- Short Squeez

- Posts

- 🍋 Private Companies, Public Attention

🍋 Private Companies, Public Attention

Plus: Disgraced Astronomer CEO resigns, Wells Fargo suspends China travel after a top banker blocked from leaving, Dorsey's Block joins S&P 500, and Citi raiding JPM for talent.

Together With

“Things may come to those who wait, but only the things left by those who hustle.” — Abraham Lincoln

Good Morning! Astronomer CEO Andy Byron has resigned after the viral kiss cam fiasco. Wells Fargo suspended China travel after a top banker was barred from leaving the country, while Citi is poaching dealmakers from JPMorgan.

Wall Street may have missed out on a massive fee event after Couche-Tard dropped its bid for Seven & i Holdings, one of the year’s biggest potential deals. Jack Dorsey’s Block soared on news it’s joining the S&P 500, and retail investors are favoring ETFs over single-stock dip buys.

Plus: Jamie Dimon opens up about getting fired from Citi on the Acquired podcast, and Jensen Huang shares what he’d study if he were in college today.

The next decade of private equity runs on AI. Download Carta’s whitepaper to see how your PE firm can stay ahead.

SQUEEZ OF THE DAY

Private Companies, Public Attention

In a move that underscores how mainstream private markets have become, JPMorgan is expanding its research coverage to private companies, starting with none other than OpenAI.

Unlike traditional equity reports, these won’t include price targets or earnings estimates. Instead, they’ll offer structured insights and tracking on key private firms. The first report questions whether any chatbot company can maintain an edge in large language models and notes that OpenAI may not reach profitability until 2029.

JPMorgan’s Head of Global Research, Hussein Malik, said in an external note to clients.: “Private companies are increasingly pivotal in shaping the growth and outlook of industries.”

With nearly 1,500 unicorns globally, and companies like SpaceX ($350B), ByteDance ($400B+) and xAI ($200B), now rivaling public-market giants, it’s no surprise Wall Street is adding private markets coverage.

Other firms are already ahead of the curve: UBS began profiling private companies back in 2022 and now covers over 1,300. But JPMorgan’s entry brings added scale and credibility to this evolving space.

Takeaway: As private markets soak up capital, companies are staying private longer than ever. Why go public and deal with volatility, regulatory headaches, and quarterly scrutiny if you don’t have to? With nearly 1 billion users, OpenAI is increasingly looking like it could become the world’s first trillion-dollar company to never IPO.

HEADLINES

Top Reads

Astronomer CEO Andy Byron resigns after viral controversy (CNBC)

Banks Wells Fargo suspends China travel after employee exit ban (CNBC)

Wall Street banks miss out on millions in fees as Seven & i Deal collapses (BB)

Block shares soar 10% on entry into S&P 500 (CNBC)

The stock market bargain that’s right under your nose (WSJ)

Trump tariffs become a convenient crutch for bankrupt U.S. companies (BB)

Jamie Dimon interview: How JPMorgan became an $800B bank (YouTube)

Inflation outlook tumbles to pre-tariff levels in latest Michigan survey (CNBC)

Donald Trump set to open US retirement market to crypto investments (FT)

Nvidia CEO on the field he'd focus on in college (CNBC)

Wall Street wants to make private markets more public (NYT)

Citi’s new banking chief steps up poaching of JPMorgan dealmakers (FT)

Nvidia and Tesla are hot, but retail investors are shifting to ETFs (Axios)

SMBC sells over $1.5B investment-grade loans to Apollo (BB)

IRS outlines tax deductions from Trump’s “big, beautiful bill” (Axios)

Trump tariffs are creating market downturns that Wall Street is gaming (Axios)

Why Delta and United are pulling away from the airline pack (CNBC)

Down in one: how private equity swallowed the BrewDog Unicorn (FT)

Demand has soured for Lululemon (BB)

PRESENTED BY CARTA

Why Some PE Firms Will Thrive (And Others Won’t Survive)

By 2030, AI won’t just be a competitive advantage, it will be the gold standard. And, the firms that don’t adopt it will likely go extinct.

Insert Carta.

They are helping top PE firms automate reporting, cut errors, and unlock deeper insights with a platform built for the future.

Their new whitepaper reveals:

The three models of PE back-office operations—and why their hybrid tech-services approach is the future

How their AI-driven platform is transforming fund reporting, due diligence, and deal flow for leading firms

What agentic AI means for scaling productivity, accuracy, and service to LPs

Don’t let your firm fall behind. See how Carta is helping PE leaders set the pace for the next decade.

CAPITAL PULSE

Markets Rundown

Market Update

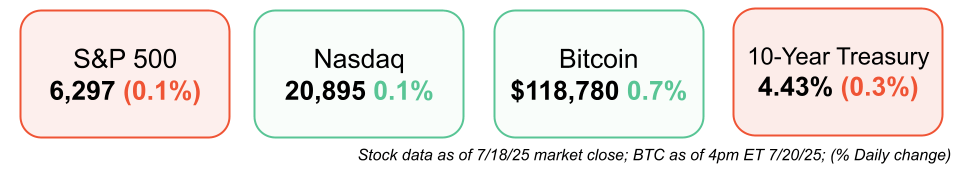

U.S. equities were mixed Monday, with the S&P 500 and Nasdaq flat, while the Dow dipped modestly.

The 10-year Treasury yield edged lower to 4.44%.

Communication and health care stocks led gains; industrials and materials underperformed.

WTI oil fell over 1% amid rising U.S. stockpiles and slower Chinese demand concerns.

The U.S. dollar slipped slightly; Europe closed higher, while Asia was mostly lower overnight.

Economic Data Highlights

No major U.S. data releases Monday; attention turns to flash PMIs and housing data later this week.

Fed officials reiterated a data-dependent stance on rates.

Markets continue to price in a September rate cut, with 1–2 cuts expected in 2025.

Eurozone consumer confidence improved slightly in July.

Reported Earnings

American Express (AXP) – Beat on EPS and revenue; strong card spending by affluent consumers drove results.

Charles Schwab (SCHW) – Slight beat on net interest income; client asset flows remained resilient.

3M (MMM) – Topped estimates; noted improving industrial demand and raised full-year profit guidance.

Schlumberger (SLB) – Delivered solid results; international oil services demand supported pricing power.

Ally Financial (ALLY) – Missed on earnings as auto loan delinquencies rose more than expected.

Truist Financial (TFC) – Met expectations; cost-cutting initiatives offset softer commercial loan growth.

Earnings Today (Before Open)

Verizon (VZ) – Focus on postpaid subscriber growth and wireless service revenue.

NXP Semiconductors (NXPI) – Analysts watching automotive and industrial chip demand.

AGNC Investment (AGNC) – Mortgage REIT outlook in focus amid shifting rate expectations.

Movers & Shakers

(+) Invesco ($IVZ) +15% after the investment management company will increase fee revenue.

(+) Charles Schwab ($SCHW) +3% because the wealth management company increased new brokerage accounts.

(–) Netflix ($NFLX) -5% after the streaming company lowered its guidance.

Private Dealmaking

38 Degrees North, a solar company, raised $230 million

Lovable, a vibe coding startup, raised $200 million

Perplexity AI, an AI search startup, raised $100 million

Q.ANT, a photonic processing company, raised $72 million

BrightAI, an industrial AI startup, raised $51 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

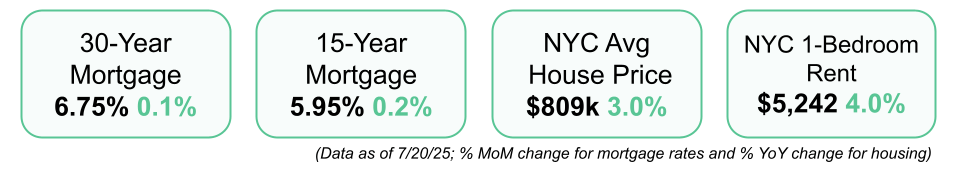

The average 30-year fixed mortgage rate rose for the second consecutive week. Despite ongoing uncertainty around long-term economic policy, the recent stability in rates over the past few months has offered a sense of confidence to many homebuyers.

Latest News

New Listings

49 Birchwood Ln Bridgehampton, NY: 6 Bed / 7.5 Bath - $5.2M

64 Grand Street Apt: 5 New York, NY: 3 Bed / 2 Bath - $4.5M

444 N Lucerne Blvd. Los Angeles CA: 6 Bed / 6 Bath - $3.5M

1 Rue Buenos-Ayres, Paris France: 4 Bed / 3 Bath - $7.6M

Beloura Villa Sintra, Lisboa Portugal: 5 Bed / 9 Bath - $5.5M

BOOK OF THE DAY

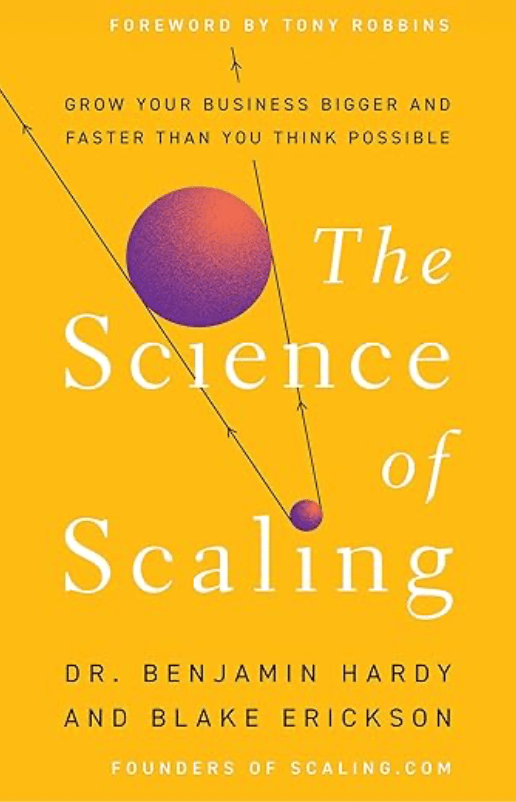

The Science of Scaling

Description: A radical growth blueprint for leaders stuck in incremental thinking. Behavioral psychologist Hardy and entrepreneur Erickson introduce the Science of Scaling framework—Frame, Floor, Focus—showing how to set impossible goals, eliminate noise, and build scalable systems that consistently deliver exponential growth.

Rating: Pre-order buzz with testimonials from Tony Robbins and Stephen Covey praising its paradigm shift

Book Length: 256 pages

Ideal For: Entrepreneurs, CEOs, and growth-minded professionals tired of linear gains—who want a field-tested roadmap to 10‑100× scale in just a few years.

“It’s rare that a book marks a paradigm shift and remodeling of an entire field of thought… If you’re looking for the clearest, most actionable blueprint I’ve seen for creating exponential impact… study it.” — Tony Robbins

PRESENTED BY VANTA

Automated Compliance = More Deals, Less Work

Security compliance is critical, but it doesn’t have to be complex.

With Vanta, you can automate your SOC 2, HIPAA, and 35+ other frameworks for less time and money–all while deadbolting your security.

Trusted by 10,000 startups, enterprises, and more:

Easy to use: One platform to manage risk and compliance 24/7

Saves time: Boost team efficiency by 129%

Pays for itself: 526% ROI in just 3 years

DAILY ACUMEN

Calendar Alpha

Wealth isn’t measured in dollars—it’s measured in calendar control.

You can’t compound what you don’t control. And yet most people build lives where their calendar becomes a prison: back-to-back calls, endless obligations, no room to think or breathe.

It’s easy to end up rich and busy, but much harder to be rich and spacious.

A small pocket of open time—on purpose—is like oxygen for your mind. That’s when you get your best ideas. That’s when you actually see the game you're playing.

Naval said it well: “The ability to do what you want, when you want, with who you want, for as long as you want, is true wealth.”

In that light, calendar design is not just a productivity hack—it’s a moral choice.

Are you compounding your freedom? Or sacrificing it for someone else’s agenda?

Build a portfolio of hours you actually want to live. That’s alpha.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply