- Short Squeez

- Posts

- 🍋 Climate as a Service Is Here

🍋 Climate as a Service Is Here

Plus: Gold hits $4,000 with no end in sight to rally, Carlyle dropped its own job report, Deloitte caught using AI, and Trilogy Metals jumped over 200% after the U.S. took a stake.

Together With

“The illusion of control is the most dangerous illusion in investing.” — Annie Duke

Good morning! With no official jobs report during the shutdown, Carlyle dropped its own proprietary data showing job growth has slowed to a trickle. Gold continued its generational run, breaking $4,000 and now up 50% YTD, as Goldman lifted its 2026 forecast to $4,900. Ken Griffin warned the rush to gold signals fading confidence in the dollar.

Deloitte will refund the Australian government after it was caught using AI. Revolut’s founder joined the billionaire exodus from the UK to the UAE to save billions in taxes. Trilogy Metals soared +200% after the U.S. took a stake in the firm. And Orlando Bravo became the latest titan to call AI valuations a bubble.

Plus: Investment banks are prepping for Fannie Mae and Freddie Mac IPOs, hedge funds targeting fire insurance in California are starting to get burned, and more benefits of creatine.

Find the edge your investment firm needs with Blueflame’s purpose-built AI.

SQUEEZ OF THE DAY

Climate as a Service Is Here

For $25 a month, you can now subscribe to your own forest.

That’s the pitch from Terraformation, a Hawaii-based climate-tech startup founded by former Reddit CEO Yishan Wong.

The company wants to turn reforestation into a subscription service, letting individuals and companies fund the planting and long-term care of biodiverse forests, with satellite monitoring, irrigation, and years of upkeep included.

Unlike the $1 “click to plant a tree” gimmicks that often stop after dropping a seedling in the ground, Terraformation says it’s building self-sustaining, carbon-absorbing ecosystems.

Its first sites are on Hawaii’s Big Island, planting Hala and Koa trees. It’s already worked with corporations to plant millions of trees and is now opening the model to individual subscribers. Tourism companies are also exploring bulk subscriptions as employee perks.

Terraformation is for-profit and backed by several high-profile investors including Sam and Max Altman, Marc Benioff, and Naval Ravikant. Corporate clients get detailed biodiversity and survival reporting, while individuals receive photos and simple progress updates.

The higher price reflects the real cost of restoration. “You might be able to plant a tree for a dollar, but you can’t grow a tree for a dollar,” says UC Santa Cruz professor Karen Holl.

Takeaway: Terraformation is tackling a classic free rider problem with a for-profit model (Bill Ackman would be proud). For consumers, it makes climate action tangible and subscription-priced. Only time will tell if saving the planet can be billed like a streaming service.

PRESENTED BY BLUEFLAME AI

AI Built for Investment Firms

Generic enterprise LLMs like ChatGPT Enterprise or Claude for Business offer broad capabilities, but when it comes to deal execution, due diligence, and portfolio monitoring, their domain gaps become costly roadblocks. Blueflame AI is built specifically for investment managers and deal professionals.

Blueflame’s purpose‑built AI connects natively across your ecosystem, whether it’s SharePoint, your CRM, market data providers, or internal research systems. It doesn’t just summarize; it reasons, executes multi‑step tasks, and builds a unified “firm memory” that’s tailored to private markets. One global PE firm using Blueflame’s workflows cut email drafting time by 60%, with 90% of outputs needing only light edits.

General models remain useful for generic content and experimentation. But for firms seeking sustained ROI and true operational leverage, the edge comes from AI built around the deal lifecycle, financial nuance, and integrated systems.

HEADLINES

Top Reads

Carlyle unveils proprietary data showing weaker U.S. employment trends (BB)

Gold prices surge toward $4,000 amid safe-haven demand and inflation fears (CNBC)

Goldman Sachs forecasts gold could hit $4,900 by late next year (WSJ)

Deloitte caught using AI (FM)

Revolut’s billionaire cofounder Nik Storonsky relocates to Dubai (Forbes)

Jamie Dimon says AI cost savings now match money spent (BB)

BlackRock’s new bets stick firm in middle of AI, energy fray (BB)

Tech investor Orlando Bravo says AI valuations are now in a bubble (CNBC)

U.S. government takes stake in Trilogy Metals, sending shares surging (CNBC)

Big banks prepare for potential Fannie Mae and Freddie Mac IPOs (WSJ)

Hedge funds targeting fire insurance hit a wall in California (BB)

Home sales to investors hit the highest share of buyers in 5 years (CNBC)

Startups stay private longer as IPO market slows, turn to alternative capital sources (CNBC)

Anthropic and IBM partner to win corporate AI business (WSJ)

Inside the high-stakes dealmaking behind OpenAI’s $500 billion valuation (YF)

Corporate anxiety is fueling a multimillion-dollar industry of Gen Z “translators” (WSJ)

Millennium PM George Klavdianos exits hedge fund (BB)

How Ares is capitalizing on the retail revolution in alternative assets (CNBC)

Evercore thinks the S&P 500 could hit 9,000 by the end of 2026 (Axios)

Private equity bets big on utilities (FT)

At $1.2 trillion, more high-grade debt is tied to AI than banks (YF)

JPMorgan was billed $115 million in legal bills for fraud founder’s defense (BB)

CAPITAL PULSE

Markets Rundown

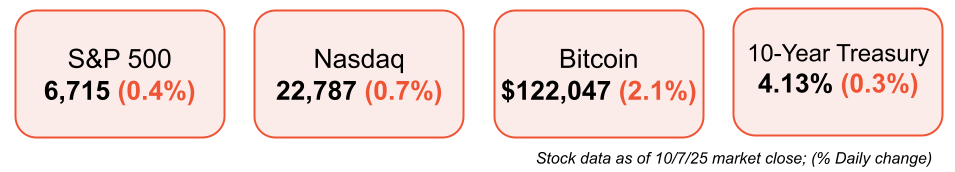

Market Update

Stocks closed lower as the government shutdown entered its seventh day

Consumer staples and utilities led gains, while consumer discretionary and communication services lagged

Small- and mid-caps underperformed large-cap stocks amid a broader risk-off tone

Japan’s Nikkei 225 hit another record high, while European markets fell on France’s political uncertainty

WTI oil rose as OPEC+ output hikes were smaller than expected

Economic Data Highlights

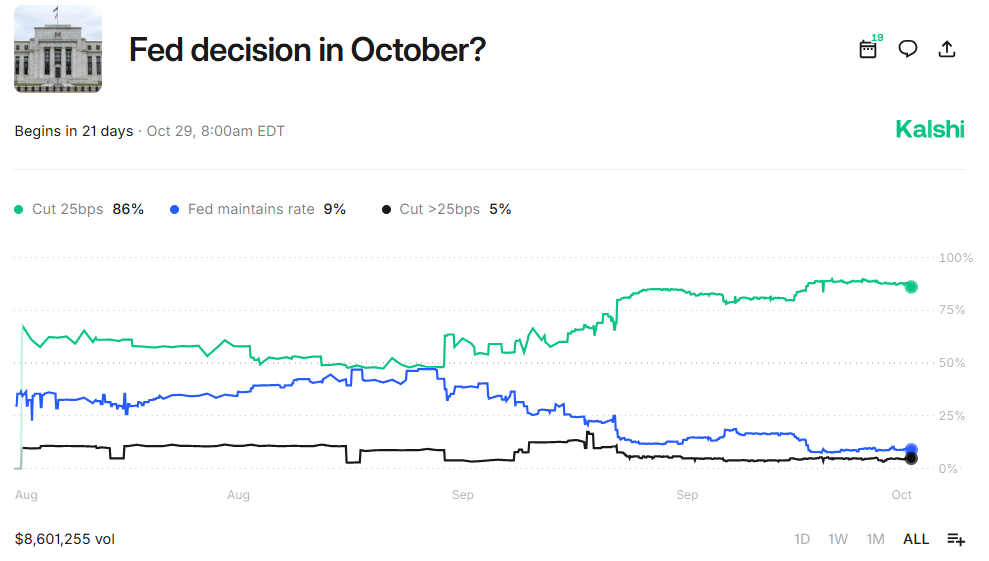

10-year Treasury yield fell to 4.13%, still above September’s 4.0% low

Futures markets price in one to two more Fed cuts this year, followed by one or two in 2026

Fed’s projections imply a slightly slower pace of easing, with one fewer cut over the same period

Several Fed officials speaking this week may provide clarity on inflation and labor-market views ahead of the October 30 meeting

Lower rates are expected to reduce borrowing costs and help stimulate economic activity in the coming months

Movers & Shakers

(+) Trilogy Metals ($TMQ) +211% after the U.S. took a stake in the minerals explorer.

(+) PayPal ($PYPL) +5% because the fintech company dropped a new service for small businesses.

(–) Ford ($F) -6% after a fire at one of the company’s aluminum suppliers.

Prediction Markets

Private Dealmaking

EvenUp, an AI solutions for injury law provider, raised $150 million

NanoPhoria Biosciences, a heart failure biotech, raised $97 million

Meanwhile, a Bitcoin life insurer, raised $82 million

Ensoma, a cell engineering company, raised $53 million

Cato Networks, a cloud security platform, raised $50 million

ProRata.ai, a chatbot for media publishers, raised $40 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Rule Breaker Investing

Description:

David Gardner, known as the “Chief Rule Breaker” at The Motley Fool, shares his decades of investing wisdom in this definitive playbook. He breaks down how to spot tomorrow’s market leaders before they’re obvious, how to adopt resilient investing habits, and how to build and manage a portfolio rooted in conviction and long-term vision. The book challenges traditional rules like “buy low, sell high” and “rebalancing winners” — advocating instead for selectively breaking them to achieve superior returns.

Book Length: 256 pages

Ideal For: Growth investors, founders, stock pickers, and anyone seeking a mindset shift from reactive trading to confident, future-focused investing.

“Stop following the market. Start breaking the rules—and lead the way.”

DAILY VISUAL

Crude Awakening

Source: Chartr

PRESENTED BY BILL

NEW! State of B2B Payments Report 2025

If you're leading finance at a growing business, you're juggling a lot: fraud prevention, cash flow, operational efficiency, and trying to scale.

But, you're not alone. BILL recently surveyed more than 700 finance leaders and here's what stood out:

1 in 4 lost money to payments fraud last year

1 in 3 are bracing for cash flow challenges in the year ahead

And 88% say digital payments platforms are essential to their ability to grow

One thing was clear: finance leaders are moving away from paper-heavy processes toward smarter, more secure systems. Digital payments are no longer a nice-to-have, but a critical tool for businesses.

BILL pulled all the findings into a brand new State of B2B Payments report. If you're rethinking your payments stack or just want to see where your peers are headed, it's worth a look.

DAILY ACUMEN

Sunk Costs

Hooters Air burned $40M trying to extend a brand into planes.

Investors, gamblers, and even relationships all fall prey to the same trap: chasing yesterday’s costs with tomorrow’s energy.

Sunk costs aren’t just financial—they’re emotional.

“I’ve already put so much into this, I can’t walk away.”

But the market doesn’t refund time.

The rational pivot is to ignore the burn and ask: if I were starting fresh today, would I choose this?

If not, exit.

ENLIGHTENMENT

Short Squeez Picks

How creatine counteracts stress and lost sleep

20 time management tips for professionals

The best bedtime for longevity

How to transform your career without leaving your job

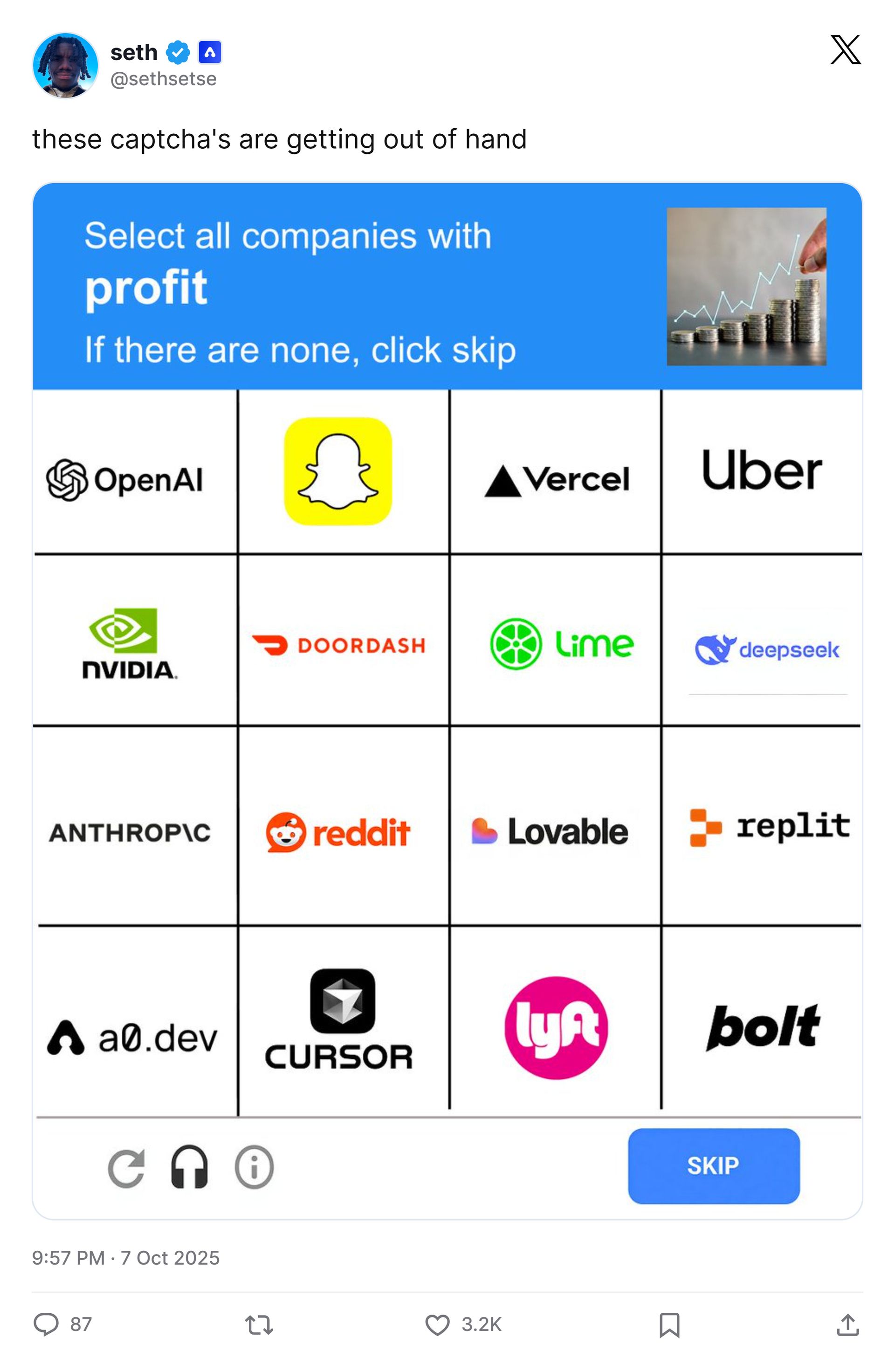

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply