- Short Squeez

- Posts

- 🍋 Trading FAANG for Chipotle

🍋 Trading FAANG for Chipotle

Plus: Trump backtracks on Intel’s CEO, the millennial boss steering Schonfeld’s comeback, Big Tech employees backing Zohran Mamdani, and OpenAI shares trading at a premium.

Together With

“His success and rise is an amazing story.” — President Trump (on Intel CEO)

Good morning! U.S. companies are buying back stock at a record pace, with 2025 buybacks on track to surpass $1.1 trillion. Gold logged its sharpest one-day drop in three months after Trump confirmed he won’t impose tariffs on the metal.

Meanwhile, Trump reversed course on Intel’s CEO, praising him just days after calling for his resignation. Big Tech employees rank among the top donors to Zohran Mamdani’s campaign, and some OpenAI investors are paying steep premiums for shares.

Plus: The millennial boss steering Schonfeld’s comeback, Klarna is prepping for an IPO while rebranding as a bank to push its debit card, and the best hotel gyms in the world.

Need compliance ASAP? Vanta automates 35+ frameworks like SOC 2, ISO 27001, and HIPAA; less stress, less risk.

SQUEEZ OF THE DAY

Trading FAANG for Chipotle

A computer science degree was supposed to basically guarantee a six-figure job straight out of college, and with the AI boom in full swing, 2025 seemed like the perfect time to break into the industry. But while tech valuations soar and the stock market rips, recent grads are finding themselves shut out of the party. In reality, landing an entry-level job is proving to be much harder than they thought.

Purdue graduate Manasi Mishra, who began coding in elementary school, said the only company to call her after graduation was Chipotle… and she did not get the job. Another grad, Zach Taylor, applied to 5,762 positions and got zero offers.

Computer science and computer engineering majors now face some of the highest entry-level unemployment rates in the U.S., 6.1% and 7.5% respectively, more than double the rate for recent biology or art history grads.

The AI boom is proving a double-edged sword. AI coding tools like CodeRabbit can generate and debug thousands of lines of code instantly, reducing the need for junior engineers. The entry-level roles new grads rely on are often the first to be automated.

Meanwhile, Amazon, Meta, Intel, and Microsoft are still laying off workers and cutting hiring. Many candidates describe the process as bleak and demoralizing, with some ghosted after multiple interview rounds.

Some grads are pivoting. Mishra leveraged her TikTok influencer experience to land a tech sales role. Others are moving into policy, marketing, or non-coding tech jobs.

Takeaway: For years, students were told to “learn to code” to secure a stable, lucrative career. Now, they’re finding themselves on the wrong side of the AI revolution. The tech world is moving at lightning pace, and at this rate, no one knows what jobs will even exist tomorrow.

HEADLINES

Top Reads

American companies are buying back stocks at a record pace (WSJ)

Trump says gold will not face a tariff (YF)

Gold sees largest one-day drop in 3 months as traders react to Trump (WSJ)

Nvidia and AMD caught in Trump–China tech fight explained (CNN)

Nvidia is willing to pay U.S. government $3 billion to save China business (YF)

Rare-earth magnet maker raises $65 million in push to counter China (WSJ)

U.S., China agree to 90-day tariff pause (Axios)

Big tech workers emerge as top donors to Mamdani's NYC campaign (NYP)

Trump flip-flops on Intel CEO after demanding resignation (CNBC)

Hedge fund Schonfeld’s millennial boss Ryan Tolkin leads comeback for firm (BB)

Trump picks E.J. Antoni as new Bureau of Labor Statistics head (CBS)

Klarna revives its IPO but this time as a bank (BB)

Citi oversaw $1 billion for trust tied to sanctioned oligarch (BB)

Jefferies extended non-competes for private capital advisory arm (BB)

Microsoft’s GitHub chief is leaving as competition ramps up in AI (CNBC)

Natural-gas futures fall amid cooler weather forecasts easing summer demand (WSJ)

Goldman Sachs says consumers expected to bear the brunt of Trump’s tariffs (NYP)

Why some OpenAI investors are buying shares at a much higher price (Axios)

Gold tariffs leave bullish investors gleaming (Axios)

Trump calls in National Guard to tackle crime and homelessness in Washington (CNBC)

PRESENTED BY VANTA

Security Compliance SOCs 90% Less Now

Security frameworks like SOC 2 and HIPAA are non-negotiable, but that doesn’t mean they have to be a total time SOC, I mean, suck.

Vanta’s all-in-one trust management platform is the easy, affordable way to automate compliance for 35+ security frameworks.

Why thousands of startups and enterprises stay audit-ready with Vanta:

Saves you hours: Automates all that tedious, manual labor

Productivity boost: Compliance teams see a 129% efficiency lift—no burnout

High ROI: Pays for itself in 3 months

Accelerate Growth: To sell to the enterprise, you need to prove compliance

Build Customer Trust: Establish a strong security foundation and show you take security seriously

Build trust. Squash risk. Make it to Friday Happy Hour. Simple, right?

Grab a time with a Vanta team member, and claim a special offer of $1,000 off.

CAPITAL PULSE

Markets Rundown

Market Update

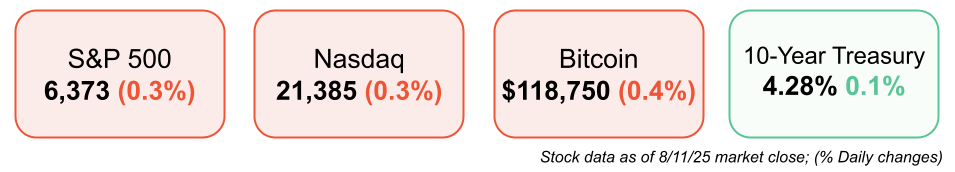

Stocks start the week lower as markets await July CPI and PPI, both expected to rise

Consumer staples and consumer discretionary led gains, while energy and real estate lagged

10-year Treasury yield eased to 4.28%, down from its July peak near 4.50%

Asia mostly higher after Trump extended China tariff pause by 90 days, as expected

WTI oil traded higher ahead of scheduled U.S.-Russia talks this week

Economic Data Highlights

July CPI due Tuesday, headline expected to edge up to 2.8% y/y from 2.7%

Core CPI seen rising to 3.0% annualized from 2.9% in June

PPI out Thursday, also expected to show an increase

Higher readings likely reflect early tariff impact, with most effects near term

Bond markets imply 10-year inflation expectations at 2.39%, still well anchored

Reported Earnings

Monday.com (MNDY) – Beat expectations with strong enterprise adoption and improving margins

Plug Power (PLUG) – Narrower-than-expected loss; revenue growth aided by green hydrogen demand

AMC Entertainment (AMC) – Narrowed loss as summer box office receipts improved y/y

Earnings Today

On Holding (ONON) – Focus on direct-to-consumer sales growth and international expansion

CoreWeave (CRWV) – Watch for cloud infrastructure growth and AI workload adoption trends

Circle (CRCL) – Key watch on USDC adoption, transaction volumes, and stablecoin market share

Movers & Shakers

(+) Tilray Brands ($TLRY) +42% after Trump weighs softening laws on cannabis.

(+) Fannie Mae ($FNMA) +15% because Trump confirmed the IPO timeline for the mortgage giant for 2025.

(–) Hershey ($HSY) -5% after a weak West African crop could impact production.

Private Dealmaking

Centerbridge Partners agreed to buy MeridianLink for $2 billion

Truemeds, an e-pharmacy focused on generics, raised $85 million

EliseAI, a developer of chatbots for the housing industry, raised $75 million

Vulcan Elements, a maker of rare-earth magnets, raised $65 million

Dropzone AI, a developer of cybersecurity agents, raised $37 million

Prophet Security, an agentic AI SOC platform, raised $30 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Shoveling $h!t

Description: A refreshingly raw and brutally honest memoir that takes you behind the curtain of entrepreneurship. Kass and Mike Lazerow recount the realities—parenting crises, financial setbacks, midnight pivots, and the relentless grind that no one sees—while building successful companies. This is entrepreneurship unfiltered, and it’s as much about grit as it is about growth.

Rating:

Amazon: 4.9 / 5

Goodreads: 4.7 / 5

Book Length: 240 pages

Audible Length: 6 hrs 5 mins

Ideal For: Founders, startup dreamers, investors, and anyone fascinated by the messy grind of entrepreneurship—especially those willing to embrace imperfection and the struggle behind every success.

“Never stop shoveling.”

DAILY VISUAL

Data Center Energy Demand Will Double Over the Next Five Years

Source: Apollo

PRESENTED BY DELETEME

Don’t Be A Victim. Protect Your Private Data In 5 Minutes.

If you want to help prevent your private data from being sold to identity thieves, fraudsters, or even insurance companies, you have a couple options:

Rummage through dozens of data broker sites yourself

Let the privacy pros at DeleteMe do it for you

Sign up is easy. Just plug in a few details, and DeleteMe will hunt down your private data, removing it from hundreds of sites online–24/7, 365.

In addition to peace of mind, you’ll get a report on what was found and where. Simple, right?

DAILY ACUMEN

Bench Depth

Everyone wants to be the star player.

But real winners build bench depth—relationships, habits, and skills they can sub in when life pulls a hamstring.

A single point of failure isn't strategy. It’s roulette.

Make your friendships anti-fragile.

Make your career portable.

Make your energy replenishable.

In bull markets, you can coast.

In bear markets, depth decides who survives.

ENLIGHTENMENT

Short Squeez Picks

The psychology of money in a BNPL world

The vacation paradox

Tips for reducing burnout at work

How to stay on top of your team’s projects without micromanaging

The best hotel gyms in the world

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply