- Short Squeez

- Posts

- 🍋 VC’s Megafund Moment

🍋 VC’s Megafund Moment

Plus: Verizon down bad, what Greenland could cost, Blackstone’s 401(k) moment, and McKinsey will require job candidates to use an AI chatbot in interviews.

Together With

"Diversification is a protection against ignorance." — Warren Buffett

Good Morning! Blackstone is partnering with retirement giant Empower to bring private markets into 401(k)s. A Verizon outage pushed 175,000 phones into SOS mode. And Bilt is launching three new credit cards with rates capped at 10% after Trump warned lenders to rein in borrowing costs.

Economists say buying Greenland could cost the U.S. up to $700B. Citi’s M&A fees jumped 84% to cap a record year. Chipotle distanced itself from Bill Ackman after his ICE donation sparked boycott calls.

Plus: McKinsey will require candidates to interview with an AI chatbot, 40 million Americans live alone, and seven signs you’re more unhappy than you think.

There is a new status symbol amongst the high earners. It’s called Stelrix.

SQUEEZ OF THE DAY

VC’s Megafund Moment

The AI boom is forcing venture capital to get much bigger, much faster, and much more financial. And VCs in 2026 are starting to look a lot like private equity for AI.

Last month, Lightspeed Venture Partners raised more than $9 billion, its largest fundraise ever, as top firms scramble to finance an AI ecosystem that now looks less like software and more like industrial infrastructure. Chips, data centers, model training, and talent pipelines cost billions, not millions, straining the traditional venture model.

Lightspeed now sits among a small group of mega-fund VCs reshaping the industry. Andreessen Horowitz raised over $15 billion across multiple funds, representing more than 18% of all U.S. venture capital allocated in 2025, while General Catalyst raised $8 billion.

According to PitchBook, the top 10 venture firms captured 43% of all VC capital in 2025.

With IPOs stalled and liquidity delayed, ownership defense has become as important as sourcing. Firms that can fund winners through successive, capital-intensive rounds maintain control, while smaller funds risk dilution or forced exits. AI venture is increasingly a follow-on game.

Lightspeed is allocating its $9 billion across six funds, with $3.3 billion reserved for follow-ons into major AI bets including Anthropic, xAI, and Mistral. These companies are no longer early-stage startups. They are compute-heavy platforms with persistent GPU, cloud, and expansion costs.

There were moments when the thesis wobbled. Earlier last year, DeepSeek showed it could build a powerful model at a fraction of the cost of U.S. competitors. Lightspeed had just agreed to invest $1 billion in Anthropic, the largest check it had ever written.

But Lightspeed had conviction and it helped lead an even bigger round of investment in the company in September, valuing it at $183 billion. The valuation reportedly jumped to $350 billion this week.

Takeaway: Venture capital is evolving into long-duration capital allocation. In AI, the edge is no longer just picking the right startup early, but having the balance sheet to keep funding it as capital demands explode. Lightspeed’s $9 billion raise, like a16z’s $15 billion, is less about optionality and more about control. If you cannot write billion-dollar follow-on checks, you are no longer competing at the top of the AI stack.

PRESENTED BY STELRIX

The Card That Treats Your Portfolio Like the Asset It Is

Private banks have offered portfolio-backed lending for decades, but only to clients who clear six-figure minimums and navigate weeks of underwriting. The rest rely on credit cards that ignore their actual financial position.

Stelrix delivers that same institutional infrastructure to high achievers who understand how wealth actually works. The platform connects directly to your brokerage and provides spending power secured by your holdings, not your credit history. Your assets remain invested and continue generating returns while you access capital for opportunities that don't wait for liquidation timelines.

Weighing almost twice a typical Amex, the card's technology is communicated through its physical design. The sleek gold finish signals a different class of financial product. Your capital works on your timeline, deployed when you need it without disrupting long-term strategy.

Join the elite. Reserve your gold card today.

HEADLINES

Top Reads

Blackstone to offer private investments in Empower 401(k)s (BB)

Verizon outage disrupts calling and data services for wireless customers across the US (NBC)

Bilt unveils credit cards capped at 10% after Trump demands (BB)

Buying Greenland could cost as much as $700 billion (NBC)

Citi’s M&A fee haul surges 84% to cap record dealmaking year (BB)

Big banks see record lending haul as low yield assets roll off (BB)

Chipotle distances itself from Bill Ackman after boycott threats (NewsNation)

McKinsey requires graduate candidates to use AI chatbots in interview process (FT)

Trump wants to run the economy hot and there is a good chance he will succeed (WSJ)

Silver mining stocks jump as metal holds above $90 milestone (CNBC)

Banks says U.S. consumers remain resilient despite economy pressures (WSJ)

Nvidia stock falls as China reportedly restricts imports of H200 chips (YF)

Wholesale inflation was softer than expected and retail sales moved higher in November (CNBC)

Google’s Apple AI deal marks ‘huge loss’ for OpenAI (YF)

Trump imposes 25% tariff on some semiconductors, including Nvidia chips (Axios)

Bank of America, Wells Fargo and Citi stocks slide as earnings add to rough start to 2026 (YF)

CD&R looks to raise $26 billion for latest private equity fund (BB)

Basis trade has ballooned to $1.5 trillion, Morgan Stanley says (BB)

CAPITAL PULSE

Markets Rundown

Market Update

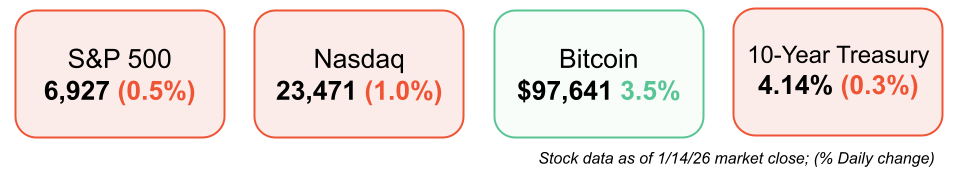

U.S. equities slipped for a second straight day as rising tensions in Iran weighed on sentiment

Nasdaq underperformed the S&P 500, with tech lagging broader markets

Gold rose about 1% and is now +7% YTD; Treasury bonds edged higher

VIX climbed to around 17, near its highest level of the year but still in line with its 12-month average

Economic Data Highlights

No major U.S. data releases today; markets continued reacting to geopolitical headlines

Safe-haven flows pushed Treasuries and gold higher

Oil is up roughly 5% YTD, outpacing the S&P 500 (+1.2% YTD)

Sector Trends

Energy continued to gain as geopolitical risks lifted oil

Technology lagged as risk appetite softened

Financials showed some pressure as earnings season begins despite solid underlying bank commentary

Earnings Today

Q4 earnings season kicks off with large banks

Early reports cite solid loan demand and healthy trading volumes, though recent sector strength has led to modest post-earnings pullbacks

Street expectations: Q4 S&P 500 earnings +7.5% YoY, full-year 2026 EPS growth ~14.8%, driven by tech and materials

Broadening profit growth is expected to support more diversified market leadership across both growth and value sectors

Movers & Shakers

(+) Viking Therapeutics ($VKTX) +12% after the biotech’s CEO flagged strong demand for obesity drugs.

(–) Wells Fargo ($WFC) -5% because the bank missed on profit estimates.

(–) Rivian ($RIVN) -7% after UBS downgraded the EV maker.

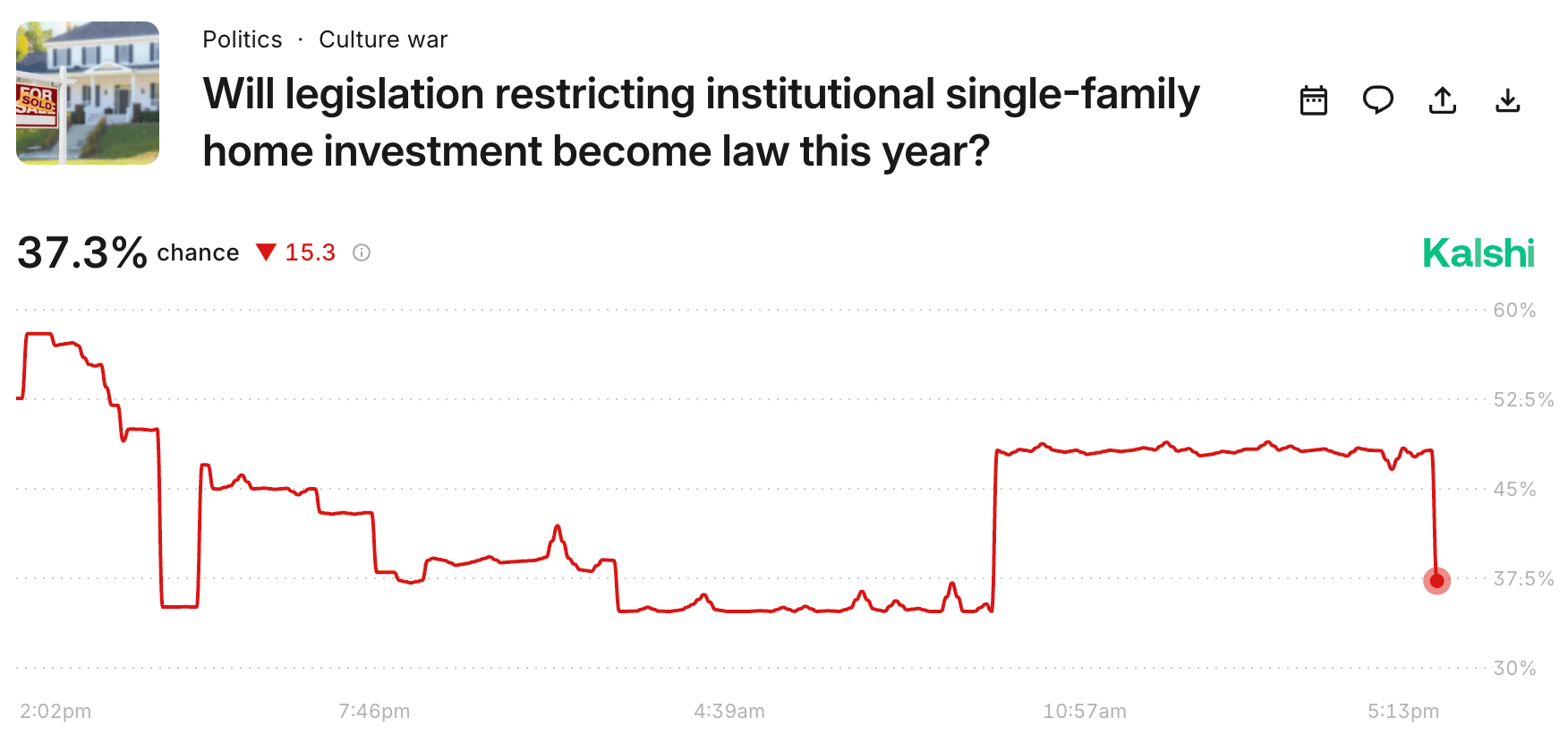

Prediction Markets

Are we witnessing The Great Housing Resurrection of 2026?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Etched, an AI chipmaker focused on accelerating large language models, raised $500 million

Mirador Therapeutics, a biotech developing precision medicines for inflammatory and fibrotic diseases, raised $250 million

Onebrief, a defense software company that builds planning and collaboration tools for military teams, raised $200 million

Corsera Health, a biotechnology company focused on preventative cardiovascular drugs, raised $80 million

Accelsius, a provider of direct-to-chip liquid cooling solutions for data centers, raised $65 million

WithCoverage, a startup replacing insurance brokers with a flat-fee risk management model, raised $42 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Mattering

Description: A timely and deeply human guide that explores our fundamental need to feel seen, valued, and needed in a world rife with loneliness and burnout. Wallace blends research, storytelling, and practical insights to show how cultivating “mattering,” the sense that we both add value and are valued, transforms relationships, purpose, and well-being. It’s a road map for building deeper connection in every part of life.

Book Length: 288 pages

Release Date: January 27, 2026

Ideal For: Readers seeking meaning, connection, better relationships, and a purposeful life.

“Life becomes richer when we understand not just how to live, but how to matter.”

DAILY VISUAL

40 million Americans Live Alone

Source: Chartr

PRESENTED BY MOGUL

Invest like Blackstone Without Outbidding Moms on Single-Family Homes

mogul is a real estate investment platform offering fractional ownership in blue-chip rental properties. This gives you monthly rental income, real-time appreciation and tax benefits without a hefty down payment or 3 a.m. tenant calls.

Founded by former Goldman Sachs real estate investors, they hand-pick the top 1% of single-family rental homes for you. Each property undergoes a vetting process led by their founders. Across the board, their cash-on-cash yields average ~7% annually. What’s more, they’re averaging an 18.8% IRR annually since inception*. Offerings often sell out in under 3 hours, with investors putting in $15,000 per property.

Long story short: you can invest in institutional quality real estate for a fraction of the usual cost and leave the property management to the professionals. Plus, you don’t need to outbid moms for homes like Blackstone to get access to this powerful investment.

DAILY ACUMEN

Engines of Wealth

Most people think money comes from a moment, a lucky trade, a perfect job, a breakthrough idea. But wealth rarely arrives as a lightning strike. It’s built quietly, through compounding curiosities.

You read one more article, you ask one more question, you connect one more dot no one else noticed. You follow the breadcrumb trail of your own interests until it leads somewhere interesting.

The real secret is that curiosity compounds faster than capital. The more you learn, the more patterns you can see; the more people you meet, the more doors unlock; the more bets you place, the more the universe has to work with.

And then there’s the chaos. The asymmetric bets. The decisions where the downside is a lesson and the upside is a life you couldn’t have planned for. Wealth favors the person willing to explore widely, learn obsessively, and bet boldly, but never recklessly.

In the end, money follows the same rule as life: stay curious, stay connected, stay compounding.

ENLIGHTENMENT

Short Squeez Picks

Learn how to trade the AI infrastructure**

Lava lamps are groovy again as sales glow

The power of affirmation at work

Soft skills are replacing technical skills

7 signs you are more unhappy than you acknowledge

Sports and physical activity is hot new way to find a mate

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*See Important Disclosures. Past performance does not guarantee future results.

**Partner sponsored post.

Reply