- Short Squeez

- Posts

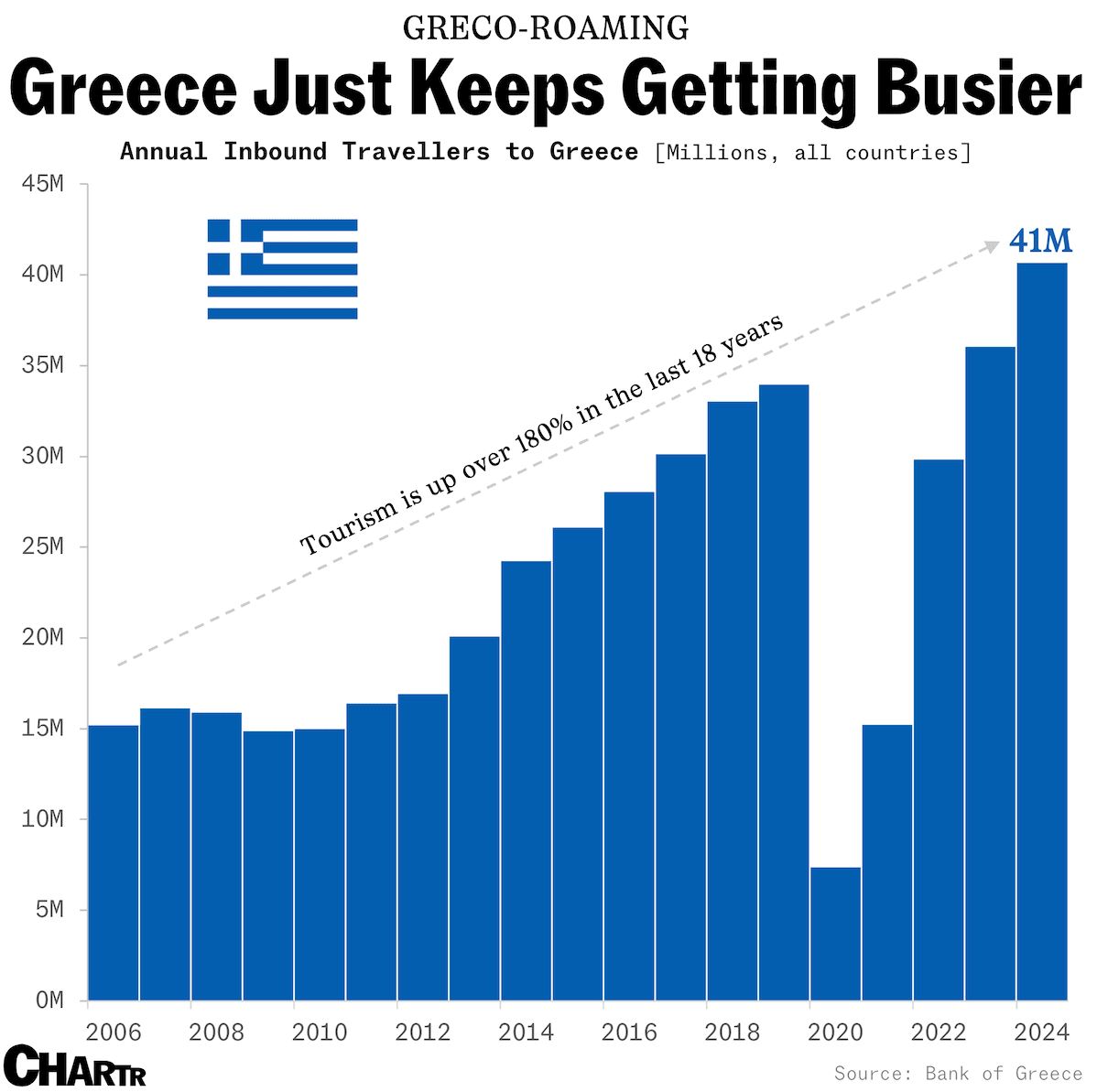

- 🍋 Greek Around and Find Out

🍋 Greek Around and Find Out

Great quarter, guys! Trump hit Powell with a “pls fix” note to cut rates, and suggested DOGE look into Elon's companies. Plus: Zuck unveiled his $15B AI dream team.

Together With

“Your job, throughout your entire life, is to disappoint as many people as it takes to avoid disappointing yourself.” — Glennon Doyle

Good morning and happy Q3! The S&P 500 closed out one of the most volatile quarters in history, surging 25% from April lows to a record high.

Trump sent Powell a handwritten note accusing him of costing the U.S. “a fortune” and vowed he won’t appoint a Fed chair who won’t cut rates. He also took a swipe at Elon, suggesting DOGE look into subsidies for Musk’s companies.

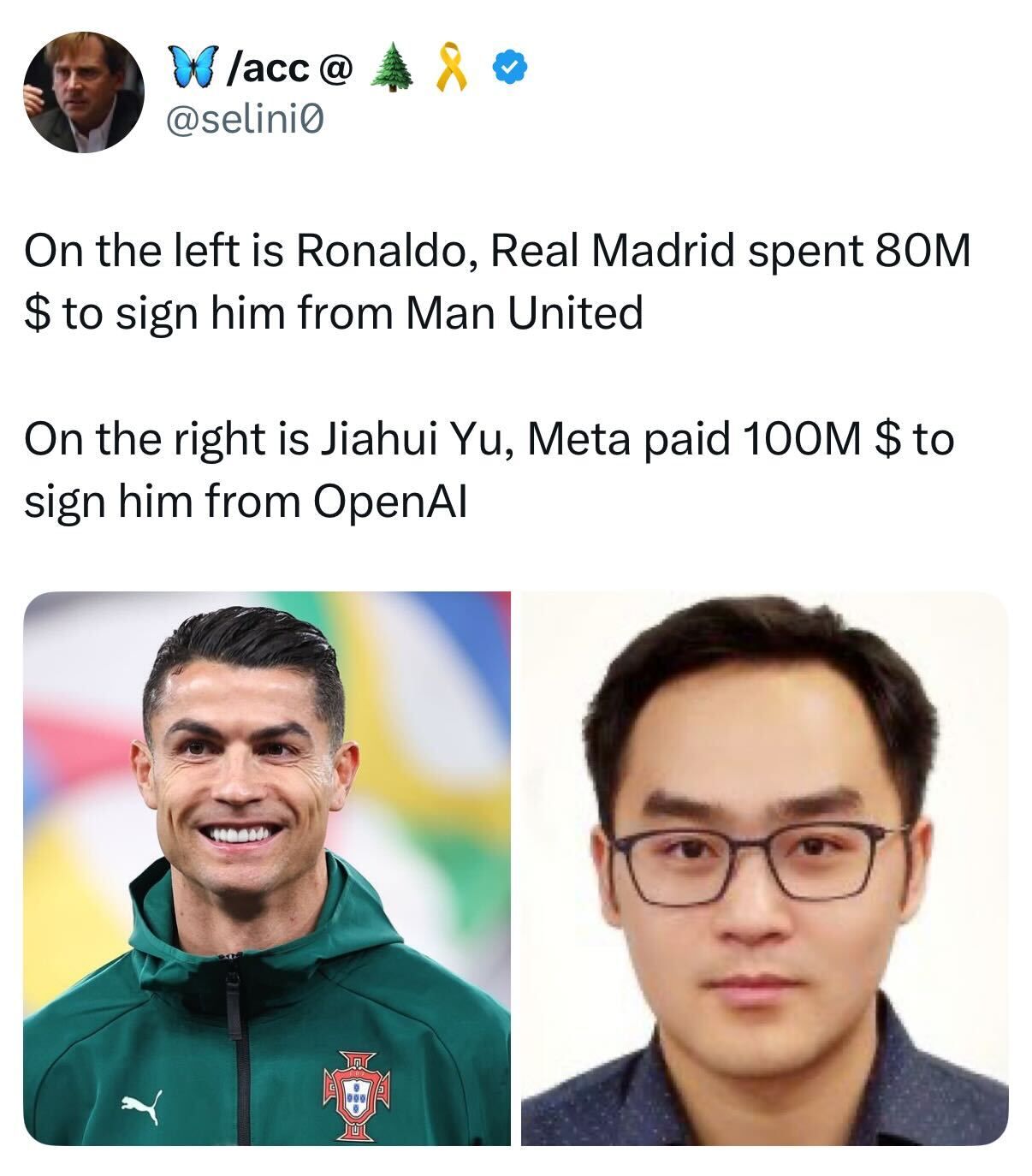

Zuckerberg launched Meta Superintelligence Labs, a $15+ billion AI dream team led by Alexandr Wang from Scale AI as Chief AI Officer.

Plus: Google is investing in nuclear fusion, Oracle locked in a massive $30B contract from an unnamed customer, and AI workers are hitting Wall Street.

Top firms like Evercore and CVC already use Mosaic to build LBO models in mere minutes. It's time that you do too.

SQUEEZ OF THE DAY

Greek Around and Find Out

Greece has become a hotspot for finance bros, Mykonos party scene and the Mediterranean yacht week migration. So in 2022, when Goldman Sachs scooped up three seaside resorts in Halkidiki for around €100 million (~$117 million), it seemed like the perfect finance-meets-lifestyle play.

The bank’s asset management arm planned to gut-renovate the properties, build a boutique Mediterranean hotel brand, and flip the resorts for a hefty profit, all while collecting fees along the way.

Unlike peers like Blackstone, which often partner with local operators, Goldman opted for a DIY approach. It created “Ousia,” a hospitality platform with 10 staff in Athens, to run the project and scout future deals.

But what looked good in a Manhattan pitch deck turned into a Greek tragedy on the ground. Permits lagged, construction costs soared, and Goldman’s lack of local know-how quickly showed. The investment ballooned from €100 million toward €215 million as costs for materials and labor surged.

By late 2024, Goldman was hunting for an exit. In spring 2025, the bank sold the resorts to Sani/Ikos Group, barely breaking even. The hotels never opened under Goldman’s watch.

Meanwhile, Sani/Ikos plans to invest over €400 million to transform the properties into nearly 750 rooms with multiple pools, 30+ restaurants and bars, theaters, and spas, aiming for a 2029 debut, four years later than Goldman had hoped.

Goldman has since pulled back from hotel investments in Greece but retains a minority stake in local real estate firm Prodea. Its broader asset management and investment banking operations in the country remain unchanged.

Takeaway: Goldman bet it could replicate Blackstone-style real estate returns without Blackstone-style infrastructure. But hospitality is a ground game, and even the smartest guys can fail without without sufficient local insight. Looks like DJ D-Sol won’t be spinning any Aegean opening nights anytime soon…

HEADLINES

Top Reads

S&P 500 ends quarter at record high (CNBC)

Trump steps up pressure campaign on Powell with handwritten note (NYT)

Trump says he'll expect next Fed chair to cut rates (Axios)

Dealmakers hit $1.8 trillion as they get used to trade chaos (BB)

Larger deals power global M&A in H1, bankers signal appetite for megadeals (YF)

Zuckerberg announces creation of Meta Superintelligence Labs (Read Memo)

Blackstone's Cirsa gambling company seeks $2.95B valuation in IPO (YF)

Private equity's Medicaid problem (Axios)

Trump plans to announce TikTok buyer in two weeks (Axios)

Apple eyes ChatGPT, Claude for Siri (BB)

Investors have moved into a post-tariff world (Axios)

Executives cautious as investors stay bullish (Axios)

Manhattanhenge: the rare event that stops New York twice a year (3DVF)

Google to buy fusion energy from Bill Gates-backed nuclear startup (WSJ)

Oracle reveals $30B cloud deal (CNBC)

Digital workers have arrived in banking (WSJ)

PRESENTED BY MOSAIC

CIM Screenshot to LBO

Imagine a world where you can take a screenshot of a CIM, upload it, and—ta-da—a full LBO model is ready in seconds. Well, that future is here.

Mosaic’s LBO platform lets you upload a CIM screenshot, input your assumptions, and generate a bid-ready model in just minutes. See it in action here.

You can also add a dividend recap, earnout, or M&A tuck-in in seconds. And with a built-in chatbot analyst, even MD comments get updated instantly.

Top firms like Evercore and CVC already use Mosaic to build LBO models in mere minutes. It's time that you do too.

CAPITAL PULSE

Markets Rundown

Market Update

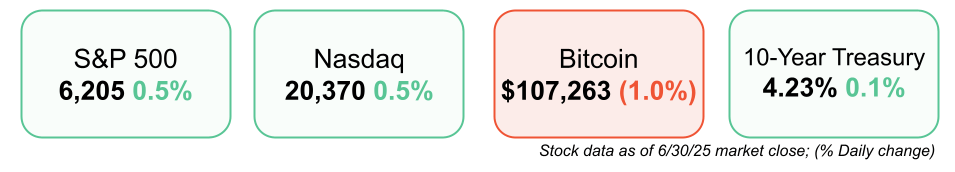

U.S. stocks closed higher Monday, with the S&P 500 and Nasdaq hitting new record highs to end the first half of the year.

Trade tensions eased as Canada rescinded its planned digital services tax, prompting hopes for resumed U.S.-Canada trade talks.

Technology and financial stocks led, while consumer discretionary and energy sectors lagged.

WTI oil declined, as geopolitical risks eased and OPEC+ prepares to meet July 6 to discuss supply increases.

Economic Data Highlights

Bond yields fell, with the 10-year Treasury yield at 4.24%, continuing its decline from the May peak of 4.60%.

Markets are pricing in three Fed rate cuts this year, more than the Fed’s current projection of two.

Yield curve flattening reflects moderating economic growth and expectations for lower interest rates.

Germany’s CPI inflation cooled to 2.0%, hitting the ECB’s target, while China’s manufacturing PMI remained in contraction for the third straight month.

Reported Earnings

Quantum Corp (QMCO) – Missed expectations as continued weakness in hyperscale demand offset gains in AI infrastructure and backup markets.

Earnings Today

Constellation Brands (STZ) – Reporting July 1 (Before Market Open): Investors watching beer segment growth, margin trends, and consumer demand resilience.

Movers & Shakers

(+) Robinhood Markets ($HOOD) +13% after launching tokens allowing EU users to trade in US stocks.

(+) Oracle ($ORCL) +4% after a $30B cloud deal.

(–) Tesla ($TSLA) -2% after news the Senate will end EV purchase credits in September.

Private Dealmaking

Home Depot bought GMS for $5.5 billion

Abbvie acquired Capstan Therapeutics for $2.1 billion

KKR sold its 46.4% stake in JB Pharma for $1.4 billion

Cato Networks, a cloud security platform, raised $359 million

Neopharmed Gentili bought Orladeyo’s European business for $264 million

Metaview, an AI platform for recruiting, raised $35 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

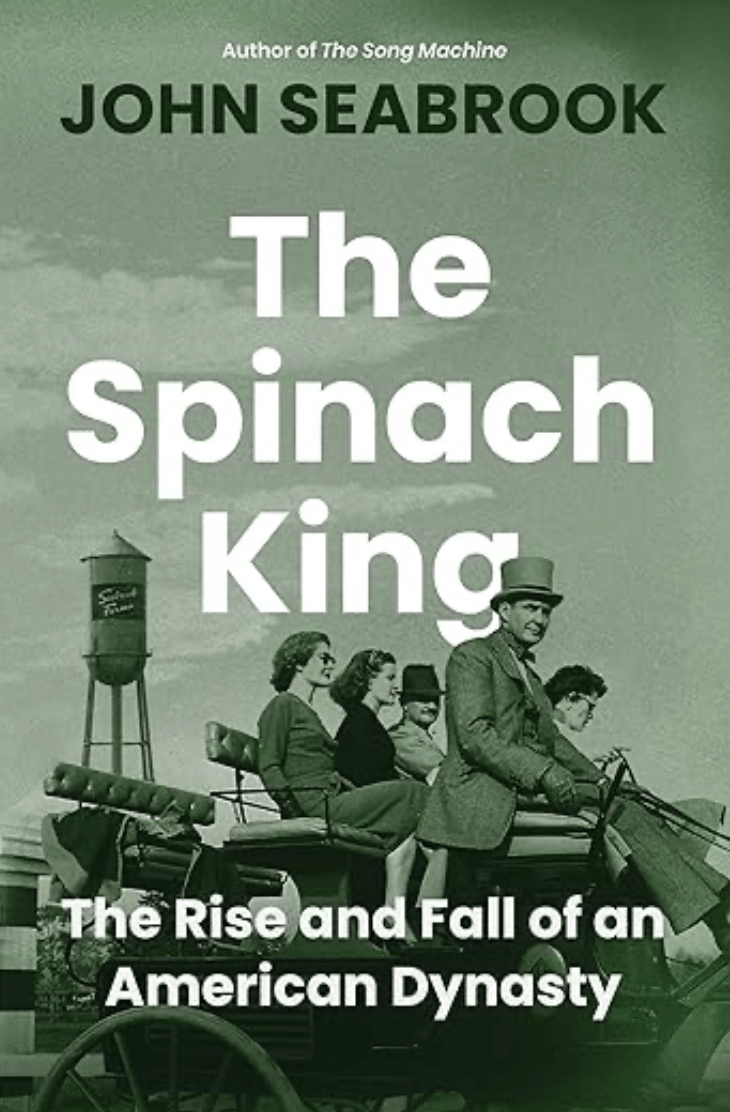

The Spinach King

Description: A compulsively readable blend of memoir and investigative history from New Yorker staff writer John Seabrook, who unravels the rise and dramatic unraveling of his family's frozen‑food empire. Once harvesting one‑third of America's frozen vegetables, Seabrook Farms grew into a multi‑generational dynasty built on exploitation, corruption, and caste, only to implode under its own lineage’s ambition and secrecy.

Rating: 4.3 / 5 on Amazon, 3.9 / 5 Goodreads

Book Length: 368 pages

Ideal For: Lovers of narrative nonfiction, true stories of business and betrayal, readers fascinated by family drama, and anyone intrigued by the human cost underneath agribusiness expansion and American wealth.

"Sophisticated and appealing … a shocking but juicy story… Seabrook brings the ease and command of New Yorker‑style reportage to bear on his own family." — Cree LeFavour, New York Times Book Review

DAILY VISUAL

Mykonos Anyone?

Source: Chartr

PRESENTED BY MEANWHILE

Traditional Life Insurance Is Dead. Bitcoin Life Insurance Is The Future.

Why plug money into a fiat-backed policy just to watch inflation erode your payout?

Choose a Bitcoin-denominated policy from Meanwhile and combine the traditional tax advantages of life insurance with the earning potential of Bitcoin.

Need cash? Borrow tax-free against your policy

Licensed and regulated by BMA, the global gold standard

Easy-apply in under 30 minutes–no doctor’s visits, no endless paperwork.

DAILY ACUMEN

Energy

Some people drain you. Others light you up. The difference? It’s not charm—it’s energy.

“Positive relational energy” isn’t just a feel-good phrase; it’s a scientifically proven force that boosts connection, trust, and performance.

You don’t need to be loud or extroverted to have it.

You just need to be present, genuinely interested, and rooting for others.

Emotions are contagious—bring curiosity, encouragement, and care into the room, and you’ll shift the entire mood.

Want better relationships?

Be the person others feel better around.

Energy is a choice. And the best part? When you lift others, you rise too.

ENLIGHTENMENT

Short Squeez Picks

8 signs someone is attracted to you but won’t admit it

Habits that quietly keep people unsuccessful in life

4 communication styles and how to communicate effectively reference

6 tips for sleeping better on a plane

Caffeine's effect on your brain while you’re asleep

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply