- Short Squeez

- Posts

- 🍋 Private Equity’s Winter

🍋 Private Equity’s Winter

Plus: Citi’s wealth boss denies making execs cry, JPM is poaching bankers at a record pace, Celsius is having a monster 2025, and the eternal debate, morning vs. evening workouts?

Together With

“What makes a decision great is not that it has a great outcome. A great decision is the result of a good process.” — Annie Duke

Good Morning! Happy Q3 to all those who celebrate. Citigroup’s embattled wealth boss Andy Sieg brushed off reports that he terrorized colleagues with profanity-laced tirades, while JPMorgan is busy poaching a record number of senior bankers as dealmaking heats up.

Celsius popped 5% after PepsiCo upped its stake to 11%; the finance bro fuel of choice is now up 130% this year. Affirm surged 11% on an earnings beat. Meanwhile, Gen Zers are six times more likely to invest today than in 2015, and a study of 67,000 job interviews found AI outperforms human recruiters.

Plus: Gold hit a record high, how Italy’s bank M&A wave collapsed, why the market for startup shares keeps getting even weirder, and whether it’s better to work out in the morning or evening.

Vanta recently secured their Series D at a $4.15B valuation. See why leading fintechs trust them for compliance (and get $1000 off).

SQUEEZ OF THE DAY

Private Equity’s Fundraising Winter

Private equity has shifted from dominating capital formation on Wall Street to enduring one of its most difficult fundraising climates in years.

Global fundraising totaled just $592 billion in the twelve months to June, weakest since 2018, despite managers deploying every incentive in the book: early-commitment fee breaks, expense caps, and transaction-fee rebates.

General partners are now offering what one adviser called “a smorgasbord of discounts” simply to secure allocations.

The challenges are structural. Higher interest rates have stalled exits, liquidity remains constrained, and limited partners are over-allocated with billions trapped in aging portfolios.

PE returned just 11% of NAV to investors last year, the weakest distribution rate since 2009. That shortfall has left pensions and endowments reluctant to recycle capital, forcing advisers to warn that a meaningful share of funds will miss their targets.

The market has also become saturated. A decade of post-GFC entrants has fueled record fund proliferation, compressing fee economics and intensifying competition. Bain estimates that net management fees have fallen by roughly half since 2008.

In Europe, the crowding is especially stark: Advent, Permira, Bridgepoint, BC Partners, Astorg, and Inflexion are all simultaneously raising multi-billion-dollar funds, creating unprecedented overlap in the market.

Even political tailwinds have disappointed. Deregulation and tariffs under Trump were billed as catalysts for deal activity but instead introduced new friction. Roughly a third of LPs have slowed commitments, while nearly 10% have paused altogether. With $474 billion of buyout dry powder still seeking a home, advisers caution that some managers may not even reach a viable first close.

Takeaway: Private equity’s fundraising model has been structurally reset. Fee discounts and concessions are no longer differentiators. LPs are rationing commitments, and only managers able to demonstrate credible, forward-looking value creation will survive in what has become the most competitive fundraising environment in a generation.

HEADLINES

Top Reads

Americans kept spending last month despite elevated inflation (CNN)

Wealthy shoppers rack up more refunds, report finds (CNBC)

AI-led job interviews outperform human recruiters, study finds (BB)

Gen Zers are six times as likely to be investing now as in 2015 (Fortune)

Citi wealth boss Andy Sieg denies claims of making executives cry (NYP)

JPMorgan poaches record amount of senior bankers (FT)

How Italy’s banking M&A wave starts crashing (CNBC)

The market for startup shares is getting even weirder (Economist)

Pepsi boosts stake in Celsius energy drink maker (Axios)

Citi asks two Japan bankers to reconsider quitting amid talent war (BB)

Padres owner Peter Seidler taps private equity for fresh capital (Axios)

How hedge funds won big on an obscure drugmaker (WSJ)

Liquidity in public and private credit markets is converging (Apollo)

Lululemon founder sells $160M in Amer Sports stock (BB)

Affirm stock jumps over 11% after earnings beat (CNBC)

Global asset management M&A tops $50B for first time in a decade (FNL)

German inflation cools in August (CNBC)

The private equity firm that wants to revitalize US manufacturing (MD)

What Wall Street is saying about the latest U.S. inflation data (CNBC)

Companies pivot to wealthy consumers as lower-income spending stalls (Fox)

U.S. stocks slip as Fed’s preferred inflation gauge stays sticky (BB)

Existing home supply climbs to highest since 2016 (Fortune)

Gold on track for best month in four as inflation data bolsters rate cut bets (CNBC)

PRESENTED BY VANTA

Why Leading Fintechs Choose Vanta for Security and Compliance

For high-growth fintechs, security and compliance aren’t optional, but managing SOC 2 workflows, ISO 27001, and other frameworks can take months of manual effort.

Vanta streamlines the process by automating up to 90% of security and compliance tasks, giving companies like Ramp and MoonPay the ability to scale while staying audit-ready.

Ramp, a Vanta customer, recently secured $500 million in funding at a $22.5 billion valuation. Vanta itself closed a Series D at a $4.15 billion valuation, proof that the platform delivers results for fast-growing teams.

With continuous monitoring, real-time risk visibility, and one unified platform, Vanta is the most efficient route to compliance.

Short Squeez readers get $1,000 off when booking a meeting with Vanta.

CAPITAL PULSE

Markets Rundown

Market Update

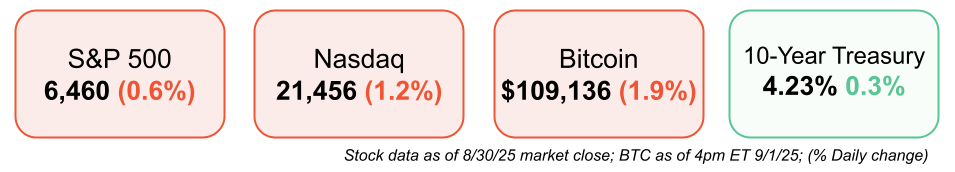

U.S. stocks fell, with the Nasdaq underperforming the S&P 500 and Dow.

Despite today’s decline, the S&P 500 gained ~1.9% in August, its fourth straight positive month; YTD the S&P 500 is up ~9.8% and the Nasdaq ~11.1%.

10-year Treasury yield steady near 4.2%, holding below its July highs.

After a ~30% rally since April lows, we see potential for near-term volatility, which may present buying opportunities for long-term investors.

Economic Data Highlights

July PCE inflation matched forecasts: headline at 2.6% y/y, core at 2.9% (vs. 2.8% prior).

Goods inflation continues to face tariff-driven pressure but should stabilize.

Services inflation may cool in coming months.

University of Michigan survey showed long-term inflation expectations at 3.5%, well below forecasts, signaling anchored inflation expectations.

Reported Earnings

Alibaba (BABA) – Reported revenue and earnings slightly above expectations; cloud growth continued to rebound, though margins were modestly pressured by competition.

Earnings Today

NIO (NIO) – Focus on delivery growth, margin recovery, and new model rollout updates.

Zscaler (ZS) – Key watch: billings growth, large enterprise wins, and AI-driven security offerings.

Iris Energy (IREN) – Investors focused on bitcoin mining capacity expansion, cost per mined bitcoin, and power efficiency metrics.

Movers & Shakers

(+) Petco Health & Wellness ($WOOF) +24% after the pet food retailer posted strong turnaround results.

(+) Affirm Holdings ($AFRM) +11% because the fintech company beat earnings.

(–) Ulta Beauty ($ULTA) -7% after the beauty retailer issued cautious guidance.

Private Dealmaking

Desjardins Global Asset Management acquired Guardian Capital Group for $1.2 billion

Commonwealth Fusion Systems, a nuclear fusion startup, raised $863 million

Rhone Group bought Freddy’s, a fast casual burger chain for $700 million

PepsiCo invested $585 million to increase its stake in Celsius

Barclays sold its stake in Entercard Group to Swedbank for $273 million

Poet agreed to buy an ethanol plant from Green Plains for $190 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

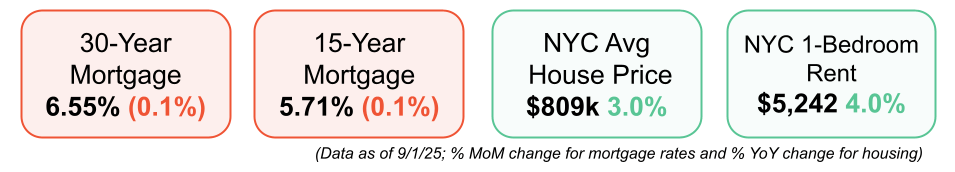

Mortgage rates have fallen to a 10-month low, fueling stronger purchase demand thanks to steady economic growth and cheaper borrowing costs. Affordability remains a hurdle for many buyers, but with rates trending lower and a potential Fed cut looming in September, more sidelined buyers may finally be tempted to jump into the market.

Latest News

New Listings

233 E 17th St Apt: PH3 New York, NY: 3 Bed / 2 Bath – $3.7M

29 Kenwood Rd Southampton, NY: 4 Bed / 3.5 Bath – $3.0M

3716 Multiview Dr Los Angeles, CA: 5 Bed / 6 Bath – $6.5M

Saint-Tropez Grimaud, Var France: 5 Bed / 2.5 Bath – $9.2M

Bonampak Cancún, Quintana Roo Mexico: 6 Bed / 6.5 Bath – $4.4M

BOOK OF THE DAY

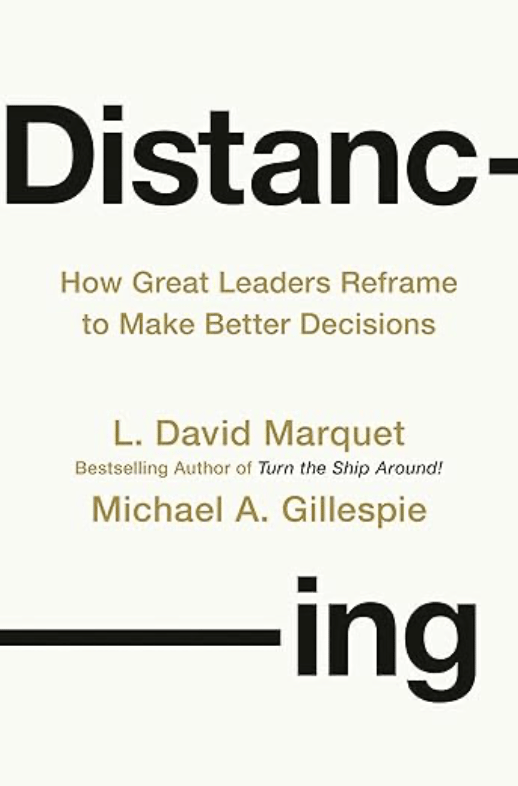

Distancing

Description: A practical leadership manual that teaches you how to become your own coach through mental reframing—what the authors call psychological distancing. Rather than getting stuck in reactive mode, you'll learn to step outside yourself via three powerful shifts:

· Self-distancing: Imagine viewing your situation as a neutral observer.

· Spatial distancing: Zoom out to see your life in a broader context.

· Temporal distancing: Imagine your future self reflecting back on your choices today.

This technique helps clear emotional clutter, enhance clarity, and empower wiser decision-making—even under pressure.

Rating: Amazon 4.9 / 5

Book Length: 224 pages

Audiobook Length: 5 hrs 25 mins

Ideal For: Leaders, executives, coaches, professionals in high-pressure roles, and anyone looking to make calmer, clearer decisions.

“We all struggle to extract ourselves from the immediacy of the moment when overwhelmed. Distancing gives you the tools to step back and think clearly.” — Publishers Weekly“

DAILY VISUAL

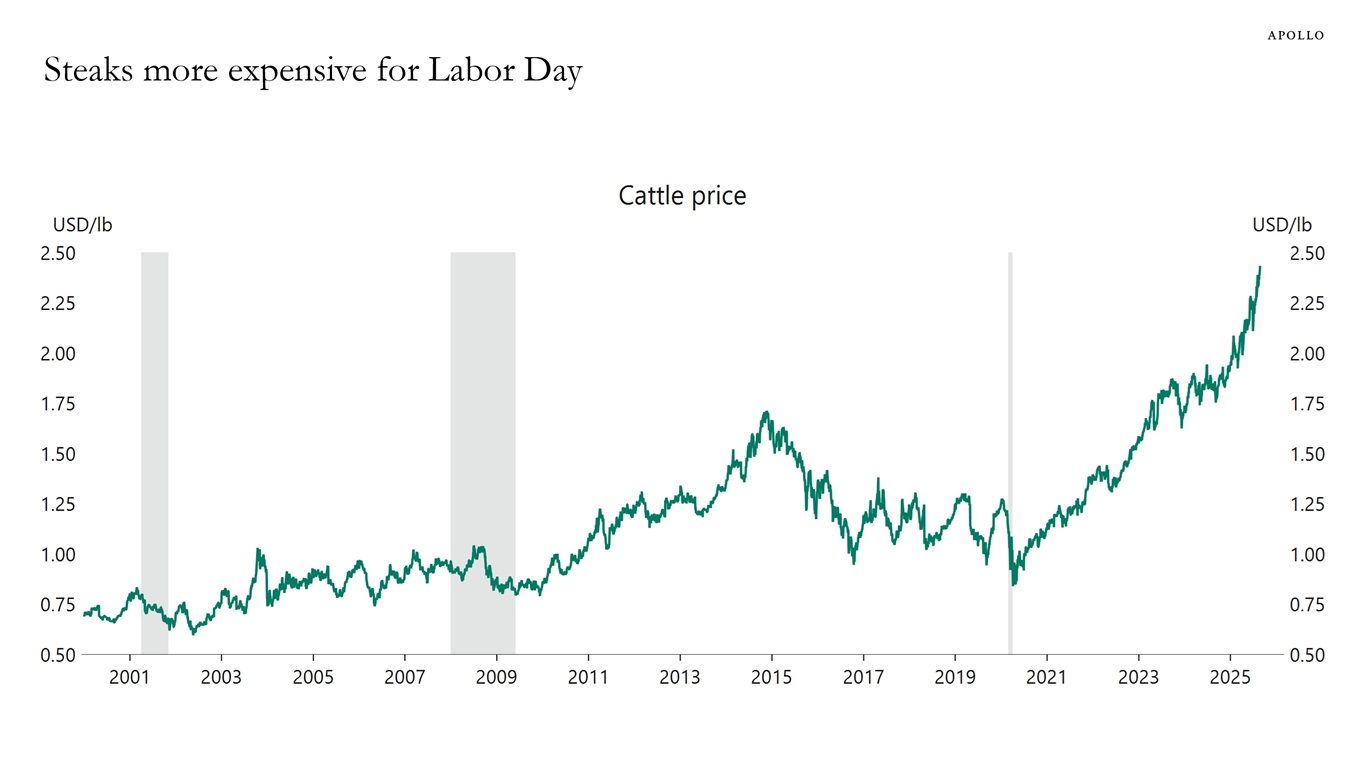

Expensive Labor Day Steaks

Source: Apollo

PRESENTED BY MOSAIC

IPO Exit Sensitivities

Mosaic automatically builds full IPO exit sensitivities so that you can compare outcomes between private and public exit paths side by side, without any extra setup.

Instant side-by-side views of private vs. IPO exit returns

Get a clear picture of which path delivers stronger economics with no need to rebuild sensitivities manually.

Test assumptions that matter for IPO readiness

Quickly flex exit multiples, margin ramps, and revenue growth to understand when the public markets make sense.

Bring more rigor to IC discussions

Back up your IPO vs. M&A recommendation with data-driven scenario analysis that’s already built.

By automating IPO exit sensitivities, Mosaic helps you evaluate every angle - without slowing down your process.

DAILY ACUMEN

Liquidity

In markets, liquidity is the ability to buy or sell without moving the price.

In life, it’s the ability to pivot without blowing yourself up.

Illiquidity is dangerous: the investor forced to sell at the bottom, the professional trapped in a job they hate because they can’t afford to quit, the founder too overleveraged to survive a slow quarter.

Liquidity looks boring when things are calm—savings account balances, skillsets you may never use, quiet relationships you maintain just in case—but in a crash it’s priceless.

Build liquidity in every dimension: financial (cash buffers), professional (transferable skills), personal (support networks).

Liquidity is optionality. Optionality is freedom. And freedom is what lets you step toward opportunity when everyone else is frozen.

ENLIGHTENMENT

Short Squeez Picks

Morning vs. evening workouts

Consistency beats timing

The minimalist travel lifestyle isn’t all it’s cracked up to be

Where to travel solo based on your personality type

When you want to quit your job but feel stuck

MEME-A-PALOOZA

Memes of the Day

u

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply