- Short Squeez

- Posts

- 🍋 Business, Not Bubble

🍋 Business, Not Bubble

Plus: Snowflake CRO drops unapproved guidance in a street interview, Companies trying to grow without hiring, the case against bonds, and microshifting the future of work.

Together With

"It's a hell of a lot more fun chasing [money] than getting it. The fun is in the race.” — Ray Kroc

Good Morning! Snowflake was forced to file an 8-K after its CRO dropped an unapproved guidance number in a street interview. JPMorgan told investors it has a “strong bias” against adding staff, while Goldman said it will “constrain headcount growth through year-end.”

PayPal signed a deal with OpenAI to become the first payments wallet integrated into ChatGPT. Grubhub is partnering with Instacart for grocery delivery. And Barclays will pay $800 million for lending startup Best Egg as it expands its U.S. personal banking footprint.

Plus: Sequoia is investing in an AI tool that could replace junior bankers, Brookfield says private credit isn’t crowding out private equity, the case against bonds, and why is microshifting the future of work.

With $170M in reservations already in, NatGold is drawing early interest as a gold-backed alternative to fiat. Learn more.

SQUEEZ OF THE DAY

Business, Not Bubble

The world’s biggest tech companies are trying to stave off growth concerns and are instead betting that investors will buy into a new narrative: AI isn’t a bubble, it’s a business. And so far, it’s working. Microsoft and Apple both joined the $4 trillion market cap club yesterday, and Nvidia is closing in on $5 trillion after reigniting the AI hype train in Washington.

At its first-ever GTC “AI Super Bowl” in D.C., Nvidia CEO Jensen Huang told investors that the AI buildout is far from overheated; it’s accelerating. He projected $500 billion in chip revenue and announced even more partnerships. Some highlights below:

Uber will use Nvidia systems to power 100,000 self-driving cars.

Lucid Motors is building its next-gen autonomous platform on Nvidia chips.

Nokia secured a $1 billion Nvidia investment to pivot into AI infrastructure. (Nokia popped +23% on the news)

CrowdStrike is partnering with Nvidia to develop adaptive cybersecurity agents.

Palantir is integrating Nvidia GPUs into its logistics platform.

Eli Lilly is building the most powerful pharmaceutical supercomputer ever.

The pitch worked. Nvidia shares jumped ~6% to a record $204 (at time of writing), putting Nvidia within striking distance of $5 trillion in market value. Huang’s message, “customers are paying happily,” is a direct challenge to months of AI bubble talk.

And in Big Tech, Microsoft and Apple both closed above $4 trillion for the first time. Microsoft’s rally followed OpenAI’s $500 billion for-profit conversion, which gave the company a 27% equity stake and locked in $250 billion worth of Azure contracts through 2032. Apple’s climb, up ~25% in three months, came from strong iPhone 17 sales ahead of earnings later this week.

Takeaway: The AI business (or bubble) is showing no signs of slowing down and investors are piling in. Nvidia is up over 130% from April lows. Enterprise budgets are growing, real customers are signing large contracts, and demand clearly isn’t saturated. There’s still valuation risk, but for now FOMO is doing more buying than the fear of bubbles is selling.

PRESENTED BY NATGOLD

The First Digitally Mined, Gold-Backed Token

NatGold is introducing a digital asset tied directly to verified in-ground gold reserves, blending the stability of gold with the efficiency of blockchain technology.

Unlike traditional crypto projects or gold ETFs, each NatGold token represents a claim on independently verified gold deposits, without exposure to fiat or the need for physical extraction. The model removes intermediaries and carbon-intensive mining, using digital issuance to create a more streamlined structure.

So far, NatGold has drawn $170 million in reservations ahead of its official launch, with more than 75,000 tokens already reserved. The first 25,000 tokens will be issued at a 10% discount to Baseline Intrinsic Value.

Please Support Our Partners!

HEADLINES

Top Reads

Snowflake files 8-K after CRO drops unapproved guidance on the street (SS)

More big companies bet they can keep growing without hiring (WSJ)

PayPal strikes payments deal with OpenAI for ChatGPT transactions (CNBC)

Domino’s Pizza shares fall after denying Bain Capital takeover interest (BB)

Barclays to acquire US lending firm Best Egg for $800M (YF)

GrubHub gets into groceries with new Instacart deal (BB)

Brookfield says private credit isn’t crowding out private equity (BB)

Sequoia invests in AI tool that could replace junior bankers (BB)

JPMorgan’s Jamie Dimon renews his return-to-office campaign (QZ)

Layoffs mount at major employers amid tough labor market (YF)

Dealmaking roars back to life under Trump 2.0 (Axios)

PwC scraps hiring pledge amid revenue slowdown, AI impact (LI)

UPS outperforms expectations after eliminating 48K jobs (YF)

“Venture capital is not an asset class,” says Sequoia investor (YF)

Novartis CEO says company has firepower for major M&A deals (CNBC)

Cathie Wood says humanoid robots will be “the biggest of all AI opportunities” (CNBC)

CAPITAL PULSE

Markets Rundown

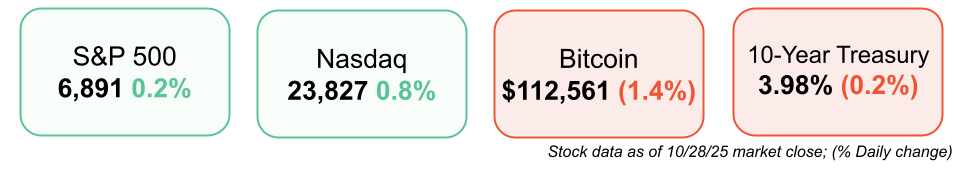

Market Update

Markets pushed to new highs, led by mega-cap tech as the “Magnificent 7” rallied ~1.3%.

Outside of tech, most sectors and the equal-weighted S&P 500 finished lower.

10-year Treasury yield held around ~4.0 % as bonds were steady.

WTI crude oil slipped below $60 per barrel; gold continued to slide, nearly 10 % off its October peak.

Trade developments include President Trump’s upcoming meetings with China’s President Xi and Japan’s Prime Minister Takaichi at the APEC summit this week.

Economic Data Highlights

Corporate earnings remain strong: the share of S&P 500 companies beating expectations is at a four-year high.

Recent wins include UPS (better-than-expected results) and United Health Group (raised full-year outlook).

The data calendar remains thin as the government shutdown delays key releases; price and activity indicators remain the primary signals.

The backdrop supports another Fed rate cut this week as policymakers weigh a cooling labour market against mild inflation pressures.

Earnings Today

Microsoft (MSFT) – Investors focused on Azure growth, AI infrastructure spending and margin sustainability.

Meta Platforms (META) – Watch for monetization of AI investments, ad-revenue strength and AI-capex guidance.

Alphabet (GOOGL) – Key metrics: cloud/AI momentum, YouTube growth trends and guidance on search/advertising.

Movers & Shakers

(+) Wayfair ($W) +23% after the e-commerce company beat earnings.

(+) Nvidia ($NVDA) +5% because the chipmaker announced a partnership with Palantir.

(–) Everest Group ($EG) -11% after the insurance company missed earnings.

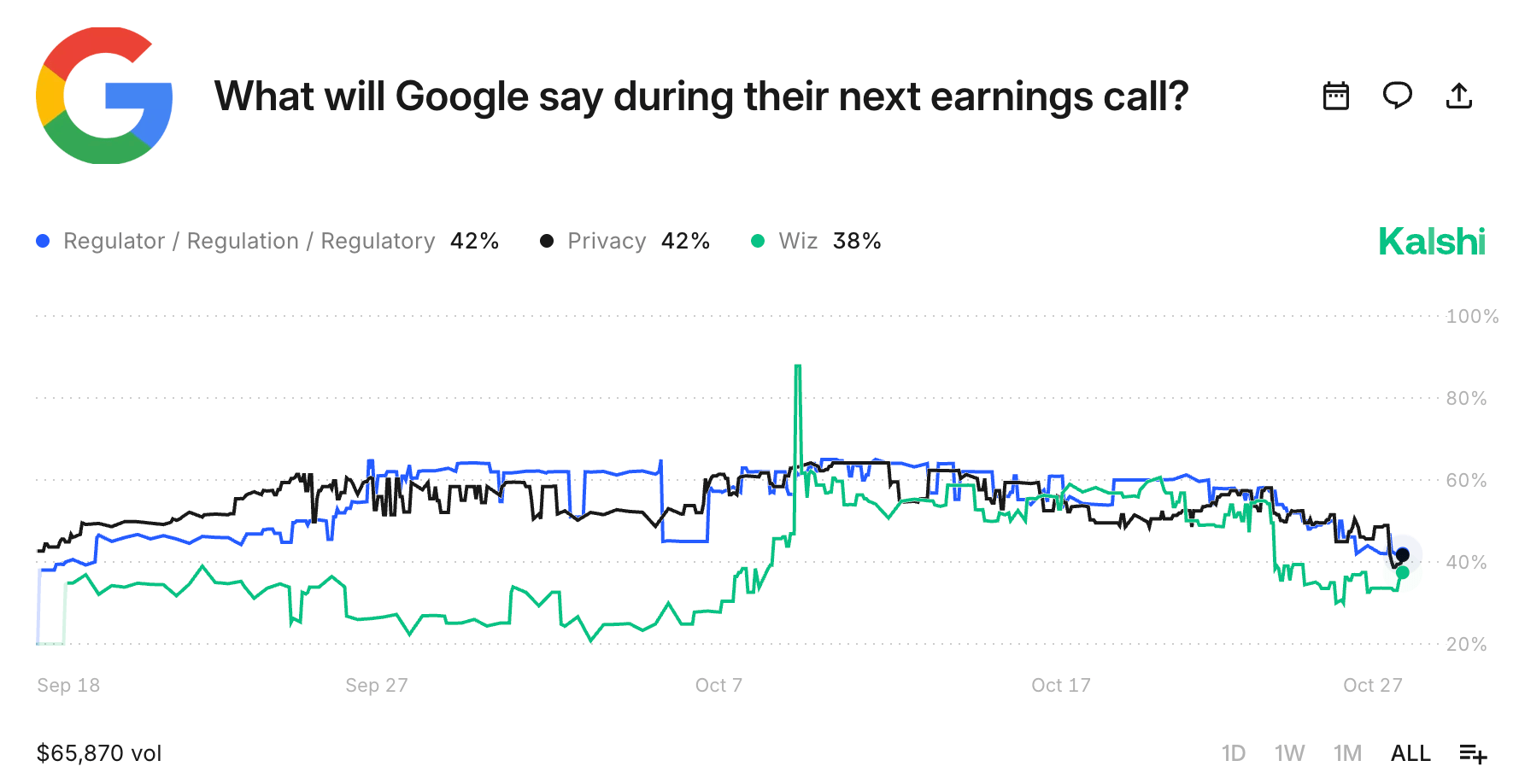

Prediction Markets

Private Dealmaking

Cygnet Energy agreed to acquire Kiwetinohk Energy for $1 billion

Mercor, a data-labeling firm, raised $350 million

Whatnot, a live-shopping platform for collectibles, raised $225 million

Hemab Therapeutics, a blood disorder biotech, raised $157 million

Sublime Security, an agentic email security platform, raised $150 million

Zag Bio, a developer of thymus-targeted medicines for autoimmune diseases, raised $80 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

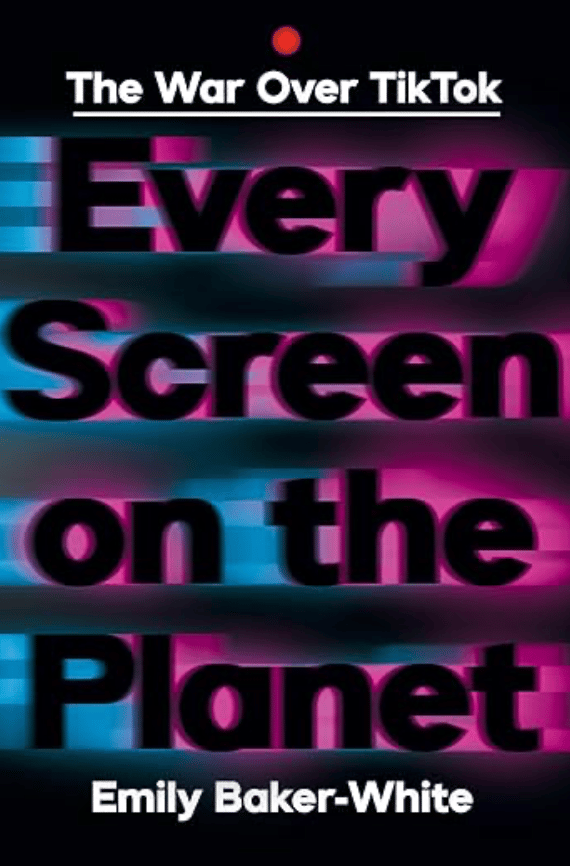

Every Screen on the Planet

Description:

An engrossing investigation into how the social-video giant TikTok evolved from a niche app to the center of a geopolitical storm. Baker-White charts TikTok’s transformation into the world’s most valuable startup and how its innovative algorithm, global reach, and ties to China’s tech ecosystem triggered a full-blown battleground over data, influence, and power.

Book Length: 368 pages

Ideal For: Tech watchers, policy analysts, media critics, entrepreneurs, and anyone curious about how a mobile app became a fulcrum in the U.S.–China data war.

“What you scroll may be personal—but who controls the algorithm decides what you see.”

DAILY VISUAL

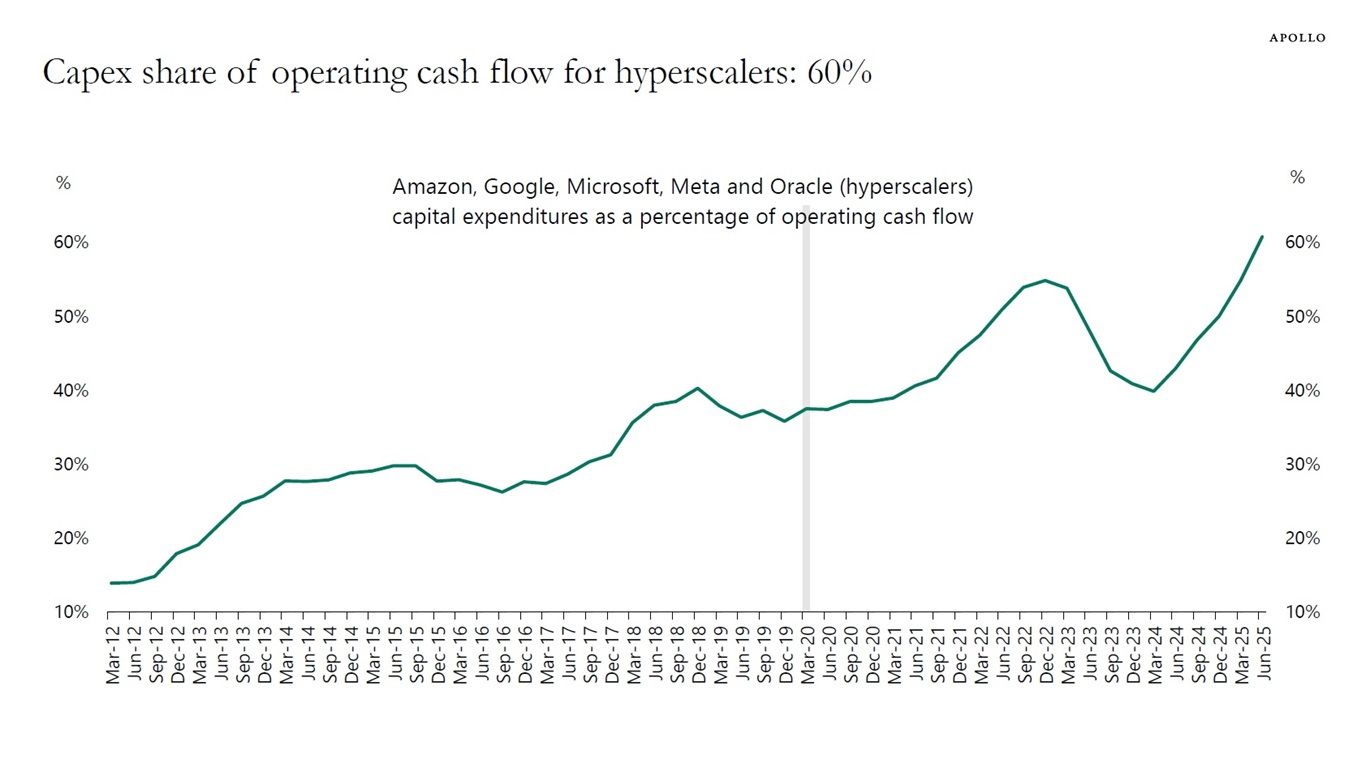

Hyperscaler Capex Spending Booming

Source: Apollo

PRESENTED BY FRE

Performance for the Clutch Moments

Traditional nicotine pouches cluster around 3mg to 6mg. FRE identified a segment of professionals requiring more options for the high pressure moments.

FRE provides one of the widest strength ranges available: 3mg to 15mg, with a pre-primed tech that activates on contact. Each can contains 20 pouches versus a typical 15, offering more consistent usage across long workdays.

Tobacco-free, spit-free, and engineered for professionals who need results during IC marathons, board presentations, and 2am model builds.

Please Support Our Partners!

DAILY ACUMEN

Inputs

Your output is only as good as your input.

Most people try to fix their work by working harder, not realizing that effort can’t compensate for poor raw material.

Garbage ideas in, garbage strategies out.

Curate what enters your brain as carefully as an investor curates a portfolio.

Read things that stretch you, talk to people who challenge you, consume content that sharpens your perspective.

You are not what you eat, you are what you absorb.

Protect your mental diet like it’s your balance sheet.

ENLIGHTENMENT

Short Squeez Picks

How to train your nervous system for optimal performance

Should you be a leader?

How to lead when the conditions for success disappear

Why is microshifting the future of work

The case against holding bonds

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*These are all 1x use only per customer and cannot be combined with other discounts.

Reply