- Short Squeez

- Posts

- 🍋 $5.6B Continuation Fund

🍋 $5.6B Continuation Fund

Plus: Gen Z's savvy at retirement saving, OpenAI leans into AI customization, Florida real estate boom fueled by Wall Street, and what's a comfortable salary?

Together With

"Capitalism without bankruptcy is like Christianity without hell.” — Frank Borman

Good Morning! Warren Buffett donated a record $6B in Berkshire stock. Meta’s seeking $29B from private credit giants to build its AI data centers. OpenAI is rolling out customized AI models for users willing to drop at least $10 million.

Gen Z is diving into 401(k)s sooner than millennials, turning to podcasts, finfluencers, and AI chatbots for financial advice. And Florida’s real estate boom is fueled by Wall Street execs fleeing New York.

Plus: How much Americans have in their 401(k)s by income, and what counts as a comfortable salary?

When you need compliance ASAP, use Vanta to automate up to 90% of the work for frameworks like SOC 2 and HIPAA. Join the live demo to see it in action.

SQUEEZ OF THE DAY

$5.6B Continuation Fund

Vista Equity Partners just raised one the largest single-asset continuation funds: a $5.6 billion fund to keep hold of Cloud Software Group, the enterprise software company created from Citrix and Tibco’s $16.5 billion merger in 2022.

The deal includes $2.7 billion of fresh investor cash and $2.2 billion from Vista’s older buyout funds. Investors in the original fund could cash out at a 4.1x return or roll into the new vehicle, with Cloud Software moving over at a roughly 5% discount to its early 2024 valuation.

While massive, Vista’s deal isn’t the biggest on record. That title goes to Hellman & Friedman, which raised a $10.2 billion single-asset continuation fund in 2022 to hold Ultimate Kronos Group (UKG). Still, Vista’s transaction shows how continuation funds have become a core tool for private equity firms facing a frozen exit market, where traditional sales or IPOs remain elusive.

GP-led secondaries, including continuation funds, hit $72 billion in volume last year, up from the previous peak of $63 billion in 2021. In Q1 of this year alone, sponsor-led secondaries totaled $25 billion and could exceed $75 billion by year-end, per PJT Partners.

Yet the momentum faces new headwinds. Tariffs and market volatility are forcing secondary buyers to demand steeper discounts, widening the gap between private valuations and what buyers are willing to pay.

Many private equity firms, like Vista, are sitting on assets they believe still have runway for growth but they’re also under pressure to generate liquidity for investors. Roughly 29,000 unsold portfolio companies, valued at $3.6 trillion, remain stuck on private equity books.

Continuation funds have become an increasingly attractive way for sponsors to buy more time with high-conviction assets while offering investors either a cash-out or a path to ride the asset’s next chapter.

Takeaway: Vista’s move to hang onto Cloud Software Group is a vote of confidence in the asset’s long-term value. It’s also a sign that, despite market headwinds, continuation funds are evolving from a niche strategy to industry staple. And remember, next time you can’t find a buyer for your business, just sell it to yourself for 4.1x!

HEADLINES

Top Reads

Warren Buffett donates record $6 billion in Berkshire shares (YF)

Meta seeks $29 billion from private capital firms for AI data centers (YF)

How much Americans have in their 401(k)s at every income level (CNBC)

OpenAI takes a page from Palantir, doubles down on consulting services (TI)

Gen Z is great at saving for retirement (NYT)

Stuck private equity deals saddle investors with endless fees (WSJ)

Wall Street’s AI embrace leaves plenty of work for junior bankers (TI)

Big banks all pass the Federal Reserve's stress tests (CNBC)

Florida commercial real estate boom fueled by Wall Street industry (NYP)

Trump says he is terminating trade talks with Canada (YF)

Private equity wants to get into your 401(k). Trump might let them (MBC)

Why a weak dollar is bullish for the tech industry (Axios)

Americans beef up savings accounts (CNBC)

Starbucks urges customers to linger (CNN)

U.S. could be done with trade deals by Labor Day, Bessent says (Axios)

Wealthfront confidentially files to go public in US (Pymnts)

Platinum Equity-backed McGraw Hill files for US IPO (YF)

With ‘F1’, Apple finally has a theatrical hit (TC)

What's a comfortable salary? (LI)

PRESENTED BY VANTA

Need Compliance? Get Audit-Ready In Weeks, Not Months

Don’t stress—when you automate your security compliance with Vanta, a few glorious things will happen:

Secure 35+ frameworks like ISO 27001 and SOC 2 for less time/money

Boost team efficiency by 129% and ROI by 529%

Easily build trust, land more deals, and skyrocket growth

…which means that Q3 beach vacay might actually happen.

Ready to join 10,000+ orgs like LangChain and Cursor automating compliance?

Tune into Vanta's Live Demo on July 10 to see the product in action and ask questions in real time. Save your spot.

CAPITAL PULSE

Markets Rundown

Market Update

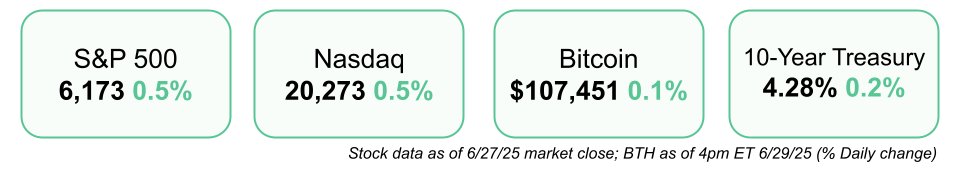

U.S. stocks rose modestly Friday, pushing the S&P 500 to a new all-time high, now up 23% since its April 8 low.

Gains were broad-based, led by strong guidance from Nike, which surged 15% after signaling a sales recovery.

Intraday volatility followed news that President Trump is ending trade talks with Canada over its digital services tax.

Crude oil was flat on the day, but down 12% for the week, marking its largest weekly drop in two years.

Economic Data Highlights

Core PCE inflation (the Fed’s preferred measure) rose 0.2% in May, slightly above expectations of 0.1%.

On an annualized basis, core PCE rose to 2.7% from 2.6%, reflecting early signs of tariff-driven price pressures.

The Fed raised its 2025 inflation forecast last week from 2.8% to 3.1%, while maintaining its view that inflation will normalize in 2026.

Looking ahead, June jobs data will be the main focus next week, with payroll gains expected to remain solid and unemployment steady at 4.2%.

Reported Earnings

Nike (NKE) – Beat expectations and surged 15% after issuing strong forward guidance and signaling a sales recovery.

Walgreens Boots Alliance (WBA) – Missed expectations due to continued margin pressures and weaker retail performance.

Earnings Today

Quantum Corp (QMCO) – Reporting June 30 (After Market Close); investors watching storage demand trends and margin expansion.

Movers & Shakers

(+) Nike ($NKE) +15% after the company’s CEO says recovery is on the horizon.

(+) EchoStar ($SATS) +13% because the company says bankruptcy concerns are subsiding.

(–) Palantir ($PLTR) -11% after easing tensions in the Middle East.

Private Dealmaking

DNOW bought MRC Global for $1.5 billion

Summit Partners sold Dr. Squatch for $1.5 billion

Comcast agreed to sell Sky Deutschland for $176 million

Tacta Systems, a robotics intelligence developer, raised $75 million

Centific, an AI data foundry, raised $60 million

Mandolin, an AI automation platform, raised $40 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

Mortgage rates have remained remarkably stable, fluctuating within just a 15-basis-point range since mid-April. Although national home sales have been flat in recent data, the steady rates have contributed to a larger pool of available inventory, giving buyers more options to choose from when entering the market.

Latest News

New Listings

21 W 17th St Apt: 11 New York, NY: 3 Bed / 2 Bath - $3.7M

207 Halsey St, Southampton, NY: 3 Bed / 2.5 Bath - $3.0M

177 SE 25th Rd, Miami, FL: 3 Bed / 3.5 Bath - $3.9M

Saint-Tropez, Grimaud, Var, France: 5 Bed / 3 Bath - $9.1M

Carrer Rocs de Sant Magí, Spain: 6 Bed / 9 Bath - $9.2M

BOOK OF THE DAY

The Compounder’s Element

Description: A refined exploration of long-term investing and personal growth. Laurence Endersen argues that true wealth is built through patience and process—not hype. He challenges readers to lean into consistent compounding, embrace calculated risks, and find fulfillment in the journey, not just the outcome.

Rating:

• Amazon: 4.6 / 5

• Goodreads: 4.7 / 5

Book Length: 240 pages

Ideal For: Thoughtful investors, long-term strategists, and quality-minded leaders who see compounding not just as math, but as a mindset.

“An insightful and engaging read… delivering sensible, hard‑earned investing wisdom with an accessible tone.”

PRESENTED BY PACASO

This House Is Insane: Mountain Views. Ski Access. A Hot Tub!?

The Lionshead property in Vail has all the luxuries you’d expect in a $2.1 million mountain vacation home–access to the slopes, panoramic views, a heated deck…

But forget all that. Here’s the real kicker:

You can invest in this property (and its revenue stream) via Pacaso, the platform that turns fractional shares of high-end vacation homes into recurring profits.

Wealthy families share in the ownership, Pacaso handles the logistics, and you get a slice of the $1.3T vacation home market.

Co-founded by the guy who sold Zillow for $16 billion

Don’t miss out–see all of Pacaso’s luxury offerings here.

DAILY ACUMEN

Great Negotiators Flow

The best deals don’t happen through force—they flow.

Great negotiators don’t dominate; they tune in.

To hit your stride in a negotiation, you need three things: preparation, presence, and personality.

Do your homework so you walk in calm and confident.

Build connection before you build terms.

Then stay fully present—listen more than you speak, ask the right questions, and read the room.

That’s how you spot leverage, earn trust, and close deals that stick.

Flow isn’t luck.

It’s a practiced state of mind—and your greatest competitive edge at the table.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

🏠 Real Estate Newsletter – City Squeez: Latest news and exclusive listings for those looking to buy, rent, or invest in real estate around the world. Sign up here.

📚 Courses: Level up with our excel, modeling, and private equity courses. View offerings.

What'd you think of today's edition? |

Reply