- Short Squeez

- Posts

- 🍋 The Run Club Economy

🍋 The Run Club Economy

Plus: Chamath's new SPAC is 5x oversubscribed according to him, Citi requiring workers to master AI-prompt writing, and Ken Griffin gets the green light for Midtown’s tallest tower.

Together With

“Most investors want to be contrarian, until it's time to act like one.” — Jason Zweig

Good morning! “SPAC King” Chamath Palihapitiya is back with a $345M SPAC he says was more than 5x oversubscribed. Citi now requires most employees to master AI prompt-writing. Trump unveiled a drug pricing deal with Pfizer and a new “TrumpRx” site.

London has slipped out of the world’s top 20 IPO markets, overtaken by Mexico and Singapore, with its exchange now ranked 23rd. Ken Griffin’s plan to build Midtown’s tallest skyscraper just got the green light. And Nike posted surprise sales growth but warned of a weak holiday season and higher tariffs.

Plus: JPMorgan now employs more Texans than New Yorkers, and tips on handling burnout without losing your mind.

Compliance can be a major headache for growth stage companies primed for scale. Vanta removes that complexity and has the client list to prove it. Read more about how.

SQUEEZ OF THE DAY

The Run Club Economy

Many New Yorkers in their 20s complain that there’s not much to do in the city besides work, drinking, and pretending to be healthy by going for a run in Central Park or the West Side Highway.

But in a city that never seems to stop hustling, it looks like some of the city’s entrepreneurs and businesses have found a way to monetize some New Yorkers’ new favorite hobby to the tune of billions. Beyond run clubs and Strava kudos, it turns out NYC’s running boom is adding a billion dollars to the local economy.

A new study found that runners pumped $934 million into the city last year, a 58% jump over five years, per New York Road Runners (“NYRR”). The NYC Marathon alone brought in $692 million, with nearly $300 million going towards hotels and restaurants. And they’re expecting this year’s race on Nov. 2 could be another economic sprint.

Run clubs have become the new bar scene, with many groups meeting up at a restaurant or bar afterwards and pumping more cash into local businesses. Training apps like Runna and Strava (valued at $2.2B, looking to IPO in 2026) are also booming.

NYRR hosted 34 races with nearly 300,000 participants and more than a million guests last year.

The ripple effect is everywhere: retailers can’t keep up with demand for Hokas, race events are selling out, and younger pros are swapping happy hours for tempo runs. Even accountant-turned-DJ John Summit hosted a run club pop-up in Hudson Yards, just blocks from his old EY desk.

Takeaway: The first roaring twenties were fueled by speakeasies and jazz; this one has run clubs, training apps, and $12 matcha lattes. In true New York fashion, every fad becomes a business, so whether you’re piling up miles or piling up bar tabs as the marathon streams past, you’re feeding the city’s economy.

HEADLINES

Top Reads

'SPAC King' Palihapitiya launches new blank-check vehicle (CNBC)

Citi mandates AI prompt training for most employees (Linkedin)

White House unveiled TrumpRx drug site in deal with Pfizer (WSJ)

London drops out of top 20 IPO markets after 69% fundraising plunge (BB)

Ken Griffin wins approval for Midtown’s tallest skyscraper project (NYP)

Nike posts surprise sales growth (CNBC)

JPMorgan now employs more workers in Texas than in New York (NYP)

U.S. consumer confidence hits five-month low on job market concerns (BB)

S&P says it may cut Electronic Arts debt to junk after buyout (BB)

CoreWeave jumps 12% after $1.4B cloud deal with Meta (YF)

Guggenheim expands Madison Avenue footprint with renewed lease (NYP)

JPMorgan Chase unveils plans for fully AI-connected megabank (CNBC)

Consumer confidence weaker than expected as shutdown fears loom (CNBC)

AI data center boom faces labor market challenges (CNBC)

Private market blowups underscore risks for retail investors (BB)

PRESENTED BY VANTA

Vanta Automates Compliance, So You Can Focus on Growth

For high-growth fintechs, security and compliance aren’t optional, but managing SOC 2 workflows, ISO 27001, and other frameworks can take months of manual effort.

Vanta offers fintechs automated, continuous compliance, letting you keep up with increasing regulatory requirements and still focus on scaling your company.

Ramp, a Vanta customer, recently secured $500 million in funding at a $22.5 billion valuation. Vanta itself closed a Series D at a $4.15 billion valuation, proof that the platform delivers results for fast-growing teams.

Learn more about how Ramp keeps its global financial operations platform compliant and stays focused on growth with Vanta.

CAPITAL PULSE

Markets Rundown

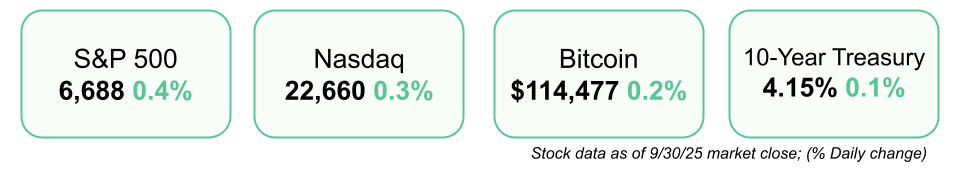

Market Update

U.S. stocks finished higher after an early pullback, capping a strong September with the S&P 500 up 3.3% for the month

Health care and technology led gains, while energy and consumer discretionary lagged

10-year Treasury yield rose to 4.16%, off its 4.0% lows earlier this month

Asia mixed: China’s PMI improved but remained in contraction; Europe flat

U.S. dollar weakened, WTI oil slipped on expected OPEC+ output hikes

Economic Data Highlights

August job openings steady at 7.2M, slightly above 7.1M forecast

September payrolls forecast: +50,000 jobs, vs. +22,000 in August

Unemployment expected at 4.3%, wage growth seen steady at 3.7% y/y

Labor market cooling but holding, with job openings just below unemployed levels

Reported Earnings

Paychex (PAYX) – Results highlighted steady payroll-services demand and resilience in small-business hiring trends

Nike (NKE) – Posted solid direct-to-consumer growth, with tariffs weighing modestly on margins and China demand mixed

Earnings Today

Cal-Maine Foods (CALM) – Watch for egg-pricing trends, volume growth, and consumer demand stability

Movers & Shakers

(+) CoreWeave ($CRWV) +12% after the company landed a $14B deal with Meta.

(+) UiPath ($PATH) +7% because the company announced a strategic partnership with OpenAI.

(–) Spotify ($SPOT) -4% after Daniel Ek will step down as CEO in 2026.

Private Dealmaking

Rebellions, an AI chipmaker, raised $250 million

Flying Tulip, an on-chain exchange, raised $200 million

Star Therapeutics, a biotech focused on bleeding disorders, raised $125 million

Eve, an AI platform for plaintiff law firms, raised $103 million

EdSights, a student voice platform, raised $80 million

Assort Health, a patient communications automation startup, raised $76 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

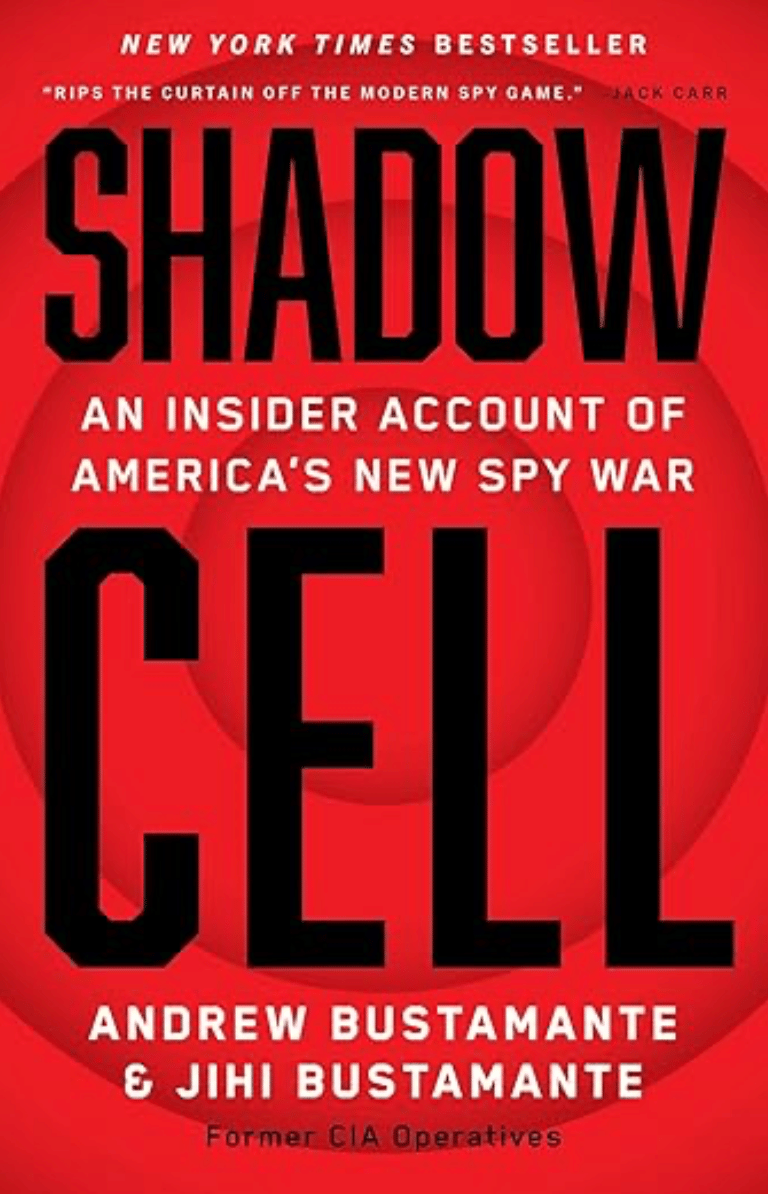

Shadow Cell

Description: A gripping memoir by a husband-and-wife CIA team tasked with rebuilding an intelligence cell after a mole compromised U.S. operations within a rival country. Operating under tight redactions, the Bustamantes narrate operatives’ tales of betrayal, undercover recruitment, and the blurred lines between loyalty and danger.

Book Length: 272 pages

Ideal For: Espionage fans, intelligence junkies, geopolitical readers, and anyone enchanted by real-world spycraft far more complex than fiction.

“This is a rare glimpse into the shadow war of the 21st century, where loyalty is tested, trust is weaponized, and victory comes at a personal cost.”

DAILY VISUAL

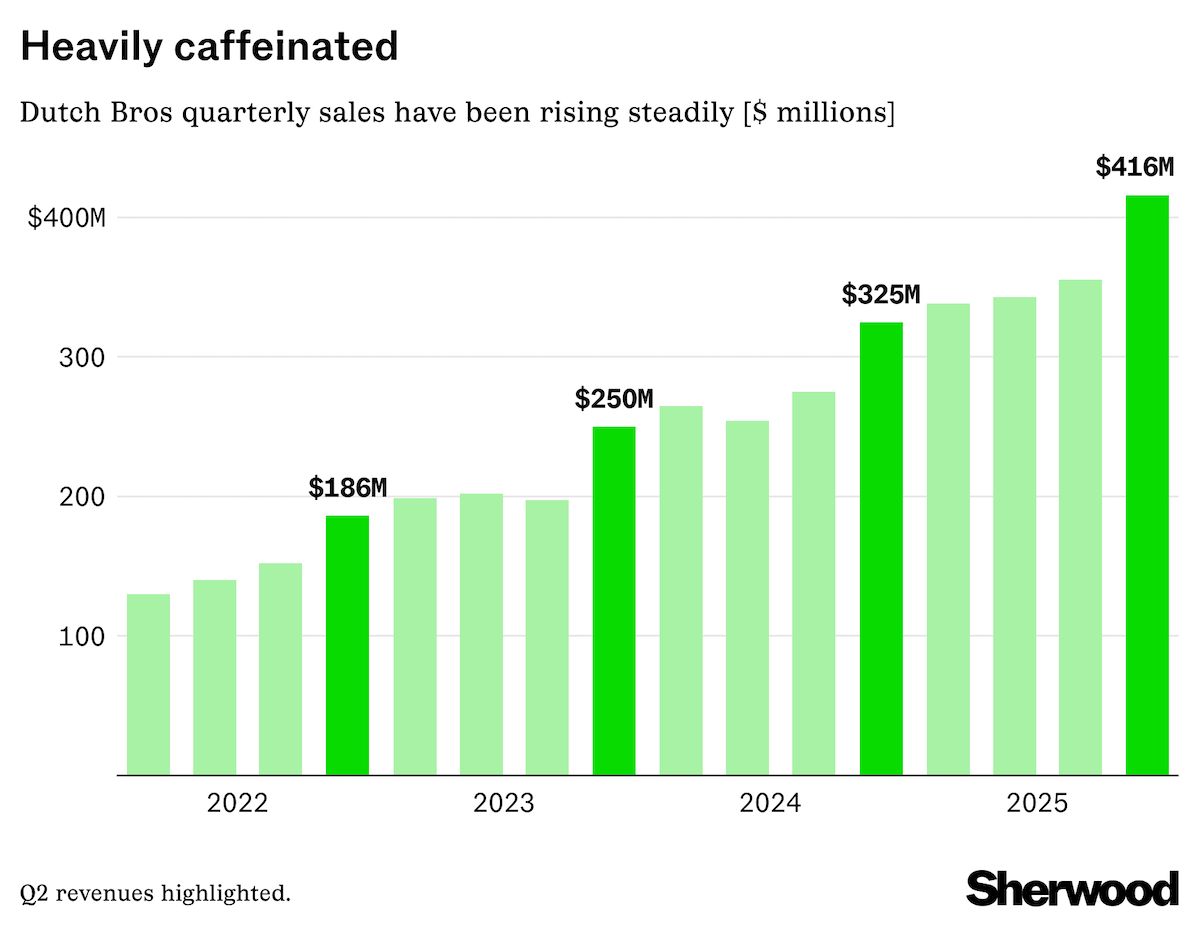

Dutch Bros Boomin’

Source: Chartr

PRESENTED BY FINIMIZE

Invest with Insight, Not Hindsight.

News headlines tell you what’s happened in the world... but not why it matters to you.

Wall Street analysts describe expert investing techniques… but they speak in DCFs and P/E ratios rather than plain English.

That’s why over a million modern investors subscribe to Finimize. Written by analysts who trained at world-leading institutions, this finance newsletter tells you what’s happening in the markets and, crucially, how that could impact your portfolio – all in a three-minute daily read.

DAILY ACUMEN

Fragility

Fragile systems break under stress.

Robust ones endure.

Antifragile ones benefit from stress.

Think of portfolios: overleveraged funds shatter in downturns; balanced ones survive; opportunistic ones thrive.

Health works the same: a fragile body collapses with illness, a robust one weathers it, an antifragile one grows stronger through training.

Ask yourself: which are you building? If every shock feels existential, you’re fragile.

If stress makes you sharper, you’re compounding antifragility.

ENLIGHTENMENT

Short Squeez Picks

What Machiavelli and St. Francis can teach us about the motivation of CEOs

How to fall asleep fast

How to handle burnout without losing your mind

8 habits that improve your focus

How to turn off a thought

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply