- Short Squeez

- Posts

- 🍋 Citi Joins the War on Early Exits

🍋 Citi Joins the War on Early Exits

Plus: Jerome Powell hit with a criminal referral, new Astronomer CEO finds silver lining in kiss cam fiasco, Blackstone backs out of TikTok bid, and Trump Media buys $2B in Bitcoin.

Together With

"We keep losing to companies that do nothing, make no money, and grow by selling shares. Someday this will end." — David Einhorn

Good morning! Jerome Powell was hit with a criminal referral by a House Republican, just days after Trump said he likely wouldn’t fire Powell but he could be dismissed for mismanaging a $2.5B Fed renovation. Meanwhile, Trump Media soared after it scooped up $2 billion in Bitcoin, further swelling the president’s net worth.

Blackstone backed out of a consortium preparing to invest in TikTok. New York/New Jersey expect a $3.3 billion boost from hosting the soccer world cup. L Catterton acquired a 20% stake in Flexjet for $800 million. Plaintiff lawyers are circling as private equity eyes a push into 401(k)s.

Plus: Bessent wants a full Fed audit, YouTube removed 34k channels linked to foreign propaganda, and SPACs are flashing signs of a 2021 comeback.

Automate your diligence with Blueflame’s IC memo tool so you can focus on decision making, not admin work. See the demo here.

SQUEEZ OF THE DAY

Citi Joins the War on Early Exits

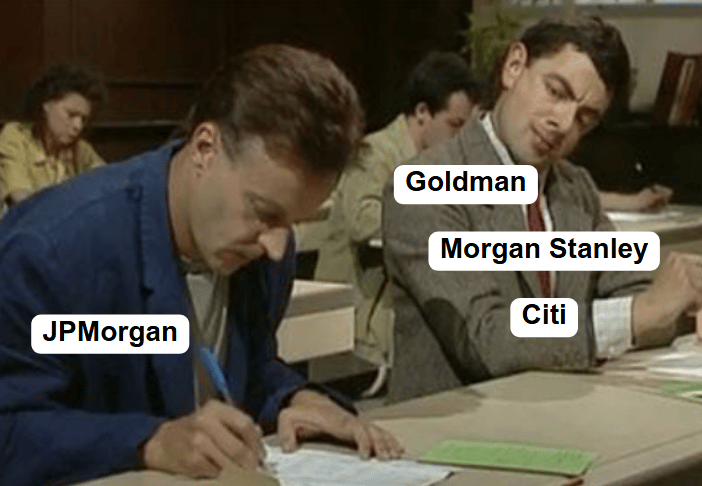

The days of private equity’s on-cycle recruiting may be numbered. Citigroup has become the latest bank to take action, requiring its new class of investment banking analysts to formally disclose whether they’ve accepted a job offer from another firm.

The move, outlined in an internal memo, is positioned as a way to promote a “fair and transparent environment.” Analysts will be reviewed on a case-by-case basis, but the underlying message is clear: early exits are no longer being tolerated quietly.

Citi’s attestation requirement is part of a growing trend across Wall Street, started by Jamie Dimon and JPMorgan. JPMorgan now enforces an 18-month minimum tenure, warning that analysts who accept external offers before then will be let go.

Goldman Sachs has taken it a step further, requiring analysts to confirm every three months that they haven’t committed elsewhere. The firm is also testing internal retention strategies, offering analysts the opportunity to transition into internal buyside roles after two years in banking.

Morgan Stanley introduced its own version of the policy in May, mandating immediate disclosure of any future job acceptances under threat of dismissal.

Private equity firms, meanwhile, have also started pulling back. Megafunds like Apollo have announced they won’t participate in this year’s on-cycle recruiting, while others like KKR and TPG have introduced similar pauses or delays.

Takeaway: The new wave of policies marks a clear shift in power. After years of watching PE firms scoop up junior talent just months into the job, investment banks are reasserting control. The “banking to buyside” pipeline isn’t going away, but it’s being rerouted. And for the first time in years, private equity may find itself competing with banks, not just for analysts, but for college talent too.

HEADLINES

Top Reads

Jerome Powell hit with criminal referral by House GOP Trump ally (Fox)

Bessent calls for review of 'entire' Federal Reserve (YF)

Trump Media stock surges after acquiring $2B of bitcoin (YF)

New Astronomer leader finds silver lining after viral Kiss Cam scandal (Fox)

Blackstone exits TikTok deal (YF)

LVMH-backed investor group takes 20% stake in private jet company Flexjet (CNBC)

Plantiffs' lawyers are ready to pounce if private equity pushes into 401(k)s (WSJ)

SPACs hit $14.7 billion this year (Axios)

NJ and NY expect $3.3B boost from hosting world cup (BB)

Banks are playing long game in push to trade private credit (BB)

CoreWeave stock climbs after company announces $1.5 billion bond sale (CNBC)

For Chicago small businesses, ‘the pope economy’ is good (CNN)

UK and ChatGPT maker OpenAI sign new strategic partnership (FT)

There are signs the stock rally is running out of gas (YF)

Wall Street likes the economy more than voters (Axios)

US SEC would set up guardrails for private investments in retirement plans (YF)

YouTube removes 34k channels linked to foreign propaganda in 2025 (Fox)

PRESENTED BY BLUEFLAME AI

Impress The Partners (Without Working This Weekend)

Why waste your entire weekend on your diligence process when you can just use Blueflame’s IC memo analysis automation tool?

Blueflame reviews your memo, extracts key data points (financials, risks, investment thesis), and generates targeted questions for the partners.

In sum: You’ll diligence in hours, not days.

Automates high-effort admin work like research and meeting prep

Pulls from internal docs, third-party systems, market data, and more

“This efficiency has saved our team nearly 3,000 hours” – VP at Private Equity Firm with $65B AUM.

CAPITAL PULSE

Markets Rundown

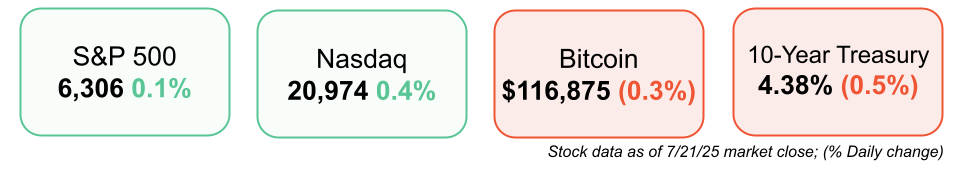

Market Update

U.S. stocks were mixed, with the S&P 500 and Nasdaq slightly higher, while the Dow Jones closed lower.

The 10-year Treasury yield slipped to 4.38%, down 0.04% on the day.

Canadian and European indexes also finished mixed, as tariff uncertainty continues.

Despite recent volatility, U.S. markets have caught up since April lows, though Canada and Europe still lead year-to-date.

The U.S. dollar edged lower, and WTI crude hovered near $70.

Economic Data Highlights

No major data releases today.

Investors are watching for updates on trade negotiations and potential Fed commentary later this week.

Reported Earnings

American Express (AXP) – Beat expectations on strong card spending; credit quality remains solid.

Charles Schwab (SCHW) – Topped forecasts with higher interest income; asset growth slowed slightly.

3M (MMM) – Exceeded EPS and revenue estimates; noted industrial demand held up and cost control improved.

Schlumberger (SLB) – Posted strong results as oil services demand and pricing power remained firm.

Ally Financial (ALLY) – Loan growth solid, but delinquencies rose slightly; net interest margins held steady.

Truist Financial (TFC) – Reported in line with expectations; commercial lending growth continues, while cost initiatives are underway.

Earnings Today

Coca-Cola (KO) – Focus on global volume growth and pricing power amid FX headwinds.

Lockheed Martin (LMT) – Investors watching order backlog and defense contract pipeline.

General Motors (GM) – EV margins, production pace, and consumer demand key areas of interest.

SAP (SAP) – Outlook on cloud growth and U.S. enterprise software demand in focus.

Movers & Shakers

(+) Solaredge ($SEDG) +8% after analysts at Susquehanna increased their price target for the company.

(+) Block, Inc. ($XYZ) +7% because the BTC tech company was added to the S&P 500.

(–) Bruker ($BRKR) -12% after the lab instrument and tools maker issued weaker-than-expected guidance.

Private Dealmaking

Flexjet, a private jet company, raised $800 million

Substack, the email newsletter platform, raised $100 million

QuNorth, a quantum computing company, raised $93 million

Eton Solutions, a wealth management platform, raised $58 million

GeologicAI, a minerals data company, raised $44 million

GigaIO, a GPU startup, raised $21 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Capitalism and Its Critics

Description: A sweeping, panoramic narrative that retells the story of capitalism through the eyes of its fiercest critics. Cassidy covers eras from the East India Company and the Luddites to Keynes, Marx, Polanyi, and today’s critiques of AI, climate, and inequality—revealing how dissent has shaped the system itself.

Rating: Amazon 4.3 / 5, Goodreads 4.3 / 5

Book Length: 624 pages

Ideal For: History lovers, economic thinkers, critics of globalization and AI, and anyone curious how capitalism evolves—especially under pressure from its own critics.

“Fascinating and informative. The history of capitalism is told through the eyes and legitimate concerns of its most articulate critics. This is intellectual history at its best.” — Simon Johnson, Nobel Prize–winning economist

DAILY VISUAL

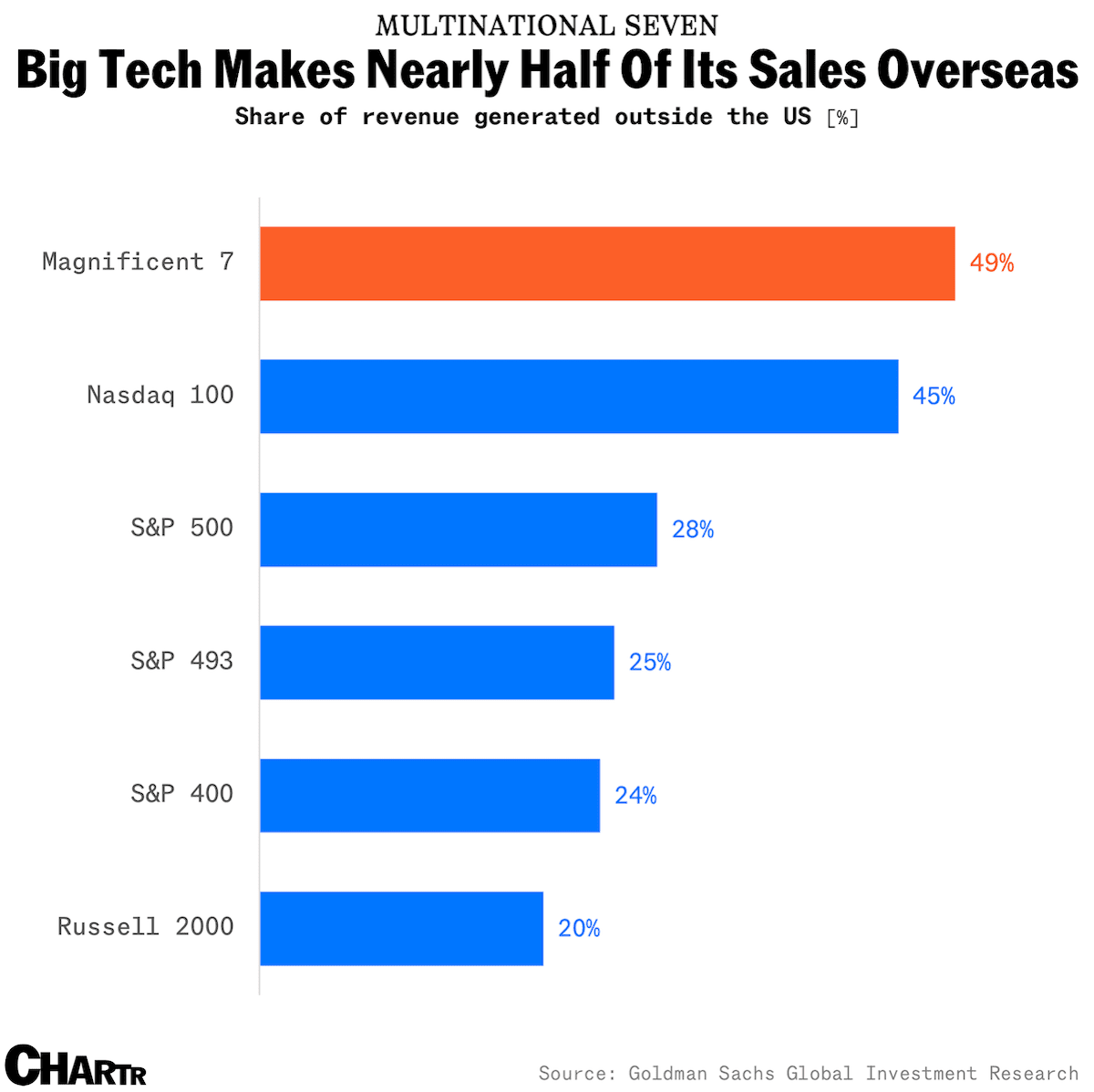

Multinational Seven

Source: Chartr

PRESENTED BY BABBEL

Learn a New Language for Summer Adventures

Traveling this summer? It’s not too late to start learning a new language! With Babbel, you can have real conversations in as little as three weeks.

Summer is the perfect time to start speaking a new language! With Babbel’s bite-sized daily lessons, you can bring your language journey to the beach, on the plane, or anywhere your adventures take you.

No expensive classes, no gimmicky game-ified apps… just expert-crafted lessons proven to help you have real conversations in a new language. Want results? Get Babbel for up to 55% off.

Go from “tourist trap” to “trip of a lifetime”: with Babbel’s award-winning lessons, you can start speaking a new language with just 10 minutes of practice a day.

DAILY ACUMEN

Scarcity Illusion

Everyone talks about scarcity like it’s a law.

But most of the time, it’s just a mindset wrapped in urgency.

Scarcity tells you: “Hurry, or you’ll miss it.”

But real leverage comes from patience—not chasing every deal, every opportunity, or every person.

Think of Buffett passing on the dot-com bubble. Think of the founder who says no to a flashy exit, holding out for impact. Think of the investor who waits years for their pitch.

Scarcity is the enemy of long-term thinking. It shrinks time horizons and inflates fear.

Abundance is where real power lives. Not because there’s more of everything—but because you believe you don’t need everything.

In business and in life, the best players don’t rush.

They position. They prepare. Then they pounce.

ENLIGHTENMENT

Short Squeez Picks

The biggest communication mistake most people make

3 power skills that are key for business success

How AI is redefining manager roles

How to enunciate better

Efficiency is leading us nowhere

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply