- Short Squeez

- Posts

- 🍋 JPMorgan Takes on Buyside

🍋 JPMorgan Takes on Buyside

JPMorgan building private credit business, plus SBF found guilty on all fraud charges.

Together With

"Marrying for money is probably a bad idea under any circumstances, but it's absolutely crazy if you're already rich." — Charlie Munger

Good Morning! Sam Bankman-Fried was found guilty on all seven fraud charges (Michael Lewis has left the chat). DoorDash is now making users pay for not adding a tip - they’ll have to wait longer for orders.

It’s been a busy few weeks of mergers. Six Flags and Cedar Fair are joining forces in a $2 billion stock deal to form a powerhouse in the theme-park industry. BP bought $100 million worth of Tesla chargers, pushing Big Oil further into the EV space.

It was a rough quarter for Apple, thanks to dwindling sales in China. And the stock market is rallying as investors bet the Fed is done with rate hikes.

SQUEEZ OF THE DAY

JPMorgan Takes on Buyside

JPMorgan wants to build out its private credit business. And they’re looking for a partner to help them get there.

Private credit is one of the hottest areas of leveraged finance right now. JPMorgan has been eyeing it for a minute, and they already have $10B of their own balance sheet set aside for private credit. But they want to compete with heavyweights in the space like Blackstone, Apollo, and Ares.

JPMorgan is talking to sovereign wealth funds, pension funds, endowments, and alternative asset managers. If the partnership goes through, JPM would originate the deals and the outside partner would provide the capital.

Wall Street banks are still figuring out how to compete with private credit. It’s eating into the market share of leveraged loans and high-yield bond markets.

Banks typically offload subprime debt rather than hold the risk on their balance sheet like private equity firms. But they’re thinking about taking a playbook out of private equity’s game plan.

Takeaway: Private equity firms and investment banks used to sit across the table from each other, partnering on deals - but never really directly competing with each other. But JPMorgan doesn’t look afraid to challenge some of the largest funds. Jamie Dimon has already complained about PE firms having it easy with the regulators, and it looks like he's ready to splash some water their way.

CAPITAL PULSE

Markets Rundown

Stocks closed higher as investors assess the probability of future rate hikes.

Movers & Shakers

(+) Roku ($ROKU) +31% after the streaming company showed signs of ad rebound.

(+) Shopify ($SHOP) +22% after an earnings beat and positive guidance.

(–) Moderna ($MRNA) -7% after sinking Covid vaccine demand.

Private Dealmaking

Disney to buy remaining 33% stake in Hulu for $8.61 billion

Tabby, a BNPL startup, raised $200 million

Infinitum, an industrial motors startup, raised $185 million

MangoBoost, an energy-efficiency software developer for data centers, raised $55 million

Censys, an exposure management startup, raised $50 million

Samara, a tiny homes maker, raised $41 million

SPONSORED BY FLIPPA

How Much is Your Online Business Worth?

Flippa’s intelligent valuations engine is the industry's most accurate tool, taking into consideration thousands of sales and live buyer demand.

Flippa combines expert advisory with world leading matching technology to ensure you sell in the fastest time, for the best price at the lowest fees.

With transactions from $5,000 to $50,000,000, Flippa is the #1 marketplace globally to buy and sell online businesses.

Start your exit journey by finding out how much your online business is worth. Get a FREE valuation now.

HEADLINES

Top Reads

Hedge funds, PE firms accuse SEC of ‘power grab’ with new rules (YF)

The IPO window slams shut (Axios)

Goldman promotes 608 managing directors (WSJ)

Larry Fink’s next M&A might go in surprise direction (Reuters)

Match stock plunges after decline in people paying for Tinder (CNBC)

Private equity makes loan payments with more debt to keep cash (YF)

Why used cars are pivotal for EVs (CNBC)

New hedge fund is hiring journalists to not do journalism (Axios)

Blackstone’s $66B real estate trust limits redemptions for 12th month (YF)

BOOK OF THE DAY

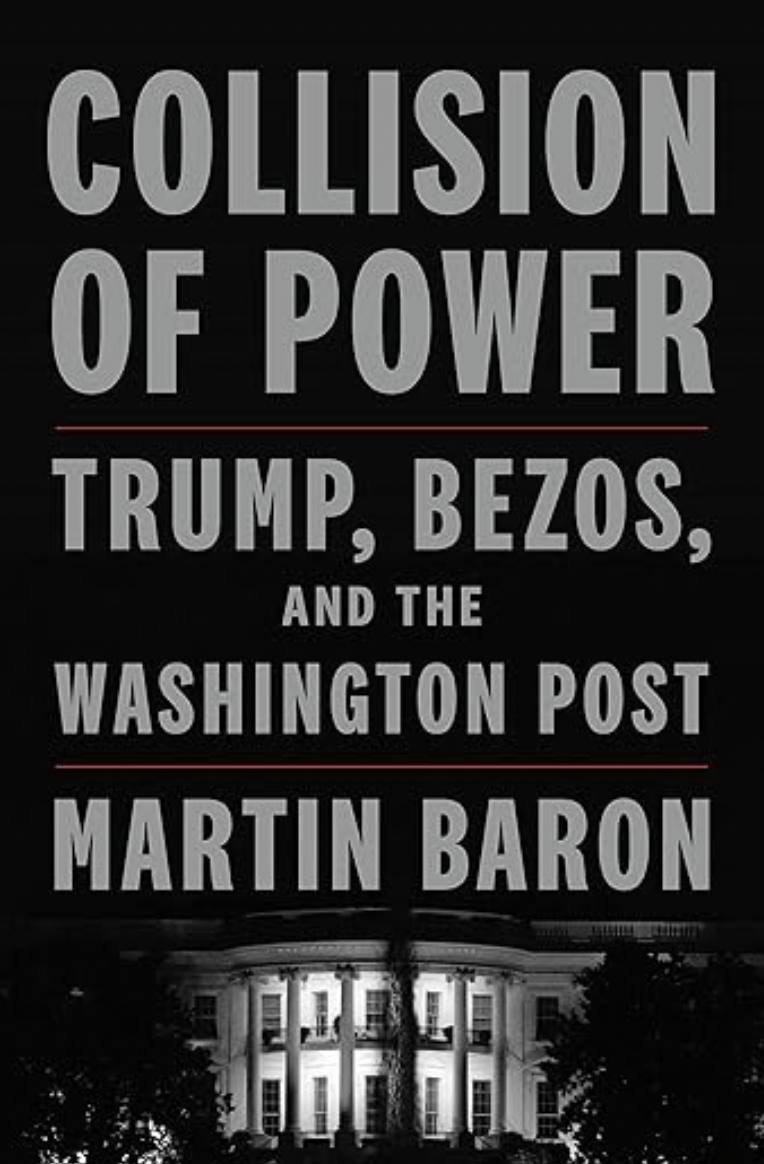

Collision of Power

Marty Baron took charge of The Washington Post newsroom in 2013, after nearly a dozen years leading The Boston Globe. Just seven months into his new job, Baron received explosive news: Jeff Bezos, the founder of Amazon, would buy the Post, marking a sudden end to control by the venerated family that had presided over the paper for 80 years. Just over two years later, Donald Trump won the presidency.

Now, the capital’s newspaper, owned by one of the world’s richest men, was tasked with reporting on a president who had campaigned against the press as the “lowest form of humanity.” Pressures on Baron and his colleagues were immense and unrelenting, having to meet the demands of their new owner while contending with a president who waged a war of unprecedented vitriol and vengeance against the media.

In the face of Trump’s unceasing attacks, Baron steadfastly managed the Post’s newsroom. Their groundbreaking and award-winning coverage included stories about Trump’s purported charitable giving, misconduct by the Secret Service, and Roy Moore’s troubling sexual history. At the same time, Baron managed a restive staff during a period of rapidly changing societal dynamics around gender and race.

In Collision of Power, Baron recounts this with the tenacity of a reporter and the sure hand of an experienced editor. The result is elegant and revelatory―an urgent exploration of the nature of power in the 21st century.

“Especially fascinating.”

ENLIGHTENMENT

Short Squeez Picks

Why one billionaire thinks raw, honest feedback is the best tip for success

How to build business confidence in one week

10 conversation stoppers that push people away

7 ways to feel more grounded in the present

The most important conversation skill

DAILY VISUAL

Holiday Spending Could See Boost From Lower Heating Costs

US holiday retail sales (2023 numbers projected)

Source: Axios

SPONSORED BY VANTAGEPOINT

Power Your Portfolio With AI

AI continues to send shockwaves through every industry across the globe.

Its latest feat? Predicting winning stocks before everyone else.

More than 35,000 investors of every level are using AI to dial in market forecasting, helping them exit before profits erode and generate more consistent returns.

Register for the live AI training and improve your predictions for Stocks, Crypto, ETFs, Forex, Options, and Futures that are already in your portfolio right now.

With only two months left in 2023, these trading experts also discovered what they’re calling the “Seasonal Switchblade” - two stocks that snap-surge bullish every November.

DAILY ACUMEN

Seven Streams of Income

Let's talk about the whole "having seven streams of income" thing. You know, that advice that floats around like a catchy tune on the radio—it sounds good, but is it really for us millennials?

Here's the lowdown: imagine trying to balance investments, real estate, side gigs, and your regular job all at once. It's like trying to juggle flaming torches while riding a unicycle on a tightrope. Not exactly a recipe for success, right?

The problem is, when you spread yourself thinner than the office coffee, you won't become a ninja in any of those areas. You'll be more like the "okay-ish" all-rounder, and that doesn't really impress your bank account.

So, instead of being the "meh" person at multiple things, how about being a rockstar in one? Put all your energy into your main gig until you're so darn good at it that money starts rolling in like it's on autopilot.

Once you've conquered that domain, then you can think about expanding your income streams. It's like building a financial empire, one brick at a time.

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply