to firm-approved slides, models, and snippets to keep branding FTC-level tight.

Doc Builder: CIMs, working group lists, engagement letters, and NDAs, built via a quick questionnaire; headers, footers, and styles auto-populate.

Deal-Ready Tombstones: filter by sector or size, insert, flex; access millions of logos with Logo Library—no more Google-Image scavenger hunts.

AI Writing Assistant: Create copy at warp speed while keeping your documents on-brand with your company’s voice and language standards.

Result: Day-1 analysts, VP-grade output, and a summer with fewer midnight and weekend “fix my deck” fire drills.

CAPITAL PULSE

Markets Rundown

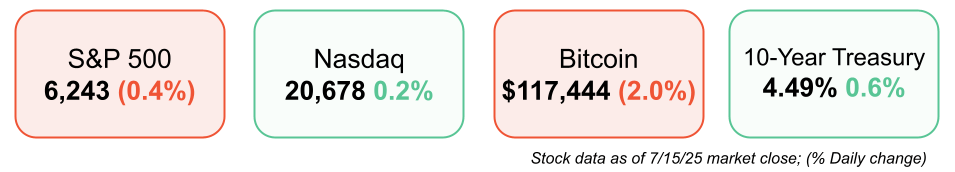

Market Update

Equities closed mixed as June CPI inflation came in line with forecasts.

S&P 500 and Dow Jones finished slightly lower, while the Nasdaq posted gains.

J.P. Morgan and other big banks kicked off earnings season with strong results.

Treasury yields climbed, with the 10-year yield up to 4.48%, near the top of its recent range.

WTI crude oil rebounded modestly after last week’s slide.

U.S. dollar strengthened against major global currencies.

Economic Data Highlights

June CPI inflation released today showed headline CPI at 2.7% YoY, just above expectations.

Core CPI came in at 2.9% YoY, matching forecasts and slightly above May’s 2.8%.

Monthly core CPI rose 0.2%, a touch below the expected 0.3%.

Declines were seen in categories like meat, dairy, used cars, and airline fares.

Inflation remains contained despite rising tariffs, but headline CPI could exceed 3.0% in coming months due to price pass-throughs.

Long-term inflation expectations remain anchored, with 10-year breakevens near 2.37%.

Reported Earnings

J.P. Morgan (JPM) – Beat expectations on stronger-than-expected trading and investment banking revenue.

Citigroup (C) – Posted solid results with stable credit quality and rising net interest income.

BlackRock (BLK) – Slight miss on AUM growth but reported solid ETF inflows and robust long-term outlook.

Earnings Today

ASML (Before Open) – Investors watching bookings and outlook for EUV demand amid rising AI chip investment.

Bank of America (BAC) (Before Open) – Focus on net interest income trends, loan growth, and credit quality.

Goldman Sachs (GS) (Before Open) – Expected rebound in investment banking revenue; watch trading and asset management units.

Morgan Stanley (MS) (Before Open) – Eyes on wealth management flows and M&A advisory strength.

Johnson & Johnson (JNJ) (Before Open) – Focus on pharma pipeline growth and medical devices sales recovery.

Progressive (PGR) (Before Open) – Market watching underwriting margins and premium growth in auto insurance.

United Airlines (UAL) (After Close) – Key watch on summer travel demand, fuel costs, and forward bookings.

Discover Financial (DFS) (After Close) – Monitoring net charge-offs, consumer spending, and loan loss provisions.

Kinder Morgan (KMI) (After Close) – Investors looking at natural gas volume trends and 2025 EBITDA guidance.

Movers & Shakers

(+) CoreWeave ($CRWV) +6% after the company will invest $6B into a Pennsylvania AI data center.

(+) Citigroup ($CITI) +4% because the bank beat earnings.

(–) BlackRock ($BLK) -6% after the asset manager missed on earnings.

Private Dealmaking

Nuclidium, a radiopharma startup, raised $99 million

SandboxAQ, an AI model developer, raised $95 million

ServiceUp, a vehicle repair management platform, raised $55 million

Renasant Bio, a kidney disease drug developer, raised $54.5 million

Moment, a portfolio management platform, raised $36 million

Aqtual, a diagnostic test drug developer, raised $31 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

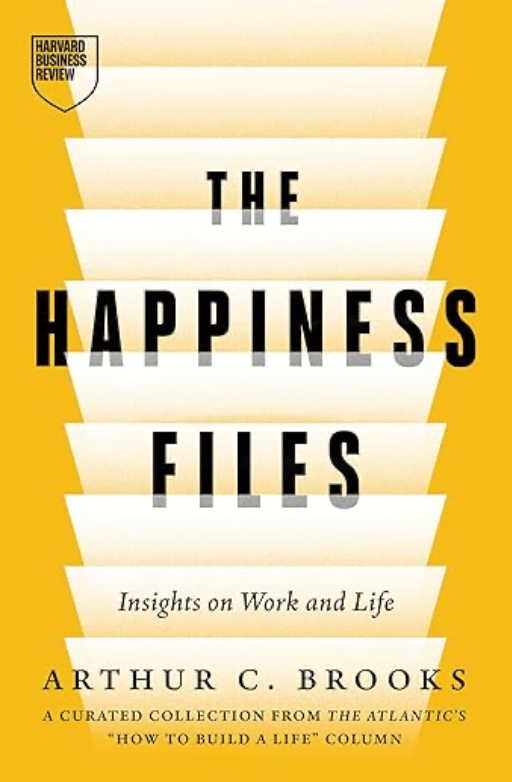

The Happiness Files

Description: A curated collection of Brooks’s best essays from The Atlantic, organized around themes of work, purpose, relationships, and emotional well-being. Equal parts science and soul, this book helps readers build a measurable, meaningful life—one practical insight at a time.

Rating: Goodreads: 3.75 / 5 (early ratings)

Book Length: 272 pages

Ideal For: Professionals, leaders, and anyone seeking bite-sized wisdom to live with more clarity, purpose, and calm.

“If you want to be happy, you need to stop trying to be successful in the eyes of other people—and start choosing your life like it’s your own.” — Arthur C. Brooks

PRESENTED BY HEBBIA

What Public Companies Hold BTC?

Curious which public companies are quietly loading up on Bitcoin? Hebbia used its AI platform to analyze thousands of SEC filings and uncover the real balance sheet exposure most investors miss.

135 companies now collectively hold ~657,000 BTC—about 3.3% of all Bitcoin in existence

MicroStrategy leads the pack with ~423,000 BTC, but dozens of lesser-known firms have hidden exposure via treasuries, ETFs, or debt vehicles

The average BTC-beta is 0.62—and a dozen companies have an even higher correlation than Bitcoin itself

Crypto doesn’t seem to be speculation anymore. Companies are building meaningful financial exposure by adding it to their balance sheet.

Want to explore more of what it can do? Book a demo to see what Hebbia can find for your team.

DAILY ACUMEN

3-Minute Hedge

Wall Street hedges risk with options. You can hedge death with squats.

Seriously. Even if you hit the gym daily, sitting for 8+ hours straight can reverse the benefits. Research shows that long sedentary spells—whether in meetings or market watch—raise your risk of early mortality by up to 40%.

But there’s a cheat code: “exercise snacks.” Just 3 minutes of movement every 45 minutes—10 squats, a stair sprint, a brisk loop around your office—can meaningfully improve blood sugar, cardiovascular health, and metabolic function.

One study found these micro-breaks outperformed a single 30-minute walk in regulating glucose levels. Turns out it’s not just how long you move, but how often you interrupt the stillness.

In investing, frequency matters: compound interest, dollar-cost averaging, drip-fed positions. Your health? Same idea.

So next time your Apple Watch tells you to stand, don’t dismiss it. Do a few lunges. Make the elevator wait. Hedge your health the same way you hedge your portfolio—proactively, consistently, and with intent.

Your ROI? Decades.

ENLIGHTENMENT

Short Squeez Picks

Is step counting just making us feel worse?

Habits that will turn your biggest goals into reality

To live longer, do these things

If you say no to these questions, you may be unhappy in your relationship

10 tiny microhabits for better health

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply