- Short Squeez

- Posts

- 🍋 Tragedy at Blackstone

🍋 Tragedy at Blackstone

Plus: New S&P bull target, 32% jump in Dubai investment firms, private credit bails out an Ivy, Carlyle’s succession shakeup, IPOs are back, and Dimon not happy with Plaid.

Together With

“There are two types of wealthy people: those who desperately want you to know they are wealthy and those who desperately don’t.” — Mark Brooks

Good Morning! Oppenheimer raised its S&P 500 year-end target to 7,100 (from 5,950), signaling ~11% upside. IPO activity is heating up, Figma and PE-backed Firefly Aerospace set ranges at $18.8B and $5.5B valuations.

Brown University is borrowing $500M via private credit. Activist investor Ricky Sandler is rallying donors to give $25K or more to oppose Zohran Mamdani’s NYC mayoral run.

Plus: Carlyle named three co-presidents, Dubai saw a 32% jump in new investment firms, and Jamie Dimon says fintech middlemen like Plaid are ‘massively taxing’ its systems with unnecessary pings.

Still piecing together portfolio data from board decks and spreadsheets? PortfolioIQ automates the entire process, saving you hundreds of hours a year. See the demo here.

SQUEEZ OF THE DAY

Tragedy at Blackstone

Wall Street was shaken Monday evening by a tragic act of violence in the heart of Midtown Manhattan. A 27‑year‑old gunman, Shane Devon Tamura, entered the lobby of 345 Park Avenue (home to tenants including Blackstone, the NFL, and KPMG) armed with an AR‑style rifle and wearing body armor.

He opened fire just before 6:30 p.m., fatally shooting NYPD Officer Didarul Islam, who was on a private security detail, and three civilians. One additional person remains in critical condition, and others suffered injuries while trying to flee.

Tamura then took an elevator to the 33rd floor, also occupied by Blackstone, where he killed another individual before dying from a self-inflicted gunshot wound. Authorities confirmed he acted alone. As of now, no political or ideological motive has been established, though the investigation is ongoing.

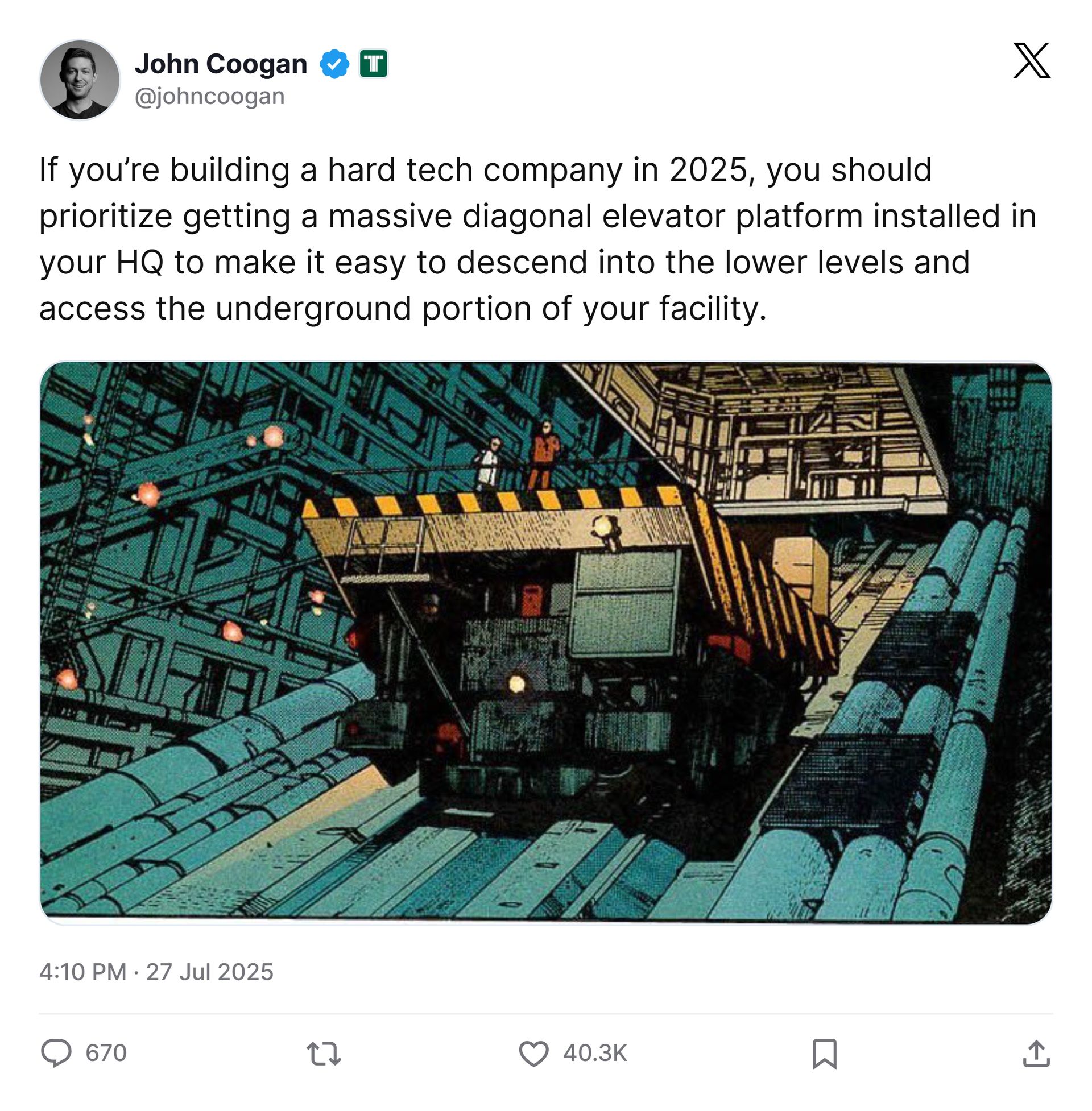

The attack triggered a massive emergency response. Park Avenue between 50th and 55th Streets was shut down, and building occupants were ordered to shelter in place. Some employees barricaded doors with conference room tables and desks (Blackstone 32nd floor pictured above), waiting hours for the all-clear.

Although the building houses Blackstone’s global headquarters, there is currently no indication that any Blackstone employees were among the victims. Media reports have not linked any of the fatalities or injuries specifically to Blackstone staff, though details are still emerging.

Takeaway: This devastating incident is a sobering reminder that violence can erupt anywhere, even inside the headquarters of the world’s most powerful institutions. While Blackstone employees were not physically harmed, the emotional toll is profound. As we await further details, the focus must remain on workplace safety, mental health, and healing. Our thoughts and prayers are with the victims and their families during this heartbreaking time.

HEADLINES

Top Reads

Wall Street just got a new high-water target for the S&P 500 (YF)

Firefly Aerospace sets IPO range that would value rocket maker at $5.5B (CNBC)

Figma eyes IPO valuation of $18.8B (YF)

Brown University snags $500M loan after warning of financial issues (BB)

NYC investor asking for $25,000 to oppose Zohran Mamdani (BB)

Carlyle’s Schwartz names co-presidents, solidifying top ranks (BB)

Hedge funds, wealth firms fuel Dubai’s record growth as finance hub (BB)

JPMorgan says fintech middlemen are ‘massively taxing’ its systems (CNBC)

Tesla signed a $16.5 billion chip contract with Samsung Electronics (CNBC)

Deutsche is losing its edge in leveraged finance deals (BB)

Wall Street is rewriting the rules of Bitcoin trading (BB)

BlackRock's Panama ports deal gets more complicated (Axios)

Robinhood says tragedy retail can’t tap private markets (BB)

EU-US trade deal could add up to $19B in pharma industry costs (YF)

Trump: Global baseline tariff will likely be 15% to 20% (CNBC)

Boeing CEO Ortberg's turnaround plan expected to roll on (YF)

Meta glasses boost Ray-Ban Maker EssilorLuxottica (BB)

Private equity gets bullish on natural gas fired power plants (WSJ)

Tariff revenue has netted $20 billion so far (Axios)

Investors celebrate trade deals inking higher tariffs (Axios)

PRESENTED BY PORTFOLIOIQ

Private Investors: Stuck In Excel Hell?

Do you spend more time organizing data than actually analyzing it? Not anymore.

PortfolioIQ brings everything into a unified view, so you get to insights faster.

Leading funds are saving 500+ hours per year with PortfolioIQ:

Auto-extract metrics from documents, spreadsheets and emails

Track actuals, estimates, re-statements, and more

Trace every data point back to the original source

What’ve you got to lose, besides hours of copy/pasting this weekend?

Check it out here (and cry tears of joy).

CAPITAL PULSE

Markets Rundown

Market Update

Stocks finished mixed after the U.S. and EU reached a long-awaited trade agreement

The Nasdaq closed at its 17th record high of the year, while the Dow slipped modestly

The new deal sets 15% tariffs on most EU imports, helping avoid a broader trade war

The U.S. dollar surged, marking its strongest daily gain since May, with notable strength against the euro

Bond yields rose modestly ahead of this week’s Fed decision

Oil prices climbed as the U.S. shortened its deadline for Russia to end its war in Ukraine or face new sanctions

Economic Data Highlights

Tariff-related uncertainty is easing, with the EU agreeing to purchase $750B in U.S. energy and invest $600B in U.S. infrastructure

The agreement lowers threatened tariffs from 30% to 15%, though steel and aluminum will still face 50% tariffs

Pharma and semiconductor tariffs remain undecided

The U.S. and China are expected to extend their tariff truce by 90 days, with meetings underway in Sweden

Markets are quiet ahead of key events: Fed rate decision (Wednesday), Q2 GDP, and July jobs report later this week

Reported Earnings

Waste Management (WM) reported EPS of $1.92, slightly above estimates; revenue beat expectations on solid volume growth and pricing

Nucor (NUE) reported EPS of $2.60, in line with expectations; revenue rose YoY but margins were pressured by higher input costs

Tilray Brands (TLRY) reported EPS of $0.02, beating estimates; revenue declined slightly as cannabis sales remained soft

Earnings Today

PayPal (PYPL) – Watch for payment volume growth and progress in cost-cutting initiatives

Spotify (SPOT) – Focus on subscriber trends and profitability improvements

UPS (UPS) – Key read on e-commerce shipping volumes and margin recovery in U.S. ground segment

Movers & Shakers

(+) PagerDuty ($PD) +7% after TD Cowen upgraded the cloud computing stock on acquisition potential.

(+) Nike ($NKE) +4% because of an upgrade by JPMorgan ahead of the soccer World Cup.

(–) Heineken NV ($HEINY) -10% after tariff uncertainties spook investors.

Private Dealmaking

Brookfield and Birch Hill acquired First National Financial for $2.2 billion

Brightstar Capital Partners acquired 50% of Arden University for over $1 billion

NiCE acquired Cognigy for $955 million

HSBC sold its Uruguay operations to BTG Pactual for $175 million

Gupshup, a conversational AI company, raised $60 million

LegalOn Technologies, a contract review AI platform, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Starting a Startup

Description: A raw, no-nonsense startup playbook for founders who believe in execution over hype. Sinclair lays out a proven, methodical framework for validating ideas, deeply understanding customers, and earning paying users before writing a single line of code. This is battle-tested guidance for teams that are ready to build fast and learn faster.

Rating: Not yet available (slated September 2025)

Book Length: ~288 pages

Ideal For: Startup founders, solo entrepreneurs, product-first builders, and anyone tired of wasted time and eager to launch with conviction, speed, and real customer feedback.

“90% of startups fail because founders build products nobody wants… Fastest team to learn wins—not the richest or smartest.” — James Sinclair

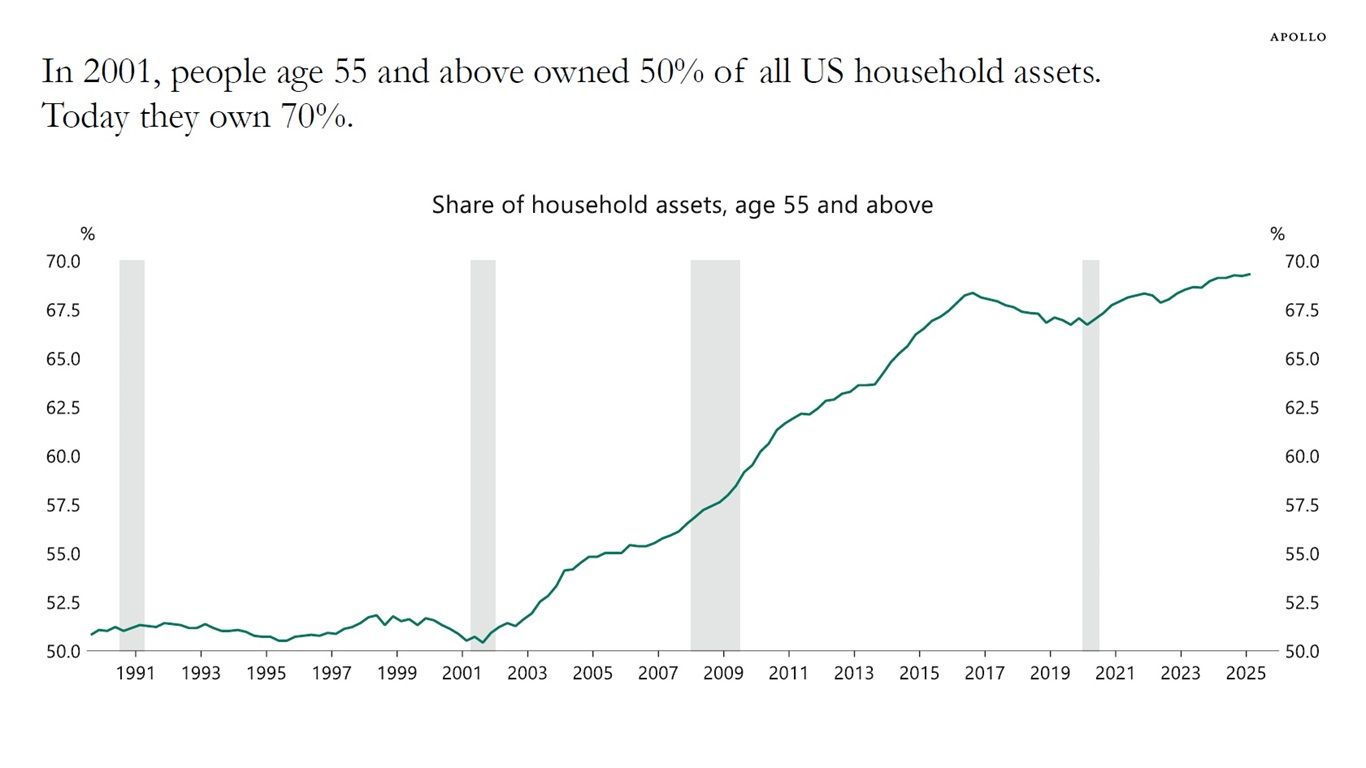

DAILY VISUAL

Households Age 55 and Above Own a Growing Share of Household Assets

Source: Apollo

PRESENTED BY DEATH & CO

From Cocktails to Check-Ins

One of the world’s most respected hospitality brands is taking a bold step: Death & Co has opened their own boutique hotel in Savannah: Municipal Grand. And you can share in their growth as an investor.

This is a major inflection point for Death & Co, making it a unique moment for investors to join. The opening adds another vertical to their business, which already includes publishing, education, and ecommerce, which have contributed to $14M in revenue so far.

They project 205% revenue growth over the next two years, and you can be a part of it.

DAILY ACUMEN

Invisible Resume

The best opportunities in life don’t come from LinkedIn.

They come from reputation, trust, and how people feel after being around you.

We spend years polishing our “official” resume, when the most powerful career engine is the one no one sees:

Your invisible resume.

It’s built in whispered referrals, in how you show up when there’s no upside, in the text someone sends that starts with: “I think you’d like this person.”

This is what makes top performers unstoppable.

They don’t just optimize their skill stack.

They build emotional equity—a brand that compels people to bet on them, even in silence.

Your real resume is written in other people’s heads.

Make it worth rereading.

ENLIGHTENMENT

Short Squeez Picks

The participation trophy culture of adulthood

Simple social rituals like eye contact and small talk are psychologically powerful

5 small hacks to improve your wealth, productivity, and happiness

Why soft skills are the key to business success

3 simple tools that transformed my productivity

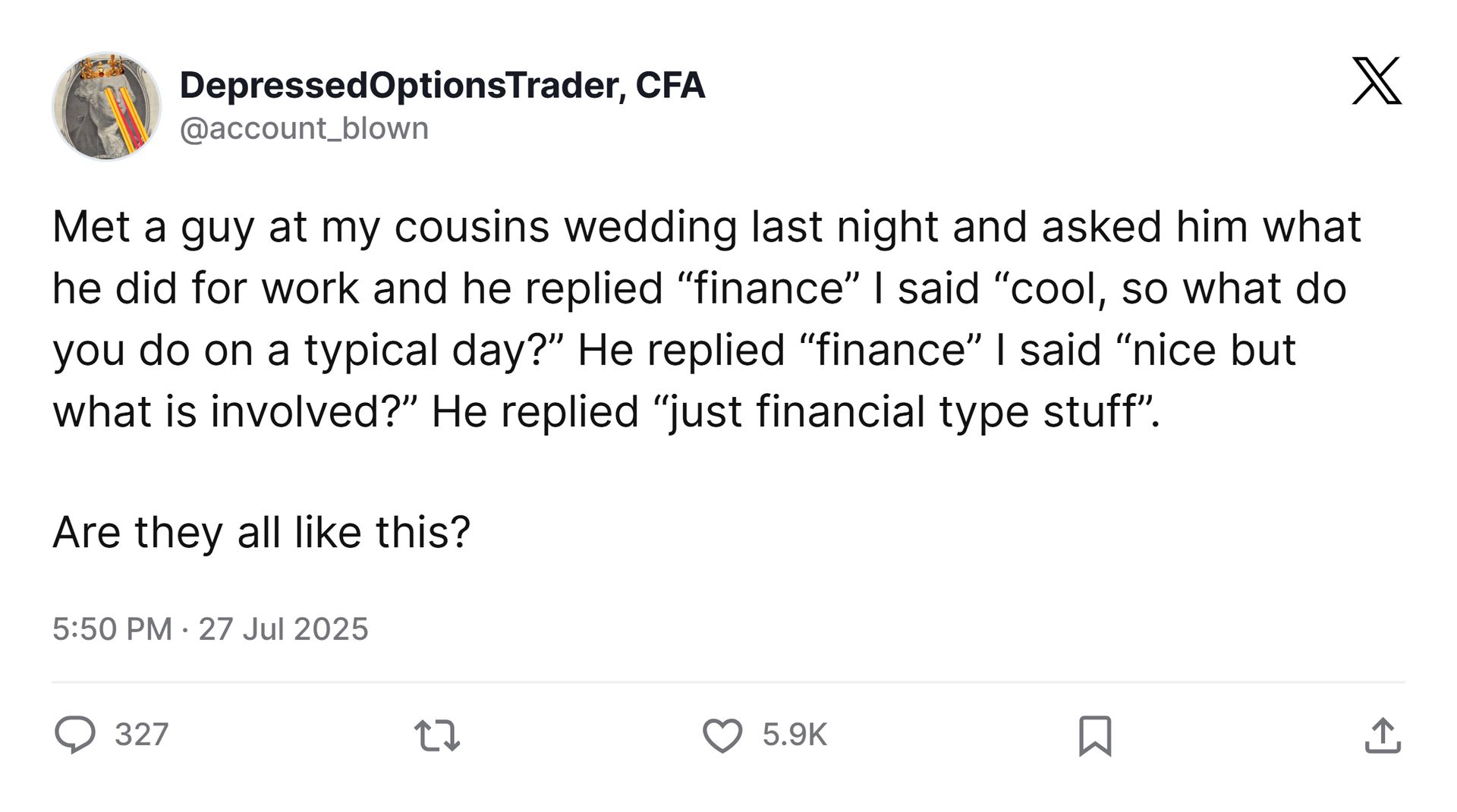

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📦 City Sublets: Verified rentals for finance professionals in NYC and beyond. Find or list your sublet with ease. Explore City Sublets.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Disclaimer: *This is a paid advertisement for Death & Company's Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

Reply