- Short Squeez

- Posts

- 🍋 $98 to Underwrite a Deal

🍋 $98 to Underwrite a Deal

Plus: The fastest company to hit $100M ARR, American Eagle up 28% after Sydney Sweeney ad, Google beat earnings, and Columbia to pay $200M to settle Trump fight.

Together With

“If you double the number of experiments you do per year, you're going to double your inventiveness.” — Jeff Bezos

Good Morning! Google beat earnings, with revenue rising 14% year-over-year. Lovable became the fastest company ever to reach $100 million ARR, hitting the milestone in just 8 months.

Uber is rolling out a new feature that lets female drivers and riders opt out of being matched with men. GoPro and Krispy Kreme joined the meme stock party. American Eagle also jumped 28% after a Sydney Sweeney ad.

Plus: U.S. and Europe are closing on a trade deal with 15% tariffs, Goldman is partnering with BNY Mellon to tokenize money market funds, Columbia agreed to pay $200M to settle Trump fight, and 7 tiny habits that make you more approachable.

A new tax-advantaged way to grow wealth with Bitcoin is here. Learn more and apply today.

SQUEEZ OF THE DAY

$98 to Underwrite a Deal

It’s 2025 and investment banks in China are now charging as little as $98 to underwrite billion-dollar bond deals.

That’s not a typo. In a recent RMB 35B (~$4.8B) issuance by China Guangfa Bank, six underwriters split a fee pool of just 0.0002% of the deal size. Two of the firms, China Galaxy Securities and Industrial Bank, reportedly won their spots with bids of just $98 each!

The reason? China’s bond market has become a volume game driven by price-sensitive state-owned enterprises (SOEs). With private sector issuance drying up and overall credit demand still soft, SOEs are dictating terms, and banks are in a race to the bottom to stay on the deal sheet and climb league tables.

Regulators are growing concerned. China's bond watchdog has launched an investigation into the Guangfa deal, flagging the ultra-low fees as potentially destabilizing. But enforcement may be toothless. As one banker noted, even when fines are issued, they tend to be symbolic, often no more than RMB 100,000 ($13,700).

The price-cutting frenzy isn’t limited to bonds. In Hong Kong, Chinese banks have also started underpricing IPO mandates, pushing out Western competitors like Goldman Sachs and Morgan Stanley. This year’s largest Hong Kong listing, EV battery giant CATL’s $5B secondary float, saw fees as low as 0.2%, compared to historical norms of 4–5%.

“Fee compression is a broad trend,” said one analyst, adding that banks could make up for losses in underwriting by selling other products.

Takeaway: China’s “growth-at-all-costs” mindset has spread to investment banking, with firms cutting fees to absurd levels to win mandates and stay ranked. As one banker put it: “These ultra-low bids are all about winning mandates and staying in the game.” But how long can you really keep operating with $98 deal fees? Only time will tell.

HEADLINES

Top Reads

Alphabet beats earnings expectations, raises spending forecast (CNBC)

Eight months in Lovable crosses the $100M ARR milestone (TC)

Uber will let women drivers, riders avoid being paired with men (CNBC)

Krispy Kreme, GoPro are latest meme darlings (YF)

Sydney Sweeney sends American Eagle stock soaring (BZ)

US and EU close in on 15% tariff deal (Axios)

Columbia agrees to pay more than $200M to settle Trump fight (WSJ)

Trump gets Japan deal, but EU digs in with $100B response (YF)

Trump floats ‘no tax on capital gains’ for home sales (CNBC)

Morgan Stanley probed by FINRA (WSJ)

Luxury brands ease off on price rises as shoppers push back (FT)

New entrance fee to visit Europe set to triple, says European Commission (CNBC)

Top arranger says India IPOs to raise $30 billion over 12 months (BB)

The private equity boom is leaving midsize players behind (BB)

June home sales drop as prices hit a record high (CNBC)

Alexander Hamilton's bank and Goldman embrace digital tokens (YF)

Citi targets Middle East money with push to hire private bankers (BB)

AI startups raised $104B in first half, but exits tell a different story (CNBC)

Japan trade deal info on Trump’s desk altered by marker (CNBC)

PRESENTED BY MEANWHILE

Finally, Bitcoin Life Insurance Is Here—But How Does It Work?

Meanwhile just launched the world’s first Bitcoin-denominated life insurance policy, offering policyholders guaranteed returns, unlimited growth potential, and tax advantages.

This e-book explains all the advantages and how you can apply in under 30 minutes:

Guaranteed BTC growth: 2% compounding tax-free in the policy

Inflation-proof: Premiums, death benefits, and policy values measured in BTC

Simple and secure: Direct Bitcoin inheritance, regulated by BMA, and no doctor’s visit required

Don’t settle for traditional, fiat-backed policies that devalue over time.

CAPITAL PULSE

Markets Rundown

Market Update

U.S. stocks closed higher, with the S&P 500 hitting a new record after a trade deal with Japan.

Japan agreed to a 15% tariff rate (down from 25%) and pledged $550B in U.S. investment.

Health care and industrials led gains, while utilities and consumer staples lagged.

Asia rallied, led by Japan’s Nikkei, which hit an all-time high; the U.S. dollar weakened.

Oil prices climbed, rebounding from recent declines.

Economic Data Highlights

No major U.S. releases today; markets await preliminary July PMIs and jobless claims on Thursday.

These will offer insight into labor-market health and business sentiment ahead of next week’s Fed meeting.

Reported Earnings

Alphabet (GOOGL) – Beat on revenue and EPS; Google Cloud margins expanded, and ad growth remained strong. Gemini adoption showed progress.

Tesla (TSLA) – Margins declined but still beat estimates; company teased Dojo expansion and upcoming low-cost EV model in 2026. Robotaxi commentary limited.

Chipotle (CMG) – Delivered strong same-store sales and margin expansion; traffic remained resilient despite menu price hikes.

Earnings Today

Blackstone (BX) – Focus on fundraising pace, real estate markdowns, and carry generation trends.

Intel (INTC) – Analysts watching for updates on foundry segment, AI chip traction, and gross margin outlook.

Coca-Cola (KO) – Investors looking for signs of volume strength and resilience in emerging markets.

Movers & Shakers

(+) GoPro ($GPRO) +12% after the digital camera company was part of a short squeeze.

(+) Krispy Kreme ($DNUT) +5% because the donut chain was part of the meme stock rally.

(–) Texas Instruments ($TXN) -13% after the semiconductor company lowered its outlook.

Private Dealmaking

Bedrock Robotics, an autonomous heavy machinery maker, raised $80 million

CertifID, a real estate wire fraud prevention company, raised $47.5 million

Firestorm Labs, a California-based drone printing company, raised $47 million

GigaIO, an A.I. infrastructure developer, raised $21 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Proof

Description: A captivating exploration of how we determine truth—and what happens when proof falters. Kucharski spans mathematics, politics, public health, AI, law, and economics to reveal that proof isn’t always absolute. It’s about weighing evidence, understanding uncertainty, and communicating with clarity amidst complexity.

Rating: Amazon 4.4 / 5, Goodreads 3.9 / 5

Book Length: 368 pages

Audible Length: ~9 hrs 43 mins

Ideal For: Curious thinkers, policy influencers, journalists, mathematicians, AI skeptics, and anyone wanting to sharpen their critical thinking in uncertain times.

“A vivid, intelligent and wide‑ranging book about how we know what we know.” — Tim Harford

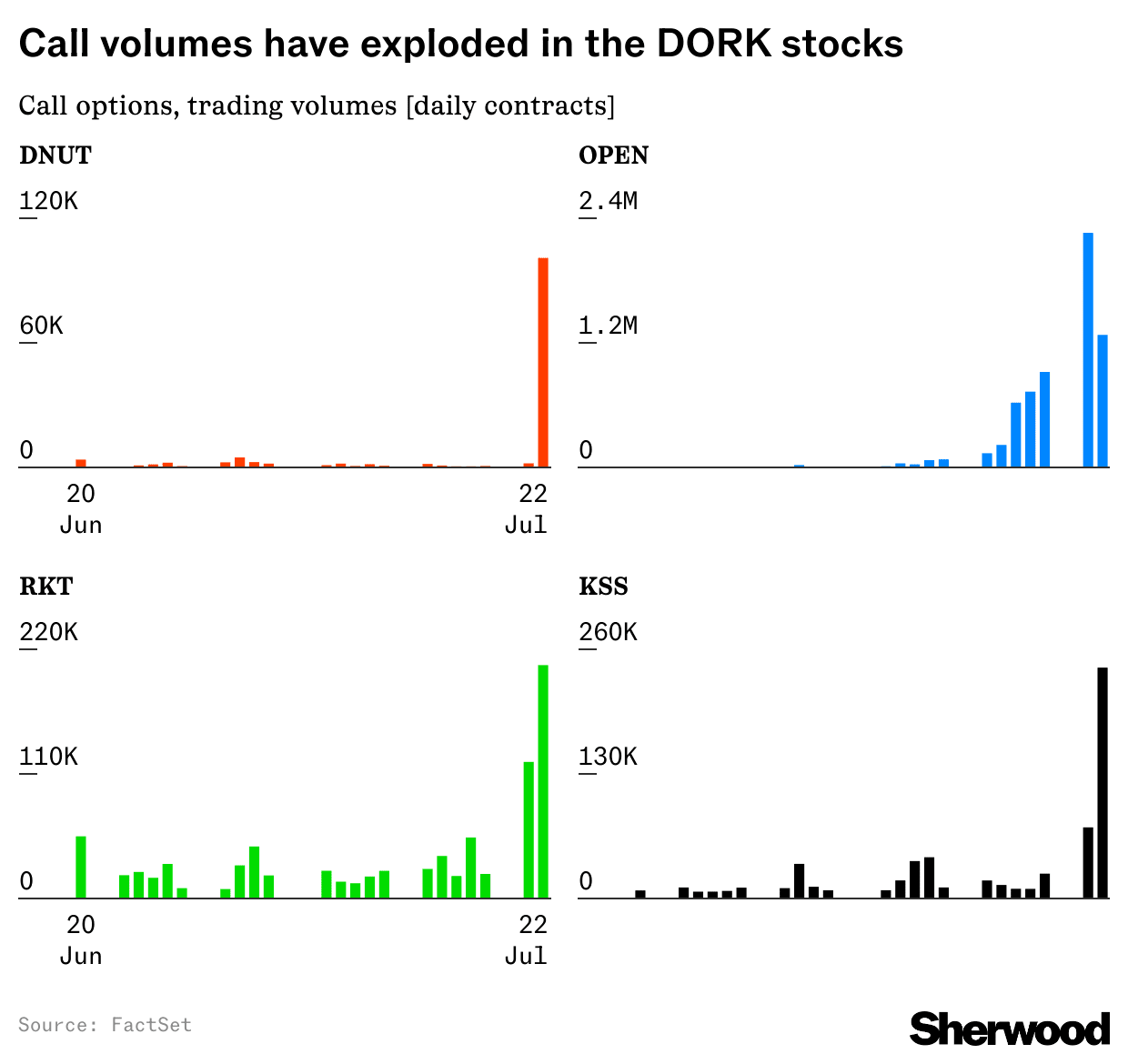

DAILY VISUAL

DORK Stocks

Source: Chartr

PRESENTED BY MACABACUS

Turn New Hires into Financial Modeling Machines

Deal flow doesn’t slow down so you can babysit slides. Macabacus turns new hires into model-and-deck machines, right inside Microsoft Office.

Excel ↔ PowerPoint Linking: tweak the model once, every linked chart & table in the deck updates.

Formula & Precedent Tracer: catch #REF chaos before your model ships; analysts and interns learn best practices as they click.

Shared Libraries: centralized access to firm-approved slides, models, and snippets to keep branding FTC-level tight.

Doc Builder: CIMs, working group lists, engagement letters, and NDAs, built via a quick questionnaire; headers, footers, and styles auto-populate.

Deal-Ready Tombstones: filter by sector or size, insert, flex; access millions of logos with Logo Library—no more Google-Image scavenger hunts.

AI Writing Assistant: Create copy at warp speed while keeping your documents on-brand with your company’s voice and language standards.

Result: Day-1 analysts, VP-grade output, and a summer with fewer midnight and weekend “fix my deck” fire drills.

DAILY ACUMEN

Make It Easy

The best career strategy? Build habits that feel like play to you but look like work to others.

It’s how creators build billion-dollar empires. How investors research obsessively without burnout. How athletes train daily without dread.

They found the intersection of curiosity, skill, and compounding—and then made the process feel frictionless.

This is what Naval meant when he said, “Play long-term games with long-term people.”

It’s also why burnout is often a sign you’re playing the wrong game—or playing someone else’s.

In a world chasing edge, your edge is what feels effortless.

Double down on that.

ENLIGHTENMENT

Short Squeez Picks

Why self-leadership is your secret weapon

7 tiny habits that make you more approachable

Harvard’s top recommended activity to keep people over 60 fit

The 90-second rule to live a better, more fulfilled life

Do we know what dogs and cats are really thinking?

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

🔑 City Sublets: Find or list short-term rentals with ease. Built for verified professionals, with a focus on NYC and finance. Browse listings or list your place.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply