- Short Squeez

- Posts

- 🍋 Zuck Hires a Goldman President

🍋 Zuck Hires a Goldman President

Plus: The Lazard banker who made $41M on insider tips, gold and silver keep ripping, Paramount sues Warner Bros., and PE dumps old fund stakes to return cash to investors.

Together With

“People think in stories, not statistics. Which is why narratives are more powerful than facts.” — Brent Beshore

Good morning! OpenAI just bought healthcare startup Torch to unify patient medical data on an AI platform. Allegiant is buying Sun Country in a $1.5B bet on budget airline consolidation. Gold ripped past $4,600 an ounce and silver hit a record as Fed uncertainty pushed investors into safe havens.

A former Lazard banker faces criminal charges after turning insider tips into a $41M windfall. Citi is cutting ~1,000 jobs under Jane Fraser’s cost push. And private equity firms are dumping record amounts of old fund stakes to return cash to investors.

Plus: Biotech dealmaking is surging, Alphabet just crossed a $4T market cap, and Paramount is suing Warner Bros. in an escalation of its takeover battle.

Ornn has built the financial infrastructure for the AI economy. Trade it here.

SQUEEZ OF THE DAY

Zuck Hires a Goldman President

Meta is turning to Wall Street to finance its AI ambitions. The company has appointed former Goldman Sachs sovereign wealth fund banker Dina Powell McCormick as its first-ever president and vice chair, signaling a shift in how it plans to fund the next phase of growth.

The role sits above finance, policy, and infrastructure, with oversight of Meta’s roughly $600 billion AI buildout over the next decade, spanning data centers, chips, and compute.

Powell McCormick brings a rare mix of high finance and government experience. She spent years at Goldman Sachs building relationships with sovereign wealth funds and other long-duration capital pools.

She also served as Deputy National Security Advisor under President Trump and is married to David McCormick, the former Bridgewater CEO and now a Republican U.S. Senator. Trump publicly praised the hire, calling it “a great choice by Mark Z.”

Investors have been pressing Meta to pair its aggressive AI spending with greater capital discipline. While Meta has largely self-funded its push so far, competitors like Nvidia, OpenAI, and Microsoft have leaned heavily on sovereign funds and strategic partners, particularly in the Middle East, to secure funding and capacity.

Meta is now entering a phase more typical of infrastructure and energy companies, where projects are too capital-intensive to sit entirely on the balance sheet. That is where Powell McCormick comes in, bringing the relationships needed to attract outside capital and structure partnerships while preserving control.

Takeaway: Meta is no longer financing AI like a pure tech company. By hiring a sovereign wealth fund dealmaker as president, it is signaling a shift toward infrastructure-style funding built around co-investment, long-duration capital, and off-balance-sheet structures. The goal is to scale faster and fund AI growth without turning Meta into a leveraged infrastructure operator.

PRESENTED BY ORNN AI

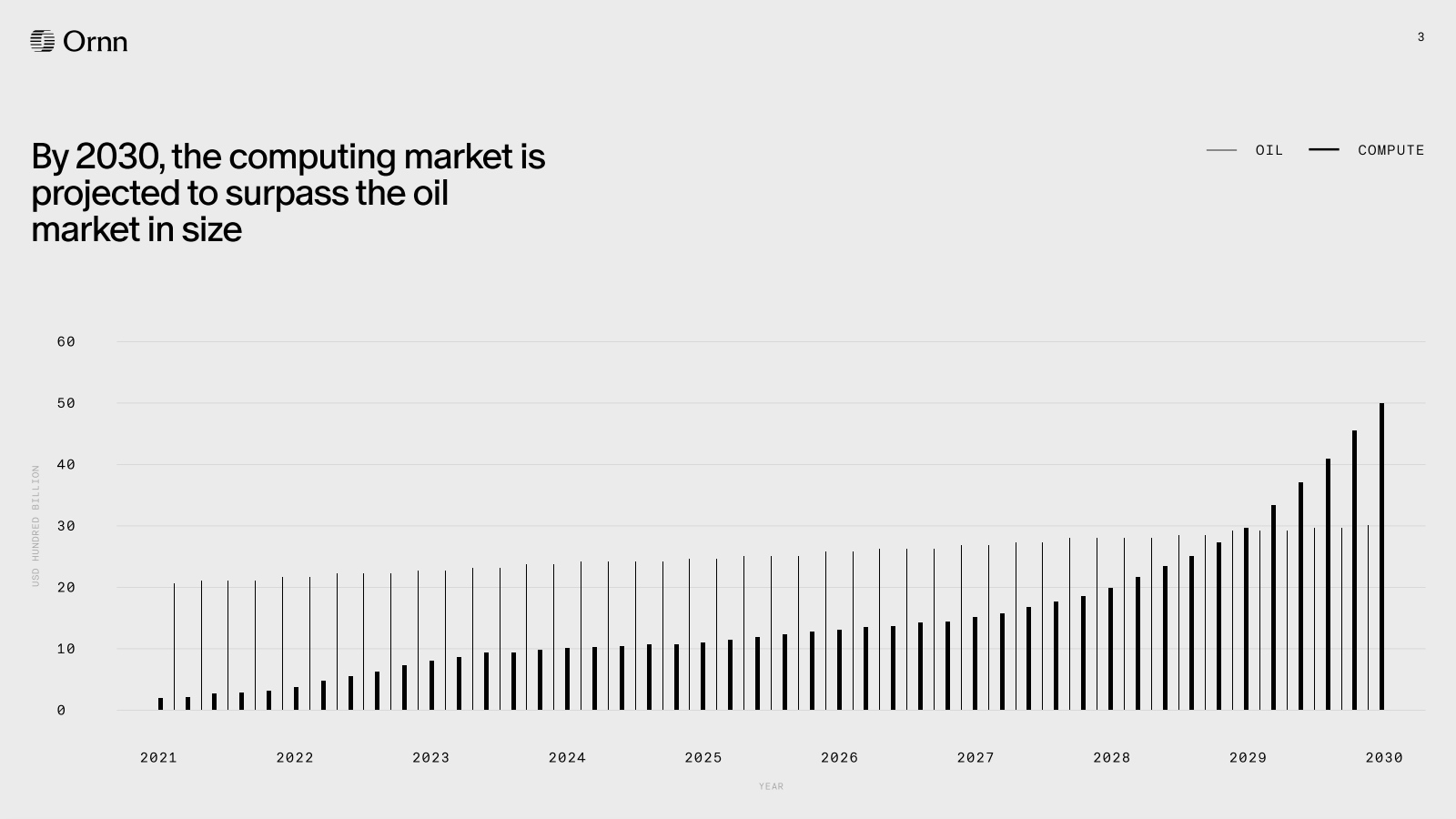

A Rival to the Most Valuable Commodity in the World?

Compute has a price. Ornn has given it a market.

Ornn AI has built a market to let you trade compute pricing like it's oil or electricity or any other commodity.

Whether you're a trader looking to gain macro exposure, a compute buyer looking to hedge GPU costs, or a financier looking to mitigate GPU depreciation, Ornn is building a market for you.

Ornn’s compute market is institutional grade and is cash settled just like any ICE Brent Oil, ERCOT or PJM power market. The marketplace offers everything you would expect from a traditional commodity market from benchmarks to margining and everything in between.

HEADLINES

Top Reads

OpenAI agrees to buy AI healthcare app Torch for about $60 million (CNBC)

Allegiant to buy Sun Country in deal valued at $1.5 billion (YF)

Gold and silver hit record highs on safe-haven demand as traders price in Fed rate cuts (CNBC)

Ex-Lazard banker’s insider tips reaped $41 million haul, US says (BB)

Looming job cuts at Citi as banks prep earnings (BB)

Private equity backers offload record amount of old fund stakes (FT)

Biotech dealmaking boom reshapes the industry (Axios)

Alphabet hits a $4 trillion market cap amid broad market gains (CNBC)

Paramount sues Warner Bros. in escalation of takeover bid (CNBC)

Citadel, Point72 alumni get $200 million in Squarepoint backing (BB)

Wall Street reboots leverage in $153 billion active stock trades (BB)

Trump’s credit-card rate cap plan has an unclear path and poses ‘devastating’ risks, bank insiders say (CNBC)

Apple picks Google’s Gemini AI to power new Siri features (CNBC)

NYC nurses launch historic strike (USA)

Nvidia and Eli Lilly are making a $1 billion bet on AI drug discovery (YF)

Trump pushes for interest-rate and credit card reforms in affordability plan (Axios)

PayPal signs major lease at Hudson Square in New York (NYP)

Former F1 champ Nico Rosberg raises $100M for venture capital firm (BB)

Blackstone eyes $2.6B of debt financing in power merger talks (BB)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities closed higher after reversing early losses tied to concerns about Fed independence

Industrials and consumer staples led gains, while financials lagged amid proposals for a 10% cap on credit-card interest rates

Treasury yields moved higher; the U.S. dollar weakened

Gold rose again, supported by geopolitical tensions in Iran and rising policy uncertainty

Economic Data Highlights

News of an investigation into Fed Chair Jerome Powell weighed on sentiment early before markets stabilized

The investigation centers on testimony related to the Fed HQ renovation project; Powell denies wrongdoing

Under the Federal Reserve Act, a chair can only be removed “for cause,” historically requiring malfeasance or neglect of duty, a high legal bar

Markets’ base case remains that any removal attempt would face significant legal challenges and take time

Structural safeguards—12-member FOMC and staggered 14-year terms—help preserve policy independence even if leadership changes

Sector Trends

Industrials and consumer staples posted solid gains

Financials underperformed on regulatory overhang

Safe-haven flows partially rotated to gold, while Treasuries sold off modestly on higher yields

Looking Ahead

Central-bank independence will remain a key theme as Powell’s term expires in May and speculation builds around a potentially more dovish successor

FOMC members have recently reaffirmed the importance of independence, limiting the risk of significant policy distortion

Tomorrow’s December CPI report is the next major market catalyst:

Headline CPI: expected +0.3% MoM, +2.6% YoY

Core CPI: expected +0.3% MoM, +2.7% YoY

Goods inflation has firmed, likely reflecting tariff-related pass-through, while services inflation continues to moderate

Movers & Shakers

(+) Vistra Corp. ($VST) +4% after UBS raised its price target to $233 on the Meta nuclear deal.

(–) Duolingo ($DUOL) -8% after the language education app’s CFO will step down.

(–) Abercrombie & Fitch ($ANF) -18% after the retailer warned of cautious holiday spending.

Prediction Markets

The biggest acquisition of the year? Rare earth minerals, uranium, and oil?! Say less.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Allegiant, a U.S. ultra-low-cost airline, is buying Sun Country Airlines, a discount carrier, for $1.5 billion

Rain, a stablecoin-based payments platform, raised $250 million

Orca Bio, a biotech developing cancer cell therapies, raised $250 million

Torq, a no-code automation platform for security teams, raised $140 million

Corgi, a provider of commercial insurance for startups, raised $108 million

Vibrant Therapeutics, a biotech developing masked T-cell engagers for solid tumors, raised $61 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Audacious

Description: A confident, practical career and life guide from entrepreneur Marty McDonald that invites you to stop playing it safe and start creating the life you actually want. McDonald weaves personal stories of triumph, risk, and bold moves with actionable frameworks that help you rewrite limiting beliefs, embrace discomfort, and turn ambition into real progress. It’s part memoir and part manifesto for anyone ready to push past fear and build a more purposeful path.

Book Length: 256 pages

Release Date: October 14, 2025

Ideal For: Career builders, creators, risk-takers, and anyone ready to trade safety for intentional growth.

“Audacity isn’t recklessness, it’s choosing courage again and again.”

DAILY VISUAL

Average Credit Card Interest Rate is 21%

Source: Chartr

PRESENTED BY BLUEFLAME AI

Never Lose Track of a CIM in Your Inbox

What if every deal document came with instant insights before you even opened it?

Blueflame AI analyzes CIMs, board decks, and expert network transcripts the moment they land in your inbox, delivering targeted summaries within minutes. No manual steps, interruptions, or context-switching required.

Blueflame AI’s email agents automatically:

Detect critical deal attachments as they arrive

Analyze CIMs, board decks, and expert network transcripts instantly

Surface key metrics, risks, and qualitative signals

Send concise, actionable summaries directly to your inbox

You stay focused on relationship-building, deal strategy, and assessing opportunities, while Blueflame AI handles the document grind in the background.

Prefer manual review? The agents still give you a second lens, ensuring you never miss important details and helping you move faster on go/no-go decisions.

Reclaim your inbox. Reclaim your time. Request your demo today.

DAILY ACUMEN

Handwritten Notes

In a digital age, handwritten notes are extinct, which makes them powerful. When Doug Conant became CEO of Campbell Soup, the company was in crisis.

His turnaround strategy? He wrote 30,000 handwritten thank-you notes to employees over 10 years. Not emails. Handwritten notes. This simple act transformed company culture and loyalty.

Why does it work? Because it requires effort in an age of convenience. A text takes seconds. An email takes a minute. A handwritten note takes time, thought, and physical presence. That effort is the message. It says: "You're worth my time."

Adam Grant's research shows that small gestures of appreciation dramatically increase motivation and performance. Yet we don't do it because it feels inefficient.

We'll spend hours on a PowerPoint but won't spend five minutes writing a thank-you note. Meanwhile, people keep handwritten notes for years but delete emails instantly.

When was the last time you wrote a handwritten note? Who in your life deserves one? A teacher who changed you. A colleague who helped you. A friend who stood by you. Three sentences. Five minutes. Immeasurable impact. Remember, in a world of efficiency, inefficiency can be your greatest gift. Sometimes the old way is the best way.

ENLIGHTENMENT

Short Squeez Picks

Why trust is an underrated leadership trait

Can meditation make you a better person?

How to practice mindfulness

7 things you can do to thrive in 2026

Hacks every renter should know

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply