- Short Squeez

- Posts

- 🍋 Strip Club Accounting

🍋 Strip Club Accounting

Plus: Oracle, Silver Lake, a16z to buy TikTok, rate cut expected today, Google’s Gemini overtook ChatGPT, and JPM offering clients concierge perks from private jets to butlers.

Together With

“Saving is for the poor. Investing is for the rich. But both start the same way, spending less than you earn.” — Nick Maggiulli

Good morning! The Fed is set for its first rate cut of 2025, but the bigger question is how many more will follow. Chipmakers notched their longest winning streak since 2017 on AI momentum, while America’s top 10% of earners drove nearly half of all consumer spending last quarter.

Trump extended TikTok’s divestment deadline again, with a consortium of U.S. investors (including Oracle, a16z, and Silver Lake) preparing to take control of most of its American business.

Meanwhile, Google’s Gemini just overtook ChatGPT on Apple’s App Store, a New York judge dropped terrorism charges against Luigi Mangione, and JPMorgan is now offering its wealthiest clients concierge perks from private jets to butlers.

Plus: Gen Z’s Beli takes on Yelp, more workers are stuck in part-time jobs, and PE firms keep pouring billions into struggling companies.

Vanta recently secured their Series D at a $4.15B valuation. See why leading fintechs trust them for compliance (and get $1000 off).

SQUEEZ OF THE DAY

Strip Club Accounting

Five executives from RCI Hospitality, the publicly traded strip club operator behind Rick’s Cabaret and Tootsie’s Cabaret, were indicted on charges of bribery and tax fraud.

According to NY Attorney General Letitia James, the execs bribed a state tax auditor with lavish trips to Florida, where he allegedly received up to $5,000 per day in “private dances” at RCI-owned clubs.

The scheme wasn’t exactly subtle. On at least 10 occasions since 2010, RCI’s controller Timothy Winata flew from Texas to Manhattan to deliver bribes at Rick’s Cabaret, Vivid Cabaret, and Hoops Cabaret.

After one Florida trip, the auditor even texted Winata: “This was the best trip I had in Florida. The girls were very beautiful and nice…I hope we can have another trip before the summer.”

CEO Eric Langan was directly looped in too. During a 2018 audit, he texted a colleague: “We need to talk about New York and Dance Dollars,” warning they could be hit with $3M in taxes.

Later that day, he followed up: “I think I got the sales taxes in New York to 350 plus interest possibly. Tim is discussing with the auditor tonight ;).”

The AG’s office says these bribes helped RCI dodge more than $8 million in city and state taxes over a 14-year stretch. RCI’s stock (ticker: RICK) dropped 22% (including after-hours trading) after the 79-count indictment dropped, which includes charges of conspiracy, bribery, and criminal tax fraud.

Takeaway: Corporate scandals usually involve creative accounting, not lap dances. But the market doesn’t care how you disguise tax fraud, investors took one look at the indictment and stripped nearly a quarter off RCI’s stock price. That’s ~$65 million in market value destroyed for ~$8 million in “savings” aka a negative ~8x return!

HEADLINES

Top Reads

Fed set to cut rates (CNBC)

Chipmakers post longest win streak since 2017 amid AI growth (YF)

Top 10% of earners are driving a growing share of consumer spending (BB)

TikTok buyers group to include Oracle, Silver Lake, Andreessen (CNBC)

Google’s Gemini tops Apple’s App Store, snagging lead spot (CNBC)

Luigi Mangione top terrorism charges thrown out by judge in state case (NYP)

JPMorgan can now help you find a private jet or butler (CNBC)

How Beli ate Yelp (NYT)

More Americans are stuck with part time jobs (WSJ)

Private equity pours billions into troubled firms that fail (BB)

BlackRock adds to key executive committee in talent shuffle (FT)

Trump's Ivy League deals expected to funnel cash to trade schools (BB)

Charlie Kirk shooting suspect charged with murder, faces death penalty (CNBC)

Trump will bring $15 billion lawsuit against the New York Times (YF)

Josh Harris says you likely won’t see more sports assets going public (CNBC)

Goldman Sachs bankers explore limits of AI (FT)

Investors are feasting on trade wars ending, rate cuts coming (Axios)

Why mutual fund titans’ push into private credit isn’t paying off (BB)

Franklin Templeton predicts slowdown in investment management deals (FT)

PRESENTED BY VANTA

Why Leading Fintechs Choose Vanta for Security and Compliance

For high-growth fintechs, security and compliance aren’t optional, but managing SOC 2 workflows, ISO 27001, and other frameworks can take months of manual effort.

Vanta streamlines the process by automating up to 90% of security and compliance tasks, giving companies like Ramp and MoonPay the ability to scale while staying audit-ready.

Ramp, a Vanta customer, recently secured $500 million in funding at a $22.5 billion valuation. Vanta itself closed a Series D at a $4.15 billion valuation, proof that the platform delivers results for fast-growing teams.

With continuous monitoring, real-time risk visibility, and one unified platform, Vanta is the most efficient route to compliance.

Short Squeez readers get $1,000 off when booking a meeting with Vanta.

CAPITAL PULSE

Markets Rundown

Market Update

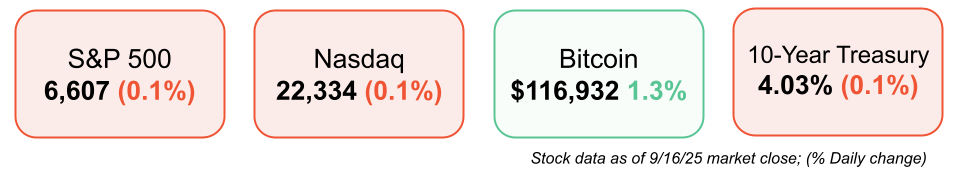

U.S. stocks closed lower, with the S&P 500 down 0.1% and the Nasdaq breaking a nine-session winning streak.

International equities were mostly weaker, with Canada, Europe and Asia lower, while Japan’s Nikkei rose.

Treasuries rallied, with the 10-year yield down to 4.03% after a strong 20-year auction.

Dollar softened against major currencies, while WTI oil rose on continued Ukrainian drone strikes on Russian refineries.

Economic Data Highlights

U.S. retail sales rose 0.6% m/m in August, with the control group up 0.7% m/m; July was revised higher.

Consumer spending shows resilience, despite weaker confidence and slower job growth.

Tariffs remain a risk, potentially squeezing real incomes if passed on to consumers.

Fed meeting: Markets expect a 25 bp cut, with a minority speculating on 50 bp. The updated dot plot will be closely watched for signals of further easing.

Reported Earnings

No significant earnings

Earnings Today

General Mills (GIS) – Focus on consumer demand resilience, cost pressures from tariffs, and pricing trends.

Movers & Shakers

(+) Webtoon ($WBTN) +39% after signing a deal with Disney to make comics.

(+) Hims & Hers Health ($HIMS) -6% because the FDA sent a warning letter because of drug advertising.

(–) Dave and Busters ($PLAY) -17% after the company’s CEO says the company is in more trouble than believed.

Private Dealmaking

California Resources agreed to buy Berry Corp. for $717 million

Divergent Technologies, a manufacturing platform for military parts, raised $290 million

Nothing, a smartphone developer, raised $200 million

Dyna Robotics, a developer of robots for commercial settings, raised $120 million

SEON, a fraud prevention startup, raised $80 million

Remedio, a cybersecurity startup, raised $65 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

From Manila to Wall Street

Description: A dual-memoir tracing the intersecting lives of Butch Meily and Reginald F. Lewis. Meily, a Filipino immigrant, rises through the cutthroat world of corporate public relations while working closely with Lewis—the first Black businessman to build a billion-dollar company through leveraged buyouts. Against the glitz of high finance and vast success, the book uncovers the personal costs of ambition, identity, loyalty, and grief.

Rating: 4.9 / 5

Book Length: 184 pages

Release Date: May 6, 2025

Ideal For:

Memoir lovers, business history fans, entrepreneurs, and anyone curious about what real leadership looks like when power, race, and legacy collide.

“I have made a living by attaching myself to powerful people and found it to be a profitable pursuit.”

PRESENTED BY BILL

Cut AP Time by 50%

Accounts payable shouldn’t eat up half your week, but for most finance teams, it still does.

BILL streamlines approvals, automates invoice capture, and centralizes everything in one place, helping companies reduce their accounts payable time by up to 50%, according to a survey of 2,000+ customers.*

See exactly how it works in Brew with BILL, a quick, live demo built for finance leaders who want faster, smarter payables.

DAILY ACUMEN

Reversal Thinking

Great investors don’t just ask, What could go right? They ask, What if I’m wrong? Reversal thinking, flipping a problem on its head, creates clarity.

Instead of asking, “How do I succeed?” ask, “How do I guarantee failure?” The answers are obvious: ignore risk, chase fads, overleverage.

Once you list them, you simply avoid them. In life, the same applies. Want a great career? Avoid being unteachable, avoid staying comfortable, avoid environments where politics matter more than output.

Sometimes the most powerful strategy isn’t charging forward, but removing the landmines that blow up progress.

Charlie Munger said it best: “Invert, always invert.” The map to winning often hides in the patterns of losing.

ENLIGHTENMENT

Short Squeez Picks

How AI is solving America’s $1T manufacturing labor crisis

Harvard Health on the importance of lifting

The best time to drink coffee

Why are so many billionaires over 80 years old?

How to fight the urge to make everything about yourself

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply