- Short Squeez

- Posts

- 🍋 PE Without the Exit

🍋 PE Without the Exit

Plus: Astronomer CEO meme galore, ChatGPT can now create excel and ppts, Perplexity valued at $18B, Juul is back from the dead, and Amazon is rewarding AI skills.

Together With

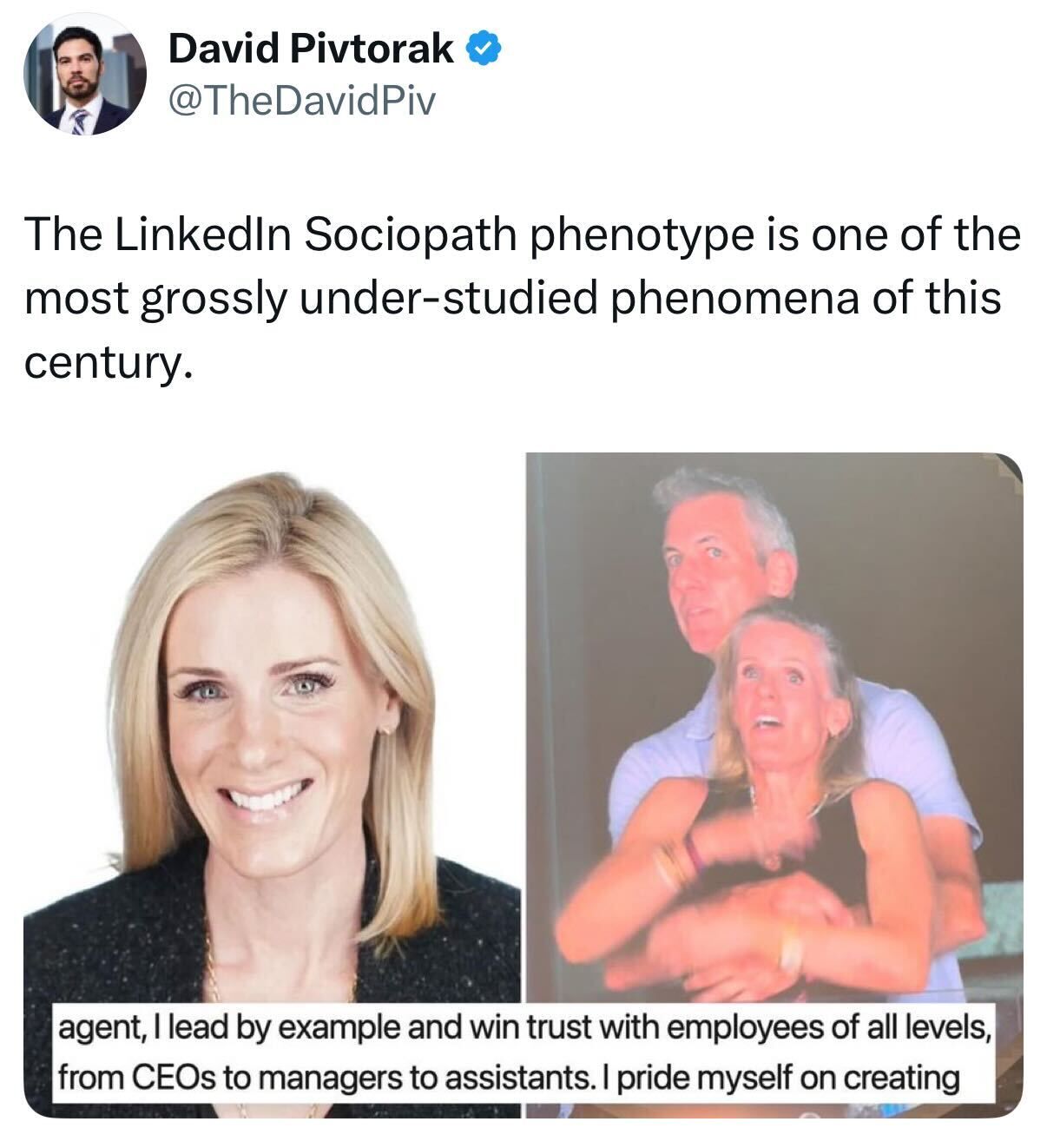

"Each day on Twitter there is one main character. The goal is to never be it."

Good Morning and Happy Friday! CEO of billion-dollar startup Astronomer was caught “hugging” his chief people officer on the Jumbotron at a Coldplay concert, and the internet had a field day (see memes below).

ChatGPT dropped a powerful a new update that lets users create and edit Excel spreadsheets and PowerPoint decks. OpenAI rival Perplexity hit an $18 billion valuation. And Amazon now requires employees to explain how they’re using AI at work... in their promotion applications.

Plus: Juul is back from the dead, more private firms are exploring IPO workarounds, Congress OK’d stablecoin regulation, and half of workers say their boss doesn’t understand what they actually do.

One of NYC’s hottest bars is expanding. Here is your opportunity to invest in their future (and to get $12 cocktails for life).

SQUEEZ OF THE DAY

PE Without the Exit

Goldman Sachs is launching a new program aimed at stopping the steady talent drain to private equity. The pitch: join investment banking full-time after your internship, and in two years, we’ll transition you into our private equity group, all without ever leaving the Goldman ecosystem.

It’s part of a broader effort to retain top talent before they’re poached. Just days ago, Goldman introduced a new policy requiring junior bankers to certify every quarter that they haven’t accepted a job offer elsewhere, essentially a loyalty pledge.

Dan Dees, co-head of global banking and markets, made the pitch sound almost romantic. In a memo to interns, he said, “The path you find yourself on at Goldman Sachs might just be the one that keeps you here many, many years later.”

Meanwhile, the PE world isn’t totally on the offense anymore. Giants like Apollo and General Atlantic are dialing back early recruiting, fending off pressure from larger banks like JPMorgan and Goldman Sachs. And with the on-cycle process under fire, Goldman is sensing its chance to reclaim the upper hand.

Takeaway: Goldman is making it clear: it’s done being a training ground for private equity. Now, if you join Goldman, you can skip the on-cycle chaos entirely and still land in private equity. Not a bad deal. Play the long game, and you might never need to leave 200 West Street.

HEADLINES

Top Reads

Coldplay’s kiss cam exposes Astronomer’s CEO Andy Byron alleged affair with HR chief Kristin Cabot (YF)

ChatGPT can now ‘think’ and ‘act’ for you after a new update (CNN)

ChatGPT will soon shop online, make PowerPoints on your behalf (YF)

How stocks could tumble if Fed chair Powell is fired (Axios)

US investment banking is so back (FT)

AI startup Perplexity valued at $18 billion with new funding (BB)

Banks are thriving so far in Trump’s economy (CNBC)

Uber invests $300M in Lucid EVs (TC)

Wall Street firms are buying utilities to tap into the AI boom (NYT)

Blackstone’s data center darling confronts a future without its $3B man (BB)

How Trump's firing Powell could backfire and lift interest rates (CNBC)

50% of employees say their boss doesn’t understand their job (CNBC)

Private firms revisit skipping Wall Street IPO on path to market (BB)

NYC braces for wealth flight with Mamdani’s political rise (BB)

Private equity billionaire says Jerome Powell has done a great job (YF)

Homebuilders are slashing prices at the highest rate in 3 years (CNBC)

Private assets group pushes for broad access to savers’ 401(k)s (BB)

Congress passes 1st major crypto legislation in the U.S. (NPR)

Amazon units reward AI skills (LI)

Kevin Warsh touts ‘regime change’ at Fed (CNBC)

Juul gets FDA’s OK to keep selling tobacco and menthol e-cigarettes (AP)

PRESENTED BY DEATH & CO

Get $12 Cocktails For Life

On New Year’s Day 2007, when it first opened its doors, the price of a signature cocktail at Death & Co was $12. Now they’re bringing it full circle for investors — for just one more week.

With $14M in revenue and a projected 205% increase over the next two years, this award-winning hospitality group is opening new bars in major U.S. cities, launching a boutique hotel in Savannah, and growing verticals like publishing, education, and e-commerce.

You have until Tuesday, 7/22, to invest in Death & Co and get $12 cocktails for life.

CAPITAL PULSE

Markets Rundown

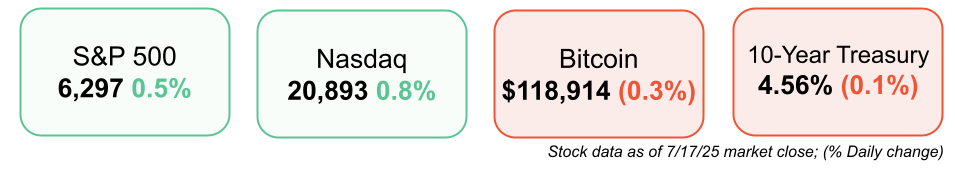

Market Update

U.S. stocks rose, with the S&P 500 and Nasdaq hitting record highs.

The 10-year Treasury yield climbed to 4.46%, still below its May peak near 4.60%.

Financials and tech led gains, while health care and real estate lagged.

WTI oil traded higher as geopolitical tensions rose following Israeli strikes on Syria.

The U.S. dollar advanced; Europe and Asia both closed higher as eurozone inflation held steady.

Economic Data Highlights

Initial jobless claims fell to 221,000, below forecasts of 232,000.

Continuing claims held steady near 1.95 million, showing labor-market resilience.

Retail sales rose 0.6% in June, beating expectations for a 0.2% gain.

Auto sales climbed 1.2%, a key contributor to stronger retail data.

Consumer strength remains, likely supporting growth despite tariff pressures.

Reported Earnings

Taiwan Semiconductor (TSMC) – Strong AI chip demand helped beat expectations; positive H2 guidance.

PepsiCo (PEP) – Solid organic revenue growth; margins held steady despite cost pressures.

General Electric (GE) – Aerospace outperformed; FY revenue outlook raised.

Abbott Labs (ABT) – Robust diagnostics/device growth; guidance reaffirmed.

Cintas (CTAS) – Beat on revenue and margins; FY outlook raised.

Elevance Health (ELV) – Medical cost trends in line; EPS guidance maintained.

U.S. Bancorp (USB) – Beat on net interest income; stable loan growth.

Travelers (TRV) – Catastrophe losses elevated; core underwriting healthy.

Netflix (NFLX) – Subscriber growth topped estimates; ad-tier traction improving.

Interactive Brokers (IBKR) – Revenue beat; interest income and account growth strong.

Earnings Today (Before Open)

American Express (AXP) – Focus on card spending trends and credit quality.

Charles Schwab (SCHW) – Watching net new assets and interest income.

3M (MMM) – Key to watch industrial demand and cost control progress.

Schlumberger (SLB) – Oil services demand and pricing power in focus.

Ally Financial (ALLY) – Auto loan delinquencies and NIM in spotlight.

Truist Financial (TFC) – Commercial loan trends and cost initiatives under review.

Movers & Shakers

(+) Lucid Group ($LCID) +36% after Uber will invest $300M, will deploy 20k vehicles.

(+) PepsiCo ($PEP) +7% on better-than-expected Q2 earnings and revenue.

(–) Abbott Laboratories ($ABT) -9% after the company’s Q3 revenue fell short of expectations.

Private Dealmaking

OpenEvidence, an AI medical assistant, raised $210 million

Zimmer Biomet acquired Monogram Technologies for $177 million

Gridserve, an EV charging company, raised $134 million

Exodigo, a data intelligence company, raised $96 million

Exein, an IoT cybersecurity startup, raised $81 million

Virtru, a data security startup, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

After the Spike

Description: A provocative and rigorously researched call to action: Spears and Geruso argue that the real demographic crisis facing us isn’t overpopulation, but the opposite—global depopulation. Blending economics, demography, and moral reasoning, they explore how population decline threatens innovation, equity, environmental progress, and future prosperity.

Rating: Amazon 4.8 / 5, Goodreads 4.9 / 5

Book Length: 320 pages

Audible Length: 9 hrs 15 mins

Ideal For: Economists, policymakers, futurists, environmental thinkers, parents, and anyone pondering the long‑term trajectory of humanity.

“In ten years, everyone will be talking about global demographic decline and what to do about it. Read this book before your friends and rivals figure out the importance of this topic.” — Simon Johnson, Nobel‑laureate economist

PRESENTED BY MEANWHILE

Die Richer: How Bitcoin Life Insurance Is Changing Wealth Planning

As Bitcoin grows in value and adoption, traditional life insurance is falling behind (and literally losing value to inflation).

That’s why Bitcoin life insurance from Meanwhile is a portfolio gamechanger—it combines the tax advantages of life insurance with the growing potential of BTC.

Tax-advantaged borrowing against your policy

Fully licensed and regulated by BMA

Seamless inheritance transfer. Quick application. No doctor’s visits.

DAILY ACUMEN

Wired

Caffeine is a bit like leverage.

Used wisely, it boosts performance, sharpens focus, and keeps the system humming. But overextended—especially under stress—it can quietly erode your foundation.

New neuroscience research reveals that caffeine, when paired with sleep deprivation, doesn’t just “keep you awake”—it may actually reduce your brain’s gray matter volume in key regions like the prefrontal cortex and thalamus.

Meanwhile, those who endured the same sleep loss without caffeine showed increases in those areas—potentially a compensatory adaptation.

Translation? Your brain has its own internal hedge strategy to survive stress. But caffeine might cancel the trade.

Even more fascinating: individual sensitivity depends on adenosine receptor availability—our brain’s natural sleep regulators.

Some people are neurologically better equipped to handle caffeine than others. Most don’t know which camp they’re in.

So the next time you reach for a third espresso during a brutal earnings week or startup crunch, remember: caffeine doesn’t replace sleep. It mortgages it. And the interest compounds in gray matter.

In investing, overreliance on borrowed energy can crash your portfolio. In life, it can quietly shrink your mind.

Sleep is the best alpha.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Disclaimer: *This is a paid advertisement for Death & Company's Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

Reply