- Short Squeez

- Posts

- 🍋 More Cockroaches

🍋 More Cockroaches

Plus: US banks rake in massive fees from Chinese IPOs, Chobani valued at $20 billion, tech companies building their own power plants, and Bitcoin falls as investors flock to Gold.

Together With

"I don't need an analyst to tell me when a 10 PE stock is cheap. I need an analyst to tell me when a 40 PE stock is cheap." — Steve Mandel

Good morning and Happy Friday! American bankers are having a lucrative year helping Chinese companies go public in Hong Kong. Carlyle and Boyu Capital are leading bids for Starbucks China, which could fetch $10 billion.

Bitcoin slipped below $108k, falling from its over-$120k peak, as investors continue to pile into gold for safety. Yogurt maker Chobani raised $600 million at a $20 billion valuation. And tech firms in the AI arms race aren’t waiting for the U.S. power grid to catch up, they’re now building their own plants.

Plus: a former Carlyle exec is going all-in on extreme-weather bets, Trump unveiled a plan to cut the cost of a common IVF drug, and how highly successful people talk to their bosses.

When structure meets strategy, taxes become a source of returns. Try the tax platform built for investors and investment teams.

SQUEEZ OF THE DAY

More Cockroaches

Markets took Jamie Dimon’s “cockroach” warning seriously Thursday, as Wall Street began to see a pattern, a string of bad loans, fraud allegations, and one massive accounting hole weren’t so isolated after all.

Investors were already uneasy about Jefferies, which dropped another 11%, extending its three-week slide to nearly 30%.

Jefferies is entangled in the collapse of First Brands, a $10 billion auto-parts supplier that filed for bankruptcy after uncovering roughly $2 billion in accounting irregularities tied to double-pledged receivables. Jefferies’ closed-door investor day did little to calm nerves, offering few details beyond assurances that its exposure was “limited.”

Zions Bancorp plunged 13% after revealing a $50 million charge-off tied to two commercial loans whose borrowers now face legal action. Western Alliance followed, disclosing it had sued a borrower for fraud, its stock dropped 11%.

By day’s end, 74 U.S. banks had collectively lost more than $100 billion in market value.

Behind all of it is the shadow-lending machine that’s been running hot for years. Private-credit funds and smaller banks have stepped in to lend to companies the big players won’t touch. These lenders make their money by taking that extra risk and charging higher rates. It works… until it doesn’t.

Dimon’s now-viral line: “When you see one cockroach, there are probably more” echoed across trading floors as investors dumped anything tied to private credit. Blue Owl fell 7%, Ares 6%, Apollo 5%, and Blackstone 3%.

Takeaway: The golden age of private credit may finally be coming to an end as the industry faces its first true stress test. Mr. Wall Street himself (Jamie Dimon) has already taken down work-from-home and early private-equity recruiting, and it looks like private credit could be next.

PRESENTED BY GELT

Tax Strategy For Capital Managers and Creators

In venture, private equity, and high-net-worth investing, structure dictates outcomes. Gelt is a specialist tax firm built for fund managers, investors, and business owners, with a dedicated team of CPAs and tax strategists supported by proprietary AI tools.

Gelt designs, models, and executes custom tax strategies that adapt as your income, entity structure, and partner needs evolve.

Clients rely on Gelt for:

Tailored tax planning and structuring led by expert CPAs

AI-powered scenario modeling to identify optimization opportunities

Full-service compliance and filings across personal, business, and multi-jurisdiction returns

Every decision is guided by experienced professionals and built to compound your after-tax returns.

HEADLINES

Top Reads

American bankers are making a mint helping China Inc. go global (WSJ)

Carlyle, Boyu leading bids for Starbucks China business which could fetch $10B (FT)

Chobani lands $20 billion valuation (Inc)

Bitcoin sinks as investors flock to gold in search of safety (YF)

TSMC profit jumps 39%, setting another record on surging AI chip demand (CNBC)

AI data centers so power-hungry they’re building their own plants (WSJ)

Trump strikes deal with German Merck on tariffs and IVF costs (YF)

Dan Sundheim’s D1 Capital seeks $1 billion for new private equity fund (BB)

Private equity veteran bets big on extreme weather investing (BB)

Paul Singer’s Elliott Management raises $7 billion for a new activist war chest (BB)

Wall Street–backed startup sparks surge in online loan trading (BB)

Traders at top hedge funds take home 25% of profits (FT)

Jamie Dimon warns employee health-care costs will climb 10% in 2026 (BB)

Big investors scale back risky bond exposure (FT)

Harvard posts biggest operating loss in 14 years (Axios)

Tariff costs to companies this year to hit $1.2T, with consumers taking most of hit (CNBC)

Is private equity ready to burn $50M on failed coaches? (BB)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks fell sharply after reports of deteriorating credit quality at two regional banks.

Zions Bancorp and Western Alliance announced large loan write-downs, following news earlier this week that subprime lender Tricolor Holdings had collapsed.

Financials led declines, falling close to 3%, though analysts suggested the write-downs appear isolated rather than systemic.

Other major sectors were also lower, marking a fragile backdrop after a strong rally since April.

Bond yields dropped, with the 10-year Treasury yield falling below 4% for the first time this year.

Gold rose above $4,300 per ounce, while oil declined to a four-year low near $57 per barrel.

Economic Data Highlights

Government data blackout continues amid the shutdown, delaying reports on retail sales, CPI, and jobless claims.

Regional Fed surveys (Philadelphia and New York) came in weaker, but cover limited portions of the U.S. economy.

Fed officials signaled continued support for easing, with Governor Waller calling for incremental 25 bp cuts in response to economic uncertainty.

Market expectations now reflect two additional rate cuts this year, as investors price in slower growth.

Reported Earnings

Taiwan Semiconductor (TSM) – Reported solid results, supported by robust AI chip demand and strong utilization rates.

Charles Schwab (SCHW) – Earnings beat expectations, aided by higher client inflows and lower expenses.

U.S. Bancorp (USB) – Results were in line with forecasts, as stable loan growth offset rising credit costs.

Earnings Today

American Express (AXP) – Focus on consumer spending trends and credit performance.

Schlumberger (SLB) – Watch for oilfield-services demand amid weaker crude prices.

Ally Financial (ALLY) – Key to monitor auto-loan portfolio and credit provisions.

Movers & Shakers

(+) Nestle ($NSRGY) +9% after the food and drink processing company will cut 16,000 jobs thanks to automation.

(+) Micron ($MU) +6% because the computer data storage company was upgraded by Citi.

(–) Jefferies Financial ($JEF) -11% after the firm’s closed-meeting investor day failed to placate investors.

Prediction Markets

Will the S&P 500 drop +7% in a single day and trigger a circuit breaker?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Chobani, the Greek yogurt maker, raised $650 million at $20 billion valuation

Zepto, a grocery delivery company, raised $450 million

Vantaca, a housing association management software provider, raised $300 million

Kardigan, a cardiovascular drug developer, raised $254 million

HistoSonics, a histotripsy therapy platform, raised $250 million

Upgrade, a consumer lender, raised $165 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

How Progress Ends

Description:

Frey challenges the common assumption that technological progress is perpetual and inevitable. Drawing on a sweeping historical lens—spanning a thousand years—he shows how periods of innovation are often followed by stagnation when institutions, incentives, or social structures fail to adapt. He argues that advances in AI and modern technology aren’t guarantees of progress, but potential catalysts of disparity or decay depending on how societies manage change.

Book Length: 552 pages

Release Date: September 2025

Ideal For: Economists, policy makers, tech skeptics and futurists, institutional leaders, and anyone curious about whether the next century’s breakthroughs will raise all boats—or leave many behind.

“Progress is not self-perpetuating; its survival depends on institutions that can scale and sustain innovation without stifling what makes it possible in the first place.”

DAILY VISUAL

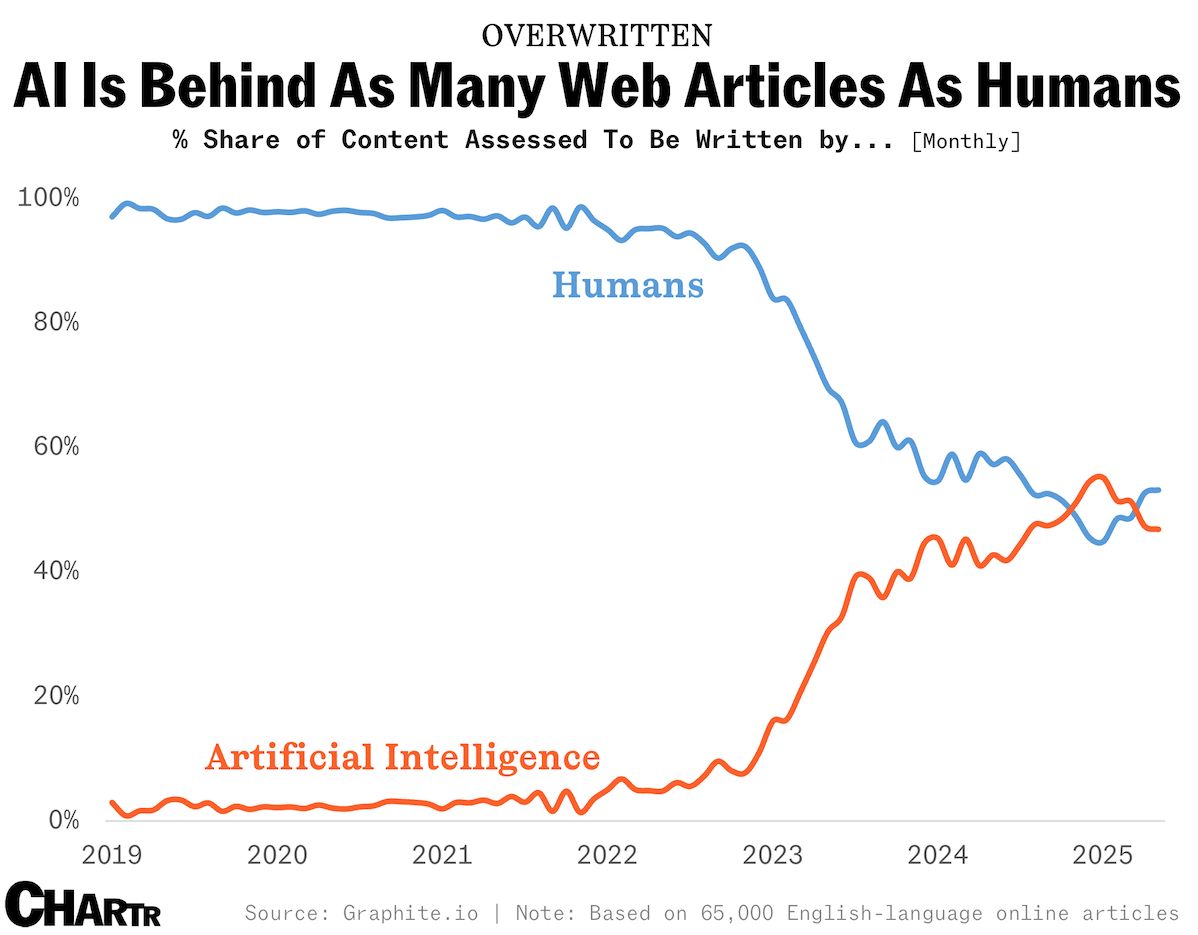

AI Taking Over

Source: Chartr

PRESENTED BY MEANWHILE

Whole Life Insurance That Earns, Borrows, and Pays in Digital Gold

Selling Bitcoin means giving up upside and paying taxes. Borrowing it means high rates and liquidation risk. Meanwhile offers another path: Bitcoin-denominated whole life insurance.

Fund a policy with BTC, earn 2% annually, and borrow up to 90% of your policy’s value at a fixed 3% interest rate, with no repayment schedule. Your loan’s cost basis locks in when borrowed, creating potential tax efficiency as Bitcoin appreciates.

Unlike crypto lending platforms that charge 8–14% interest and risk margin calls, Meanwhile policies are fully regulated in Bermuda, backed by audited capital reserves, and structured to avoid currency mismatch ie. no forced selling.

Key Benefits:

Earn ~2% BTC compounding annually, tax-efficiently

Borrow Bitcoin backed by Bitcoin; no liquidation risk

Guaranteed BTC payouts to your family

No need to manage private keys or trust third-party lenders

Keep your upside, skip the taxes, and protect your family in digital gold.

DAILY ACUMEN

The Mirror Principle

Life has a strange way of reflecting what you project.

When you move through the world cynical and guarded, it gives you more reasons to stay that way.

When you act with curiosity and generosity, it responds in kind.

Markets mirror psychology too: optimism attracts liquidity, pessimism dries it up.

The mirror does not change first; you do.

Shift your internal state and the external world starts to follow. It is not mystical, it is math.

Energy compounds like interest.

ENLIGHTENMENT

Short Squeez Picks

Telltale signs someone isn’t ready to step into leadership

How highly successful people talk to their bosses

How to break free from romantic obsession

The power of doing less to achieve more

7 easy dinner cheats busy people swear by

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply