- Short Squeez

- Posts

- 🍋 This Deal Is Ruining Christmas

🍋 This Deal Is Ruining Christmas

Plus: Databricks hits $134B as AI money pours in, oil crashes below $55, and JPMorgan lets clients borrow against luxury cars.

Together With

“Your salary makes you middle class. Your spending makes you poor. Your investments make you rich.” — Naval Ravikant

Good Morning! Databricks is raising $4B+ in Series L funding at a $134B valuation, up 34% from its last round. JPMorgan will let wealthy European clients borrow against luxury cars. Oil slid below $55 a barrel, a four-year low.

High-speed traders are feuding over shaving 3.2 billionths of a second. Apollo is weighing a $12B sale of Atlas Air. EQT discusses its humanoid robot rollout, and Carlyle is set to lose $100M+ on its loan to now-bankrupt iRobot.

Plus: “Vibe coding” startup Lovable valued at $6.6B. Goldman and BofA back the Texas Stock Exchange with $20M, global brands turn to private equity to salvage their Chinese businesses, and how to succeed as a late bloomer.

Start the new year off by rewarding yourself for paying rent (and your mortgage, soon). Join Bilt today.

SQUEEZ OF THE DAY

This Deal Is Ruining Christmas

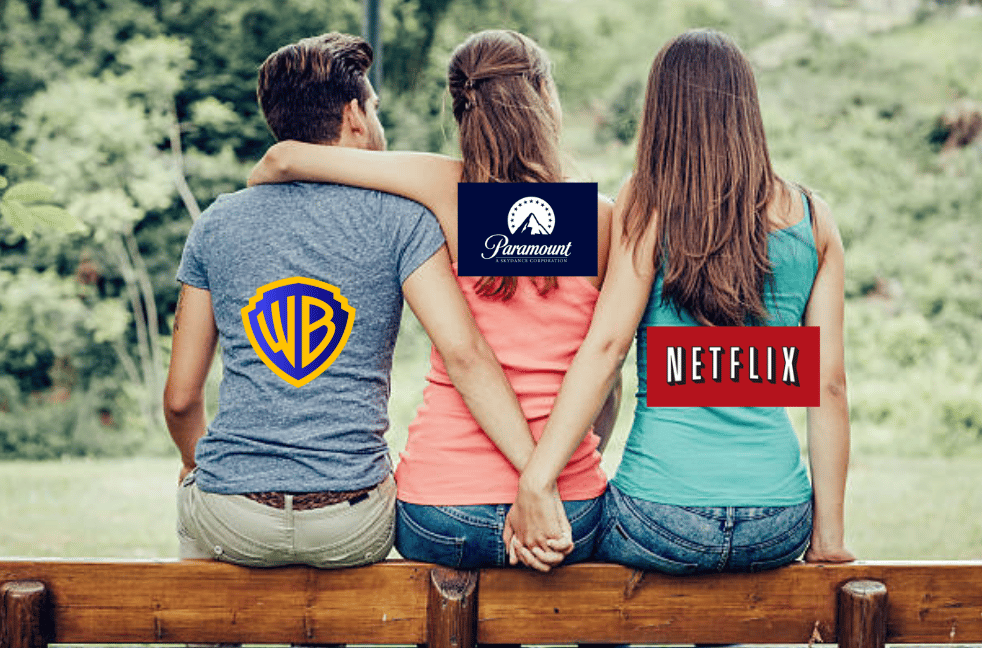

The Warner Bros. Discovery saga took another turn yesterday afternoon, after reports broke that the company plans to urge shareholders to reject Paramount’s $108.4 billion hostile bid and back Netflix’s $83 billion deal. Jared Kushner’s Affinity Partners withdrew from the Paramount offer yesterday, but David Ellison is still insisting his funding remains intact.

One thing’s for certain though. No matter how this ends, Wall Street gets paid. Advisors on all sides are in line for massive fees and, privately, would not mind seeing the auction drag out a little longer.

If the bidding escalates, advisory and financing fees could easily climb into the hundreds of millions. The only downside is that some bankers may be working straight through the holidays.

“I’ve skipped Christmas Eve and New Year’s for far smaller transactions,” said Dwayne Safer, a former Stifel banker who is now a finance professor at Messiah University.

Another banker added: “When NBA players play on Christmas Day, no one says their holiday is ruined. They say, ‘Isn’t it great you’re in the NBA?’ For investment bankers, this is the equivalent. This is as good as it gets.”

Here are the banks involved:

Warner Bros. Discovery is advised by Evercore, J.P. Morgan, and Allen & Company

Netflix’s bid is being advised by Moelis, with Wells Fargo providing more than half of a $59B bridge loan alongside BNP Paribas and HSBC.

Paramount is advised by Centerview, M. Klein & Co., Bank of America, and Citigroup, with financing from BofA, Citi, and Apollo.

Goldman Sachs and Morgan Stanley are among the notable losers after advising Comcast on an unsuccessful competing bid for WBD.

Takeaway: This deal probably isn’t getting done anytime soon, RIP to the bankers putting in NBA-level performances this festive period. But if it does close, it could meaningfully reshuffle the league tables and deliver a massive windfall for the banks involved. And if Netflix ultimately wins, Moelis may cement its place as the elitest boutique.

PRESENTED BY BILT

Earn on Your Biggest Monthly Expense

Rent is likely your largest recurring expense, but until now, it's been money that just disappears every month with nothing to show for it (other than a roof over your head). You get rewarded for your coffee, your groceries, your flights. But your rent? Bilt makes sure that earns you something too.

Bilt is the loyalty program for renters that turns every rent payment into points you can use toward travel, Lyft rides, Amazon.com purchases, and more. The loyalty program works with your existing lease, no matter where you live. You're already paying rent, now you can get rewarded for it.

And, starting in February, Bilt is expanding to mortgage payments for the first time. Homeowners will be able to earn points on their monthly payments just like renters do, and unlock exclusive benefits around their neighborhood at over 45,000 restaurants, fitness studios, pharmacies, and more. Whether you rent or own, your housing payment finally works for you.

Please Support Our Partners!

HEADLINES

Top Reads

Databricks is raising funds at a $134 billion valuation (WSJ)

JPMorgan will let its rich European clients borrow against their luxury cars (BB)

Oil prices fall to 4-year low below $55 as supply glut shows up (YF)

High-speed traders are feuding over a way to save 3.2 billionths of a second (WSJ)

Vibe coding startup Lovable's latest funding round values it at $6.6 billion (CNBC)

Apollo weighs potential $12 billion sale of Atlas Air (BB)

Carlyle loses over $100 million on soured loan to Roomba maker (BB)

Goldman, BofA push Texas stock exchange’s haul to $270 million (BB)

Global brands seek private equity partners to save their China businesses (FT)

Defense giants say investors should still bet on them, even as hopes for Russia-Ukraine deal sparks a selloff (CNBC)

Private equity giant EQT discusses its humanoid robot rollout (Axios)

Wall Street is wary of stocks bearing the economy (Axios)

AI is about to empty Madison Avenue (WSJ)

US bank lending to competitors surged 26% this year, Fitch says (BB)

CLO managers bet big on buyout revival to lift profits in 2026 (BB)

JPMorgan executive urges Europe to move faster on reforms (BB)

Amateur prop traders chase elusive profits in simulated markets (BB)

Startup backed by Altman, JPMorgan announces partnership with Amazon (CNBC)

Here’s a new angle on private equity’s volatility laundering (FT)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks mixed as investors digested delayed labor data; the Nasdaq edged higher on strength in technology and consumer discretionary, while the Dow lagged amid declines in health care and energy.

Payrolls rose 64K in November, above expectations, but the unemployment rate climbed to 4.6%, the highest since October 2021.

Global markets were softer overnight, with Asia and Europe lower; oil fell >2% on renewed Russia-Ukraine peace hopes.

Treasury yields slipped, with the 10-year around 4.15%.

Economic Data Highlights

Retail sales (Oct.) were flat headline, but control-group sales jumped 0.85%, beating estimates and pointing to resilient consumer demand.

Labor market shows cooling, not distress: job gains modest, unemployment higher largely due to labor-force expansion.

Inflation ahead: November CPI due Thursday, with headline and core expected at 3.1% YoY; October CPI will not be released due to the shutdown.

Earnings Today

GIS – Watch pricing power and volume trends in packaged foods.

JBL – Focus on electronics manufacturing demand and margins.

MU – Key read on memory pricing, AI-related demand, and inventory normalization.

Movers & Shakers

(+) Circle Internet Group ($CRCL) +10% after Visa announced that transactions can be settled with Circle’s stablecoin.

(+) IONQ, Inc. ($IONQ) +8% because Jefferies initiated coverage on the quantum stock with a buy.

(–) Frontier Group ($ULCC) -11% after the airline’s CEO announced he will depart.

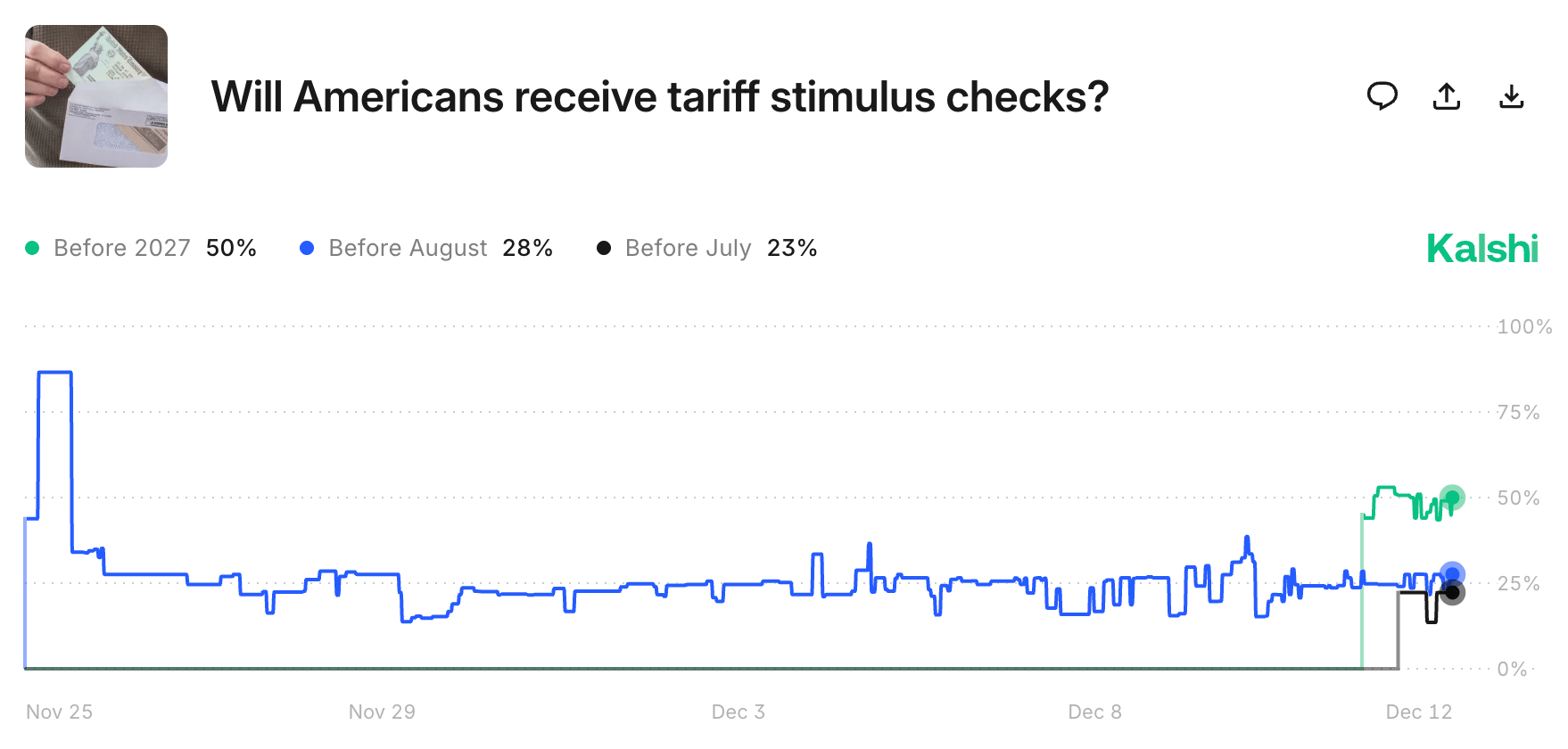

Prediction Markets

There’s only a 1% chance we get a Christmas bonus from the government.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Databricks, a data analytics software, is raising $4 billion

Holcim, a global building materials company, acquired a majority stake in Cementos Pacasmayo, a building materials producer, for $1.5 billion

Carlyle, a private equity firm, acquired Hogy Medical, a maker of surgical kits, for $1 billion

Cvent, an event management software company owned by Blackstone, acquired Goldcast, a video content platform, for $300 million

Chai Discovery, a developer of AI-designed molecules, raised $130 million

Last Energy, a developer of micro-nuclear reactors, raised $100 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Magnetic

Description: A refreshing take on manifestation that blends neuroscience, psychology, and practical habits into a grounded path for shaping your life. Livezey strips away the fluff of vision boards and affirmations, focusing instead on identity, belief systems, and behavior shifts that make goals not just wished for — but lived. It’s part mindset guide, part actionable playbook for becoming the person who naturally attracts the life you want.

Book Length: 304 pages

Release Date: 2025

Ideal For: Self-improvers, creators, entrepreneurs, and anyone curious about turning inner beliefs into outer results.

“You don’t manifest what you want — you manifest who you are becoming.”

DAILY VISUAL

US Demographics Are Changing

Source: Apollo

PRESENTED BY FARSIGHT

AI-Generated Pitch Materials for Deal Teams

Creating CIMs, pitch decks, and sector deep dives is still a manual grind for most deal teams.

Farsight is an AI agent purpose-built for investment banks and PE firms, designed to replicate your team’s full execution workflow 100x faster.

Built by ex-bankers and investors, Farsight generates:

Fully formatted pitch materials

Rationale-backed comps and benchmarking

Strip profiles, data room outputs, and buyer lists

Excel backups with cell comments and firm-style formatting

It doesn’t summarize; it executes. Analysts use it to turn weeks of work into minutes, without sacrificing quality or control.

Please Support Our Partners!

DAILY ACUMEN

Speed

Mark Zuckerberg's original motto for Facebook was "Move fast and break things." Reid Hoffman, co-founder of LinkedIn, famously said, "If you're not embarrassed by the first version of your product, you've launched too late."

Amazon's Jeff Bezos makes reversible decisions quickly, reserving slow deliberation only for irreversible ones.

The world's most successful people understand something counterintuitive: speed is often more valuable than perfection. Perfectionism isn't about high standards, it's about fear wearing a disguise.

Every day you wait to start is a day you're not learning, not iterating, not improving. The first draft of anything is garbage - E.B. White knew it, Hemingway knew it, every successful creator knows it.

But you can't edit a blank page. Ship it. Launch it. Start it messy and improve it later. Speed creates momentum, generates feedback, and builds confidence.

What are you overthinking that you could just do today? Remember, done is better than perfect, and perfect is the enemy of done. Action, even imperfect action, beats perfect planning every single time.

ENLIGHTENMENT

Short Squeez Picks

How to be successful as a late bloomer

The benefits of lemon water

7 conversation habits of naturally likable people

Money boundaries and mental health

How to effectively level up your leadership

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply