- Short Squeez

- Posts

- 🍋 Figma’s Monster IPO

🍋 Figma’s Monster IPO

Plus: Reddit is mooning again, Apple beat, Amazon disappointed, and MSFT joined the $4T club, Trump slapped 35% tariffs on Canada, and Dimon and Trump squashed beef.

Together With

"From the kids I talk to, they see (Nvidia) and the big 7 the same way. Everything is a meme to individual traders these days.” — Mark Cuban

Good Morning! Trump followed through on his threat to hike tariffs on exports from Canada from 25% to 35%, and also dropped a new 10% global minimum and 15%+ rate for countries with trade surpluses.

Microsoft popped 4% post-earnings, joining Nvidia in the exclusive $4T club. Apple beat estimates with its strongest revenue growth since 2021, while Amazon slipped on a weaker-than-expected forecast.

Elsewhere: Jamie Dimon and Trump finally buried the hatchet with a long-awaited Oval Office sit-down. Elon’s Hyperloop is turning into a $900M flop. And Reddit shares jumped more than 20% on second-quarter sales and guidance beat.

Plus: Ray Dalio is officially out at Bridgewater, wrapping up a decade-long succession saga, and the three times it's healthier to sleep than work out.

Babbel, everyone’s favorite language learning app, is turning 18. To celebrate, they are giving lifetime access for $239.

SQUEEZ OF THE DAY

Figma’s Monster IPO

IPO mania is back in full swing, and Figma had one of the more memorable debuts in recent memory yesterday.

Figma priced its IPO at $33 per share and opened at $35, but that calm didn’t last long. Within minutes, the stock ripped to $85, was halted for volatility after clearing $112, and finally closed the day at $115.50. That’s a 250% gain in a single trading session, valuing the company at nearly $68 billion.

The IPO raised $1.2 billion, largely benefiting early backers like Sequoia, Greylock, Index, and Kleiner Perkins. Demand was so high that many retail investors on Robinhood reported being allocated just one share instead of the dozens or hundreds they requested. (One person bragged about getting 17 shares.)

Figma, often dubbed the Google Docs of design, enables real-time collaboration on digital products. It boasts over 13 million monthly users, including deep-pocketed enterprise clients like Google, Microsoft, Netflix, and Uber.

In Q2, the company posted up to $250 million in revenue, growing nearly 40% year over year, with more than 1,000 clients paying over $100K annually.

Adobe tried to buy Figma for $20 billion in 2022, but the deal was blocked by regulators. Two years later, that $20 billion price tag looks like a steal.

Takeaway: Figma’s IPO was a home run for early investors but left a lot of money on the table. A 250% pop on Day 1 isn’t just a feel-good headline, it’s a sign the offering was seriously underpriced, raising questions about how well the underwriters read the market. Oh and at this rate, Figma might end up acquiring Adobe, not the other way around.

HEADLINES

Top Reads

The White House sets a swath of new tariff rates for dozens of countries (NPR)

Microsoft officially tops $4 trillion in market cap (CNBC)

Apple earnings reveal unexpected iPhone strength (YF)

Banker and longtime Trump critic now frequent visitor at White House (Fox)

Amazon's gloomy earnings forecast overshadow beat (CNBC)

Reddit jumps as company posts fastest revenue growth in 3 years (YF)

Jamie Dimon and Trump finally had a meeting after battling for years (CNN)

Elon Musk's Boring Co. is turning into a $900M flop (BB)

Stocks fall after Powell remarks on potential rate cut dim investor hopes (WSJ)

JPMorgan marks 1,000th branch opening since 2018 expansion plans (CNBC)

Bridgewater founder sells his remaining stake in firm (BB)

Dimon says lots of Mamdani's plans have never worked before (BB)

Trump gives major drugmakers 60 days to cut U.S. prices (Axios)

Trump’s $200M White House ballroom to begin in September (CNN)

Blue Owl chief warns of manic market for secondhand PE stakes (FT)

Jamie Dimon says he believes in stablecoins and blockchain (CNBC)

Treasury Secretary Bessent under fire over Social Security comments (Axios)

How Trump used America’s leverage to win trade war (CNN)

KKR posts higher revenue, increases assets under management segment (WSJ)

PRESENTED BY BABBEL

You’re Only 3 Weeks Away From a New Language

Traveling this summer? It’s not too late to start learning a new language! With Babbel, you can have real conversations in as little as three weeks.

Summer is the perfect time to start speaking a new language! With Babbel’s bite-sized daily lessons, you can bring your language journey to the beach, on the plane, or anywhere your adventures take you.

No expensive classes, no gimmicky game-ified apps… just expert-crafted lessons proven to help you have real conversations in a new language. Want results? Get Babbel, language learning that works.

Go from “tourist trap” to “trip of a lifetime”. With Babbel’s award-winning lessons, you can start speaking a new language with just 10 minutes of practice a day.

CAPITAL PULSE

Markets Rundown

Market Update

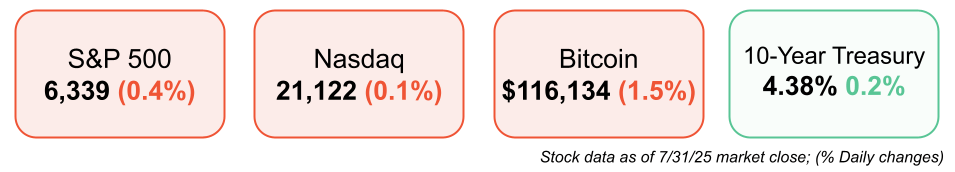

U.S. equity indices turned lower, reversing earlier strength; the Nasdaq underperformed, with the S&P 500 and Dow also in the red

Pharmaceuticals and real estate lagged after pressure on drug pricing; emerging markets and Canada also weakened

Bond yields and the dollar held steady ahead of nonfarm payrolls

Oil prices declined, erasing earlier gains

Economic Data Highlights

June personal consumption rose just 0.1%, while core PCE inflation increased 0.3%, pushing goods inflation to ~3.7% annualized

Jobless claims remain low, but layoff announcements spiked per Challenger data

Markets await today’s nonfarm payrolls — weak labor data could increase chances of a September Fed rate cut

Reported Earnings

Amazon (AMZN) beat both earnings and revenue expectations but the stock slipped on a weaker-than-expected forecast.

Apple (AAPL) exceeded estimates with $1.57 EPS on $94 billion in revenue, fueled by double-digit iPhone and services growth despite tariff pressures.

Coinbase (COIN) missed expectations hard—EPS hit $0.12 and revenue $1.5 billion, with transaction volume down sharply despite a one-time investment gain boosting net profit.

Earnings Today

Chevron (CVX) – Watching for impact from lower commodity prices and signals from its refined margin and Hess acquisition synergy

ExxonMobil (XOM) – Focus on how refining margins hold up amid upstream weakness expected to drive earnings decline

Moderna (MRNA) – Investors focused on execution of cost cuts and pipeline momentum as vaccine revenue falls sharply

Movers & Shakers

(+) Carvana ($CVNA) +17% after the car retailer beat estimates.

(+) CoreWeave ($CRWV) +11% because of strong Microsoft earnings.

(–) Shake Shack ($SHAK) -15% after the fast casual chain cut its revenue forecast.

Private Dealmaking

Quince, a DTC online fashion retailer, is raising about $200 million

Observe, an observability startup, raised $156 million

Motive, an ops platform for the physical economy, raised $150 million

Artbio, a radiopharmaceutical cancer therapy developer, raised $132 million

QI Tech, a financial infrastructure fintech, raised $63 million

BlinkOps, a cybersecurity company building micro-agents, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Courage To Be Disliked

Description: A transformational exploration of Adlerian psychology presented as a dialogue between a philosopher and a young man. Through five "nights" of conversation, the book dismantles beliefs in trauma, the past, and validation by others—showing that true freedom and happiness flow from choosing your goals and refusing to live by others' expectations.

Rating:

• Amazon: 4.5 / 5

• Goodreads: 3.9 / 5

Book Length: 288 pages

Ideal For: Philosophical self‑help readers, personal-growth seekers, and anyone wrestling with approval, past conditioning, or existential pressure—and ready to reclaim happiness through radical agency.

“The courage to be happy also includes the courage to be disliked. When you have gained that courage, your interpersonal relationships will all at once change into things of lightness.” — Alfred Adler

PRESENTED BY FINIMIZE

Invest with Insight, Not Hindsight.

News headlines tell you what’s happened in the world... but not why it matters to you.

Wall Street analysts describe expert investing techniques… but they speak in DCFs and P/E ratios rather than plain English.

That’s why over a million modern investors subscribe to Finimize. Written by analysts who trained at world-leading institutions, this finance newsletter tells you what’s happening in the markets and, crucially, how that could impact your portfolio – all in a three-minute daily read.

DAILY ACUMEN

Reverse Valuation

VCs ask: “Is this company worth the price?”

Life asks: “Is this price worth the person?”

Every job, relationship, city, habit — it costs something.

Your time, your energy, your identity.

And just like overpaying for a stock, overpaying with your soul rarely ends well.

So flip the script: don’t just assess outcomes. Assess the cost of becoming the person who gets them.

Good trades respect valuation.

Great ones respect values.

ENLIGHTENMENT

Short Squeez Picks

Do New Yorkers want more skyscrapers in their city?

6 superpowers of generalists

4 strategies to help new leaders give feedback

Why it’s time to embrace hybrid training

3 times it's healthier to work out than sleep

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📦 City Sublets: Verified rentals for finance professionals in NYC and beyond. Find or list your sublet with ease. Explore City Sublets.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply