- Short Squeez

- Posts

- 🍋 CV-Squared

🍋 CV-Squared

Plus: Goldman’s new Dallas campus, founder suicides expose China’s deeper strains, Opendoor CEO out, and a startup turning NYC parking garages into clean energy hubs.

Together With

"I don't look to jump over seven-foot bars; I look around for one-foot bars that I can step over." — Warren Buffett

Good Morning! Goldman is opening a 14-floor Dallas campus with a gym and childcare as it expands its Texas footprint. PE megafunds see brighter deal days ahead while smaller firms struggle to keep pace.

China’s entrepreneurial spirit is fracturing as rising founder suicides reveal deeper economic and regulatory strains. A startup is converting NYC parking garages into clean energy hubs. Gallagher is drafting pro athletes for insurance internships. And Samsung is gaining market share from Apple as foldable phones pick up steam.

Plus: Why skill certificates rarely pay, job interviews go old-school, and why hands-off investing wins.

How Bilt hit a $10.7B valuation to become one of the fastest-growing fintechs. Read Forbes coverage here.

SQUEEZ OF THE DAY

CV-Squared

Private equity funds are getting increasingly creative with how they hold onto assets in a difficult exit environment.

The vehicle of choice has been continuation funds, or CVs, which allow GPs to roll portfolio companies into a new structure rather than selling them at unattractive valuations. New investors provide liquidity, some existing LPs take cash off the table, and the GP avoids a forced sale.

Now the market has taken the concept a step further with “CV-squareds,” essentially a continuation fund of a continuation fund. The structure extends ownership even longer, but some LPs are pushing back.

Revelstoke Capital Partners used a CV in 2020 to keep Fast Pace Health through the pandemic. The deal worked then, but a more recent attempt to extend ownership again was blocked by LPs.

Others have been more successful. Accel-KKR raised $1.9 billion for a second continuation fund, and PAI Partners (Froneri) and CapVest (Carium Pharma) are pursuing similar transactions.

The rise of CVs shows the standoff between GPs and LPs. Sponsors are sitting on assets they don’t want to sell at today’s valuations, while LPs are frustrated after years of muted distributions. Payouts have dropped to around 7% of fund value this year, down from 25% pre-2020.

Continuation funds can work in investors’ favor. Evercore data shows that single-asset CVs have outperformed traditional buyouts in recent years and often carry lower fees. Accel-KKR’s Isolved deal alone has delivered a 19.2x gross multiple, which gave the GP reason to pitch a second extension.

But CV-squareds raise conflicts of interest as sponsors reset fees and roll assets yet again. Many LPs prefer a clean sale or IPO over what feels like an endless loop.

Takeaway: Continuation funds have become a lifeline for GPs navigating a prolonged exit drought, now representing nearly 20% of all private equity exits. But as CV-squareds gain traction, the line between smart structuring and financial engineering is blurring… and LPs are growing less willing to play along.

HEADLINES

Top Reads

Goldman building 14-floor Dallas campus with fitness center and childcare (Fox)

Burford Capital eyes U.S. law firms by targeting minority stakes (FT)

Private equity’s “big fish” gear up but small players struggle to keep pace (WSJ)

China’s entrepreneurial spirit under strain (FT)

Startup looks to New York parking garages as underground heat sources (BB)

Gallagher recruits pro athletes for summer insurance internships (CNBC)

Samsung taking market share from Apple as foldable phones gain traction (CNBC)

Skill certificates rarely pay off (WSJ)

Saudi Arabia’s sovereign fund exits U.S. equities including Meta (BB)

Private credit primed to profit from new federal student loan limits (WSJ)

Sam Altman’s brain‑chip venture considers pivoting to gene therapy (BB)

Opendoor CEO resigns following investor pressure campaign (CNBC)

Big Tech hires its way into the AI talent pool with massive “reverse acquihires” (WSJ)

Advent International makes a $1.3 billion bid for Swiss chipmaker u‑blox (BB)

1 in 5 workers are 'quiet cracking' (LinkedIn)

Corporate bond spreads hit 27-year low as FOMO floods markets (BB)

Family offices dive deeper into private markets for higher returns (CNBC)

NYC mayoral candidate Mamdani courts Wall Street, holds call with Jamie Dimon (BB)

Trump’s Fannie/Freddie stock plan could drive up mortgage rates, Pimco warns (BB)

July retail sales rise, inflation shows mixed signals for consumers (Axios)

Europe’s $5B soccer transfer spree ignites private debt boom (BB)

TV reaches peak product placement (Variety)

CoreWeave IPO investors get green light to cash out gains (BB)

CEOs lag employees on AI fluency (NYT)

Blackstone-backed Legence engineering firm files for U.S. IPO (BB)

Trump pushes private equity into 401(k) retirement plans (Axios)

PRESENTED BY BILT

The $10.75B Fintech Turning Rent Into Rewards

Most rewards programs give you points for spending anywhere but where your money actually goes: your rent.

Bilt is flipping that model. Backed by a fresh $10.75 billion valuation, Bilt now lets over 5 million renters earn points on rent and spending around their neighborhood. Those points can be redeemed for flights, hotels, workouts, Lyft rides, even student loans.

Read how Bilt is building the future of payments and rewards.

CAPITAL PULSE

Markets Rundown

Market Update

S&P 500 fell from record highs as tech and financials weighed, offsetting gains in health care, real estate, and communications

Dow Jones finished marginally higher, Russell 2000 down for a 2nd day but still up ~3% for the week

European markets gained on optimism around Trump–Putin meeting; Asia mostly positive

Treasury yields rose 2–5 bps across maturities; global bond markets saw similar moves

Dollar softened against trade-weighted peers; WTI oil closed lower

Economic Data Highlights

U.S. retail sales +0.5% m/m in July, helped by Prime Day and competing retailer promotions

June sales revised higher, pointing to improvement in spending momentum

Weakness in restaurant and bar spending signals softness in services demand

University of Michigan sentiment index dropped sharply, citing inflation and labor-market worries

Import data suggest tariffs being absorbed by importers, not exporters, raising consumer and corporate cost concerns

Reported Earnings

No significant earnings reported Friday

Earnings Today

Palo Alto Networks (PANW) reports after market close; focus on AI-driven security adoption, enterprise spending trends, and margin trajectory

Movers & Shakers

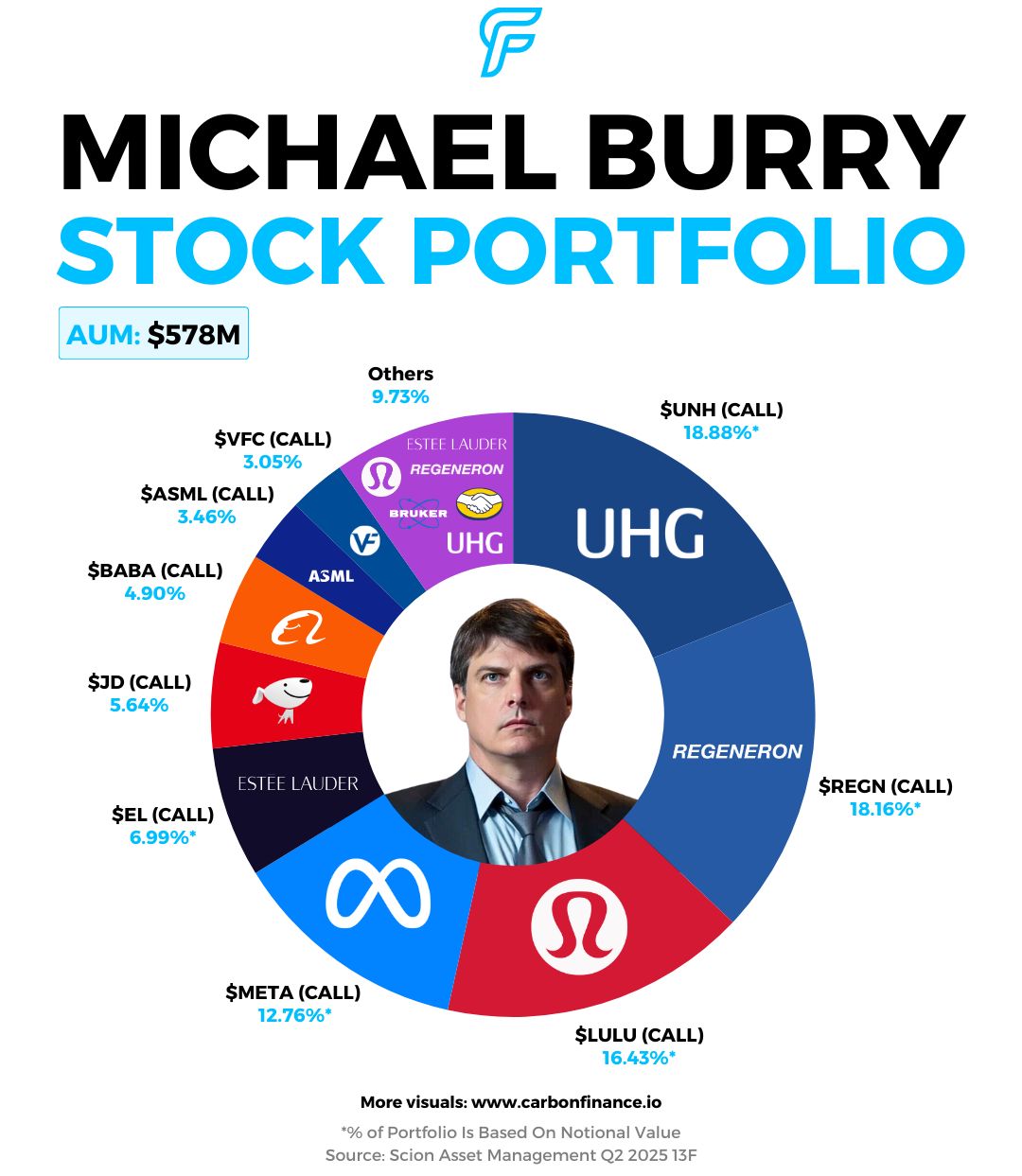

(+) UnitedHealth ($UNH) +12% after Warren Buffett revealed the insurer is his mystery stock.

(+) Salesforce ($CRM) +4% after activist Starboard bought more stock.

(–) Applied Materials ($AMAT) -14% after the manufacturing company lowered its guidance.

Private Dealmaking

Nautic Partners agreed to buy KabaFusion for $2.2 billion

Quanta Services agreed to buy Dynamic Systems for $1.56 billion

Accenture agreed to buy CyberCX for $670 million

Cohere, an LLM model developer, raised $500 million

Cognition, an AI coding startup, raised $500 million

Associated British Foods agreed to buy Hovis for $96 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

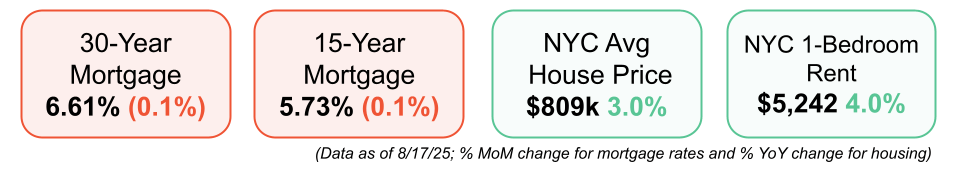

The average 30-year fixed-rate mortgage fell for the fifth consecutive week and dropped to its lowest level since October. Purchase application activity is improving as borrowers take advantage of the decline in mortgage rates.

Latest News

Why the jobs number revision was such a gut punch to real estate

Why it’s actually a good time to buy a house, according to a Zillow economist

A $340 million New York office makeover is converting boardrooms to bedrooms

While Los Angeles burned, rules to protect homes from wildfires were on hold

Americans are getting priced out of homeownership at record rates

New Listings

522 West 29th Street Apt New York, NY: 3 Bed / 3.5 Bath – $5.9M

177 SE 25th Rd Miami, FL: 3 Bed / 3.5 Bath – $3.9M

39 Greenvale Ln Southampton, NY: 4 bed / 5 Bath – $2.9M

Alpes-Maritimes, France: 5 Bed / 6 Bath – $7.6M

Tulsayab Quintana Roo Mexico: 4 Bed / 4 Bath – $3.3M

BOOK OF THE DAY

Lean Learning

Description:

A transformative blueprint for navigating information overload in our high-speed world. Pat Flynn introduces “just-in-time” learning—acquiring knowledge only when it’s needed—and emphasizes action over planning. With practical tools like the “Power 10” sprint and micro-mastery, it helps creators, entrepreneurs, and lifelong learners move from overwhelm to momentum.

Rating:

• Amazon: 4.6 / 5

• Goodreads: 4 / 5

Book Length: 256 pages

Ideal For: Creators, entrepreneurs, high-achievers, and over-learners who want to turn ideas into action and build momentum faster.

"This book is a lifeline. It's the exact blueprint to cut through the noise, trust yourself, and start building the business and life you desire."

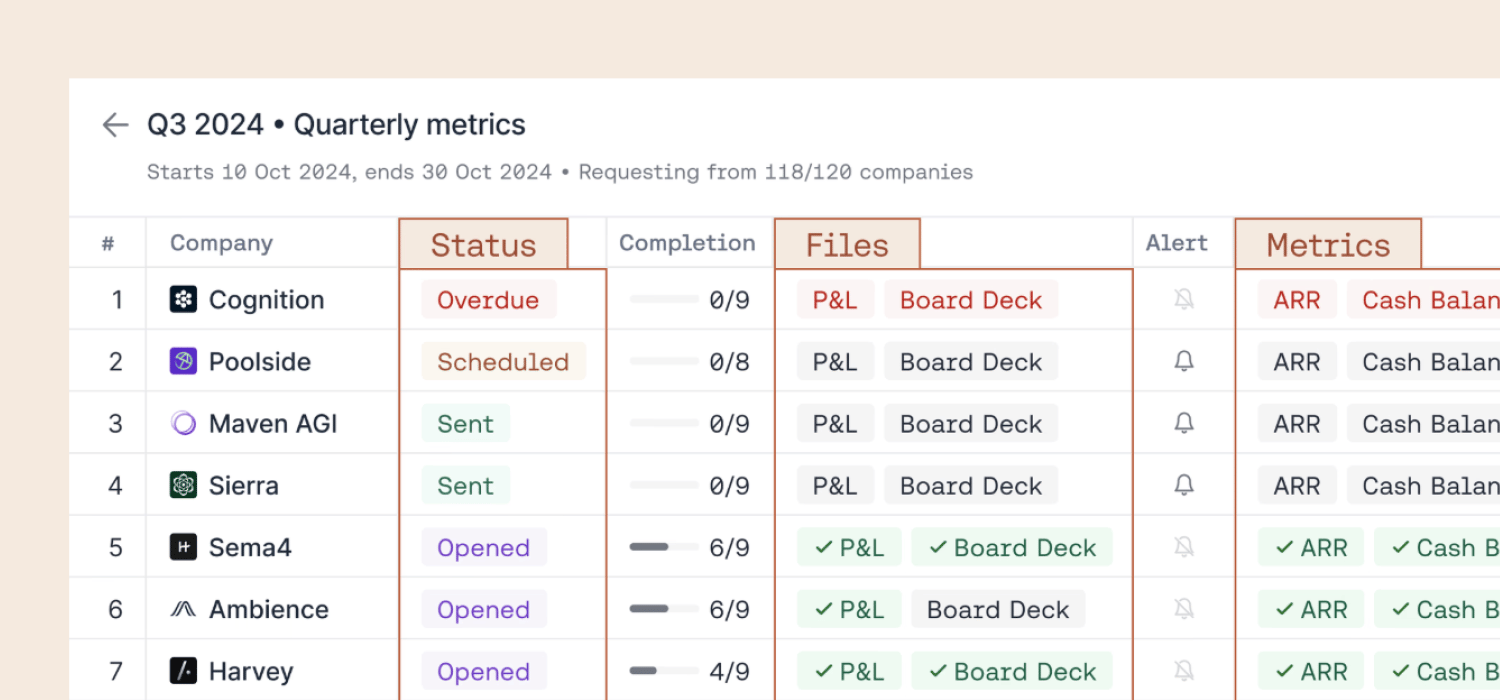

PRESENTED BY PORTFOLIOIQ

The Portfolio Data Terminal for Private Investors

Collecting portfolio data is slow, messy, and scattered across endless emails and files. PortfolioIQ removes this friction.

Verified extraction: Pulls data from decks, emails, and spreadsheets with 100% accuracy.

Unified dashboards: Standardizes metric names and time periods across your portfolio.

Source tracking: Lets you trace every data point back to where it came from.

The result? More time spent analyzing performance, less time piecing numbers together manually. See it in action today.

DAILY ACUMEN

Second-Order Thinking

Markets price in the obvious instantly. A Fed cut? Bonds rally. Oil shock? Airlines drop. The real edge lies in the second-order effects.

A Fed cut may lower mortgage rates, which boosts housing starts, which lifts demand for lumber, which makes a sawmill stock suddenly interesting. Most stop at step one. The best go three steps deeper. Life works the same way.

The first-order reward of working late is finishing the task.

The second-order cost is burning out your energy, your relationships, your creativity.

True judgment is asking “and then what?” until the answers stop being obvious.

Jeff Bezos once said he makes decisions based on what won’t change in 10 years—an elegant way of embedding second-order thinking.

The question isn’t just “what happens?” but “what happens next, and next, and next?”

Sharpen that lens, and you’ll see opportunities others miss—not because you’re smarter, but because you’re willing to play the game beyond the first move.

ENLIGHTENMENT

Short Squeez Picks

Why hands-off investing pays off

The viral “6-6-6” walking challenge that’s actually worth trying

America’s best new cocktail bar is in NYC (and worth the hype)

8 daily habits that quietly make you smarter & more creative

Inside Uber’s plan to become the “Kleenex” of robotaxis

The “cortisol cocktail” that could help you stress less

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply