- Short Squeez

- Posts

- 🍋 How Many PE Funds?!

🍋 How Many PE Funds?!

Plus: Elon Musk is halfway to becoming the world’s first trillionaire, OpenAI is now worth as much as him with a $500B valuation, and Poland is offering €2,000 baby bonuses.

Together With

“Avoid management pablum … Talk like you speak — get rid of the jargon.” — Jamie Dimon

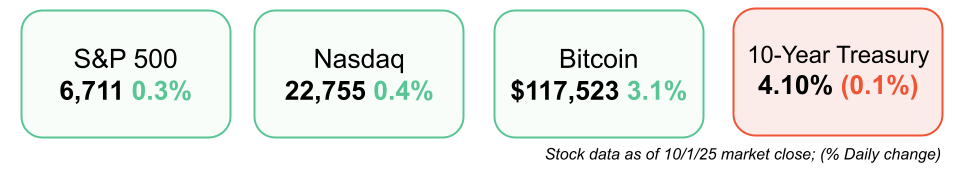

Good morning! Elon Musk became the first person worth $500 billion as Tesla shares soared. The U.S. government shut down after Trump and Congress failed to reach a deal, while the S&P 500 closed above 6,700 for the first time.

BlackRock is nearing a $38B acquisition of AES to capitalize on AI’s thirst for power. Leon Cooperman says we’ve entered the stage of the bull market Warren Buffett warned about. And Ikea is planning a massive NYC expansion with a $213 million purchase of Nike’s former Soho flagship

Plus: KKR is expanding its Middle East footprint with an ADNOC gas pipeline investment, a hotel in Poland offering €2,000 baby bonus to customers to encourage conception, and why Gen Z isn’t drinking as much.

Your money on autopilot? YieldClub is a new app that allows you to earn 6-12% yield on your cash. Check it out here.

SQUEEZ OF THE DAY

How Many PE Funds?!

While private equity was once seen as a growth industry with many generations of Blackstone and Apollo alums going on to start their own firms, many experts are warning that the industry is finally starting to contract and consolidate, at least by the number of firms.

Brookfield CEO Bruce Flatt says the U.S. has roughly 7,000 private equity firms but room for fewer than half that. “There should be 4,000 fewer,” he said at an investor day, noting that the post-ZIRP era has exposed how “this is hard work.”

KKR’s Alisa Wood also added: “There are 19,000 private equity funds in the U.S. … and 14,000 McDonald’s. How are there more private equity funds than McDonald’s? That’s actually crazy.”

The drought in deals and exits since the Fed started hiking in 2022 has left LPs hungry for cash and is putting strain on the entire private equity model. And fundraising has hit an especially tough spot, with more than 19,000 private capital funds chasing $3.3 trillion in commitments, three times the supply of actual dollars.

Apollo president Jim Zelter also warned: “Many PE funds that raised their most recent vehicle don’t realize it’s their last.”

Mega funds are fighting back by leaning into scale, retail capital, and new asset classes. Brookfield (with $1T+ AUM) is betting on AI infrastructure, where CFO Hadley Peer Marshall sees $7T of investment need.

Blackstone is pushing into data centers. Brookfield is also tapping Middle East sovereign wealth funds, lining up a $2B fund backed by Saudi Arabia’s PIF and Hassana.

But even the mega funds face headwinds. Brookfield’s buyout arm has only added $3B to reach $43B in fee-bearing assets, far off CEO Anuj Ranjan’s goal to triple them. Its flagship PE fund closed at $12B (vs. a $15B target), and bankruptcies of PE-backed U.S. firms jumped 15% last year to the highest on record.

Takeaway: Flatt’s view is Darwinian. Firms with quality assets and the ability to pivot into credit, infrastructure, or retail capital will endure; others will become “zombies,” small teams running down bad portfolios. The mid-tier PE shop built in the easy-money era now faces a reckoning. So remember to think twice before joining your college roommate’s “private equity fund.”

HEADLINES

Top Reads

Elon Musk becomes first person to hit $500 billion in net worth (Axios)

OpenAI completes share sale at record $500 billion valuation (BB)

Government shuts down after Trump and Congress fail to reach deal (CNN)

Leon Cooperman says we’ve hit the bull market stage Buffett warned about (CNBC)

BlackRock nears $38B AES deal to capitalize on AI power demand (CNBC)

Ikea plans massive NYC expansion (BB)

Tesla hikes lease prices as EV tax credit expires (Axios)

Meta will soon use your conversations with its AI chatbot to sell you stuff (CNN)

Ford sales surge 82% in Q3, powered by trucks and EVs (YF)

Rick Perry's REIT Fermi surges 55% after $683 million IPO (YF)

KKR, ADNOC team up on major Middle East gas pipeline investment (CNBC)

China is winning the race for intelligent robots (WSJ)

Data centers and hyperscalers spark global real estate gold rush (CNBC)

JPMorgan’s $500M EA debt fee draws eager banks (BB)

The AI boom will require $7 trillion in global investment, Brookfield says (QZ)

Why October will be more treat than trick for investors (Axios)

KKR braces for Japanese private credit boom (FT)

Peloton overhauls its product line (CNBC)

€2,000 bonuses and free parties: hotels enter Poland’s fertility fight (FT)

Trump-Pfizer deal blindsides other drug companies (Axios)

PRESENTED BY YIELDCLUB

Higher Yields, No Lockups

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 6–12% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

CAPITAL PULSE

Markets Rundown

Economic Data Highlights

Shutdown impact: ~750k government workers furloughed, nonessential services paused

Essential functions (Social Security, Medicare, law enforcement, air travel) remain open

CBO estimates: 0.1–0.2% GDP hit per week of closure; long-term effects likely modest

Unique this time: potential permanent layoffs flagged by OMB, and BLS data suspended (jobs, CPI)

Reported Earnings

Cal-Maine Foods (CALM) – Results came in softer than expected, with higher egg prices supporting revenue but earnings below forecasts

Earnings Today

No significant earnings scheduled for today

Movers & Shakers

(+) AES ($AES) +17% after BlackRock is reportedly nearing a deal for the utility company.

(+) Nike ($NKE) +6% because of strong sales growth.

(–) Reddit ($RDDT) -12% after study shows drop in ChatGPT citations.

Private Dealmaking

Vercel, a front-end cloud development platform, raised $300 million

Crystalys Therapeutics, a biotech focused on gout, raised $205 million

Ausperbio, a biotech focused on chronic hepatitis B, raised $63 million

Neptune Robotics, a maker of underwater robots, raised $52 million

Valence, an enterprise AI coach, raised $50 million

Fetcherr, a pricing engine for airlines, raised $42 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

When Everyone Knows That Everyone Knows

Description: A nuanced exploration of common knowledge—not just what people know, but what they know others know, and how that recursive awareness shapes our decisions, power dynamics, and social norms. Pinker applies these layers of shared understanding to markets, politics, rumor, social media, and everyday life.

Book Length: 368 pages

Ideal For: Readers fascinated by psychology, game theory, decision-making, social norms, and how hidden layers of mutual awareness mediate almost every interaction.

“What makes things unravel is not that people don’t know the facts. It’s that they can’t be sure that others know them too.”

DAILY VISUAL

US Govt Shutdowns

Source: Chartr

PRESENTED BY KALSHI

Slop Bowls, Not Sloppy Bets

Chipotle’s Q3 earnings call is October 29, but you don’t need to own the stock to profit.

Kalshi is letting you trade on what words get said during the call, including favorites like “carne asada” (currently with a 72% chance). If it’s mentioned, a “Yes” contract pays out $1.

For anyone who’s ever stood in line at Chipotle behind a dozen Patagonia vests, this is the most on-brand trade you’ll make this quarter.

Your burrito might cost $14. But your prediction could pay much more.

DAILY ACUMEN

Mean Reversion

Trends seduce us.

Stocks, fads, moods.

But most variables drift back toward averages over time.

Growth slows, margins compress, euphoria cools, despair lifts.

Investors who extrapolate straight lines are always shocked.

Life has mean reversion too: a hot streak of luck fades, a cold streak warms.

The trick is distinguishing signal from noise: some things revert (weather, sentiment), others structurally change (technology curves, demographics).

Mean reversion is a reminder that extremes rarely last, but mistaking which ones do can kill you.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply