- Short Squeez

- Posts

- 🍋 Wall Street's Data Hedge

🍋 Wall Street's Data Hedge

Plus: Nvidia earnings day, Cracker Barrel caves to Trump pressure, JPM backing hedge fund that sources ideas from freelance quants, T-Swift engagement and new Caitlin Clark logo.

Together With

"Time wounds all deals." — Steve Schwarzman

Good morning and happy Nvidia earnings day! Results drop after the bell, with futures pointing higher even as the chipmaker warns of an $8 billion China hit. Cracker Barrel’s stock jumped 7% after-hours after the chain reinstated its old logo, just hours after Trump urged them to bring it back in a Truth Social post.

JPMorgan committed $500 million to a hedge fund that trades on ideas sourced from freelance finance quants. Trump’s legal fight with the Fed is heating up after his ouster of Lisa Cook. And Taylor Swift’s engagement to Travis Kelce has lit up prediction markets, with fans betting on every detail of her next chapter.

Plus: Hedge funds are shorting the VIX at the highest levels in three years, Nike rolled out a new signature logo for Caitlin Clark, and walking fast makes you live longer.

How did Bilt hit a $10.7B valuation to become one of the fastest-growing fintechs? Read Forbes coverage here.

SQUEEZ OF THE DAY

Wall Street’s Data Hedge

Over the past several weeks, Wall Street has been recalibrating its reliance on official government data, leaning harder on private sources to hedge against political risk.

Trump’s blow-up with the Bureau of Labor Statistics, calling July’s jobs report “rigged” and firing BLS chief Erika McEntarfer, has sparked fears that economic data could be politicized.

For investors, that risk is real: if inputs are questionable, every model that relies on them (rate forecasts, DCFs, VaR) gets distorted.

The effects ripple across markets. Hedge funds lose visibility on Fed policy. Risk desks at banks build in wider swings around releases. Private equity and credit shops tighten underwriting. Even pensions and insurers are adding cross-checks to reports they once trusted.

Smart investors aren’t waiting around. Hedge funds are running “shadow datasets,” comparing BLS prints to ADP, Challenger layoffs, ISM surveys, and S&P Global indexes. Private credit firms are paying premiums for labor and vendor data. What was once “alt data” is now becoming the core input.

Markets haven’t sold off on Trump’s BLS purge yet. But trust is a hidden premium in finance: lose it, and multiples contract, risk premiums rise, and volatility spikes. As one strategist put it, once you stop believing the spreadsheet, you’re not trading earnings anymore, you’re trading politics.

Takeaway: Wall Street isn’t ditching the BLS, but no one’s taking it as gospel either. Private data is now the hedge, not the supplement. If Washington starts cooking the books, the winners will be the savvy investors already equipped at reading between the lines.

HEADLINES

Top Reads

Stock futures edge higher ahead of Nvidia earnings (CNBC)

Nvidia to report Q2 earnings, warns of $8B hit from China chip ban (YF)

Trump pressures Fed majority; Lisa Cook at center of rate fight (CNBC)

Lisa Cook preparing lawsuit against Trump over Fed ouster (CNBC)

What happened the last time a president pressured the Fed (CNBC)

Taylor Swift engagement fuels bets on prediction sites Kalshi (BB)

JPMorgan reports slowdown in credit-card spending growth (WSJ)

Hedge funds are shorting the VIX at levels not seen since 2022 (BB)

Workers securing bigger raises in a shifting labor market (Axios)

Crowdsourcing hedge fund secures $500M commitment from JPMorgan (BB)

Klarna aims for $14B valuation in revived IPO push (YF)

IBM and AMD team up in quantum computing push (Axios)

EchoStar stock surges after $23B AT&T spectrum deal (CNBC)

Goldman warns “Goldilocks summer” ending as growth fears rise (BB)

Cracker Barrel CEO and board dismissed investor warnings (Fox)

Trump Jr.’s VC fund backs Polymarket as prediction markets gain traction (Axios)

Caitlin Clark gets her own Nike logo and shoe (AP)

PRESENTED BY BILT

The $10.75B Fintech Turning Rent Into Rewards

Most rewards programs give you points for spending anywhere but where your money actually goes: your rent.

Bilt is flipping that model. Backed by a fresh $10.75 billion valuation, Bilt now lets over 5 million renters earn points on rent and spending around their neighborhood. Those points can be redeemed for flights, hotels, workouts, Lyft rides, even student loans.

Read how Bilt is building the future of payments and rewards.

CAPITAL PULSE

Markets Rundown

Market Update

U.S. stocks closed higher, with strength in NVIDIA ahead of earnings lifting sentiment, while small caps again outperformed.

Treasuries saw a split reaction: 30-year yields climbed 2 bps on Fed worries, while shorter maturities rallied after a strong 2-year auction.

Yield curve steepened, with the 5s–30s spread at its widest since 2021.

Dollar weakened broadly, falling against every DM currency.

Oil prices slipped, though WTI held steady within its $60–65/bbl range.

Economic Data Highlights

Trump moved to fire Fed Governor Lisa Cook, citing alleged mortgage fraud. Cook vowed to challenge in court, raising questions about Fed independence.

A recent Supreme Court ruling limits presidential removal powers, leaving the outcome uncertain; markets priced in some risk of greater Fed politicization leading to short-term easing and longer-term inflation risks.

Durable goods orders mixed: headline down in June, but core capital goods +1.1% m/m, signaling business investment remains firm.

Housing weaker, with FHFA and S&P price indexes both falling in June; rising inventory and slower sales weigh on prices.

Consumer confidence dropped in August on tariff concerns, job worries, and inflation fears.

Reported Earnings

Okta (OKTA) – Beat on revenue and EPS; guidance showed steady enterprise adoption, though some billings growth slowed.

MongoDB (MDB) – Results topped estimates; Atlas cloud growth remained strong, though margins were pressured by rising costs.

Earnings Today

NVIDIA (NVDA) – Focus on AI-driven chip demand, hyperscaler orders, and forward guidance.

CrowdStrike (CRWD) – Key metrics: ARR growth, new customer adds, and AI security adoption.

Snowflake (SNOW) – Investors watching consumption trends, AI workload demand, and margin trajectory.

Movers & Shakers

(+) Echostar ($SATS) +70% after AT&T will buy wireless spectrum licenses from EchoStar for $23 billion.

(+) Eli Lilly ($LLY) +6% because of strong weight loss drug results for the pharmaceutical company.

(–) Kohl’s ($KSS) -7% after the retailer warned of late vendor payments.

Private Dealmaking

MannKind acquired scPharmaceuticals for $360 million

Arnatar Therapeutics, an RNA therapeutics developer, raised $52 million

Blue Water Autonomy, an unmanned ships developer, raised $50 million

TinyFish, a developer of enterprise web agents, raised $47 million

Anocca, an immunotherapy startup, raised $46 million

Upstage, an enterprise document AI startup, raised $45 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

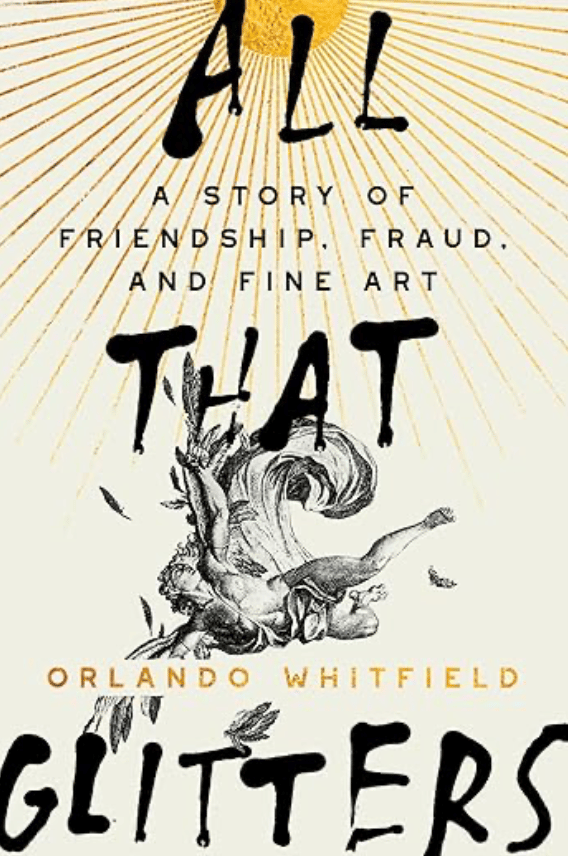

All That Glitters

Description: A riveting, insider memoir that pulls back the velvet drapes on the modern art world. Orlando Whitfield traces the arc of his friendship with Inigo Philbrick—from university dreamer to globe-trotting art dealer to convicted fraudster. The book delivers equal parts glamour and gravity, exposing how an unchecked, opaque market created the perfect conditions for dazzling deception.

Rating:

Amazon 4 / 5

Goodreads 3.6 / 5

Book Length: 336 pages

Audiobook Length: 9 hrs 57 mins

Ideal For: True crime readers, art world obsessives, memoir lovers, and anyone fascinated by the intersection of ambition, friendship, and catastrophe in high-stakes spaces.

“Reads like a ‘Liar’s Poker for the art world.’”

PRESENTED BY PACASO

Major Investors Are Buying This “Unlisted” Stock

When some of the big investors who backed companies like Airbnb, Uber, and eBay before they IPO’d all invest in a new company, people take note.

That’s the case with Pacaso. Founded by a former Zillow executive, Pacaso’s bringing co-ownership to the vacation home market, a $1.3T opportunity. And it’s been a hit. Pacaso has already made over $110M in gross profits and added homes in 40+ destinations.

They’ve even reserved their Nasdaq ticker, $PCSO.*

But what makes Pacaso unique compared to companies like Airbnb and Uber is that they’ve opened up the opportunity for the public to invest in them as a private company. And more than 10,000 people have.

You can join them for $2.90/share. But, you have to act before the 9/18 deadline.

Become a Pacaso shareholder here.

DAILY ACUMEN

Compounding

The math of compounding is simple: exponential growth from reinvested returns.

The psychology is brutal: years of apparent stagnation before the curve bends.

That’s why most people quit too soon. They want visible progress every quarter, every promotion, every investment statement.

But compounding doesn’t reveal itself linearly—it hides, then suddenly explodes.

The S&P 500 looks flat for decades until the last few years drive the chart skyward.

Careers are the same: a decade of grinding, learning, stacking credibility, before one breakout role makes you look like an overnight success.

Relationships compound too—the longer you keep trust intact, the more valuable it becomes. The real risk isn’t a bad year; it’s pulling your capital—financial or human—too early.

Compounding only works if you let it run. The best investors, and the happiest people, master patience not because waiting is fun, but because they know time is the most powerful multiplier of all.

ENLIGHTENMENT

Short Squeez Picks

Five strategies for bold leadership amid chaos

The productivity trick that works better when you treat life like a story

Four lesser-known destinations to seek out this summer

This is what happens when ChatGPT tries to write scripture

Walking fast makes you live longer

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

Reply