- Short Squeez

- Posts

- 🍋 “Sell America” Trade Is Back

🍋 “Sell America” Trade Is Back

Plus: BofA dishing out equity to employees, the messy drama at Mira Murati's AI startup, even top MBAs are struggling to find jobs, and Andreessen Horowitz is betting $3 billion that AI isn’t a bubble.

Together With

“By the way, “product” includes all interactions a user has with the company.” ― Sam Altman

Good Morning! Bank of America is granting about $1 billion in equity to employees, excluding senior managers. A major Danish pension fund plans to sell $100 million in Treasurys, citing ‘poor’ U.S. government finances, while Ray Dalio warns “capital wars” could push investors away from U.S. debt.

Goldman Sachs launched a private equity ETF with no illiquid assets. Blackstone, Apollo, and Ares are teaming up with OneDigital to push deeper into 401(k)s. And Wells Fargo is moving its wealth HQ to Florida.

Plus: The messy drama at former OpenAI CTO Mira Murati’s startup, MBA grads struggling to land jobs, Andreessen Horowitz betting $3 billion that AI isn’t a bubble, and commercial builders increasingly focused on data centers.

Stop the endless back and forth of “final” decks. Try Macabacus’ Deck Check today.

SQUEEZ OF THE DAY

The “Sell America” Trade Is Back

The “sell America” trade went into hibernation early last year, but it absolutely roared back yesterday. Markets suffered their worst day since April 2025 after President Trump escalated tensions with Europe over Greenland, and global investors scrambled to pare back exposure to U.S.-centric assets in a classic risk-off move.

The U.S. Dollar Index slid nearly 1%, its biggest drop since Trump’s April tariff flare-up. Treasury prices sold off sharply, pushing long-term yields to four-month highs. Gold and silver jumped to fresh records, while Bitcoin fell, a signal that investors were seeking safety in hard commodities rather than crypto.

U.S. equities got hammered, too. The Dow dropped more than 800 points, while the S&P 500 and Nasdaq each fell more than 2%. The VIX surged to its highest level since November, meaning investors are now pricing in sustained policy volatility, not just a single bad day.

The key reason for the sell-off is similar to the one we’ve seen from other TACO trades; Trump threatened to impose 10% tariffs on eight European countries starting Feb. 1, which will rise to 25% by June, unless the U.S. is allowed to “take over” Greenland.

European officials convened an emergency meeting and are reportedly weighing retaliatory tariffs. Investors are now worried that U.S. trade policy has become unpredictable, reviving the classic “sell America” trade: a weaker dollar, higher yields, and a higher risk premium for holding U.S. assets.

The bond market is driving most of the volatility. The spike in long-dated Treasury yields signals rising anxiety about U.S. fiscal risk and the possibility that foreign buyers could pull back from financing U.S. deficits. Ray Dalio captured this dynamic in Davos, warning that trade wars can bleed into “capital wars,” where countries grow less willing to fund America’s borrowing.

European equities sold off alongside Asia, with the Stoxx 600 extending its decline. But the bigger story is relative positioning. Investors are actively hedging away from a market that already dominates global portfolios. With U.S. stocks now accounting for the majority of global market capitalization, there is little room for complacency if policy risk keeps rising.

Takeaway: When the dollar falls, bonds sell off, equities drop, and precious metals rally together, markets are questioning America’s policy stability, not just pricing a headline. If the tariff threats persist, the “sell America” trade could become more than a blip: it could turn into a sustained re-rating of U.S. risk. But, if history is any indicator, we could see Trump chicken out in the coming weeks.

PRESENTED BY MACABACUS

Retire the FINAL_final_v7 Deck

There are two kinds of “final” decks: the ones you send, and the ones you keep fixing.

If yours is living somewhere around FINAL_final_v7, you are not alone. Every edit introduces drift: a slightly different font, a chart that nudges off-grid, and bullets that break. Multiply that across 60 plus slides and it turns into late-night cleanup right before the deck goes upstairs.

Deck Check by Macabacus runs a fast quality pass across your pitchbooks, CIMs, and client decks to flag formatting, alignment, branding, and consistency issues, so “final” can actually mean final.

Retire the FINAL_final.

HEADLINES

Top Reads

Bank of America to award $1B in stock to nearly all employees through Sharing Success Program (Fox)

Danish pension fund to sell $100 million in Treasurys, citing 'poor' U.S. government finances (CNBC)

Ray Dalio warns of “capital wars” as global investors may shun US debt (CNBC)

Goldman Sachs launches private equity ETF with no illiquid assets (Citywire)

Blackstone, Apollo, Ares team up with OneDigital in 401(k) push (BB)

Wells Fargo becomes first major bank to relocate wealth operations headquarters to Florida (Fox)

Even MBAs from top business schools are struggling to get hired (WSJ)

Andreessen Horowitz makes a $3 billion bet that there’s no AI bubble (BB)

Commercial builders are losing their appetite to build anything but data centers (WSJ)

Amazon CEO Andy Jassy says tariffs are starting to drive up product prices

(CNBC)

When did Dry January get so expensive? (WSJ)

Trump threatens 200% tariff on French wine and champagne to pressure Macron into Board of Peace (CNBC)

Goldman Sachs grapples with top lawyer's Epstein problem (WSJ)

Investment in Manhattan real estate is booming with Union Square storefronts filling up (NYP)

Americans are the ones paying for tariffs, study finds (WSJ)

Netflix amends Warner Bros. Discovery offer to all cash (CNBC)

Wall Street had hopes for AI, Alphabet made those wishes come true (Axios)

CAPITAL PULSE

Markets Rundown

Market Update

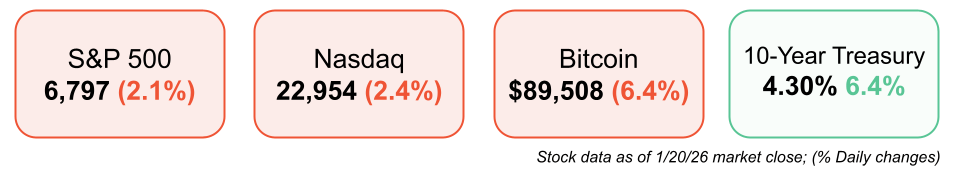

U.S. equities sold off sharply as tariffs and geopolitics weighed on sentiment, with the S&P 500 and Nasdaq –2%+ and the Dow –1.8%

European markets declined, with the Euro Stoxx 50 –0.6%, following tariff threats tied to Greenland negotiations

Treasury yields moved higher on the long end, while the U.S. dollar fell nearly 1%

Gold (+3%+) and silver (+6%) surged as investors sought safe havens

Japanese government bond yields jumped, with the 30-year JGB rising to ~3.87% on fiscal concerns

Economic & Macro Themes

The U.S. announced 10% tariffs on eight European nations, rising to 25% on June 1 absent a deal

The EU accounts for ~19% of U.S. trade, suggesting modest downside risk to growth and upward pressure on goods prices if tariffs persist

Retaliation from Europe remains a risk and could further weigh on global growth

Despite near-term volatility, markets are entering this period with solid economic momentum and strong recent growth

Sector Trends

Risk-off positioning dominated, with broad equity weakness across growth and cyclicals

Precious metals outperformed sharply

Energy and commodities reflected heightened geopolitical uncertainty

Earnings Season

Q4 earnings season remains constructive despite market volatility

About 7% of S&P 500 companies have reported, with earnings tracking ~7% growth for the quarter

2025 earnings expected to finish 11%+, with ~15% growth projected for 2026

Looking Ahead

Near-term volatility may persist as tariff negotiations and geopolitics evolve

Historically, pullbacks are a normal feature of strong long-term equity returns

We continue to favor equities over fixed income, viewing volatility as an opportunity to add exposure

Preferred areas include U.S. large- and mid-caps, international small- and mid-caps, and emerging-market equities amid a supportive earnings backdrop

Movers & Shakers

(+) IAMGOLD ($IAG) +15% after Bank of America raised its price target because of strong market movement.

(+) Sandisk ($SDNK) +10% because Citi almost doubled its price target.

(–) Lululemon ($LULU) -6% after the company removed a line of leggings from its website over quality concerns.

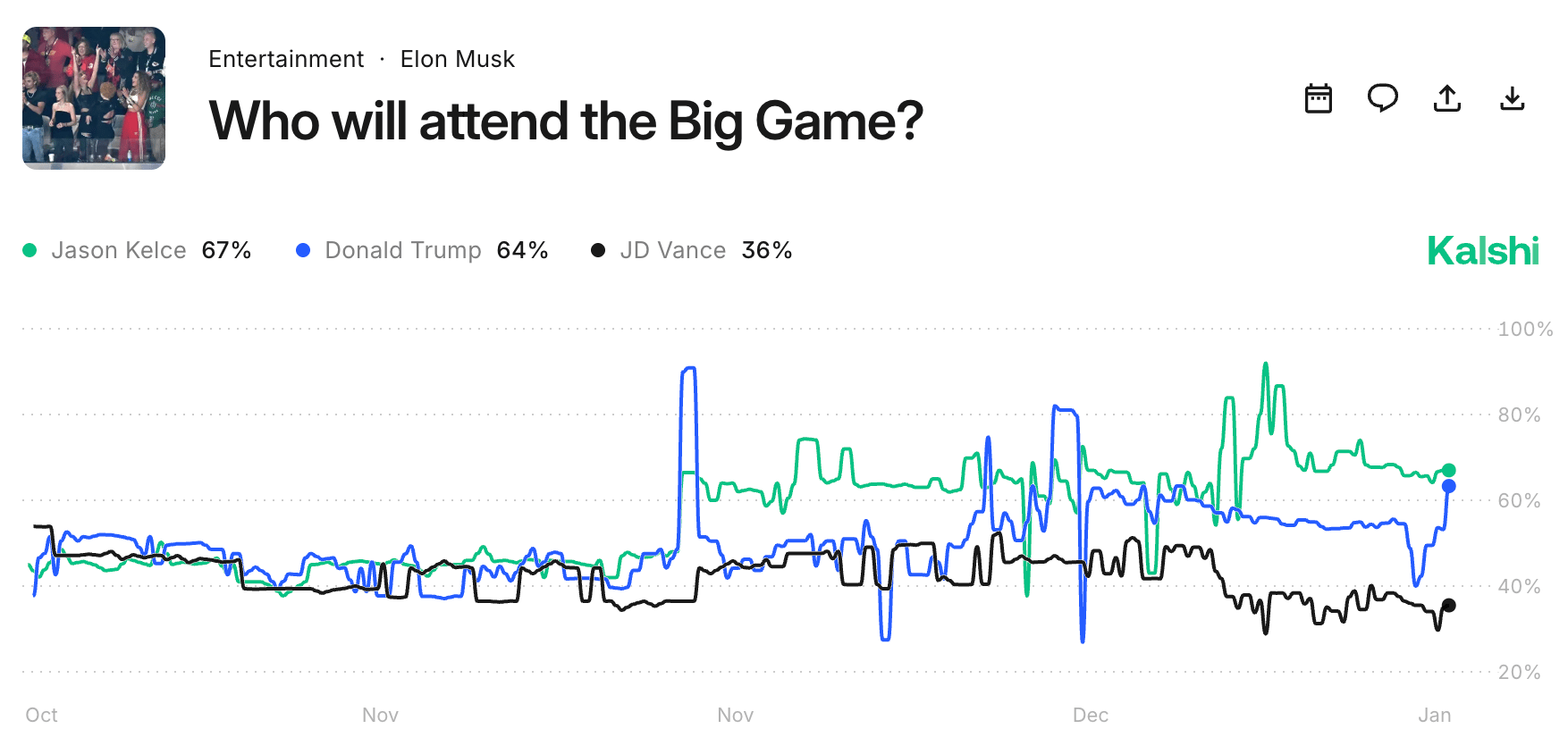

Prediction Markets

The Super Bowl is in California on February 8th. Who do you think will attend?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

GSK acquired RAPT Therapeutics, a developer of therapies for food allergies, for $2.2 billion

humans&, a human-centric AI lab focused on building general-purpose AI systems aligned with human values, raised $480 million

Terralayr, a battery storage company focused on large-scale energy storage infrastructure, raised $210 million

Pennylane, an accounting and financial management software platform for businesses, raised $200 million

DealHub, an enterprise sales engagement platform that manages quotes, contracts, and revenue workflows, raised $100 million

Emergent, an AI software creation platform that enables developers to build and deploy AI applications, raised $70 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

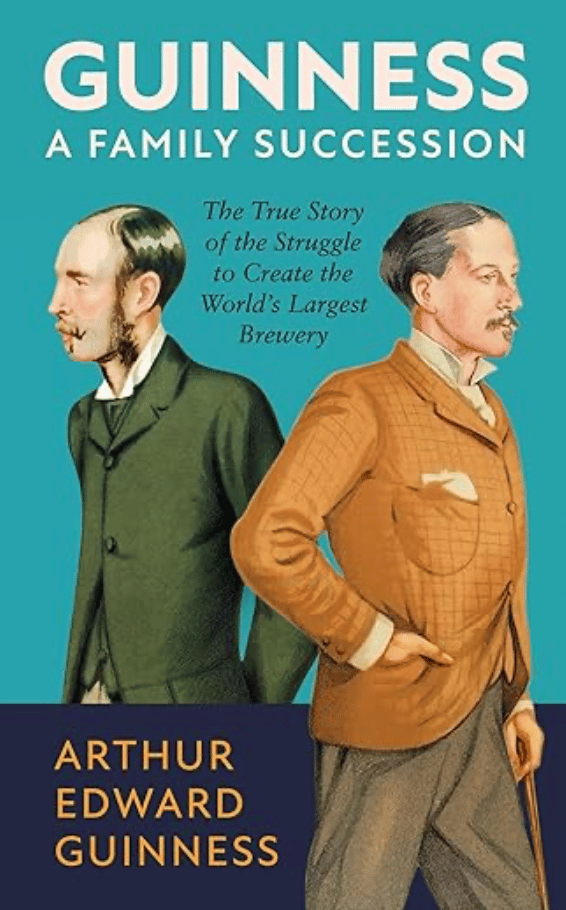

Guinness

Description: An intimate and sweeping business history from inside one of the world’s most iconic brands. Arthur Edward Guinness, with historian Antonia Hart, tells how four generations of the Guinness family navigated rivalry, expansion, innovation, and corporate upheaval to build a brewing empire. The story blends family drama with strategic insight, showing how legacy, leadership, and bold decisions shaped both an enduring company and a cultural legend.

Book Length: 312 pages

Release Date: October 21, 2025

Ideal For: Business history lovers, brand builders, leaders, and anyone fascinated by how family firms grow, evolve, and endure.

“Great brands aren’t just built, they’re inherited, contested, and fought for.”

DAILY VISUAL

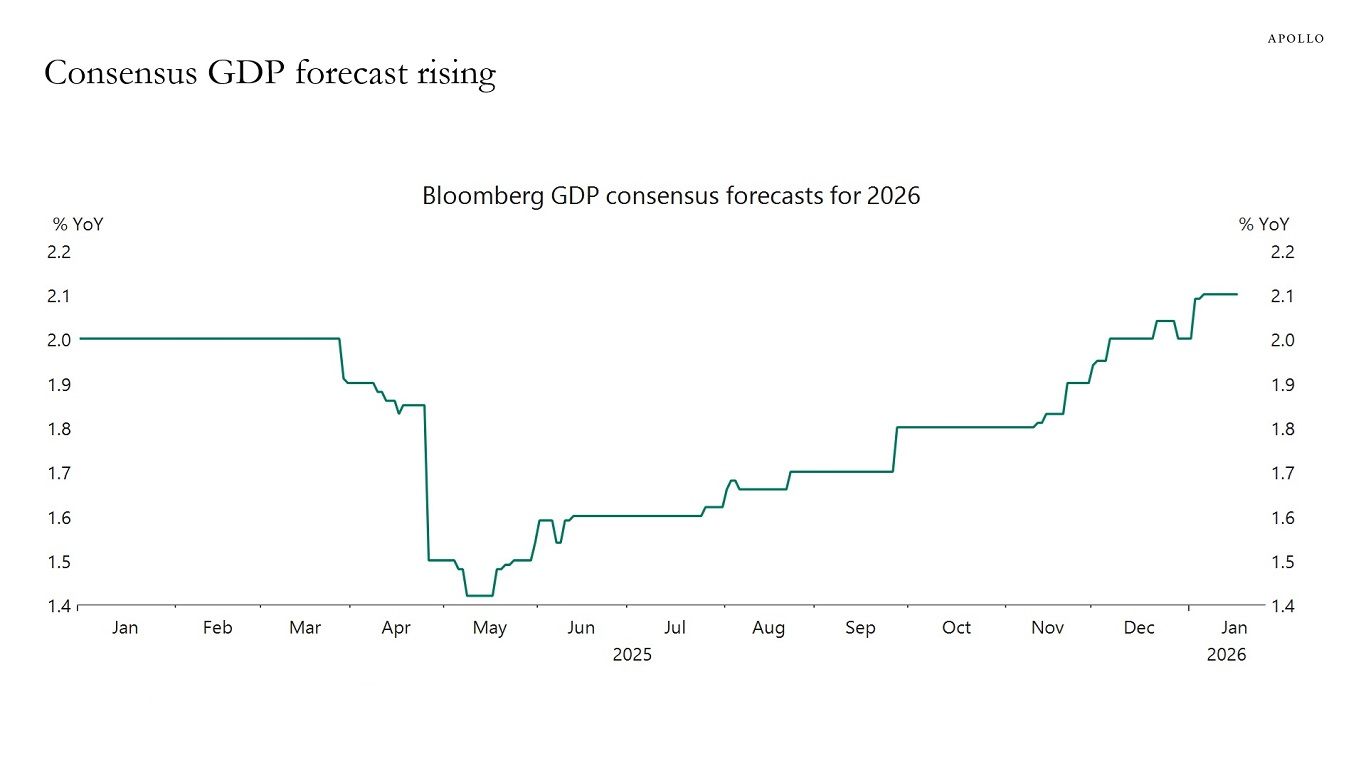

US Growth Accelerating as We Go Through 2026

Source: Apollo

PRESENTED BY ORNN AI

The Ornn Index: S&P 500 for Accelerated Compute

GPU compute pricing is messy because compute isn’t interchangeable. An H100 in Dallas is not the same as an H100 in Norway, and the same chip can behave very differently depending on the provider, networking, uptime, and counterparty risk.

But capital providers still have to price it.

Right now, lenders, neoclouds, and data center builders are making multi-year commitments using list prices, surveys, guesswork, and assumptions that don’t map to reality.

Ornn is building the missing reference layer: indices based on actual GPU compute transactions, not quoted rates. Think of it as WTI for high-performance compute, giving the market a common benchmark without pretending everything is identical.

Compute doesn’t need to be fungible. It needs to be observable.

DAILY ACUMEN

Micro-decisions

Every morning, you make approximately 35,000 decisions. Most are unconscious, but a handful shape everything.

What you eat for breakfast determines your energy for hours. Whether you check your phone before getting out of bed sets your mental state for the day. Snoozing your alarm teaches your brain that commitments are negotiable.

These seem trivial, but they're training your neural pathways for bigger decisions.

When Jeff Bezos makes decisions, he categorizes them as either reversible or irreversible. Reversible decisions get made quickly with 70% of the information. Irreversible decisions get deep thought.

Most of your daily decisions are reversible, yet you agonize over them, burning mental energy needed for what actually matters. Meanwhile, the micro-decisions you make on autopilot are quietly programming your future.

What you choose in the first hour after waking predicts the rest of your day with stunning accuracy.

Morning exercise correlates with better food choices later. Reading before emails correlates with more strategic thinking.

These aren't coincidences. They're cascades. One good decision makes the next one easier. One bad decision makes the next one harder.

What micro-decisions are you making unconsciously that deserve conscious attention?

Remember, you don't decide your future once. You decide it 35,000 times a day, one small choice at a time.

ENLIGHTENMENT

Short Squeez Picks

How to focus longer*

How to beat the mid-afternoon slump

The best places to visit in Switzerland

How embracing strangers boosts longevity

Is insomnia a sleep hack?

When your hard workout leads to overtraining symptoms

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Sponsored post.

Reply