- Short Squeez

- Posts

- 🍋 Wall Street’s Most Expensive ‘No’

🍋 Wall Street’s Most Expensive ‘No’

Plus: Mercedes-Benz puts Microsoft Teams in cars, Goldman pauses layoffs, Blackstone tops $1.2T AUM, and the 5¢ meme stock behind 15% of US trading volume.

Together With

"We believe the dealmaking pause is behind us." — Jon Gray

Good Morning! In a feature literally no one asked for, Mercedes-Benz is adding Microsoft Teams to its vehicles. Goldman Sachs is pausing a second round of layoffs after a stronger-than-expected Q2 from its investment bankers.

The EU and US reached a trade agreement, with 15% tariffs on European exports to America. Blackstone crossed a record-breaking $1.2T in AUM. Hackers leaked 72,000 photos and IDs from Tea, the viral women-only app for flagging men. Citi is entering the high-end credit card wars and dropped the "Strata Elite."

Plus: The five-cent meme stock that made up 15% of US trading volume, and what’s driving billion-dollar valuations for sports teams?

Automate compliance for SOC 2, ISO 27001, HIPAA, CMMC, and more with Vanta. Get $1,000 off.

SQUEEZ OF THE DAY

Wall Street’s Most Expensive ‘No’

For many on Wall Street, especially in hedge funds, the promise of a life-changing bonus is what keeps the engine running. It’s the dangling carrot that drives analysts to push for alpha and traders to chase P&L into December.

And if you ever feel shortchanged on your bonus, it probably wasn't as brutal as what happened to Robert Gagliardi.

Gagliardi joined hedge fund Evolution Capital in April 2021. Over the next 11 months, he generated $60 million in trading profits, which (he claims) was over 97% of the firm’s total revenue during that period.

Despite that, Evolution declined to pay a $7.5 million discretionary bonus. When Gagliardi pressed for it, the firm’s founder, Michael Lerch, allegedly responded, “I’m not going to pay you the bonus. F*** you. Sue me.”

Evolution argues it was within its rights to withhold the bonus, citing Gagliardi’s short tenure, "abrasive attitude", and complications stemming from his involvement in the U.S. DOJ’s probe into Morgan Stanley’s block trading.

While Gagliardi was never charged and says he was cleared by the SEC, Evolution pointed to reputational and trust issues, including his close ties to Pawan Passi, the former Morgan Stanley executive who paid a $250,000 fine for leaking confidential deal info.

While bonuses are legally discretionary, they’re widely understood as the primary vehicle for compensation in hedge funds and trading roles. Base salaries for hedge fund analysts typically range from $125K to $200K, depending on fund size and experience, but the real money is in bonuses. Traders and PMs with meaningful P&L often receive 10–20% of the profits they generate. By that math, Gagliardi’s ask wasn’t out of line.

Takeaway: In theory, you eat what you kill. In practice, your bonus is only as secure as your internal politics. You can generate $60 million, but if you lose the room, you may still walk away with nothing. Gagliardi may get something back, but past outcomes suggest he could walk away with only a fraction of what he believes he's owed, or likely nothing at all.

HEADLINES

Top Reads

Mercedes Benz, Microsoft team up to turn your car into office (PL)

Goldman puts brakes on layoffs after strong Q2 (NYP)

Trump reaches agreement with E.U. to lower tariffs to 15% (CNN)

Hackers leak 72,000 user photos and IDs from the Tea app (Fox)

Trump floats the possibility of tariff rebate checks (Axios)

Astronomer hires Gwyneth Paltrow with a wink after ‘kiss cam’ viral video (NBC)

Man wins payout after Google photographs him in the nude in his yard (Fox)

This could be the most consequential week for the economy in years (CNN)

Five cent meme stock makes up 15% of trading on US exchanges (BB)

Citi launches $595 high-end credit card to challenge Amex, J.P. Morgan (YF)

Coursera says 12 people every minute enroll in an AI course (CE)

The V-shaped recovery in stocks is a V-shaped recovery in earnings (YF)

Blackstone sets industry record with $1.2 trillion in assets (YF)

Banks get pickier about whom they want as credit card customers (WSJ)

Goldman Sachs hungry for acquisitions, but not for the targets you think (NYP)

Japan says $550 billion package could finance TSMC in the US (YF)

Carlyle buys farm loans that hedge losses as industry suffers (BB)

Americans see their 401(k)s as rainy day funds (WSJ)

Big firms will win private equity’s race for 401k(s), according to Jon Gray (BB)

PRESENTED BY VANTA

More Deals, Less Work

Security compliance is critical, but it doesn’t have to be complex.

With Vanta, you can automate your SOC 2, HIPAA, and 35+ other frameworks for less time and money–all while deadbolting your security.

Trusted by 10,000 startups, enterprises, and more:

Easy to use: One platform to manage risk and compliance 24/7

Saves time: Boost team efficiency by 129%

Pays for itself: 526% ROI in just 3 years

CAPITAL PULSE

Markets Rundown

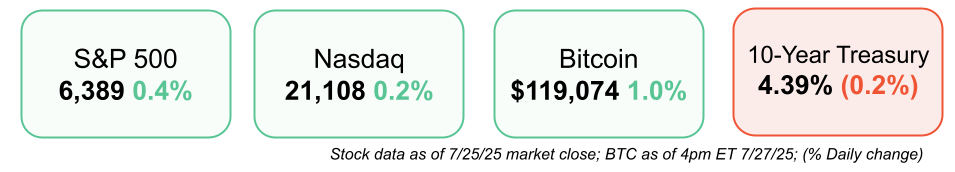

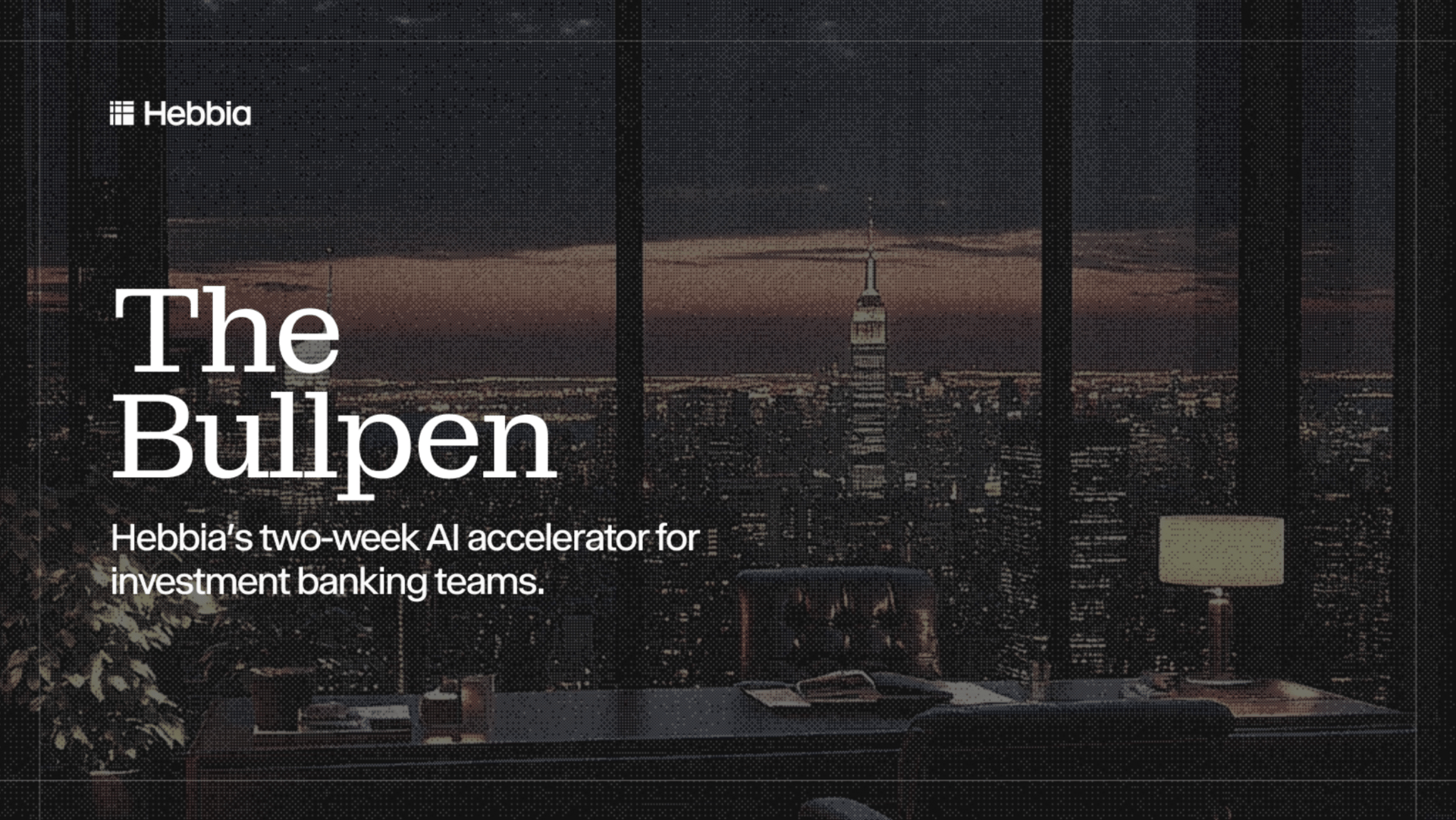

Market Update

Stocks finished the week higher, with the S&P 500 and Nasdaq reaching new record highs, fueled by strong early earnings and easing trade tensions

The 10-year U.S. Treasury yield fell to 4.38%, down from its May peak near 4.60%

Materials and industrials led sector gains, while energy and communications lagged

Asia and Europe declined as EU–U.S. trade negotiations continued

The U.S. dollar strengthened against major currencies

WTI crude oil fell on reports that U.S. firms may resume production in Venezuela

Economic Data Highlights

Durable goods orders fell 9.3% in June, better than the expected 11.0% drop

Transportation equipment plunged 22.4%, driving the decline

Core durable goods (ex-transportation) rose 0.2%

Data points to a gradual recovery in manufacturing, which may support the broader economy and labor market

Reported Earnings

HCA Healthcare reported EPS of $6.84, beating estimates; revenue rose 6.4% YoY to $18.61B and the company raised full-year guidance

Phillips 66 posted mixed results as refining margins softened; details awaited on EPS vs. expectations

Charter Communications missed estimates with EPS of $9.18; internet subscriber losses drove shares down ~18%

Earnings Today

Waste Management (WM) – Watch for trends in commercial waste volumes and pricing power

Nucor (NUE) – Focus on steel demand outlook and margins amid trade uncertainty

Tilray Brands (TLRY) – Look for updates on cannabis market dynamics and international expansion

Movers & Shakers

(+) Coursera Inc ($COUR) +36% after the online learning company is leveraging AI into strong Q2 earnings.

(+) Boston Beer ($SAM) +7% because the Samuel Adams and Truly parent company beat earnings.

(–) Charter Communications ($CHTR) -18% after the Spectrum parent company announced an earnings miss; loss of internet subscribers.

Private Dealmaking

5C Group, an AI power plant developer, raised $835 million

Electra, an EV charging network, raised $472 million

Zenobē, an EV fleet-as-a-service provider, raised $354 million

Armada, a modular AI data center startup, raised $131 million

HeroDevs, a software company, raised $125 million

Yieldstreet, a private markets investment platform, raised $77 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

The average 30-year fixed mortgage rate stayed about the same this week, despite slower home sales during the spring. Home prices had started to level off in early summer, but are now rising again in markets where buyers are still searching for fairly priced homes.

Latest News

New Listings

70 Little W St Apt: 32A New York, NY: 6 Bed / 5 Bath – $6.5M

200 Caravelle Dr Dillon, CO: 5 Bed / 5.5 Bath – $3.6M

5333 Collins Ave Apt: 403 Miami Beach, FL: 2 Bed / 2.5 Bath – $4.6M

204 Courchevel, Savoie France: 6 Bed / 6 Bath – $5.6M

70043 Monopoli BA Monopoli, BA Italy: 3 Bed / 5 Bath – $3.8M

BOOK OF THE DAY

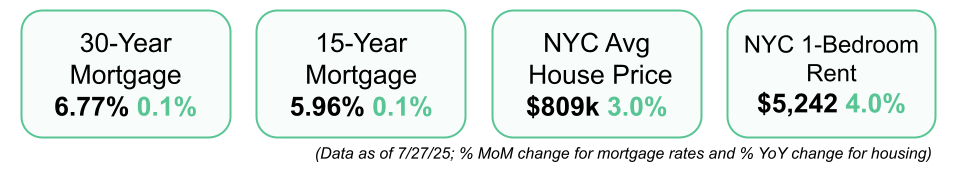

The Little Book of Data

Description: This engaging guide argues that data is not about number crunching—it’s about ideas. Through vivid stories featuring innovators—from a creator using a “loneliness score” to epidemiologists spotting disease hotspots—Evans shows how mastering data thinking can empower any professional to make better decisions and solve big challenges. His style is fast-moving, comic, and surprisingly fun.

Rating: Amazon: 4.8 / 5, Goodreads: 4.2 / 5

Book Length: 288 pages

Ideal For: Professionals, managers, or anyone curious about AI, analytics, and data-driven decision-making—and looking for approachable, real-world examples to build confidence with data.

“Data is not about number crunching. It’s about ideas.” — Justin Evans

PRESENTED BY HEBBIA

The Accelerator Designed for Investment Banks

Meet The Bullpen, Hebbia’s new two-week AI accelerator built for investment banking pros. Cut diligence time, automate contract analysis, and assemble winning pitch decks all within the platform. This is your chance to see how top investment banking teams are using Hebbia.

Want to experience AI built for finance and that isn’t just a chatbot?

DAILY ACUMEN

Stress Isn’t The Problem

Burnout doesn’t come from working too hard.

It comes from working too long without meaning.

Research shows that people can endure enormous stress—long hours, high stakes, constant challenge—if they feel a sense of autonomy, mastery, and purpose.

But take away agency? Strip out progress? Mute the mission? That’s when stress becomes toxic.

It’s not about “work-life balance.” It’s about work-life resonance.

Does what you do echo with who you are?

In investing terms: people burn out when their emotional P&L goes red—when the effort exceeds the personal return.

So don’t just audit your hours. Audit your energy.

Does your work cost you… or compound you?

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply