- Short Squeez

- Posts

- 🍋 Junk Bonds Are The New IG

🍋 Junk Bonds Are The New IG

Plus: Opendoor moons 80%, record private equity firms turning into zombie funds, JPMorgan wants to build London’s largest office tower, and gold continues to soar.

Together With

“The smartest person in the room, I’ve learned, is usually the person who knows how to tap into the intelligence of every person in the room.” — Scott Kelly

Good Morning and Happy Friday! Grocery inflation just hit its highest level since 2022 as tariffs pile up, while gold broke through its inflation-adjusted peak from 45 years ago as investors hedge against economic jitters.

A record number of PE firms will turn into zombie funds this year, while Deutsche’s distressed desk scored $100 million betting on EchoStar’s near-bankruptcy.

Paramount-Skydance is weighing a bid for Warner Bros Discovery, sending the stock up 29%. Opendoor extended its monster 561% YTD rally, soaring another 78% after naming a new CEO.

Plus: JPMorgan wants to build London’s largest office tower, PE execs warn consolidation is coming as some firms die of distribution thirst, and Uber is rolling out helicopter rides from NYC to the Hamptons.

The dollar’s purchasing power has rapidly eroded over the years. Find out what Meanwhile is doing to not only preserve your wealth, but grow it.

SQUEEZ OF THE DAY

Junk Bonds Are The New IG

Junk bonds, long considered the riskiest corner of corporate credit, have historically carried a steep discount to investment-grade debt.

The market took off in the 1980s when Drexel Burnham Lambert pioneered their use in financing LBOs, cementing “junk bonds” as both a term of art and a funding tool for private equity.

For decades, high yield carried a wide risk premium, often 4–5x the spread of investment-grade notes, especially in the run-up to the 2008 crisis.

But in 2025, the distinction between “junk” and investment grade has rarely been thinner.

Last week, the spread between BB-rated high yield and BBB-rated investment-grade debt narrowed to just 80 basis points, one of the tightest levels since 2019 and a fraction of the 1,000+ bps blowouts seen during Covid or the GFC. Even relative to the ~300 bps pre-Covid norm, today’s gap looks historically compressed.

Several factors are driving the rally: default rates remain unusually low, corporate and household balance sheets are healthier than average, and credit funds continue to absorb massive inflows.

Investors are also locking in yields that, while drifting lower this year, remain elevated versus the last decade, the average U.S. high-grade yield sits at 4.8%, compared to a 10-year mean of 3.8%.

The traditional boundary between high yield and investment grade is also eroding as borrowers increasingly bypass the rating agencies and raise capital directly from private credit lenders like Apollo, Blue Owl and Ares.

Strategists at BNP Paribas think investment-grade spreads could grind even lower, down to 60 basis points, before we hit true extremes.

Takeaway: Junk bonds are trading more like blue chips, with investors accepting historically thin compensation for incremental risk. As long as fund inflows stay relentless and the Fed is seen as easing, spreads can remain irrationally tight. But history suggests the market rarely sustains these levels for long, when risk premiums normalize, the adjustment is rarely painless.

HEADLINES

Top Reads

Trump’s tariffs begin filtering into consumer prices (CNBC)

Gold surpasses its inflation-adjusted record high set in 1980 (BB)

Warner Bros Discovery weighs Paramount-Skydance bid (CNBC)

Opendoor stock closes 78% higher after naming new CEO (CNBC)

Peak number of private equity firms running zombie risk (BB)

Deutsche distressed debt made $100M on Echostar bets (BB)

JPMorgan draws up plans for London’s biggest office building (BB)

Private equity execs warn of industry failures (Axios)

New Yorkers will soon be able to hail Uber helicopter rides to JFK, Hamptons (NYP)

Veritas Capital banks $14.4B for technology deals (WSJ)

Fannie, Freddie get first bull on Wall Street in Deutsche Bank (YF)

MTA lost $1B to fare and toll evasion last year, watchdog finds (NYP)

“Job hugging” is replacing job hopping in U.S. careers (WSJ)

Citi CEO says dealmaking is picking up, recession unlikely (BB)

Wall Street loves Oracle’s AI story (Axios)

Wells Fargo CEO warns of downside risks for U.S. economy (CNBC)

Workers taking mental health leave up 300% from pre-pandemic levels (CNBC)

PRESENTED BY MEANWHILE

Life Insurance That Preserves Your Wealth

Every dollar today buys just 3 % of what it did a century ago. That’s why your savings account isn’t saving; it’s slowly bleeding value to inflation.

Meanwhile offers a life insurance policy denominated entirely in Bitcoin (premiums, reserves, and payouts in BTC) designed to preserve purchasing power rather than erode it.

What it does: Meanwhile is the world’s first fully regulated Bitcoin‑denominated life insurer, licensed in Bermuda.

Why it matters: While inflation has erased over 96 % of the dollar’s value since 1915, Bitcoin holds potential to maintain value across generations.

The benefit: Meanwhile enables Bitcoin holders to protect their family’s future and savings in BTC, insulating them from fiat‑currency decay.

Protect your legacy in an asset that isn’t losing value every year.

CAPITAL PULSE

Markets Rundown

Market Update

U.S. stocks closed higher, with the S&P 500 and Nasdaq at record highs after CPI came in line with expectations.

Materials and health care stocks led gains, while energy lagged.

10-year Treasury yield fell to 4.02%, reflecting investor positioning for Fed easing.

Asia was mixed, with Japan’s Nikkei and Korea’s Kospi hitting record highs; Europe climbed as the ECB held rates at 2.0%.

Dollar weakened; WTI oil fell on IEA’s forecast for additional OPEC+ output hikes.

Economic Data Highlights

CPI inflation rose to 2.9%, matching forecasts and up from 2.7% in July.

Gasoline prices climbed 1.9% m/m, contributing to the headline rise, while core CPI held steady at 3.1%.

Labor Market Signals

Initial jobless claims rose to 263K, the highest in four years and above expectations.

Continuing claims held at 1.94M, and job openings remain just below unemployment levels.

This signals a cooling labor market from a position of strength, with potential fiscal and monetary support likely to cushion further slowdown.

Reported Earnings

Kroger (KR) – Posted better-than-expected same-store sales and expanded digital grocery penetration.

Adobe (ADBE) – Delivered strong ARR growth across Creative Cloud and Document Cloud; AI tools adoption accelerated.

RH (RH) – Results topped expectations on luxury home demand and margin recovery; reiterated full-year guidance.

Earnings Today

No significant earnings scheduled

Movers & Shakers

(+) Opendoor Technologies ($OPEN) +80% after the iBuying company named a new CEO.

(+) Warner Bros Discovery ($WBD) +29% because Paramount is preparing a new bid for the entertainment company.

(–) Netflix ($NFLX) -4% after the company’s chief product officer departed.

Private Dealmaking

Replit, a development environment, raised $250 million

Odyssey Therapeutics, an autoimmune biotech, raised $213 million

Perplexity, an AI search startup, raised $200 million

Harbor Health, a clinic group and insurer, raised $130 million

CuspAP, a developer of AI models for chemistry, raised $100 million

NRG Therapeutics, a neurology drug developer, raised $64 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Dirtbag Billionaire

Description: A deeply reported biography of Yvon Chouinard, revealing how a self-described “dirtbag climber” forged Patagonia into a business icon known for its environmental activism—and then dedicated his company and profits to protecting the planet. The story traces not just innovation in sustainability, but real paradoxes: fighting climate change while navigating profit, activism while managing a global brand, and the art of giving away power.

Rating: 5.0 / 5

Book Length: 320 pages

Ideal For: Entrepreneurs, sustainability activists, business ethics lovers, and anyone inspired by radical purpose in business

“Patagonia has shown that doing well by doing good is not just possible—it’s worth building everything around.”

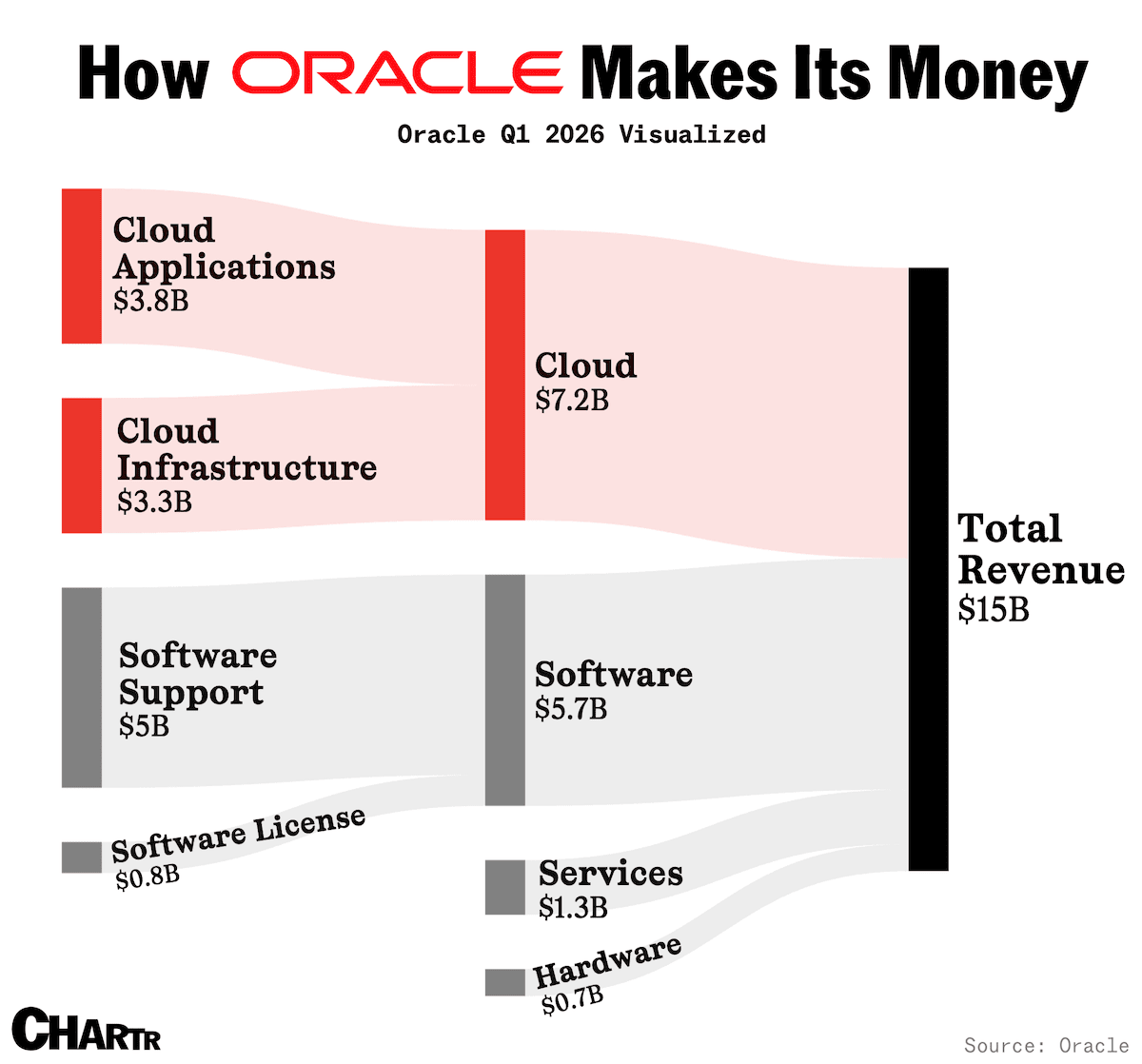

DAILY VISUAL

Oracle ‘s Revenue Mix

Source: Chartr

PRESENTED BY PACASO

Learn From This Investor’s $100m Mistake

A Grammy-winning artist passed on investing $200K in an emerging real estate disruptor in 2010. It’d be worth $100M+ today.

Now, the investors behind Venmo and Uber are backing another real estate disruptor. And this time, you can invest.

Meet Pacaso. Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions & service fees across 2,000+ owners. That’s good for more than $110M in gross profits to date, including 41% YoY growth last year alone. They’ve even reserved their Nasdaq ticker, PCSO.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

DAILY ACUMEN

Attention Arbitrage

Capital flows where attention flows, but attention moves faster than capital. That gap is where opportunity lives.

Every major trade—crypto in 2011, AI in 2023, even dot-coms in 1996—was a bet on where attention was about to go.

In life, your edge is noticing what the world is about to care about and getting there first.

That might mean learning a skill that’s about to become scarce, or buying a domain name for a trend no one takes seriously yet, or even befriending someone everyone underestimates.

Attention arbitrage is uncomfortable because it often looks silly in real time.

By definition, if it feels popular, you’re already late.

The game is to find the corners of the internet, the coffee chats, the weird research papers that point to tomorrow’s main stage.

Then act before the crowd arrives. Your reward is that by the time they do, you’re already a local.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

*Disclaimer: This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

Reply