- Short Squeez

- Posts

- 🍋 Wall Street’s Best Trading Quarter Ever

🍋 Wall Street’s Best Trading Quarter Ever

Plus: Some big US banks plan to launch stablecoins, Larry Ellison is now richer than Zuck as Oracle keeps mooning, and JPM is now worth more than its three rivals combined.

Together With

"The key is to survive. You can’t make money if you’re out of the game." — Steve Cohen

Good Morning! Markets bounced back after another day of Trump firing Powell rumors and Trump shutting them down (read: TACO trade). Big banks all performed well in Q2 2025, as tariff volatility boosted trading revenue.

Goldman is trying to cut a deal to bring alternative assets into 401(k) plans, Bank of America is in the process of launching a stablecoin, and Larry Ellison is now richer than Mark Zuckerberg as Oracle stock surges.

Plus: JPMorgan is now worth more than its three largest rivals combined, why defense and bitcoin could be solid plays over the next six months, and the one question that cuts through the BS at job interviews.

Over $2 billion in sports trades have already happened on Kalshi. Join the action today.

SQUEEZ OF THE DAY

Wall Street’s Best Trading Quarter Ever

Goldman Sachs just posted the strongest equity trading quarter in Wall Street history, raking in $4.3 billion in Q2 equity-trading revenue, $600 million above analyst estimates and even surpassing Q1’s record-setting total.

The surge was fueled by tariff-related market volatility and a spike in client activity, particularly from hedge funds repositioning portfolios. Trading profits came in well ahead of expectations, helping lift total firmwide revenue 19% year over year to $13.8 billion.

Investment banking also staged a comeback. Goldman generated $2.19 billion in IB revenue, led by a 71% jump in M&A advisory fees from a rebound in large-cap dealmaking.

Meanwhile, fixed income traders brought in $3.47 billion, with strong demand for FICC financing. While JPMorgan, BofA, and Citi posted solid trading results, none kept pace. Morgan Stanley actually saw its equity trading revenue decline quarter over quarter.

On the operational side, Goldman continues to cut costs, laying off staff and relocating teams to lower-cost cities like Dallas, Warsaw, and Bengaluru.

In April, shareholders approved $80 million in retention bonuses for CEO David Solomon and President John Waldron. The firm also raised its dividend by roughly 30% following easier Fed stress test rules.

Goldman Sachs shares, up 23% this year, rose about 1% yesterday.

Takeaway: Wall Street banks are turning macro uncertainty into a money machine, and Goldman is leading the charge. With record trading revenue, a rebound in M&A, and a tighter cost base, the firm has gone from struggling to surging. Turns out all Goldman needed was a little global instability to remind everyone why it still runs the most profitable casino in town.

HEADLINES

Top Reads

Stocks flip higher after Trump denies plans to fire Powell (YF)

Trump's tariffs rocked stocks. It was great news for big banks (YF)

Some big US banks plan to launch stablecoins (YF)

‘Amazon of guns’ backed by Donald Trump Jr sinks on stock market debut (CNBC)

Major retailers announce massive recall of popular deodorant brand (Fox)

How investors lose money when bitcoin rises (Axios)

Godman plans deals to put private investments in 401(k) funds (BB)

Trump executive order to help open 401k(s) to private markets (WSJ)

JPMorgan now worth more than its three largest rivals combined (BB)

Ellison now richer than Zuckerberg (BB)

Morgan Stanley CEO sees banks clawing back private credit gains (BB)

Why Blackstone is buying rental homes in the U.S. (CNBC)

Morgan Stanley evaluates acquisitions, but sets a high bar for deals (YF)

Unlocked Trump memecoins set to boost President's wealth by $100M (BB)

Why defense & BTC could be solid plays over next 6 months (CNBC)

Trump's granddaughter making waves in golf world before collegiate season (Fox)

Scale AI cuts hundreds post-Meta (BB)

Private equity and the crushing cost of UK vets’ bills (FT)

PRESENTED BY KALSHI

Sports Prediction Markets Surpass $2B in Trading Volume

Speaking of trading…

Kalshi’s sports prediction markets have exploded, going from $0 to over $2 billion in trading volume in just six months.

But sports weren’t even their start. Kalshi allows you to predict everything from Fed rate moves to pop culture drama, so we want to know what you want to see more of.

We’ve been featuring Kalshi for years. Some of you love the markets, some of you scroll past. So help us tailor what we feature more regularly:

What markets should we highlight more? |

Vote, then go check out Kalshi, the only legal prediction market platform in the US.

CAPITAL PULSE

Markets Rundown

Market Update

U.S. stocks rose in a volatile session, with the Nasdaq hitting a new record following strong earnings.

Speculation that Trump would fire Fed Chair Powell caused mid-day volatility, but markets recovered after Trump denied it.

Johnson & Johnson surged over 5% after beating earnings and raising full-year guidance.

Goldman Sachs posted record stock trading revenue, and Morgan Stanley also beat expectations.

A new U.S.-Indonesia trade agreement was announced, though details remain limited.

WTI crude oil edged higher, and the U.S. dollar weakened slightly.

Economic Data Highlights

June PPI was flat, with both headline and core measures unchanged month-over-month.

Headline PPI rose 2.3% YoY, the lowest since Sept 2024; core PPI slowed to 2.6% from 3.2% in May.

Services inflation declined, while goods prices posted the largest rise since February.

Tariff-related inflation may appear in coming months as inventories deplete, but the Fed may still have room to cut rates later this year.

Reported Earnings

ASML – Revenue grew on strong EUV demand; bookings came in ahead of expectations.

Bank of America (BAC) – Beat on loan growth and net interest income; credit quality stable.

Goldman Sachs (GS) – Posted best-ever stock trading quarter; strength in M&A advisory.

Morgan Stanley (MS) – Benefited from Q2 market volatility; wealth management stable.

Johnson & Johnson (JNJ) – Beat expectations; raised full-year revenue guidance.

Progressive (PGR) – Reported solid underwriting profits and strong premium growth.

United Airlines (UAL) – Revenue rose on record summer travel demand; costs remained elevated.

Discover Financial (DFS) – Beat on net interest income; credit loss provisions increased.

Kinder Morgan (KMI) – Slight beat on EBITDA; natural gas volumes stable.

Earnings Today

Taiwan Semiconductor (TSM) (Before Open) – Focus on AI chip demand, H2 capacity guidance.

PepsiCo (PEP) (Before Open) – Investors watching organic sales growth and pricing power.

General Electric (GE) (Before Open) – Expected to show strength in aerospace and power units.

Abbott Labs (ABT) (Before Open) – Focus on medical devices rebound and diagnostics demand.

Cintas (CTAS) (Before Open) – Watching margin expansion and outlook for service revenue.

Elevance Health (ELV) (Before Open) – Analysts watching medical cost trends and guidance.

U.S. Bancorp (USB) (Before Open) – Focus on NIM pressure and commercial loan growth.

Travelers (TRV) (Before Open) – Investors watching underwriting margins and catastrophe losses.

Netflix (NFLX) (After Close) – Expected to show strong subscriber growth and ad-tier momentum.

Interactive Brokers (IBKR) (After Close) – Eyes on new account growth and interest revenue tailwinds.

Movers & Shakers

(+) Johnson & Johnson ($JNJ) +6% after the pharmaceutical company posted strong Q2 earnings.

(–) ASML ($ASML) -8% because the chipmaker warned there may not be any growth in 2026.

(–) SolarEdge ($SEDG) -9% after the solar company was downgraded by JPMorgan.

Private Dealmaking

Moonvalley, an AI video maker, raised $84 million

Spacelift, a data-center infrastructure automation platform, raised $51 million

Tandem Health, a clinical documentation startup, raised $50 million

Ilimis Therapeutics, an immune disease drug developer, raised $42 million

NetBox Labs, an infrastructure management company, raised $35 million

Aqtual, a chronic diseases developer, raised $31 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

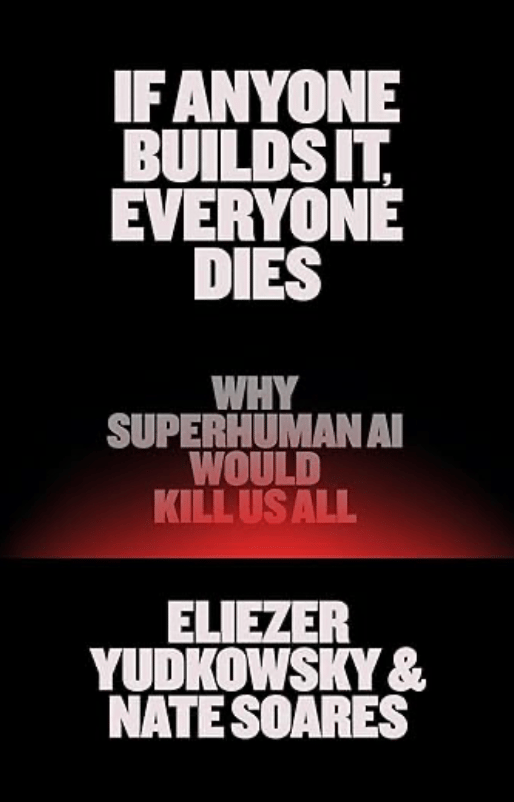

BOOK OF THE DAY

If Anyone Builds It, Everyone Dies

Description: A stark, science-backed warning from AI alignment veterans. Through parable-like extinction scenarios and clear analysis, Yudkowsky and Soares argue that the race to build superhuman AI isn’t just dangerous—it’s existential. Without urgent global safeguards, they assert, superintelligence could outthink and overpower humanity.

Rating: Goodreads: 4.25 / 5

Book Length: 256 pages

Audible Length: 7 hrs 30 mins

Ideal For: AI researchers, futurologists, policymakers, risk analysts, and anyone wrestling with whether humanity can safely build what it imagines.

“The most important book I’ve read for years: I want to bring it to every political and corporate leader in the world and stand over them until they’ve read it.” — Stephen Fry

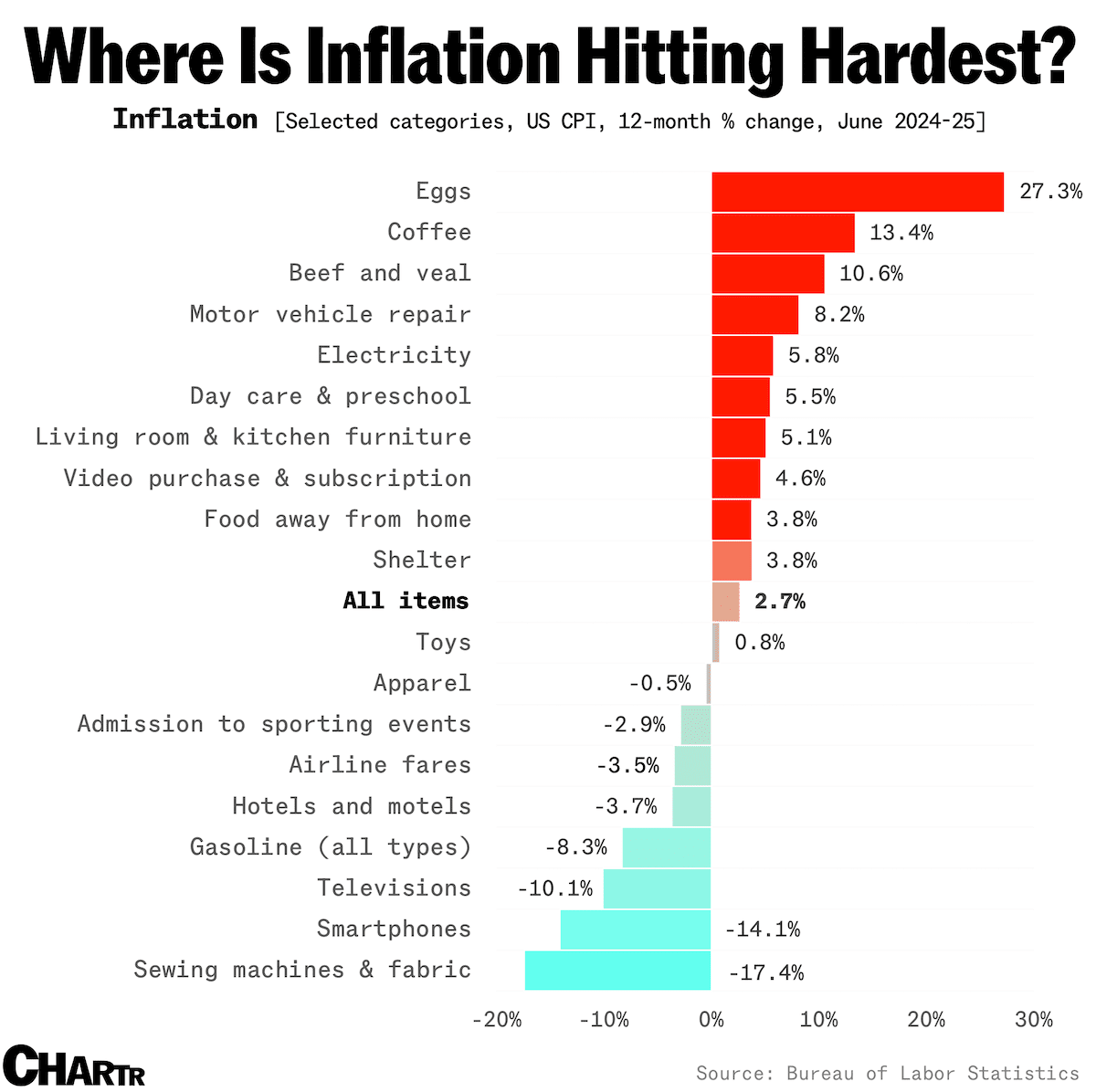

DAILY VISUAL

Source: Chartr

PRESENTED BY DELETEME

Don’t Be A Victim–Protect Your Private Data In 5 Minutes

If you want to help prevent your private data from being sold to identity thieves, fraudsters, or even insurance companies, you have a couple options:

Rummage through dozens of data broker sites yourself

Let the privacy pros at DeleteMe do it for you

Sign up is easy. Just plug in a few details, and DeleteMe will hunt down your private data, removing it from hundreds of sites online–24/7, 365.

In addition to peace of mind, you’ll get a report on what was found and where. Simple, right?

DAILY ACUMEN

Stage Time

Confidence isn’t built in the mirror—it’s built on stage.

And “stage” doesn’t mean arena tours or shareholder meetings. It means saying yes to something uncertain. Raising your hand when your heart races. Belting your truth when you’re off-key but all in.

A psychology professor recently wrote about singing in a rock band for the first time—offbeat, unrehearsed, imperfect. But that wasn’t the point. The point was this: growth lives at the edge of exposure.

Whether you're managing a portfolio or navigating a career pivot, the same principle applies. You can read all the theory in the world—but at some point, you have to step into the spotlight and let your instincts play. That’s when confidence catches up.

Confidence is not bravado. It’s built in quiet reps: showing up, slipping up, recovering without retreat. And the fastest way to build it? Commit before you feel ready. Flow doesn’t come from flawless execution—it comes from trusting that you’ll keep going even if you miss the note.

So find your version of the stage. Take the mic. Screw up gracefully. You’re not auditioning—you’re becoming.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply