- Short Squeez

- Posts

- 🍋 Baby Bonuses Just Dropped

🍋 Baby Bonuses Just Dropped

Plus: Blackstone exec among those killed in Manhattan shooting, automation is coming for junior roles in PE, and OpenAI launched a Study Mode in ChatGPT.

Together With

“There is usually an inverse relationship between how much something is on your mind and how much it’s getting done.” — David Allen

Good Morning! Union Pacific is acquiring Norfolk Southern in an $85 billion deal to create America’s first transcontinental freight railroad. M&A volume is up nearly 20% this year to $2.2 trillion, and JPMorgan is set to take over Apple Card from Goldman.

Anthropic is raising capital at a $170 billion valuation. Apple just lost its fourth AI researcher to Meta, likely in a nine-figure comp package. And private equity-backed firms accounted for 80% of recent defaults.

Plus: Companies that raise guidance outperform the index by 3 points, while misses lag by 4. Automation is coming for junior roles in PE, and an OpenAI launched a Study Mode in ChatGPT.

Correction to yesterday’s story: Blackstone executive Wesley LePatner was among four people killed in Monday’s tragic Midtown NYC shooting. Our thoughts are with her family and everyone affected by this devastating event.

Want a summer with fewer midnight and weekend “pls fix” emails? See how Macabacus can make that a reality.

SQUEEZ OF THE DAY

Baby Bonuses Just Dropped

China’s birth rate has been dramatically plummeting since peaking in the late 1980s. Last year, the country logged only 9.54 million births, a 50% decrease from 2016.

And now, the country that used to fine people for having too many kids under the One-Child Policy (up until 2015) will pay you to have one.

China announced a new $502-per-child annual subsidy to incentivize childbirth. It’s modest, but over 20 million families could qualify. And it’s the latest in a growing list of panic policies. China has already pushed to extend maternity leave, provide mortgage discounts and tax breaks, and has even suggested penalizing adults who remain childless.

China had been one of the most career-first societies over the past couple of decades. Known for its "996 culture" (working 9am - 9pm, 6 days a week), women in particular were encouraged to delay having children, but now China is asking its society to reconsider.

The UN projects China’s population will shrink from 1.4 billion to 1.3 billion by 2050, and under 800 million by 2100. And a shrinking workforce could mean no growth, rising liabilities, and long-term existential risk.

China has been a key driver of global growth for decades. But a collapsing birth rate means a smaller workforce, weaker consumer demand, and slower GDP, all of which could ripple into global markets. From Apple and Tesla to luxury stocks and commodities, China’s population curve might be the most underpriced risk in the market.

Takeaway: China is entering a new era of demographic desperation, and it could be a warning sign if you’re long China. The same country that once punished large families and glorified 996 work culture is now handing out baby subsidies and pushing women out of boardrooms and into nurseries. Only time will tell if baby bonuses can put a band-aid on the problem.

HEADLINES

Top Reads

Blackstone exec among those killed in Manhattan shooting (Axios)

NYC shooting has experts reviewing building safety protocols (BB)

Union Pacific will buy Norfolk Southern in an $85 billion deal (Fox)

Dealmakers hit summer highs with $100B industrials haul (BB)

JPMorgan nears deal for Apple Card from Goldman Sachs (CNBC)

Anthropic in talks to raise fresh capital at $170B valuation (CNBC)

Apple reportedly lost another AI researcher to Meta (YF)

Private equity drives 80% defaulted debt jump (BB)

Good guidance is the new earnings beat for investors (Axios)

Automation is coming for private equity’s junior roles (FT)

AI is already wrecking fragile job market for college graduates (WSJ)

Capital Group, KKR seek SEC nod for retail private equity fund (BB)

Ex-Millennium trader launches energy-focused hedge fund (BB)

Fed unlikely to cut but this week’s meeting is packed with intrigue (CNBC)

HSBC asks managing directors to work in-office 4x/week (BB)

Chipotle AI hiring tool helping firm find employees 75% faster (CNBC)

Barclays posted strong Q2 earnings thanks to IB revenue (CNBC)

Are consultants useless? (FT)

OpenAI launches Study Mode in ChatGPT (TC)

PRESENTED BY MACABACUS

Turn New Hires into Financial Modeling Machines

Deal flow doesn’t slow down so you can babysit slides. Macabacus turns new hires into model-and-deck machines, right inside Microsoft Office.

Excel ↔ PowerPoint Linking: tweak the model once, every linked chart & table in the deck updates.

Formula & Precedent Tracer: catch #REF chaos before your model ships; analysts and interns learn best practices as they click.

Shared Libraries: centralized access to firm-approved slides, models, and snippets to keep branding FTC-level tight.

Doc Builder: CIMs, working group lists, engagement letters, and NDAs, built via a quick questionnaire; headers, footers, and styles auto-populate.

Deal-Ready Tombstones: filter by sector or size, insert, flex; access millions of logos with Logo Library—no more Google-Image scavenger hunts.

AI Writing Assistant: Create copy at warp speed while keeping your documents on-brand with your company’s voice and language standards.

Result: Day-1 analysts, VP-grade output, and a summer with fewer midnight and weekend “fix my deck” fire drills.

CAPITAL PULSE

Markets Rundown

Market Update

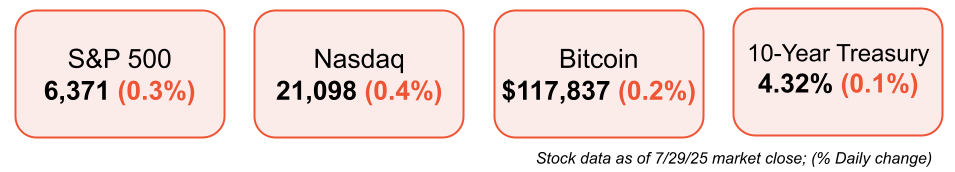

Stocks pulled back, ending a multi-day rally. The S&P 500 and Nasdaq slipped modestly, while small caps underperformed

European equities gained on trade deal momentum, but Asia and emerging markets were weaker

The U.S. dollar continued its climb, though still down year-to-date

10-year Treasury yields fell after strong demand in a government bond auction

Oil prices surged nearly 4% after the U.S. gave Russia a 10-day deadline to reach a truce in Ukraine

Economic Data Highlights

Consumer confidence improved, but households still report hiring concerns

Job openings declined, with hiring soft but layoffs still at low levels

Trade deficit narrowed due to a drop in imports, likely boosting tomorrow’s GDP reading

The Atlanta Fed lifted its Q2 GDP estimate, but underlying growth remains soft amid ongoing trade and policy uncertainty

Reported Earnings

PayPal beat expectations on both earnings and revenue, with strong payment volume and improving margins

Spotify missed revenue targets but posted strong user growth across both premium and ad-supported tiers

UPS delivered solid revenue growth, though profit margins were under pressure as shipping volumes remained mixed

Earnings Today

Microsoft – Focus on cloud and AI performance as Azure growth and AI-related demand drive results

Meta Platforms – Key watch on ad revenue strength and ongoing investment in AI infrastructure

Robinhood – Investors looking for momentum in crypto trading and signs of improving user engagement

Movers & Shakers

(+) CyberArk Software ($CYBR) +13% after the cybersecurity company is in talks to be acquired by Palo Alto Networks.

(–) UPS ($UPS) -11% because the delivery company announced disappointing earnings.

(–) Spotify ($SPOT) -12% after the streaming company announced weak forecast.

Private Dealmaking

Union Pacific will buy Norfolk Southern in a $85 billion deal

Baker Hughes acquired Chart Industries for $13.6 billion

CRH sold Eco Material Technologies for $2.1 billion

iA Financial acquired RF Capital for $435 million

Vanta raised $150 million at $4.2 billion valuation

HeroDevs, a provider of open-source software security tools, raised $125 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Wealthy and Well-Known

Description: A practical, high-impact guide for professionals ready to amplify their influence. Rory and AJ help you master personal branding to become a “Mission-Driven Messenger”—standing out authentically in crowded markets, attracting opportunities, and monetizing your reputation with purpose and precision.

Rating: Amazon 5 / 5

Book Length: 288 pages

Ideal For: Content creators, entrepreneurs, coaches, professionals, and anyone who wants to build credibility online—or offline—to attract impact, clients, and purpose-aligned opportunities.

“A clear, actionable framework to turn your reputation into real revenue—without sacrificing authenticity.”

PRESENTED BY CARTA

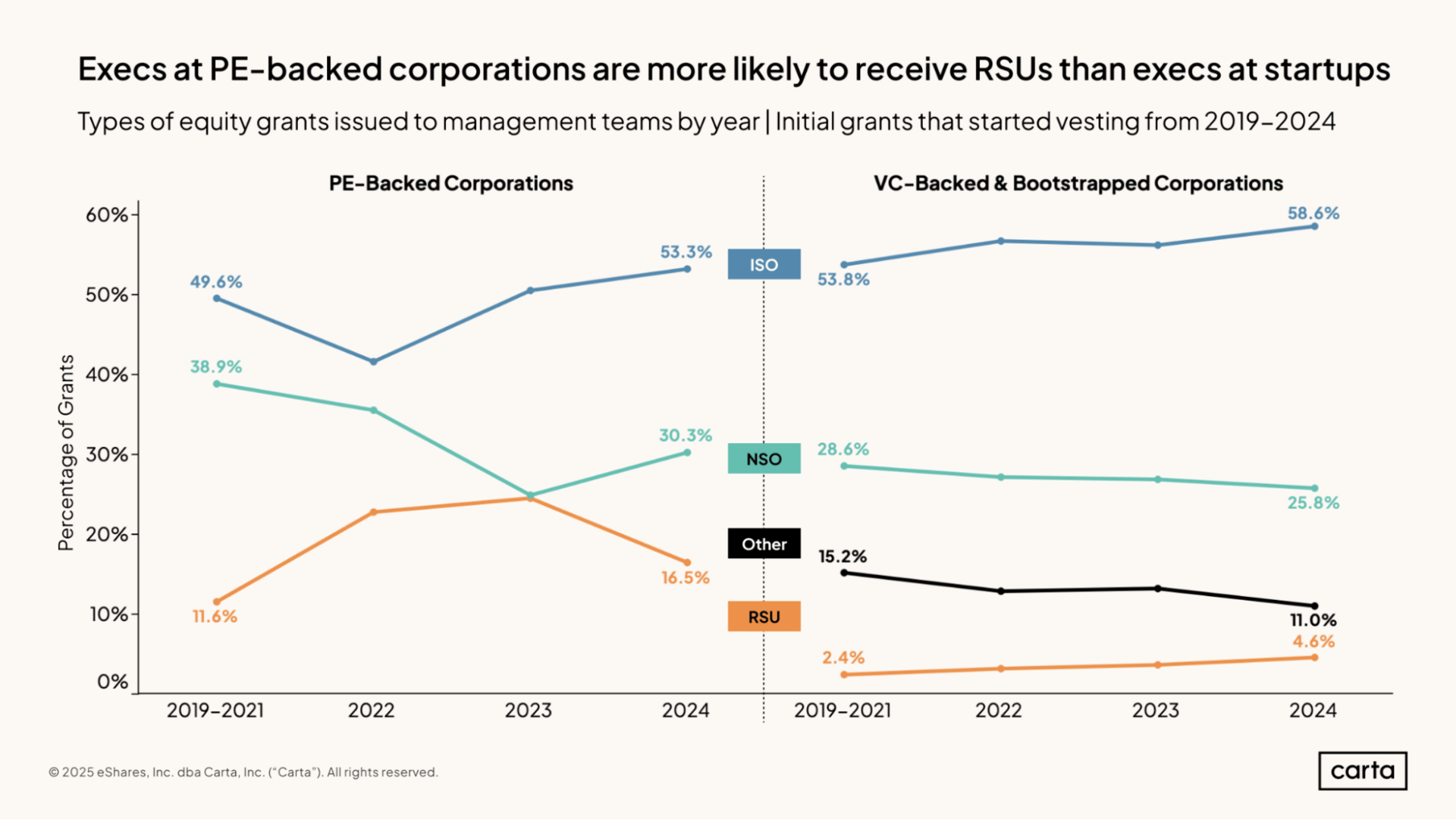

So… Who Really Gets The Equity In PE-Backed Companies?

Compensation strategies at private equity-backed companies aren’t one-size-fits-all. In this multi-trillion dollar industry, incentive structures can make or break outcomes.

Read Carta’s PE Executive Equity Report to learn how over 2,000 private equity-backed companies align equity with performance:

Trends in carry, co-investment, securities, and vesting schedules

Why incentives are increasingly tied to value creation

How much equity CEOs are getting (spoiler: the median is over 2%)

If you’re a PE investor, GP, or portfolio leader, this report is your cheat code.

DAILY ACUMEN

Patience Pays

In investing, the best gains often come from doing... nothing.

Holding. Waiting. Enduring the noise.

Same goes for careers, relationships, even personal growth.

The problem? Our brains are wired for action. We equate motion with progress. But in a compounding world, most of your returns are backloaded.

Tiny choices now = massive outcomes later.

The trick is staying in the game long enough for those outcomes to arrive.

Patience isn’t passive. It’s strategic stillness.

It’s what keeps you from cashing out at the first red candle—or quitting on something good just because it’s not perfect yet.

Play long enough, and the odds shift.

Play with conviction, and the world starts to tilt.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📦 City Sublets: Verified rentals for finance professionals in NYC and beyond. Find or list your sublet with ease. Explore City Sublets.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply