- Short Squeez

- Posts

- 🍋 New Exit Opp Just Dropped

🍋 New Exit Opp Just Dropped

Plus: Wellington Management wants you to know who they are, Elon’s trillion-dollar comp package, the ultra-wealthy flocking to Italy, and why “The Great Lock-In” is trending.

Together With

"Always make one less car than the market demands.” — Enzo Ferrari

Good Morning! Wellington Management, the $1T asset manager you’ve probably never heard of, is expanding into private markets and hedge funds, hiring aggressively and bringing on PR to court retail investors. Bank of America will also open up private equity funds to its ultra-wealthy clients.

A weak jobs report sent unemployment to its highest since the pandemic, fueling bets on faster Fed cuts. Tesla’s board signed off on a new comp plan for Elon Musk worth nearly $1T if he hits his targets, while Cantor Fitzgerald is ramping up hiring in the Middle East.

Plus: Women are flying to South Korea for a painful anti-aging injectable, Italy is luring millionaires with tax breaks, and why “The Great Lock-In” is trending.

Only 5% of companies are seeing real ROI from AI. See how Blueflame is doing it for their clients.

SQUEEZ OF THE DAY

From Banking to Travel Advisory

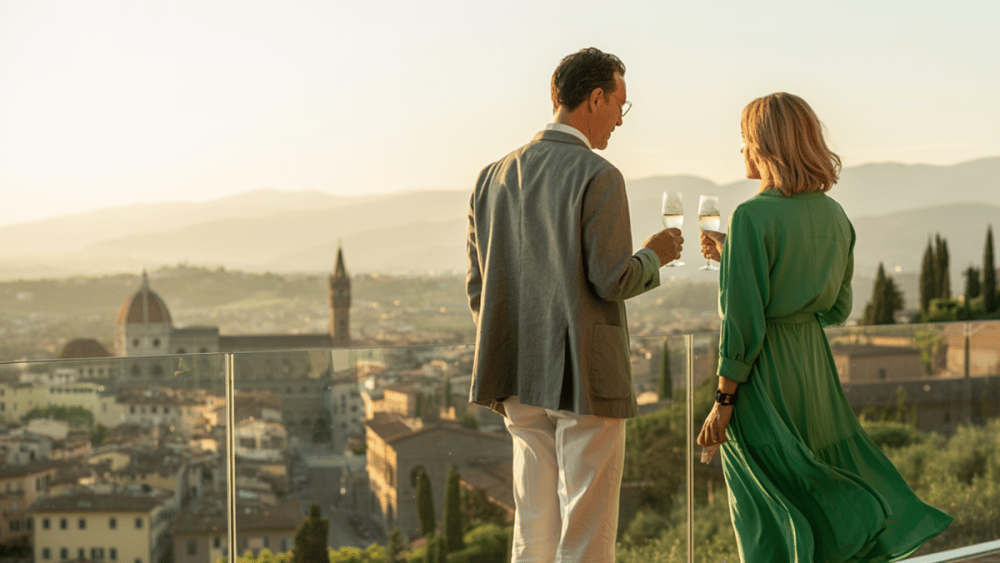

In 2025, the Wall Street exit opp with the best work-life balance might not be a fintech startup or a family office seat. It may be luxury travel advising.

The field once thought dead and replaceable by AI is now pulling in former bankers, accountants, and lawyers with the promise of high commissions, portable careers, and the kind of flexibility an investment banker could only dream of having.

LinkedIn data shows “travel adviser” is now the fifth-fastest growing profession, up more than 50% in three years. U.S. bookings through agents are projected to hit $141 billion next year, about 26% of the market.

Venture capital is piling in too: startups like Fora Travel have raised $60 million to train career-switchers and side hustlers, offering online courses, mentorship, and tech platforms that let new advisers ramp up quickly and manage clients at scale.

Some advisers say they’re making 3-4x the comp from their previous roles, working from anywhere and on their own schedule. Dozens of career-switchers have already crossed $1 million in annual sales, with average couples spending ~$40,000 a year on two trips. One wealthy family booking a $50,000 vacation could translate into a $5,000 commission.

A loyal book can quickly turn travel advising into a business that rivals traditional paychecks.

For ex-Wall Street professionals, luxury travel advising looks less like trip booking and more like boutique wealth management. The job isn’t about allocating capital, it’s about allocating experiences.

A handful of ultra-wealthy families can anchor an entire book, and what’s really being sold is judgment, discretion, and access. Just as private bankers don’t compete with robo-advisors, top travel advisers don’t compete with Expedia. Their edge is the ability to get a GM on the phone, secure upgrades, lock in hard-to-get reservations, and deliver bespoke experiences no algorithm can.

Takeaway: The economics come with risk. Like boutique wealth management, revenue is concentrated and volatile, hinging on a few key relationships. Losing one or two households can hit income hard, and a downturn in discretionary spending could ripple directly through commissions.

Without a strong network, the model risks sliding into a crowded, low-margin service business. The real differentiator is credibility: can you deliver the kind of access that keeps UHNW clients loyal year after year?

HEADLINES

Top Reads

After 100 years, trillion-dollar fund manager Wellington wants you to know its name (BB)

Jobs slowdown seals Fed rate cut (YF)

U.S. adds 22,000 jobs in August as unemployment hits 4.3% (YF)

Elon secures new Tesla pay package that could make him trillionaire (CNN)

Cantor plans to hire dozens of bankers in Middle East push (BB)

BofA offers wealthy clients access to private equity funds (BB)

Companies rush to tap U.S. bond market (YF)

Women are flying to South Korea for anti-aging “Rejuran” treatment (WSJ)

Warren Buffett's public criticism is a rare move for the typically passive owner (CNBC)

Italy’s flat tax sparks a super-rich boom in Milan (CNBC)

Spirit Airlines struggles as rivals circle (WSJ)

Inside eBay’s quest to become an AI leader (WSJ)

Alphabet nears $3T valuation as key risk clears (BB)

Morgan Stanley lands another high-profile IPO mandate (TSP)

What to ask before buying bonds (WSJ)

Peak Rock raises $3B for private equity credit funds (WSJ)

Lululemon looks beyond yoga leggings into bags and lifestyle expansion (BB)

U.S. clothing retailers test rich shoppers with new pricing strategies (NYP)

Why 'The Great Lock In' is trending (LI)

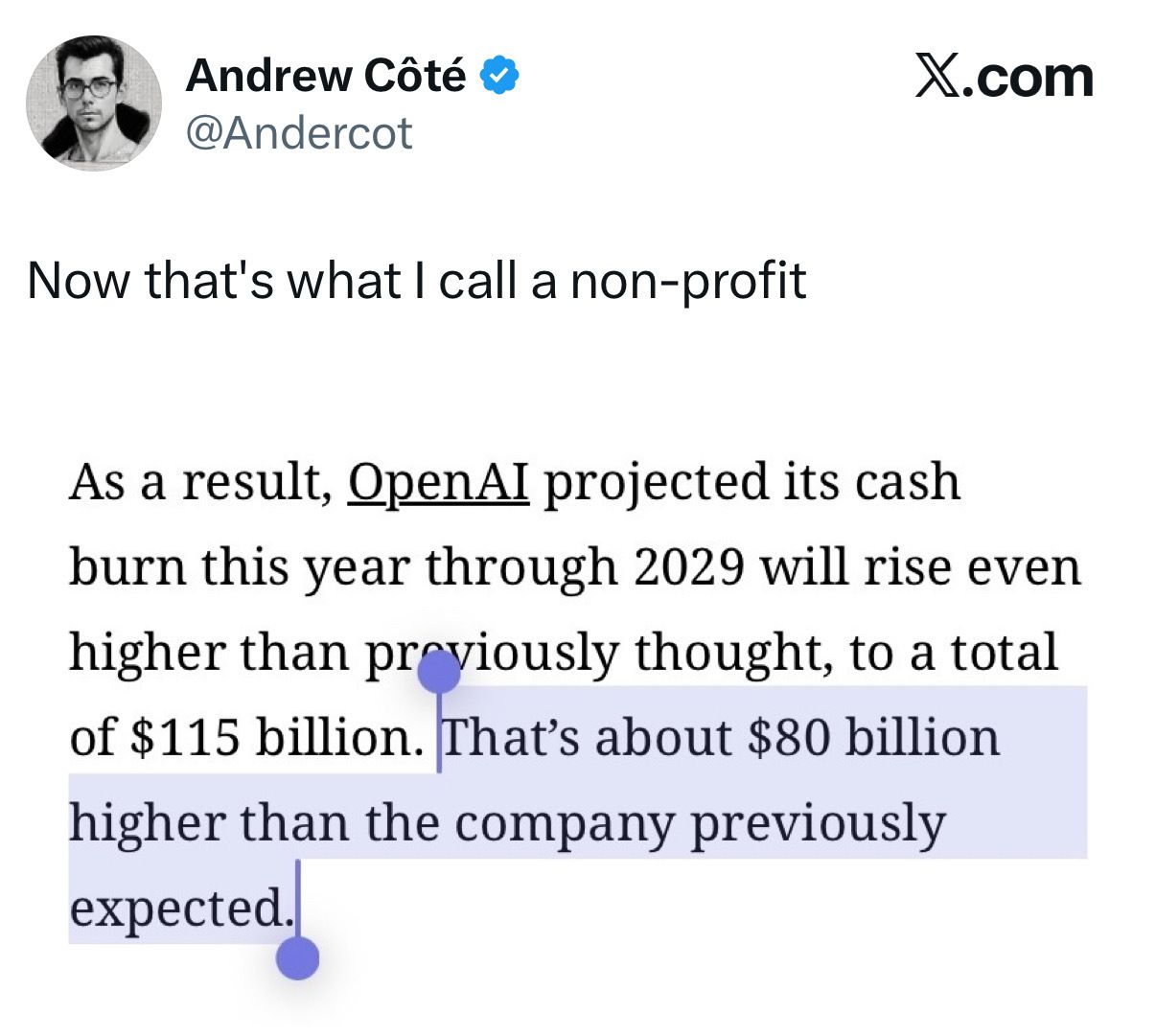

PRESENTED BY BLUEFLAME AI

Why 95% of AI Efforts Fail, and How Blueflame Clients Break the Mold

MIT’s latest report on GenAI adoption is a wake-up call: despite $30–40B in enterprise spend, 95% of companies report no measurable AI ROI.

But a small group is getting it right. MIT found that the top 5% of firms succeed by targeting vertical use cases, integrating AI into daily workflows, and partnering with domain experts; all principles Blueflame was built around.

For investment firms, Blueflame delivers, among other things:

60% faster diligence timelines

10 hours saved per CIM review

At an $8B PE firm, it delivered a 60% increase in outreach efficiency without adding headcount.

Blueflame integrates with CRMs, data providers, and file storage to embed AI into sourcing, diligence, and reporting workflows. Clients move beyond pilots and into real, repeatable ROI.

In a market where most AI investments stall, Blueflame puts investment firms in the winning 5%.

CAPITAL PULSE

Markets Rundown

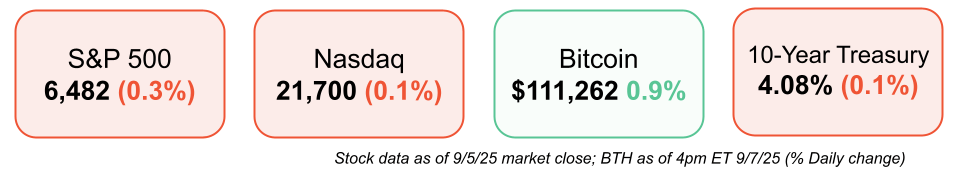

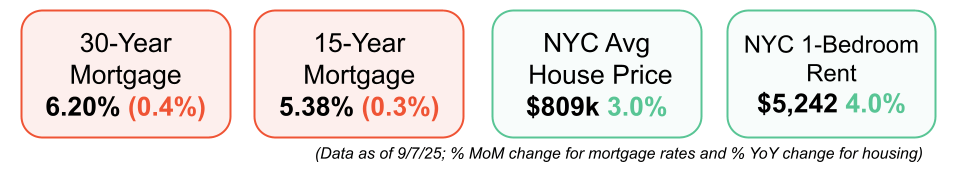

Market Update

Stocks gave up early gains, with the Nasdaq and S&P 500 turning negative by the close as growth concerns outweighed early optimism.

Bond yields fell sharply, with 2-year yields dropping to their lowest level in three years and the 10-year down to 4.09%.

Dollar weakened, reflecting expectations of imminent Fed rate cuts.

Broadcom surged 9% after beating earnings estimates and announcing a $10B customer win, rumored to be OpenAI.

Economic Data Highlights

August payrolls rose just 22K, well below the 75K expected, marking four months of near-stagnant hiring.

Unemployment ticked up to 4.3%, while June was revised to show job losses — the first negative month since 2020.

Manufacturing employment declined 12K, but health care and leisure & hospitality provided modest gains.

Wage growth slowed to 3.7%, reinforcing a cooling trend in labor demand.

Markets are now fully pricing in a September Fed cut, with expectations for the fed funds rate to drop below 3% by end-2026.

Reported Earnings

Broadcom (AVGO) – Strong AI chip demand drove revenue and EPS beats; margins held firm.

Lululemon (LULU) – Same-store sales and revenue exceeded forecasts; inventory discipline improved.

DocuSign (DOCU) – Delivered an earnings beat with stable e-signature volumes; AI contract analytics adoption gained traction.

Earnings Today

Planet Labs (PL) – Focus on recurring imagery revenue, government contracts, and path to profitability.

Casey’s General Stores (CASY) – Key metrics include fuel margins, in-store same-store sales, and prepared food category growth.

Movers & Shakers

(+) Guidewire Software ($GWRE) +20% after the insurance tech company reported a strong earnings report.

(+) Samsara ($IOT) +17% because the internet of things company beat earnings.

(–) Charles Schwab ($SCHW) -6% after Friday’s jobs report points to a weakening economy.

Private Dealmaking

Cadence Design bought the design and engineering unit of Hexagon for $2.9 billion

MediaForEurope acquired a 75.6% stake in ProSiebenSat 1 for $1.7 billion

Treeline Biosciences, a cancer drugmaker, raised $200 million

Baseten, an AI inference infrastructure startup, raised $150 million

Galvanize Therapeutics, a biotech for cancer and lung disease, raised $100 million

Augment, an AI productivity platform for logistics, raised $85 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

Mortgage rates continue to fall lower as purchase demand continues to trend upwards. The continuity of rates moving down continues to increase optimism for new homebuyers and current homeowners. Refinance applications made up 47% of all mortgage applications this week, marking an eleven-month high.

Latest News

New Listings

845 United Nations Plaza New York, NY: 3 Bed / 2.5 Bath – $12.0M

148 Middle Line Hwy: Southampton, NY: 8 Bed / 9 Bath – $8.0M

700 NE 24th St Apt: 4007 Miami, FL: 4 Bed / 5.5 Bath – $4.2M

9370 Arco da Calheta, Madeira Portugal: 3 Bed / 3 Bath – $6.8M

Via Vittorio Veneto 111 Verbania, VB Italy: 12 Bed / 8 Bath – $5.2M

BOOK OF THE DAY

They All Came To Barneys

Description:

A vivid, stylish walk through the golden era of Barneys New York—through the eyes of fashion icon and long-time creative director Linda Fargo. From star-studded fashion presentations to quietly powerful personal encounters, Fargo captures the store's evolution, its role in launching designers like Marc Jacobs and Proenza Schouler, and its cultural imprint as a temple of taste and innovation. Equal parts memoir, fashion history, and heartfelt homage.

Rating: Amazon 4.8 / 5

Book Length: 288 pages

Ideal For:

Fashion aficionados, retail historians, design professionals, and anyone curious about how a boutique became a beacon of style, influence, and cultural cachet.

“Barneys was more than a store—it was a stage where artistry met elegance, and every garment told a compelling story.”

PRESENTED BY PACASO

From Italy to a Nasdaq Reservation

How do you follow a record-setting year? By getting stronger.

Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year, so Pacaso’s planned Italy expansion is big.

They’ve already made $110 million+ in gross profits to date, including 41% YoY growth last year. (They even reserved the Nasdaq ticker PCSO.) And you can invest for $2.90/share.*

DAILY ACUMEN

Position Sizing

Even the best stock can wipe you out if you size it too big.

Life works the same way. If 90% of your identity is your job, a layoff can feel like death.

If 100% of your wealth is in one bet, one downturn erases years of work.

Position sizing is risk management for your existence.

Concentrate where you have true edge, but diversify where you are fragile.

Build side incomes, side projects, side identities.

You swing for the fences where it counts—but you make sure no single miss takes you out of the game.

Longevity is the real alpha.

AI Agents That Cut Support Costs By Up To 80%

AI Agents Designed For Complex Customer Support

Maven AGI delivers enterprise-grade AI agents that autonomously resolve up to 93% of support inquiries, integrate with 100+ systems, and go live in days. Faster support. Lower costs. Happier customers. All without adding headcount.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

q

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Reply