- Short Squeez

- Posts

- 🍋 Buy a Stake in Millennium for $1M

🍋 Buy a Stake in Millennium for $1M

Plus: Buffett's mystery stock revealed, Trump weighing a government stake in Intel, Airbnb launches “Reserve Now, Pay Later," and private credit slump drags on.

Together With

"What we learn from history is that people don't learn from history." — Warren Buffett

Good Morning and Happy Friday! Warren Buffett’s Berkshire Hathaway disclosed a $1.6B stake in UnitedHealth for Q2, sending the insurer’s shares up 10% in after-hours trading. The firm also exited its $1B position in T-Mobile.

Intel jumped 7% on reports the Trump administration is considering taking a stake in the chipmaker. Trump also suggested Elizabeth Warren take a drug test. In private credit, activity continues to slow, with Blue Owl deploying 67% less capital to new deals year over year.

Plus: Airbnb launches “Reserve Now, Pay Later” for select U.S. trips, Palantir’s 1,700% growth in three charts, and companies are pouring billions into AI with little to show for it.

Blueflame AI is constantly seeking ways to elevate how they help investment teams work. See their latest upgrade.

SQUEEZ OF THE DAY

Buy a Stake in Millennium for $1M

Got $1 million lying around? Goldman Sachs is offering wealthy clients a rare chance to buy into Izzy Englander’s $78 billion hedge fund giant, Millennium Management.

Goldman’s Petershill unit is selling stakes starting at $1M (and up to $20M) as part of a broader deal valuing Millennium at roughly $14 billion.

The fund is shopping a 10–15% equity slice, potentially raising $2 billion, with half coming from Petershill and the rest from big institutions like sovereign wealth funds.

Petershill’s version of the deal comes with an extra layer of fees: 1% management and 10% carry, unlike the direct institutional route.

Still, Millennium’s track record is hard to argue with, it’s lost money only once since 1990 (down 3.5% in 2008) and has posted double-digit gains in most years. Client capital is locked up for five years, keeping the investor base sticky.

Founded in 1989, Millennium now has over 320 investment teams and even allocates capital to other hedge funds. If the deal goes through, it’ll be one of the first hedge fund giants to open the doors beyond the traditional institutional crowd.

Takeaway: For the ultra-wealthy, it’s a rare shot to own a piece of one of the most consistently profitable hedge funds in history. The $1 million buy-in is just the start, and Petershill’s extra fees mean you’ll be paying a premium for access. Still, with Millennium’s decades-long winning streak, some investors may see it as the kind of club you can’t afford not to join.

HEADLINES

Top Reads

Warren Buffett reveals new stake in insurer UnitedHealth (CNBC)

Trump administration is considering stake in Intel (CNBC)

AI startup Cohere raises $500 million, pushing valuation to $6.8 billion (BB)

Trump says Elizabeth Warren must take a drug test (Fox)

Private credit funds find fewer deals to deploy capital (BB)

Palantir’s AI business drives revenue growth (CNBC)

GenAI paradox: Companies pouring billions into AI; it has yet to pay off (BS)

Mortgage rates slip to the lowest level of 2025 (WSJ)

Bitcoin drops after touching record highs as crypto rolls over (YF)

Apollo and Motive Partners launch a new AI-backed private-markets servicer (WSJ)

July producer price inflation slows more than expected (Axios)

Trump tariffs push investors to rethink stock strategies (Axios)

Portland Trail Blazers owner sells stake to Tom Dundon (Axios)

HSBC plans major global reorganization (YF)

NBA approves sale of Boston Celtics to private equity mogul (ABC)

Potential Fed chair pick David Zervos backs aggressive interest rate cuts (CNBC)

We asked AI to identify Buffett’s mystery stock, here’s what it said (CNBC)

Investors play more defense even as stocks hit new highs (BB)

More business travelers are bringing families along on trips (CNBC)

Apple Watch gets a new (old) add-on (BB)

Stocks play growing role in 401(k)s (WSJ)

PRESENTED BY BLUEFLAME AI

Diligence Without 50 Open Tabs

Digging through email threads, presentations, spreadsheets, and a million browser tabs just to find that Adjusted EBITDA number from 2019?

Blueflame built Global Search to create a faster way to find answers across all your apps with just one search bar.

Search deal notes, emails, and news in a single query

Get investment-ready responses with source links baked in

Filter by sector, deal, or team workflow and trace any answer back to its source

Blueflame is making the lives of investment teams easier. It's time you level up your diligence process.

CAPITAL PULSE

Markets Rundown

Market Update

S&P 500 closed modestly higher while the Nasdaq finished slightly negative after hotter-than-expected PPI data

International markets were mostly positive

2-year Treasury yield rose 0.05% to 3.73%, 10-year up 0.05% to 4.29%

U.S. dollar gained against major currencies; bond yields climbed across the curve

Economic Data Highlights

July PPI rose 0.9% m/m, far above forecasts of 0.2% and prior month’s 0.0% — largest gain since June 2022

Services inflation up 1.1% (driven by trade services); goods inflation up 0.7% (led by food)

Jump in PPI seen as early tariff impact; could pressure margins or be passed to consumers

Next key release: July PCE inflation on Aug. 29

Reported Earnings

JD.com (JD) – Beat on revenue and EPS; strength in e-commerce demand and logistics expansion offset by softer electronics margins

Deere & Co. (DE) – Revenue slightly missed estimates; ag equipment demand softened, but pricing and cost control supported margins

Nu Holdings (NU) – Reported strong customer growth and record profitability; NIM expansion and loan book growth exceeded expectations

Earnings Today

No significant earnings scheduled

Movers & Shakers

(+) Equinox Gold ($EQX) +15% after the gold miner benefited from gold prices hitting several new all time highs last quarter.

(+) Intel ($INTC) +7% because the Trump administration is considering taking a stake in the semiconductor company.

(–) Coherent ($COHR) -20% after the AI company lowered its guidance and was downgraded by BofA.

Private Dealmaking

Unite Group agreed to buy Empiric Student Property for $813 million

Reprieve Cardiovascular, a congestive heart failure treatment, raised $61 million

Gameto, a stem cell-derived therapies developer, raised $44 million

Fable Security, a human risk management platform, raised $31 million

Tahoe Therapeutics, a foundational dataset developer, raised $30 million

Rune Technologies, a predictive battlefield software developer, raised $24 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Anointed

Description: A compelling exploration of how social status—that invisible currency—shapes nearly everything: from art valuations to hotspots, trust networks to career trajectories. Toby Stuart reveals how small advantages compound into outsized outcomes, creating invisible winners and reinforcing inequality—even when merit is absent. It's both an insightful social critique and a call to build more equitable systems.

Book Length: 288 pages

Release Date: September 2, 2025

Ideal For: Thought leaders, sociologists, executives, and anyone seeking to understand how prestige, inertia, and invisible hierarchies shape influence, innovation, and inequality.

“An informative and highly engaging exploration of an influential social-status dynamic.”

DAILY VISUAL

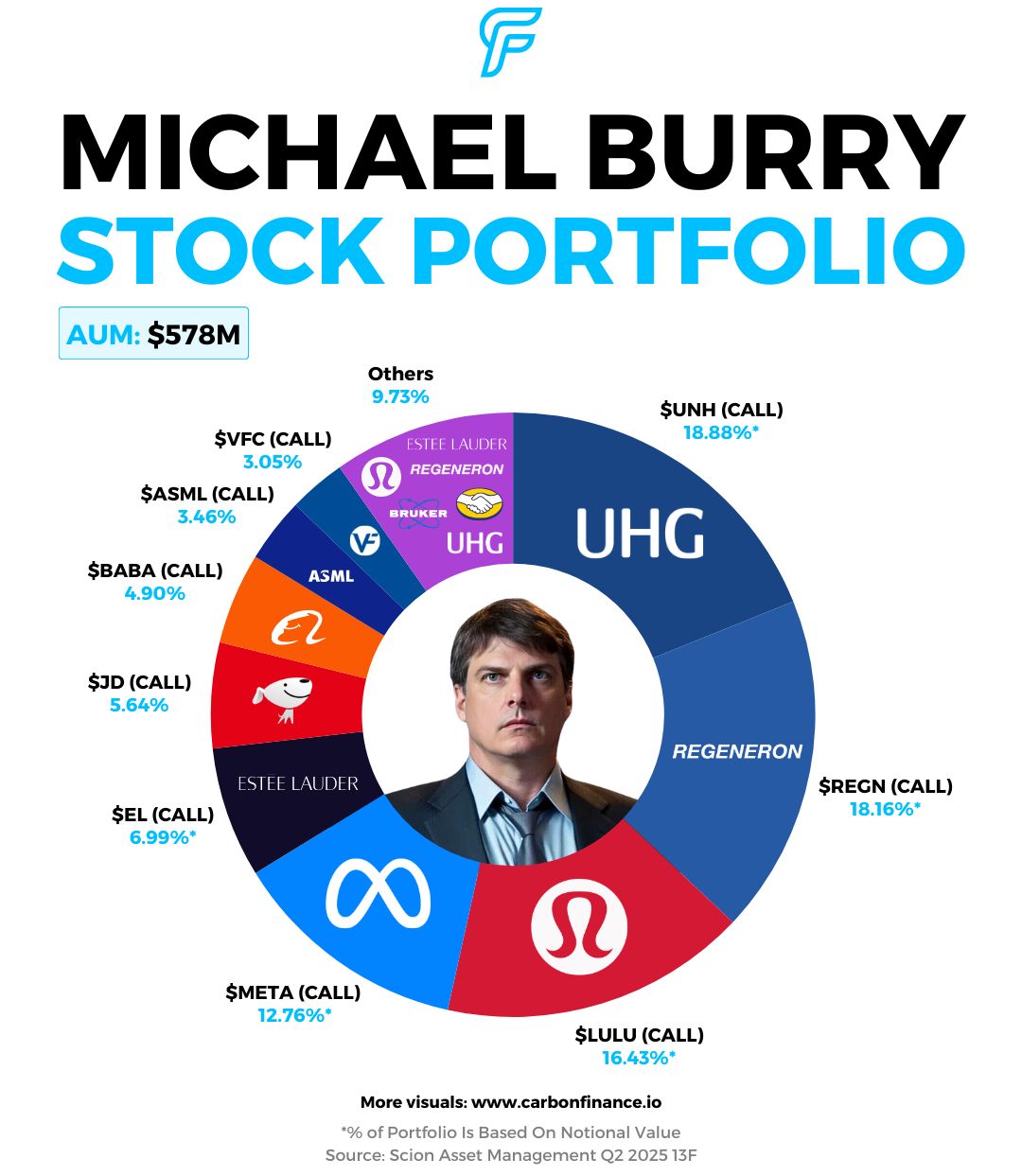

Michael Burry Joins Buffett in Scooping Up UnitedHealth

Want more? Visualize the markets with Carbon Finance

PRESENTED BY PACASO

Why Buy All of Cedar Isle When You Only Want to Enjoy the Best of It?

With 7 bedrooms, a sparkling pool, and a charming guest house, this Nantucket retreat is more than most families need to own outright. Vacation home ownership not for you? Instead, invest in Pacaso.

Pacaso offers the opportunity to co-own Cedar Isle (and approx. 200 other stunning luxury vacation homes), all with fully managed, white-glove service.

The model works: Pacaso has already earned $100M+ in gross profits with 41% YoY growth, and now, you can invest in Pacaso through their public growth round.

DAILY ACUMEN

The Invisible Tug of War

In markets, price is what you pay, value is what you get — but most investors spend their lives staring only at the scoreboard, not the playing field.

Price dances to the tune of psychology: optimism pulling it skyward, pessimism dragging it down. Value, meanwhile, moves slowly, anchored in fundamentals — the earning power of real assets, managed well.

Superior investing isn’t predicting where prices will go tomorrow. It’s recognizing when the rope between price and value is stretched too far in either direction, and having the discipline to act before the crowd sees it.

But here’s the trap: the rope can stay taut — or stretch further — for far longer than your conviction (or capital) will allow. That’s why wisdom lives in patience, preparation, and position-sizing, not in the thrill of guessing the next tick.

The market is a voting machine in the short run, a weighing machine in the long run. Your edge comes from remembering which game you’re playing.

ENLIGHTENMENT

Short Squeez Picks

Game your brain: how playing more can make you smarter

The 3 flavors of executive dysfunction (and how to fix them)

7 bite-sized stories that will change how you see money & life

The 1-minute trick that keeps motivation from fizzling out

Why focusing on time (not money) fuels long-term drive

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Disclaimer: This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. There’s no guarantee that Pacaso will file for an IPO.

Reply