- Short Squeez

- Posts

- 🍋 Biggest LBO Ever

🍋 Biggest LBO Ever

Plus: JPMorgan’s $20 billion win over private credit, Forbes 30u30 alum gets seven years in prison for defrauding JPM, and Robinhood continues its generational run.

Together With

“Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.” ― Morgan Housel

Good Morning! JPMorgan’s $20 billion financing for EA, the largest debt commitment ever by a single bank, is a big win for investment banks over private credit.

Robinhood’s stock jumped 12% thanks to prediction market momentum, with CEO Vlad Tenev noting more than four billion event contracts have traded on the platform since launch. Forbes “30 Under 30” alum Charlie Javice was sentenced to seven years in prison for defrauding JPMorgan.

Chipotle is rolling out Red Chimichurri in an appeal to Gen Z after two quarters of disappointing sales. Vanguard is weighing whether to allow crypto ETF trading in a rare move for the otherwise cautious company.

Plus: The group of stocks that could replace the magnificent 7 in the AI era, Verisure targets a $16.3 billion valuation in Europe’s biggest IPO since 2022, and economists are warning private credit could amplify shocks in the next downturn.

Asset protection and wealth generation have evolved. Learn how life insurance can be a path to building wealth with Meanwhile.

SQUEEZ OF THE DAY

Biggest LBO Ever

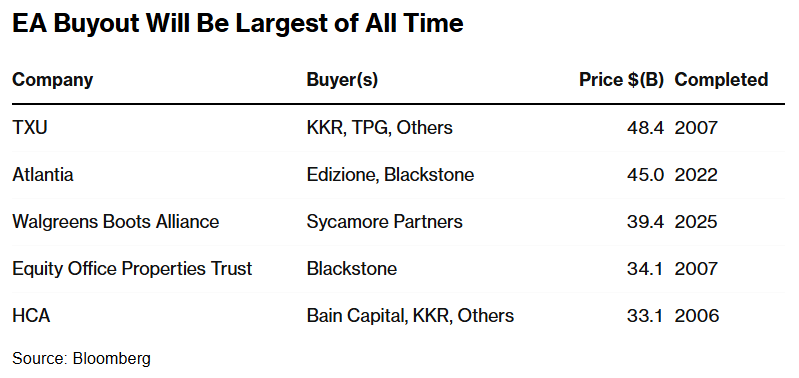

Electronic Arts, the $48 billion video-game giant behind The Sims, Madden NFL, and FIFA (now FC), is officially going private in a record-breaking $55 billion deal, the largest leveraged buyout ever.

The buyer group, Saudi Arabia’s Public Investment Fund, Silver Lake, and Jared Kushner’s Affinity Partners, agreed to pay $210 a share in cash, a 25% premium to the pre-deal price. And JPMorgan is writing a $20 billion debt check, the biggest debt financing package ever for a buyout.

The buyer consortium is led by Saudi Arabia’s Public Investment Fund, which will roll over its existing 9.9% stake and supply the bulk of the $36 billion equity check.

It’s the latest effort by Saudi Arabia to diversify its economy away from oil. It already owns gaming assets such as Monopoly Go! publisher Scopely and a minority stake in Nintendo.

Silver Lake is tech-focused, is doubling down on gaming as infrastructure, and brings credibility (it owns Unity Software, a key EA partner), while Kushner adds political clout in his highest-profile deal yet to date.

The deal comes at an interesting time for the $178 billion gaming industry. Pandemic highs have retreated. And EA, with sports franchises like Madden and FC that deliver predictable recurring revenue, is exactly the kind of cash-flow infrastructure private equity loves. While some of its video games, like Madden, are cultural icons, the stock badly trailed the S&P 500 over the last five years.

EA’s CEO, Andrew Wilson, will stay on and says going private frees EA to invest for the long haul without quarterly earnings pressure.

Takeaway: EA’s sale doesn’t just reset the record books, and it also shows how the new LBO model works: sovereigns with permanent capital, tech PE with synergies, and political operators brokering ties. Regulatory scrutiny is inevitable for a cross-border deal of this scale, but the involvement of the president’s son-in-law and a $1 billion break-up fee may help clear the path.

HEADLINES

Top Reads

JPMorgan’s $20B EA deal marks win over private credit (BB)

Robinhood soared 12% thanks to prediction markets boost (WSJ)

Charlie Javice sentenced to 7 years in prison for $175M fraud (ABC)

Chipotle hopes a spicy new sauce lures in more Gen Z eaters (CNN)

Vanguard considers allowing crypto ETF trading, a major reversal (BB)

Looming shutdown raises risks for jobs market, economy (CNN)

Verisure seeks up to $16.3B valuation in Europe’s largest IPO since 2022 (WSJ)

Private credit could amplify shock in next crisis (BB)

Trump team eyes Wall Street tool to boost clout in vital minerals (BB)

Debt is fueling the next wave of the AI boom (WSJ)

Former Sequoia partner launches $400M Evantic Capital to reinvent VC (BB)

Dealmakers notch rare $1T M&A haul despite sluggish market (BB)

Anthropic unveils Claude Sonnet 4.5 AI model (CNBC)

Trump’s new tariff threats target foreign movies and furniture (YF)

Wall Street banks gear up for M&A boom play (CNBC)

Blackstone’s Sherrill says insurers are “returning to the 1920s” (BB)

Private credit gears up for biggest year in emerging markets (YF)

Electronic Arts agrees to $55B private buyout (YF)

Prosus to acquire Providence’s La Centrale for $1.3B (WSJ)

Wall Street looks beyond magnificent 7 for winning AI stocks (BB)

PRESENTED BY MEANWHILE

Whole Life Insurance That Earns, Borrows, and Pays in BTC

Selling Bitcoin means giving up upside and paying taxes. Borrowing it means high rates and liquidation risk. Meanwhile offers another path: Bitcoin-denominated whole life insurance.

Fund a policy with BTC, earn 2% annually (in Bitcoin), and borrow up to 90% of your policy’s value at a fixed 3% interest rate, with no repayment schedule. Your loan’s cost basis locks in when borrowed, creating potential tax efficiency as Bitcoin appreciates.

Unlike crypto lending platforms that charge 8–14% interest and risk margin calls, Meanwhile policies are:

Fully regulated in Bermuda

Backed by audited capital reserves

Structured to avoid currency mismatch ie. no forced selling

Key Benefits:

Earn ~2% BTC compounding annually, tax-efficiently

Borrow Bitcoin backed by Bitcoin; no liquidation risk

Guaranteed BTC payouts to your family

No need to manage private keys or trust third-party lenders

Keep your upside, skip the taxes, and protect your family in Bitcoin.

CAPITAL PULSE

Markets Rundown

Market Update

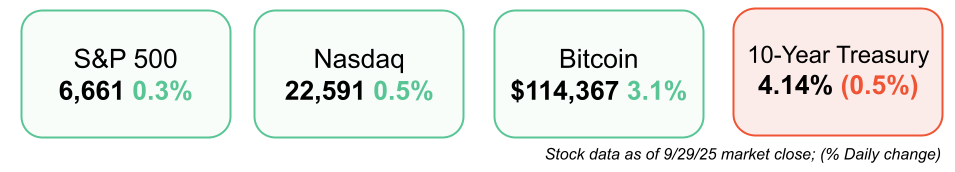

U.S. stocks edged higher, with mid-cap stocks leading the rally

Consumer discretionary and technology shares outperformed; energy and communications lagged

10-year Treasury yield dipped to 4.14%, still above its recent low of 4.0%

Asia closed mostly lower, while Europe held relatively flat

WTI oil slipped on forecasts of OPEC+ increasing output

Economic Data Highlights

August JOLTS expected at 7.1 million job openings (down from 7.2M)

September payrolls forecast: +50,000 jobs, with unemployment steady at 4.3%

Wage growth projected at +3.7% y/y — matching August

Labor market cooling, but still holding steady with openings slightly below unemployment

Reported Earnings

Carnival (CCL) – Posted stronger bookings and pricing trends, though outlook noted fuel cost pressures

Earnings Today

Paychex (PAYX) – Watch small-business hiring trends and services revenue growth

Nike (NKE) – Focus on consumer demand in China, direct-to-consumer strength, and margin impact of tariffs

Movers & Shakers

(+) Aurora Cannabis ($ACB) +28% after posted on Truth Social about the therapeutic benefits of cannabis.

(+) AppLovin ($APP) +6% after Morgan Stanley hiked its price target on strong ad business catalysts.

(–) Carnival ($CCL) -4% after the cruise line announced earnings.

Private Dealmaking

Electronic Arts agreed to be taken private for $55 billion

Genmab agreed to acquire Merus for $8 billion

GTCR agreed to acquire Dentalcorp for $1.6 billion

KKR agreed to buy a 50% stake in the North American solar assets of TotalEnergies for $1.25 billion

Aurelius agreed to acquire the EMEA metering business of Landis+Gyr for $215 million

Modal Labs, a serverless cloud platform, raised $87 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The World’s Worst Bet

Description: A bold chronicle of how globalization—once hailed as the ultimate engine of prosperity—became a fragile gamble that left many behind. Lynch traces the rise, fall, and costs of global integration: disappearing factories, hollowed-out supply chains, and backlash politics. Drawing on deep reporting and personal stories, he doesn’t just diagnose the breakdown—he lays out what we must rebuild to preserve the good parts of interconnection.

Book Length: 416 pages

Ideal For: Economists, policy thinkers, business leaders, journalists, and anyone wanting a clear, contextual map of why globalization is under strain—and how it might be rescued rather than rejected.

“A painfully convincing history of how both political parties decided that worldwide free trade was a good thing.”

DAILY VISUAL

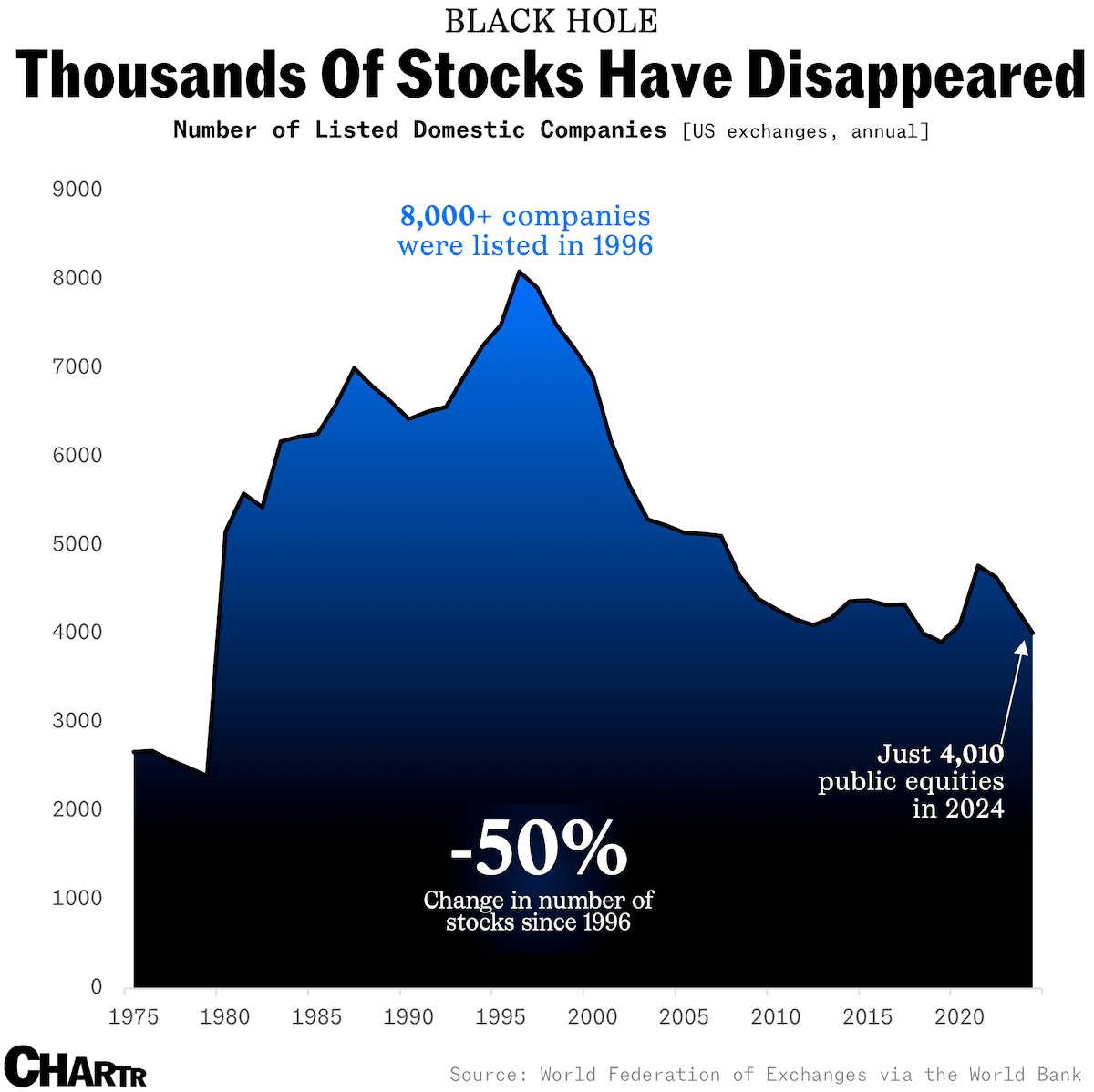

Who Needs the Public Markets Anyway?

Source: Chartr

PRESENTED BY BILL

Cut AP Time by 50%

Accounts payable shouldn’t eat up half your week, but for most finance teams, it still does.

BILL streamlines approvals, automates invoice capture, and centralizes everything in one place, helping companies reduce their accounts payable time by up to 50%, according to a survey of 2,000+ customers.*

See exactly how it works in Brew with BILL, a quick, live demo built for finance leaders who want faster, smarter payables.

DAILY ACUMEN

Deadlines

Deadlines are artificial cliffs, but they work because humans fear cliffs.

Markets have them in earnings reports, Fed meetings, contract expirations.

Life has them in birthdays, reunions, project launches.

A deadline focuses attention, compresses procrastination, forces clarity.

Without them, entropy wins.

The trick is self-imposed cliffs: schedule the pitch, book the meeting, set the release date.

Deadlines aren’t about pressure, they’re about creating urgency where inertia rules.

ENLIGHTENMENT

Short Squeez Picks

Two key heart health metrics that could determine how long you’ll live

A 3-word phrase highly engaging people use

5 perfect weekend trips to take this fall

A food tour of the world without ever leaving NYC’s Queens

Does running or cycling burn more calories?

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

*Based on a 2021 survey of more than 2,000 BILL customers.

Reply