- Short Squeez

- Posts

- 🍋 Trump’s $2,000 Tariff Dividend

🍋 Trump’s $2,000 Tariff Dividend

Plus: 50-year mortgages, millionaires value trainers/therapists more than wealth advisors, crypto winter is here, and banks reversing ESG pledges.

Together With

“The desire to be smarter than the market is usually a sign that you’re not.” — Michael Mauboussin

Good Morning! Sweetgreen will sell the robotics unit it bought in 2021 for $70 million to Wonder for $186 million. The Trump administration is “working on” introducing 50-year mortgages for home buyers. And a new study found that millionaires value their trainers and therapists more than their wealth advisors.

Crypto’s 20% slide over the past month has erased nearly all of 2025’s gains. Banks are quietly walking back ESG pledges and upping financing to companies linked to deforestation.

Plus: Turks are driving hours to Greece to buy cheese and avoid higher inflation, and the difference between being frugal and being cheap.

Find the edge your investment firm needs with Blueflame’s purpose-built AI.

SQUEEZ OF THE DAY

Trump’s $2,000 Tariff Dividend

President Trump floated a wild idea on social media this weekend: giving most Americans a $2,000 “dividend” funded by tariff revenues. The proposal, which he’s teased before, would exclude high earners and rely on what he described as “trillions” collected from tariffs.

The numbers tell a different story. The Treasury has taken in roughly $195 billion in tariff duties so far this year, according to its September report, and is on pace to reach $250 billion by year-end. That’s a record high, but well short of the $450 billion-plus required to fund $2,000 payments for most U.S. households.

At an average effective tariff rate of nearly 18%, the highest since 1934, per Yale’s Budget Lab, the costs have already filtered through to consumers. Businesses have passed higher import prices downstream, and while revenues have surged, so have input costs. Economists at Goldman Sachs estimate the current tariff structure could shave 0.3% off GDP annually if sustained.

Treasury Secretary Scott Bessent has said the administration’s goal is to rebalance trade and strengthen domestic manufacturing, not to fund cash payouts. He left the door open to smaller, rebate-style tax relief in the future but stressed that debt reduction remains the priority.

There’s also a legal wrinkle. Roughly half of tariff revenues stem from duties imposed under emergency powers that are now under review by the Supreme Court. If the Court rules against the administration, those revenues could be reversed and refunded.

Takeaway: The tariff dividend may be more politics than policy. Revenues are rising, but the costs are, too. Higher prices, slower trade, and legal uncertainty could wipe out any fiscal upside. What sounds like free money today could tighten economic conditions tomorrow… though the only real beneficiaries might be Robinhood and DraftKings.

PRESENTED BY BLUEFLAME AI

AI Built for Investment Firms

Generic enterprise LLMs offer broad capabilities, but when it comes to deal execution, due diligence, and portfolio monitoring, their domain gaps become costly roadblocks. Blueflame AI is built specifically for investment managers and deal professionals.

Blueflame’s purpose‑built AI connects natively across your ecosystem, whether it’s SharePoint, your CRM, market data providers, or internal research systems. It doesn’t just summarize; it reasons, executes multi‑step tasks, and builds a unified “firm memory” that’s tailored to private markets. One global PE firm using Blueflame’s workflows cut email drafting time by 60%, with 90% of outputs needing only light edits.

General models remain useful for generic content and experimentation. But for firms seeking sustained ROI and true operational leverage, the edge comes from AI built around the deal lifecycle, financial nuance, and integrated systems.

Please Support Our Partners!

HEADLINES

Top Reads

Sweetgreen to sell robotic salad unit to Wonder for $186 million (BB)

Trump administration proposes 50-year mortgages to boost housing (Hill)

Millionaires value their personal trainers, therapists more than wealth advisors (CNBC)

Crypto bear market wipes out nearly all of 2025’s gains (BB)

Global banks increase financing to companies linked to deforestation (BB)

Turks drive hours to buy cheese in Greece to escape inflation (BB)

Warren Buffett’s cash fortress helps Berkshire close the gap with the S&P 500 as AI jitters hit Wall Street (CNBC)

KKR revenue and profit rise on insurance growth (WSJ)

Number of billion-dollar U.S. IPOs lags behind private funding rounds (BB)

Who’s worried about a “private-credit winter”? (WSJ)

Brookfield sees strong fundraising momentum after banking $30 billion (WSJ)

Consumer sentiment sinks amid shutdown fears (CNBC)

What Elon Musk must do to earn his $1 trillion Tesla pay package (YF)

Potential Palm Beach teardown listed for $185 million (WSJ)

Hedge-fund manager Sandler says he’ll keep his firm in New York for now (BB)

OpenAI leans on debt to fund data-center expansion (NYT)

Japan’s largest tech fund says AI stocks aren’t yet in bubble territory (BB)

Sweetgreen cuts 2025 outlook after sales drop (BB)

Hedge funds for the masses gain traction on Wall Street (WSJ)

KPMG axes ‘busy season’ overtime pay for junior auditors (FT)

CAPITAL PULSE

Markets Rundown

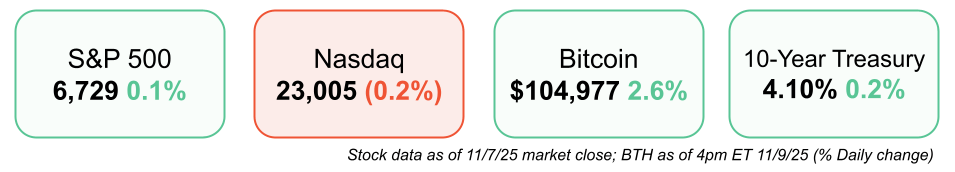

Market Update

Stocks finished mostly higher despite another weak day for tech, with the Nasdaq slightly lower.

Materials, energy, and consumer staples gained more than 1%, helping lift the Dow and S&P 500.

S&P 500 ended the week down 1.6%, led lower by tech, though still up more than 14% year-to-date.

Overseas markets fell, with Japan’s Nikkei down 4% for the week and Europe also lower.

10-year Treasury yield held near 4.1%, little changed on the day.

Economic Data Highlights

Private data signals steady activity as the federal shutdown enters its sixth week.

ISM Manufacturing slipped to 48.7, but new orders and export orders improved.

ISM Services climbed to 52.4, its strongest since February, with firm demand and better employment readings.

ADP payrolls rose 42,000, ending a two-month streak of job losses, while Challenger job cuts jumped.

Consumer sentiment weakened, though underlying economic trends remain stable.

Earnings Today

Monday.com (MNDY) – Focus on enterprise demand and net retention trends.

CoreWeave (CRWV) – Focus on updated AI-compute demand commentary.

Instacart (CART) – Key areas include order growth and margin outlook.

Movers & Shakers

(+) Expedia ($EXPE) +18% after the travel booking company raised its guidance.

(+) Peloton ($PTON) +14% because the stationary bike company released a strong earnings report.

(–) Sweetgreen ($SG) -7% after the salad chain announced lower same-store sales.

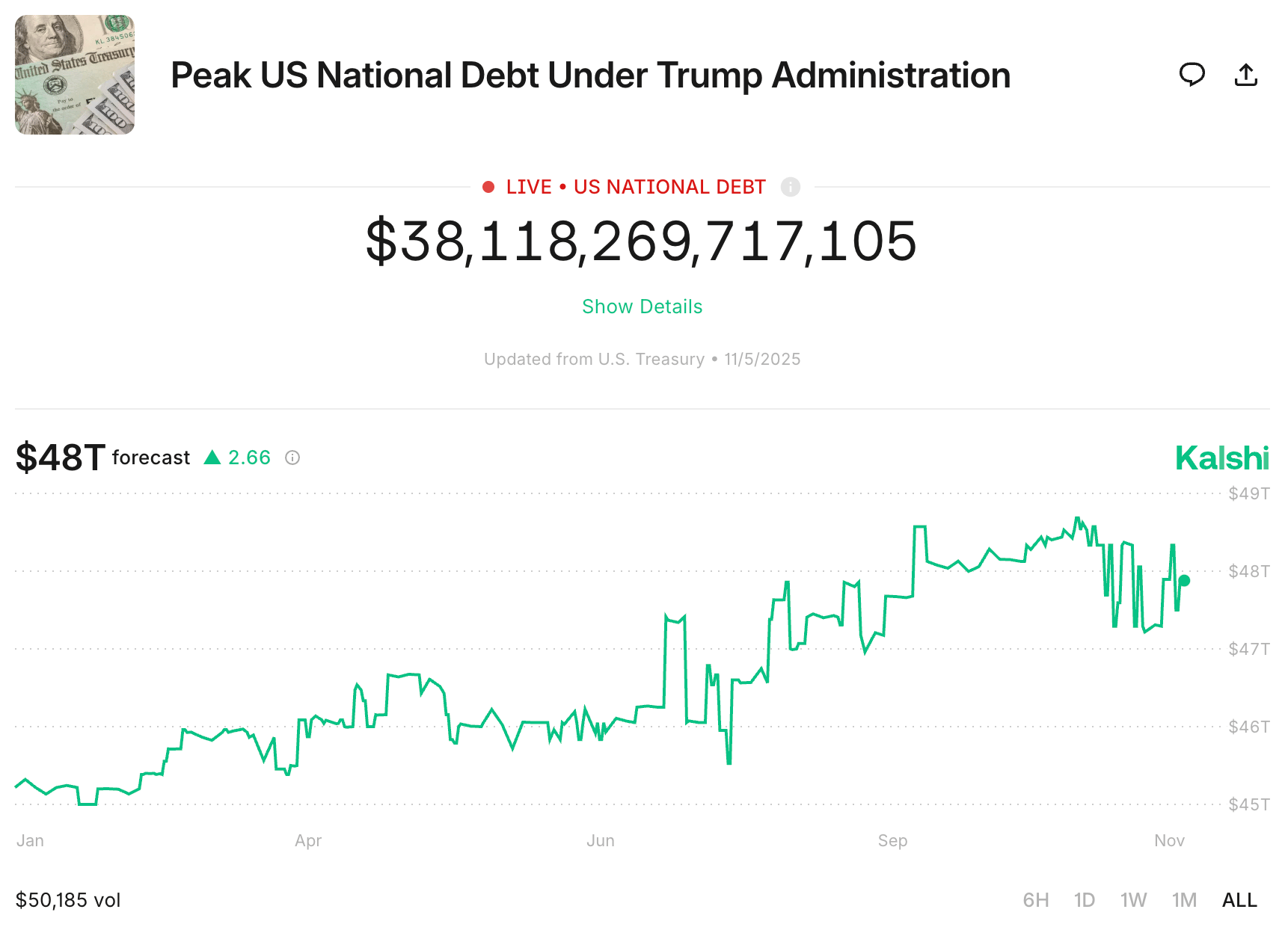

Prediction Markets

How high will the national debt rise?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

EQT agreed to invest $930 million for a 28% stake in Douzone

Metropolis, a tech-enabled parking lot network, raised $500 million

Wonder, a food hall concept, bought the Spyce robotic kitchen business from Sweetgreen for $186 million

AAVantgarde Bio, a maker of gene therapies for eye disease, raised $141 million

Neok Bio, a cancer drug developer, raised $75 million

Upway, a provider of refurbished e-bikes, raised $60 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

2034: How AI Changed Humanity Forever

Description: A forward-looking narrative that imagines the pivotal decade when artificial intelligence didn’t just transform industries—it re-wired human purpose, work, creativity, and identity. Told from a future vantage point, this book explores how a world shaped by AI could be both more capable and more vulnerable, and how our humanity might adapt—or crumble—in the face of relentless change.

Book Length: 164 pages

Release Date: 2024

Ideal For: Tech thinkers, futurists, policy watchers, anyone curious about life in an AI-driven future—what changes, what disappears, and what remains uniquely human.

“What we build today may redefine who we are tomorrow—and that future is already in motion.”

DAILY VISUAL

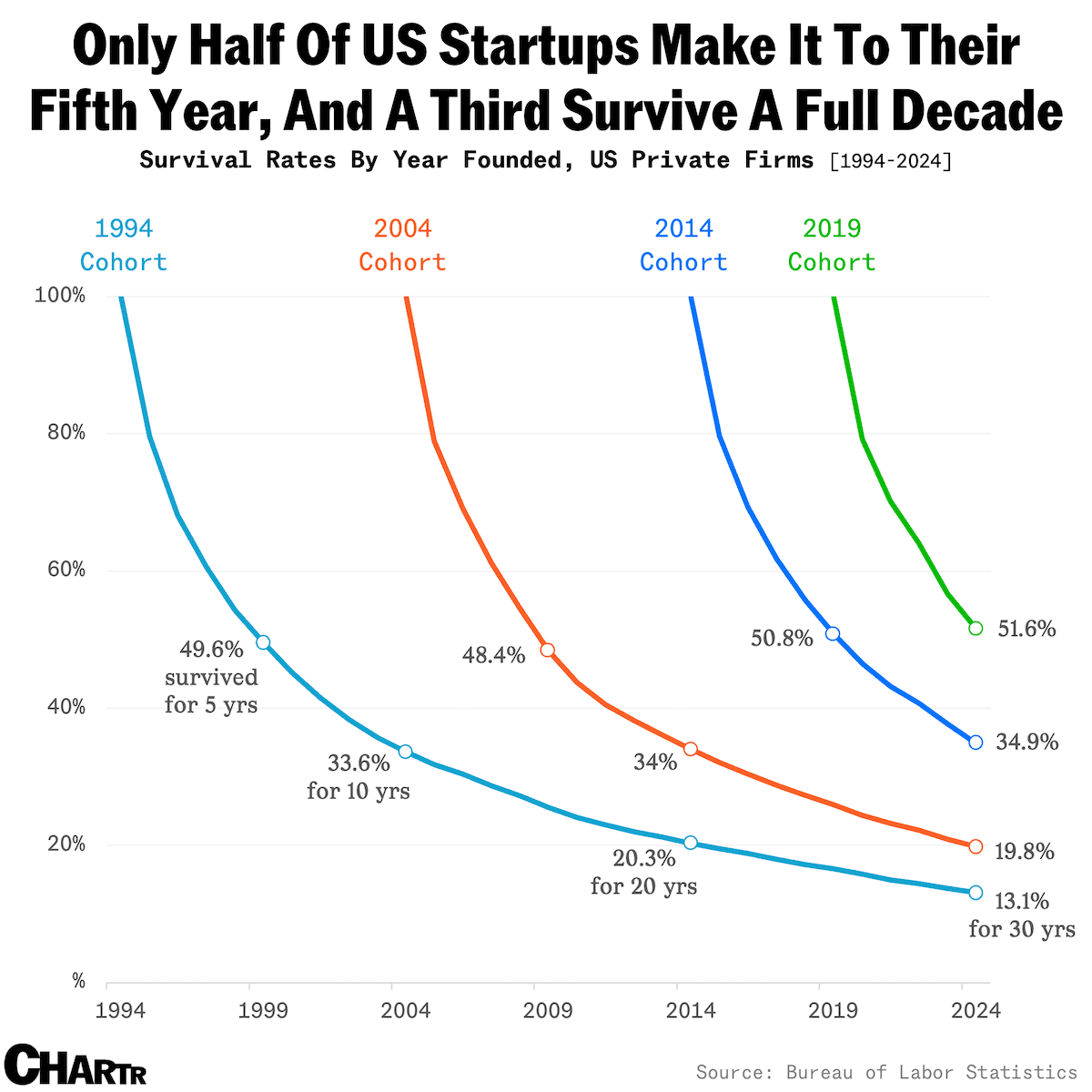

Half of New US Firms Disappear Within 5 Years

Source: Chartr

PRESENTED BY FRE

Performance for the Clutch Moments

Traditional nicotine pouches cluster around 3mg to 6mg. FRE identified a segment of professionals requiring more options for the high pressure moments.

FRE provides one of the widest strength ranges available: 3mg to 15mg, with a pre-primed tech that activates on contact. Each can contains 20 pouches versus a typical 15, offering more consistent usage across long workdays.

Tobacco-free, spit-free, and engineered for professionals who need results during IC marathons, board presentations, and 2am model builds.

Please Support Our Partners!

DAILY ACUMEN

Irreplaceability

AI doesn’t replace people. It replaces patterns. The more predictable your workflow becomes, the easier it is for a model to replicate.

For years, being “consistent” was a compliment. Now it’s a warning label. Automation feasts on routines, not creativity.

Your edge is the one thing machines can’t imitate: curiosity. The willingness to notice something odd, ask a better question, combine two unrelated ideas, or change your approach simply because it feels stale.

AI optimizes for probability. Humans are built for possibility.

If your value comes from repeating steps, you’re replaceable. If it comes from insight, improvisation, and play, you’re not. The people who stay relevant are the ones willing to break their own patterns before the world breaks them.

Predictability can be automated. Curiosity can’t.

ENLIGHTENMENT

Short Squeez Picks

The difference between being frugal and cheap

5 discreet signs you’re in a wealthy person’s home

How to turn uncertainty into your biggest opportunity

17 tips to stay motivated

5 tricks to make your run faster and more fun

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply