- Short Squeez

- Posts

- 🍋 Short Squeez Summer

🍋 Short Squeez Summer

Plus: Stocks are ripping but no one knows why, Goldman is starting to get worried about the economy, and SpaceX warning investors that Musk might jump back into politics.

Together With

"You’re not going to get promoted if you’re just doing your job." — Elon Musk

Good morning! Trump announced new trade deals with Japan and the Philippines. Most “Trump trades” have been in the green six months in, but Goldman is starting to sound the alarm on the broader economy.

The AI arms race is heating up: Elon’s xAI is reportedly seeking another $12 billion to buy more chips, just weeks after raising $10B. Meanwhile, SpaceX is warning investors that Musk might be eyeing a return to politics. And SoftBank and OpenAI’s $500 billion Stargate project has been sharply scaled back

Plus: Harvey Schwartz’s inspiring story from being a Rutgers reject to Carlyle CEO, Amazon is acquiring AI wearable startup Bee, and how many dates before you talk about money?

This luxury mountain retreat is making some wealthy families (and the investors cashing in) very, very happy. See it for yourself.

SQUEEZ OF THE DAY

Short Squeez Summer

It may be mid-summer 2025, but markets are giving off serious January 2021 vibes: meme stocks are officially back.

Retail traders have found new targets, and no sector is safe. This week, their chosen vessels of volatility were: Opendoor Technologies and... Kohl’s.

It all started when activist investor Eric Jackson, best known for calling Carvana early, posted a bullish thesis on Opendoor on X on July 14. The post went viral, and retail traders piled in. Since then, Opendoor shares have surged over 250%, despite dropping 10% yesterday as traders took profits.

And it just so happens that Reddit day traders aren’t just real estate experts, they’re big box retail gurus too.

Shares of Kohl’s jumped 38% today, after nearly doubling yesterday, making Tuesday the best single-day performance in company history. According to Bloomberg, the rally is being driven by a familiar culprit: a massive short squeeze.

But the rocket fuel for this renewed frenzy isn’t just social media hype, it’s also policy tailwinds.

Charles Schwab just expanded its 24-hour ETF trading offering to capitalize on growing demand from retail investors. That same demand helped Schwab post solid Q2 profits.

Even more wild: FINRA is considering slashing the “pattern day trading” minimum from $25,000 to just $2,000. That means almost anyone could soon be making 4+ day trades a week using margin.

Not everyone is thrilled. Michael Goldstein, finance professor at Babson and ex-FINRA advisor, warned that $2k is dangerously low for leveraged day trading: “There’s a whole bunch of 20-somethings who will have a very bad experience early on, and then shy away from the stock market as a whole for a decade.”

Takeaway: With markets and crypto at all-time highs, it was only a matter of time before meme stocks made a comeback. And we wouldn’t be surprised if the list grows in the weeks ahead. Investors aren’t following Buffett principles, they’re buying volatility and praying for exit liquidity.

HEADLINES

Top Reads

Why are stocks up? No body knows (WSJ)

Harvey Schwartz: From Rutgers reject to Carlyle CEO (Interview)

Trump announces trade deal with Japan that lowers tariff to 15% (AP)

Trump announces Philippines trade deal, after pact with Indonesia (Axios)

Six months in, most Trump trades are paying off (BB)

Goldman Sachs is getting worried about the economy (CNBC)

Investors risk 1999-like bubble and 2000s-era crash (Axios)

Big change is coming to the Fed (Axios)

Musk allies to raise up to $12B for xAI chips as it burns through cash (WSJ)

SpaceX warns investors Musk could return to politics (YF)

BlackRock restricts use of company devices for China travel (BB)

Europe stock exchanges mull 24-hour trade to attract retail investors (CNBC)

Why the HR exec in Astronomer scandal hasn’t been fired (NYP)

AstraZeneca to invest $50B in US (Hill)

Activist investors target $30B tied up in biotech stocks (BB)

Coffee giant Nescafé targets Gen-Z as consumption habits shift (CNBC)

SoftBank & OpenAI’s $500B Stargate project struggles to get off ground (WSJ)

Amazon acquires AI wearable startup (CNBC)

PRESENTED BY PACASO

This House Is Insane: Mountain Views. Ski Access. A Hot Tub!?

The Lionshead property in Vail has all the luxuries you’d expect in a ~$16 million mountain vacation home–access to the slopes, panoramic views, a heated deck…

But forget all that. Here’s the real kicker:

You can invest in this property (and its revenue stream) via Pacaso, the platform that turns fractional shares of high-end vacation homes into recurring profits.

Wealthy families share in the ownership, Pacaso handles the logistics, and you get a slice of the $1.3T vacation home market.

Don’t miss out–see all of Pacaso’s luxury offerings here.

CAPITAL PULSE

Markets Rundown

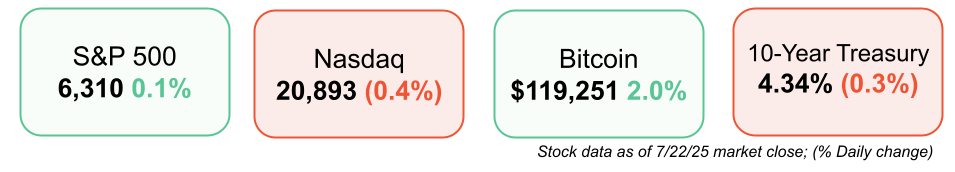

Market Update

U.S. stocks were mixed, as megacap tech stocks pulled back, ending the Nasdaq’s nine-day win streak.

The S&P 500 edged higher, with broad-based gains offsetting weakness in the "Magnificent Seven."

The Dow rose 0.4%, and the Russell 2000 small-cap index outperformed, gaining 1.0%.

10-year Treasury yields fell to 4.33%, as bond markets rallied on subdued inflation expectations.

Oil prices slipped 0.6% but remained within their $65–70 range; the U.S. dollar was steady.

Europe and Japan declined, while emerging markets rose on trade optimism.

Economic Data Highlights

No major U.S. data released today.

Markets await preliminary July PMIs on Thursday and jobless claims, which will provide insight into labor-market health and business sentiment.

Fed decision next week remains in focus, with expectations for rates to remain on hold.

Reported Earnings

General Motors (GM) – Beat EPS estimates with $2.53 adj. EPS despite a $1.1B tariff hit; warned Q3 impacts could worsen but reaffirmed full-year guidance.

Coca-Cola (KO) – Delivered solid volume and pricing growth; FX headwinds were less of a drag compared to prior quarters.

Lockheed Martin (LMT) – Missed on GAAP EPS due to $1.6B in one-time charges, but reaffirmed full-year sales and free cash flow guidance.

SAP (SAP) – Cloud revenue grew 24% YoY, driven by strong U.S. enterprise demand and backlog momentum.

Earnings Today

Tesla (TSLA) – Focus on margins, pricing discipline, and updates on Optimus, Dojo, and new models.

Alphabet (GOOGL) – Investors watching AI monetization (Gemini), ad trends, and Google Cloud margins.

Chipotle (CMG) – Analysts expect solid same-store sales and operating margins; commentary on menu pricing and consumer demand in focus.

Movers & Shakers

(+) Kohl’s Corp. ($KSS) +38% after a meme stock-fueled rally.

(–) Opendoor Technologies ($OPEN) -10% because the meme stock rally fizzled.

(–) Lockheed Martin ($LMT) -11% after the defense stock missed on earnings.

Private Dealmaking

Zerohash, a crypto infrastructure business, in talks to raise $100 million

Boulevard, a software for self-care businesses maker, raised $80 million

vVARDIS, a Swiss dental company, raised $50 million

iCounter, a cyber risk intelligence company, raised $30 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

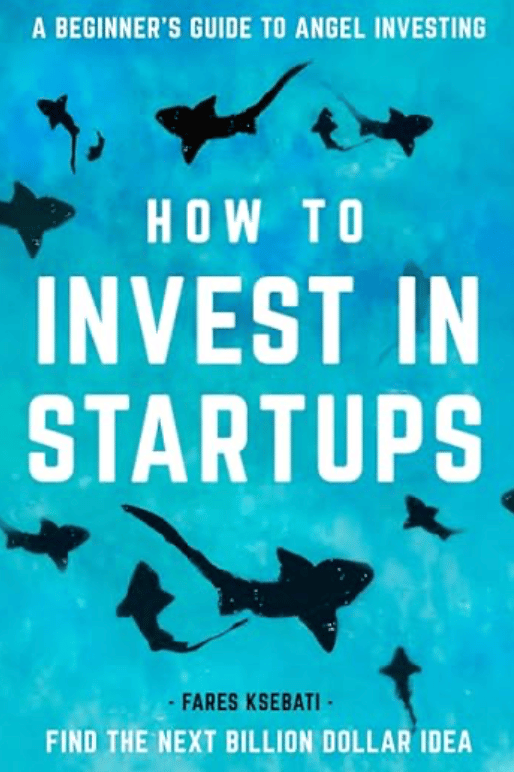

BOOK OF THE DAY

How To Invest In Startups

Description: A clear, jargon-free introduction to angel investing, this guide breaks down how to find promising founders, evaluate startup potential, perform due diligence, write an investment thesis, and get started with small online checks—even with just $100. Perfect for beginners aiming to learn the ropes of early-stage investing.

Rating: Amazon 4.8 / 5

Book Length: 206 pages

Ideal For: Anyone curious about angel investing—non‑accredited beginners and first-time investors eager to understand how to start small, reduce risk, and support high‑growth startups.

“A clear, practical introduction tailored to those new to angel investing, helping you build a solid foundation without jargon.” — BookAuthority

PRESENTED BY PORTFOLIOIQ

Private Investors: Stuck In Excel Hell?

Do you spend more time organizing data than actually analyzing it? Not anymore.

PortfolioIQ brings everything into a unified view, so you get to insights faster.

Leading funds are saving 500+ hours per year with PortfolioIQ:

Auto-extract metrics from documents, spreadsheets and emails

Track actuals, estimates, re-statements, and more

Trace every data point back to the original source

What’ve you got to lose, besides hours of copy/pasting this weekend?

DAILY ACUMEN

10-Year Cycles

Most people overestimate what they can do in a year—and wildly underestimate what they can do in ten.

That’s why great investors zoom out.

They think in decades, not deadlines.

But here’s the paradox: you still have to execute like it’s urgent.

Every day is a brick in the cathedral. And the cathedral only stands if you don’t miss the bricks.

So live with two clocks:

The slow one that keeps you humble, patient, and compounding.

The fast one that reminds you life is short and time is a non-renewable asset.

The future belongs to those who can hold both. Zoom out to stay wise. Zoom in to get wealthy.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Disclaimer: This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. There’s no guarantee that Pacaso will file for an IPO.

Reply