- Short Squeez

- Posts

- 🍋 Wall Street’s IPO Boom

🍋 Wall Street’s IPO Boom

Plus: Goldman’s CFO says PE deal boom is finally here, JPM down 5% after more than expected costs, and private credit is starting to look a lot like the bond market.

Together With

“Even if you fail at your ambitious thing, it's very hard to fail completely. That's the thing that people don't get.” — Larry Page

Good Morning! Goldman’s CFO says the PE deal boom is finally here, with sponsor-led activity picking up across the industry. JPMorgan dropped nearly 5% after warning of higher than expected costs. And SpaceX is eyeing a 2026 IPO that could raise $30 billion at a $1.5 trillion valuation, which would be the largest IPO in history.

NYC is set to add 12,000 apartments by converting outdated offices. Vietnam’s stock market is ripping in 2025. And Meta’s shifting AI strategy is reportedly creating internal confusion.

Plus: Options traders are bracing for big swings around today’s Fed decision, private credit is starting to look like the bond market, and here’s how much you need to join the richest 10% of U.S. households by region.

Don’t let “Pls fix” ruin anymore evenings. Let Macabacus perfect your deck.

SQUEEZ OF THE DAY

Wall Street’s IPO Boom

The U.S. IPO engine is firing back up after three quiet years. With equities near record highs, bankers say pitch activity is “overwhelming,” and companies are now fighting for syndicate spots and racing to lock in underwriters. Wall Street isn’t just hoping for a 2026 IPO boom; it’s manufacturing one.

U.S. IPO volume will top $40 billion once Medline prices next week. At the top of the range, it would raise $5.37 billion, the largest global debut of 2025. It’s a real rebound from 2024, even if it still trails the $100B+ frenzy of 2020–2021. Bankers say 2025 is only the warm-up.

Bank of America’s Jim Cooney says the “velocity of IPO pitch activity is overwhelming across every industry,” and JPMorgan’s Keith Canton expects many late-2025 candidates to spill into early 2026, setting up a fourth straight year of rising issuance.

On-file names include Ethos, Grayscale, and York Space Systems, with confidential filers like Kraken and Alphonso behind them. Ackman’s closed-end fund, EquipmentShare, and even Fannie Mae and Freddie Mac are circling the market.

SpaceX is also laying groundwork for what could be the biggest IPO ever, potentially raising $30+ billion at a $1.5 trillion valuation. Advisers are targeting mid-to-late 2026, though timing could slip. If it lands anywhere near expectations, it would instantly define the cycle and reset risk appetite across the market.

The window isn’t frictionless. Several hyped 2025 listings, including StubHub, Navan, and Gemini Space Station, have traded poorly, and IPOs as a group are lagging the S&P 500. That drag is forcing tighter pricing.

Moelis’s Steven Halperin says discounts will stay at the high end of recent ranges, with investors cautious and banks under pressure to deliver alpha. JPMorgan’s Canton echoed it: there have been big wins, but also deals that simply haven’t worked.

Takeaway: 2026’s pipeline looking stacked from Grayscale to Kraken, and SpaceX’s mega IPO listing. The idea of a $1.5 trillion company still being private is almost absurd…what’s the point of listing at that size? In any case, SpaceX’s IPO could set the tone for 2026 and maybe the next few years. Good luck to anyone pricing the week after.

PRESENTED BY MACABACUS

Pls Fix? Pls, no.

"Pls fix”

Two words that ruin dinner plans, date nights, and any hope of leaving before 9 PM.

Macabacus' Deck Check automatically proofreads your entire deck in seconds. It catches formatting, alignment, and consistency errors before your MD does.

No more late-night revisions. No more weekend “quick fixes”. Just perfect decks, built faster and on-brand.

Trusted by top investment banks and private equity firms, Deck Check keeps you one step ahead of the "Pls Fix" email.

Please Support Our Partners!

HEADLINES

Top Reads

Goldman CFO says private equity deal boom is finally happening (BB)

JPMorgan stock drops after bank predicts $105B in expenses next year (YF)

SpaceX to pursue 2026 IPO raising far above $30 billion (BB)

NYC to get 12,000 new apartments from outdated office buildings (BB)

Vietnam stock market is booming in 2025, why this may just be the beginning (CNBC)

Meta’s shifting AI strategy is causing internal confusion (CNBC)

Options traders bracing for wild stock trading off Fed decision (BB)

Private credit is beginning to look like a bond market, and that comes with red flags (CNBC)

University of Utah nearing landmark private equity deal expected to generate $500 million (YF)

How much money you need to be in the wealthiest 10% of U.S. households, by region (CNBC)

BlackRock halts plan for infrastructure fund targeting wealthy Europeans (BB)

JPMorgan wants to stamp its name on Boston’s skyline (BB)

Goldman clients take more cautious posture after November rout (BB)

Vornado’s Midtown tower more than 90% leased after signing new tenants (NYP)

Blackstone helps former e-commerce sensation buy a salt producer (BB)

The solution to hedge fund leverage isn’t more market risk (BB)

Watching Netflix makes stocks go down (FT)

Ares buys Redback Boots stake in Australia private equity debut (BB)

CAPITAL PULSE

Markets Rundown

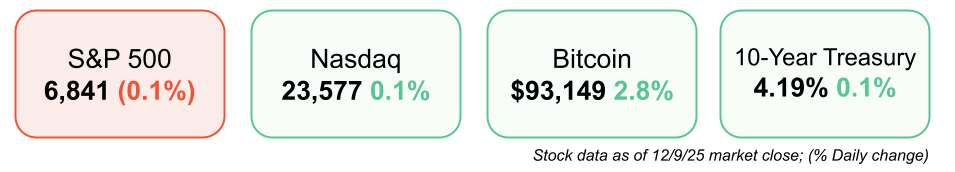

Market Update

Stocks were little changed Tuesday as investors awaited the outcome of the Fed’s final policy meeting of 2025.

Markets broadly expect a 0.25% rate cut at today’s meeting, with focus on updated Fed projections and guidance for 2026.

On the data front, the NFIB Small Business Index rose to 99, slightly above forecasts, while October job openings held steady at 7.7 million, suggesting steady labor demand.

Bond yields edged higher, with the 10-year Treasury yield closing near 4.18%.

Asian markets were mixed overnight, while European equities slipped, even as the eurozone Sentix index improved modestly.

Economic Data Highlights

The NFIB Small Business Index improved for a second month, signaling a mild rebound in confidence.

The share of small businesses planning to hire rose to 19%, the highest since late 2024, pointing to a stable labor market despite recent weakness in private payrolls.

Expectations for higher inflation-adjusted sales also climbed to 15%, the best level since January.

Sector Trends

Technology stocks held firm, buoyed by optimism ahead of key earnings.

Industrials and energy were mixed, while defensive sectors lagged slightly.

Global Perspective

The U.S. dollar has weakened nearly 9% in 2025, its worst year since 2017, weighed by narrowing yield differentials and political uncertainty.

The weaker dollar has boosted international equity returns, with the MSCI AC World ex U.S. Index up over 30% in dollar terms.

We expect continued dollar softness into 2026, as global central banks diverge and the ECB nears the end of its easing cycle while the BOJ continues to tighten.

Earnings Today

Oracle (ORCL) – Watch for cloud and AI-driven revenue growth trends.

Adobe (ADBE) – Focus on Creative Cloud momentum and guidance updates.

Chewy (CHWY) – Investors will watch customer retention and profitability metrics closely.

Movers & Shakers

(+) Ares Management ($ARES) +7% after the investment management firm was added to the S&P 500.

(–) JPMorgan Chase ($JPM) -5% because the bank expects a significant increase in expenses next year.

(–) Twenty One Capital ($XXI) -20% after the Tether-backed crypto treasury firm completed its SPAC merger.

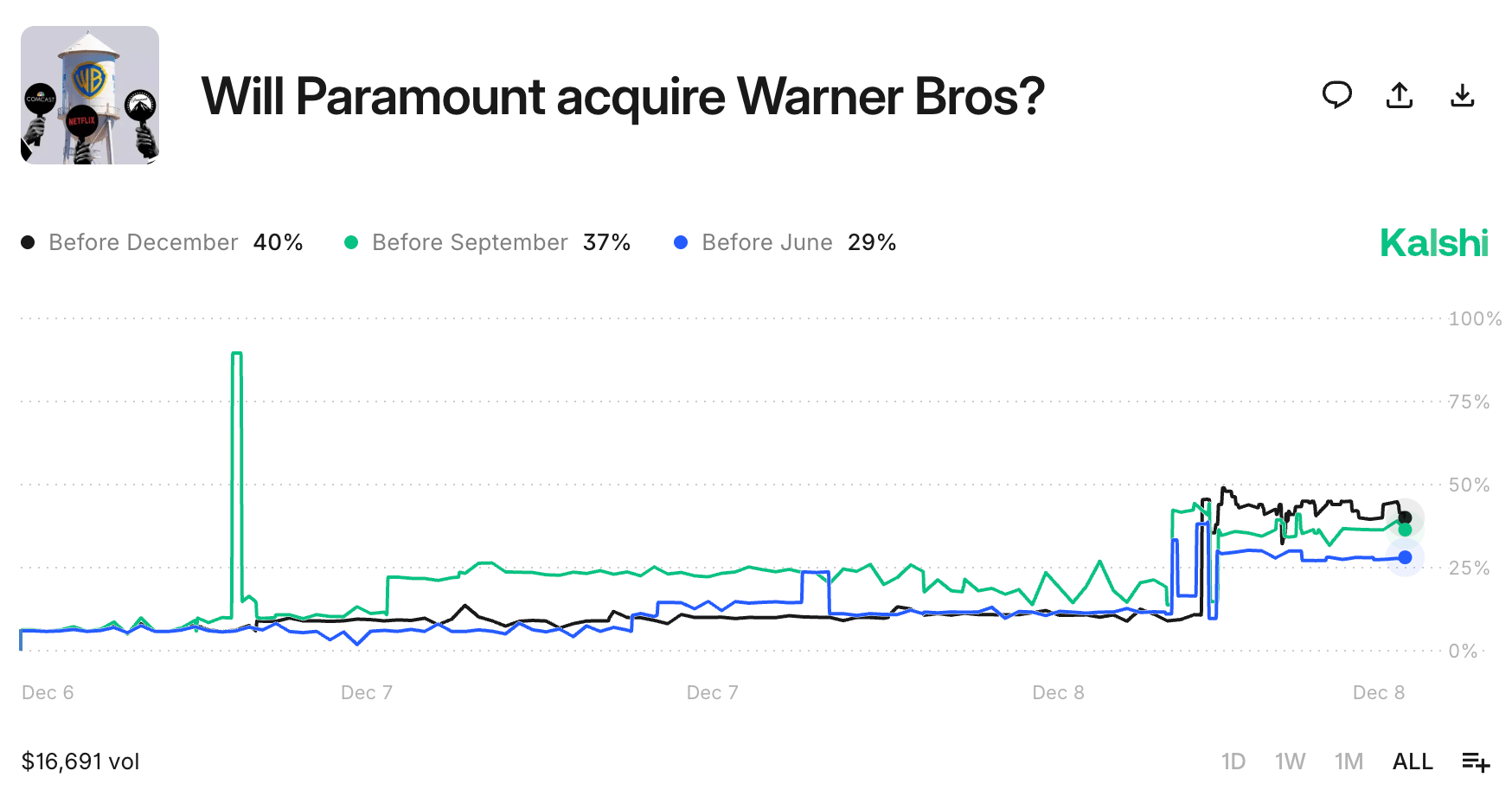

Prediction Markets

Private Dealmaking

ContextLogic will buy US Salt, an evaporated salt products provider, for $907.5 million

Saviynt, an identity security company, raised $700 million

Unconventional AI, a developer of next-gen digital computers, raised $475 million

Airwallex, a payments firm, raised $330 million

Boom Supersonic, a supersonic jetmaker also using its turbines to power AI data centers, raised $300 million

Blue Current, a developer of silicon solid-state batteries, raised $81 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

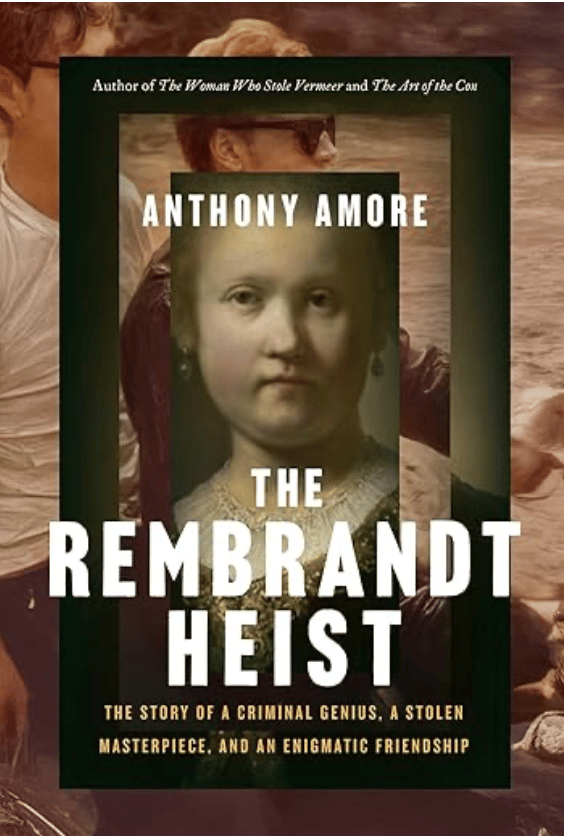

BOOK OF THE DAY

The Rembrandt Heist

Description: A gripping true-crime dive into one of art history’s most audacious thefts — the 1975 brazen daylight heist that saw a Myles Connor shake down the Museum of Fine Arts, Boston for a stolen Rembrandt van Rijn painting. Amore chronicles not just the crime, but the unlikely friendship, betrayal, and psychology behind what makes someone risk it all for one frame on a wall. Part heist thriller, part moral portrait — it’s as much about loyalty and identity as it is about art and crime.

Book Length: 272 pages

Release Date: November 4, 2025

Ideal For: True-crime junkies, art lovers, history buffs, and anyone fascinated by what happens when obsession, loyalty and criminal genius collide.

“Some paintings are worth more than money — they’re worth the risk.”

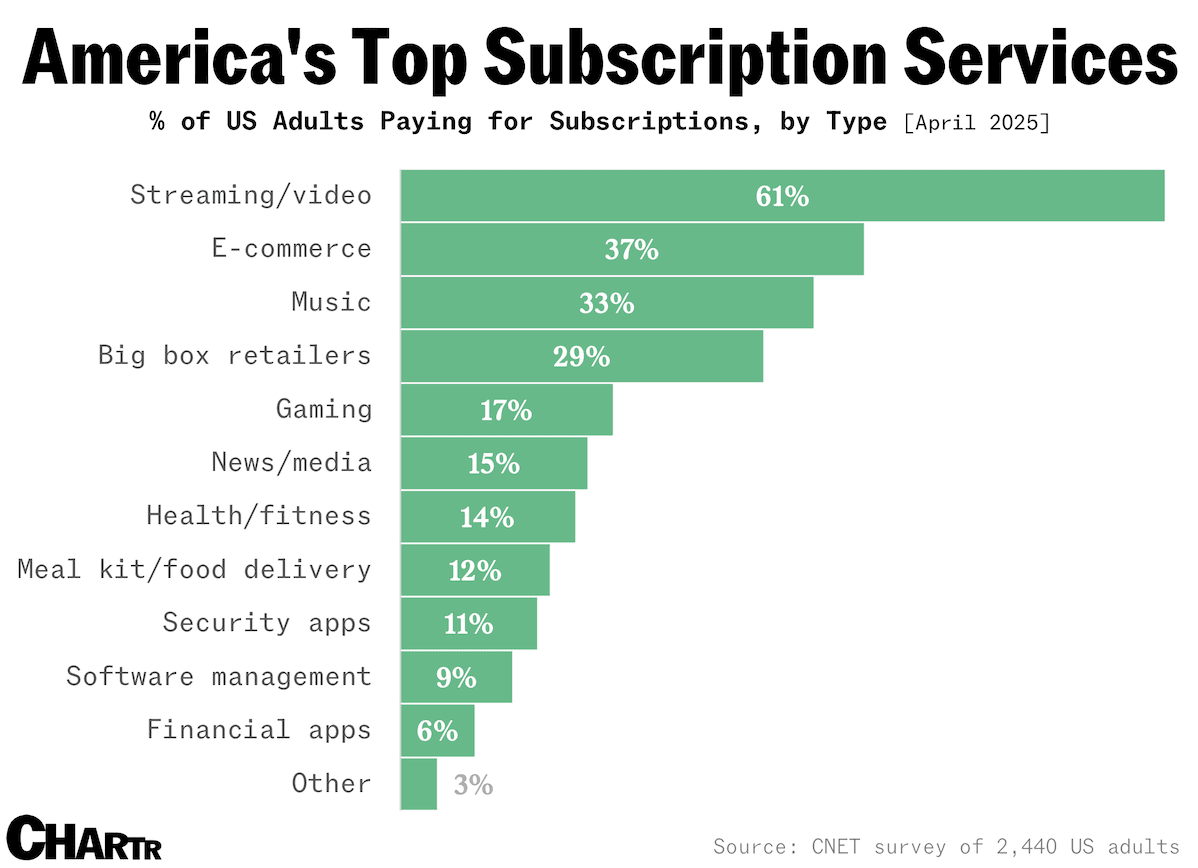

DAILY VISUAL

Subscription Captivity

Source: Chartr

PRESENTED BY BILT

Earn on Your Biggest Monthly Expense

Rent is likely your largest recurring expense, but until now, it's been money that just disappears every month with nothing to show for it (other than a roof over your head). You get rewarded for your coffee, your groceries, your flights. But your rent? Bilt makes sure that earns you something too.

Bilt is the loyalty program for renters that turns every rent payment into points you can use toward travel, Lyft rides, Amazon.com purchases, and more. The loyalty program works with your existing lease, no matter where you live. You're already paying rent, now you can get rewarded for it.

And, starting in February, Bilt is expanding to mortgage payments for the first time. Homeowners will be able to earn points on their monthly payments just like renters do, and unlock exclusive benefits around their neighborhood at over 45,000 restaurants, fitness studios, pharmacies, and more. Whether you rent or own, your housing payment finally works for you.

Please Support Our Partners!

DAILY ACUMEN

Curiosity

Leonardo da Vinci filled over 13,000 pages of notebooks with questions and observations about everything from anatomy to water flow.

His insatiable curiosity made him a genius. Children ask about 300 questions a day. Adults? Maybe 10.

We lose our curiosity as we age, and with it, our capacity for wonder and growth.

Ask more questions. Challenge assumptions. Explore the unfamiliar.

Remember, curiosity didn't kill the cat, complacency did.

ENLIGHTENMENT

Short Squeez Picks

How breathwork became the new meditation

16 surprising ways to beat stress

Is cardio or strength more important for longevity?

How to find your brain’s productivity style

Why disciplined people don’t feel disciplined

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply