- Short Squeez

- Posts

- 🍋 Trump Bullies Powell

🍋 Trump Bullies Powell

Plus: You can now Venmo the Treasury to pay off the national debt, Lazard CEO won’t make analysts sign affidavits, and Blackstone's IPO pipeline strongest since 2021.

Together With

"I've created more billionaires on my management team than any CEO in the world." — Jensen Huang

Good Morning! Lazard’s CEO backed the private equity hiring slowdown but said he wouldn’t make analysts “sign affidavits,” opting instead to focus on making Lazard a more attractive place to work.

Trump promised he won’t destroy Musk’s companies, after Tesla tumbled on weak earnings. Blackstone says its IPO pipeline is the strongest since the 2021 peak, Accelerant popped in its market debut, and Pinnacle is acquiring Synovus in the largest regional bank M&A deal of 2025.

Plus: You can now Venmo the Treasury to pay off the national debt, PE firms are flipping assets to themselves in record numbers, and how to tell if you’re running low on dopamine.

Why risk it? DeleteMe will find and remove your personal data from hundreds of data broker sites (so you don’t have to). Learn more here.

SQUEEZ OF THE DAY

Trump Bullies Powell

Donald Trump is once again turning up the heat on the Federal Reserve, and he’s using one of his favorite tactics: flood the zone.

Rather than stick to one critique, Trump is attacking Fed Chair Jerome Powell from every angle. He’s questioned Powell’s leadership, scrutinized spending on the Fed’s headquarters renovation, stacked a planning commission with political allies, and begun floating potential replacements, all while hammering one message: lower interest rates now.

Yesterday, Trump toured the Fed’s renovation site and turned it into a media spectacle. He had a bickering contest with Powell over the Fed renovation number, told reporters “I would love Powell to lower interest rates,” and ended the exchange with a slap on the back for the visibly frustrated Fed Chair.

While Trump has backed off prior threats to fire Powell, the search for his successor is already underway. National Economic Council Director Kevin Hassett is reportedly the frontrunner.

The Trump team sees this multi-pronged pressure campaign as win-win proposition: Powell either caves, a new chair takes the job with clear instructions, or the Fed becomes a built-in scapegoat if the economy falters.

At the same time, conservative think tanks like Heritage’s Project 2025 are pushing for a Fed overhaul, narrowing its mandate to inflation and the dollar, ending interest payments on bank reserves, and cutting back its role in financial markets.

A Trump ally even filed a lawsuit yesterday accusing the Fed of withholding policy meeting details to sabotage Trump’s economic agenda.

Takeaway: Yesterday’s Trump-Powell showdown made for great political theater but the independence of the Federal Reserve is under its most intense political stress test in decades. For now, Powell isn’t blinking. But with his term ending in May 2026, the question is: how much pressure can he take?

HEADLINES

Top Reads

Lazard CEO welcomes rollback of extreme private equity hiring (BB)

Trump says he won’t ‘destroy’ Musk’s companies by taking away subsidies (CNBC)

Tesla stock sinks after earnings miss, Musk's warning (YF)

Blackstone says deal pipeline strongest since 2021 peak (YF)

Todd Boehly-backed Accelerant pops in market debut (BB)

Pinnacle buys Synovus in $8.6B deal (WSJ)

You can now Venmo the treasury to pay Uncle Sam’s debt (Axios)

Regulators investigating if KKR provided misleading info in Telecom Italia deal (YF)

Permira, Nordic in takeover talks for vaccine maker Bavarian (BB)

JPMorgan traders still see significant step higher for stocks (BB)

Private equity firms flip assets to themselves in record numbers (FT)

Blackstone gathers $5B for secondhand infrastructure bets (BB)

Estonia’s tech elite are getting behind a European challenger to Robinhood (CNBC)

Investors beware the dangers lurking in private credit (FT)

Brookfield is missing the PE secondaries boom its CEO saw coming (BB)

Deutsche Bank shares gain 9% after second-quarter profit beat (CNBC)

Intel beats shareholder lawsuit over $32B stock plunge (YF)

Lutnick says TikTok will go dark if China won’t agree to U.S. control of the app (CNBC)

McDonalds woos Gen Z with 'dirty sodas' (WSJ)

PRESENTED BY DELETEME

Don’t Be A Victim–Protect Your Private Data In 5 Minutes

If you want to help prevent your private data from being sold to identity thieves, fraudsters, or even insurance companies, you have a couple options:

Rummage through dozens of data broker sites yourself

Let the privacy pros at DeleteMe do it for you

Sign up is easy. Just plug in a few details, and DeleteMe will hunt down your private data, removing it from hundreds of sites online–24/7, 365.

In addition to peace of mind, you’ll get a report on what was found and where. Simple, right?

CAPITAL PULSE

Markets Rundown

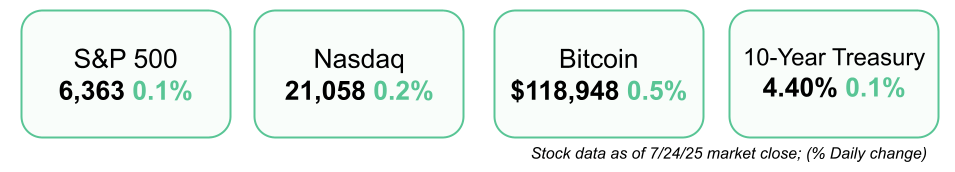

Market Update

U.S. stocks hit new highs, with the S&P 500 and Nasdaq closing at record levels.

Dow Jones and Russell 2000 closed slightly lower in a mixed session.

10-year Treasury yield held steady at 4.40%; bond markets largely flat.

U.S. dollar was unchanged; oil dipped 0.6% but stayed within its recent $65–$70 range.

Asia and Europe rose, helped by optimism around new trade deals.

Economic Data Highlights

Initial jobless claims ticked lower last week, signaling continued labor-market resilience.

Continuing claims edged up, suggesting those unemployed are finding it harder to re-enter the workforce.

U.S. growth is tracking around a 1% annualized pace for H1 2025.

Tariffs remain a headwind, but strong balance sheets may cushion the economy.

Reported Earnings

Blackstone (BX) – Beat estimates on strong fund inflows and growing fee-related earnings.

Intel (INTC) – Topped revenue and EPS forecasts; highlighted strength in AI chips and data center demand.

Coca-Cola Consolidated (COKE) – Revenue rose on higher bottling volume; gross margin improved year-over-year.

Earnings Today

HCA Healthcare (HCA) – Key focus on procedure volume trends and margin recovery.

Phillips 66 (PSX) – Watch refining margins and outlook on crack spreads.

Charter Communications (CHTR) – Investors tracking broadband subscriber growth and cost control initiatives.

Movers & Shakers

(+) American Eagle ($AEO) +4% after announcing a partnership with Sydney Sweeney.

(–) Tesla ($TSLA) -8% because of an earnings miss, Musk warning of a 'few rough quarters'.

(–) IBM ($IBM) -8% after a slowdown in software sales.

Private Dealmaking

Pinnacle buys Synovus for $8.6 billion

Bridgepoint sold Vermaat for $1.8 billion

Coats Group acquired OrthoLite Holdings for $770 million

Lovable, an AI startup, raised $200 million

Greptile, an AI automate code review startup, raised $30 million

Ephemera, an open-source messaging protocol company, raised $20 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

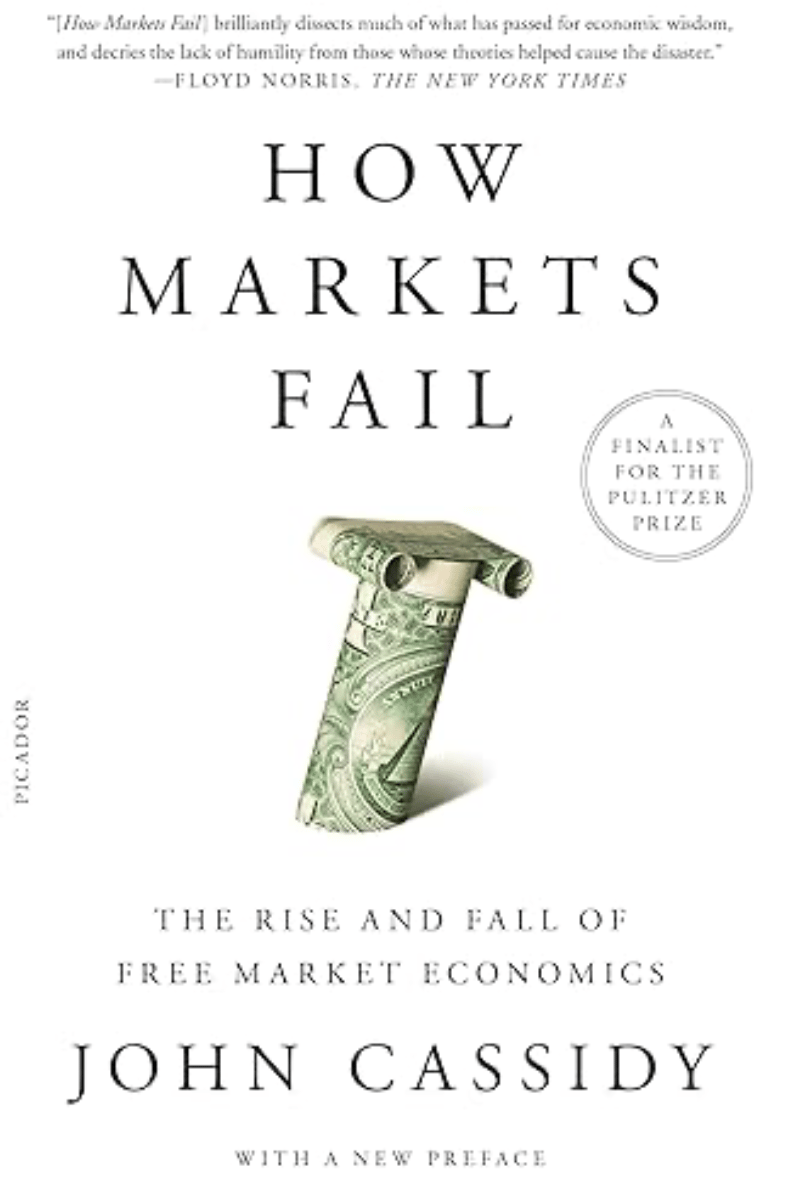

How Markets Fail

Description: A sharp, accessible critique of free‑market ideology, tracing how faulty economic theory, speculative bubbles, and human irrationality led to financial crisis—arguing that unregulated markets often fail to reflect underlying risk and truth.

Rating: Amazon 4.5 / 5, Goodreads 4.1 / 5

Book Length: 432 pages

Audiobook Length: 14 hours

Ideal For: Economists, policy wonks, critical thinkers, investors, and anyone questioning the efficiency myth of modern markets—and eager to understand why regulation matters.

“Economics, when you strip away the guff and mathematical sophistry, is largely about incentives.” — John Cassidy

PRESENTED BY DEATH & CO

Invest in One of the World’s Most Respected Bar Brands

What started as a single bar in New York has now expanded to Nashville, Atlanta, Savannah, and more major cities — and you have the opportunity to invest as it all comes to life.

Death & Co is defining modern hospitality, driving $14M in annual revenue and projecting 170% top line growth this year alone. With award-winning books and placements on multiple “World’s 50 Best Bars” lists, they’re uniquely positioned for strategic (and exponential) growth.

They’re giving readers a unique opportunity to participate in their latest funding round. Perks include $12 cocktails for life, exclusive events, and more.

DAILY ACUMEN

Luck

There are two kinds of luck: passive and earned.

Passive luck is winning the lottery.

Earned luck is being in motion—building, sharing, asking, shipping—so that when randomness shows up, it actually has a place to land.

In his famous framework, Marc Andreessen called this Luck Type IV: serendipity that seems to chase you down because of who you’ve become.

It's not luck in the traditional sense—it's exposure to surface area.

Every cold email. Every rep at the gym. Every post. Every call you almost skipped.

These are invitations to luck.

In a market driven by asymmetry, your greatest asset isn’t just capital. It’s movement.

Move fast. Stay kind. And widen the surface area.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Disclaimer: *This is a paid advertisement for Death & Company's Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

Reply