- Short Squeez

- Posts

- 🍋 The Venezuela Trade

🍋 The Venezuela Trade

Plus: The top-performing hedge funds of 2025, the 39-round Goldman Sachs interview, and Meta’s Reels became a $50 billion business.

Together With

“Maduro effed around and he found out.” — Pete Hegseth, United States Secretary of War

Good Morning! Welcome to Mondayest Monday of the year. Tesla’s Q4 deliveries fell far more than expected, and BYD surpassed Tesla as the world’s largest EV seller. Hedge funds capped a strong 2025, on pace for their best year in at least five years, with Bridgewater’s Pure Alpha II up 34%, its best performance ever.

Apollo data shows companies are staying private longer, with the median age now at 14 years. Brooklyn Mirage is set to reopen as Pacha New York, and banks are earning higher fees on green bonds than on fossil-fuel debt.

Plus: How Meta’s Reels became a $50 billion business, OpenAI taking on Apple’s app store dominance, the Goldman Sachs interview process that dragged through 39 one-on-ones, and is a Birkin bag actually a good investment?

New year, new yield. Earn 5-15% on your cash with YieldClub.

SQUEEZ OF THE DAY

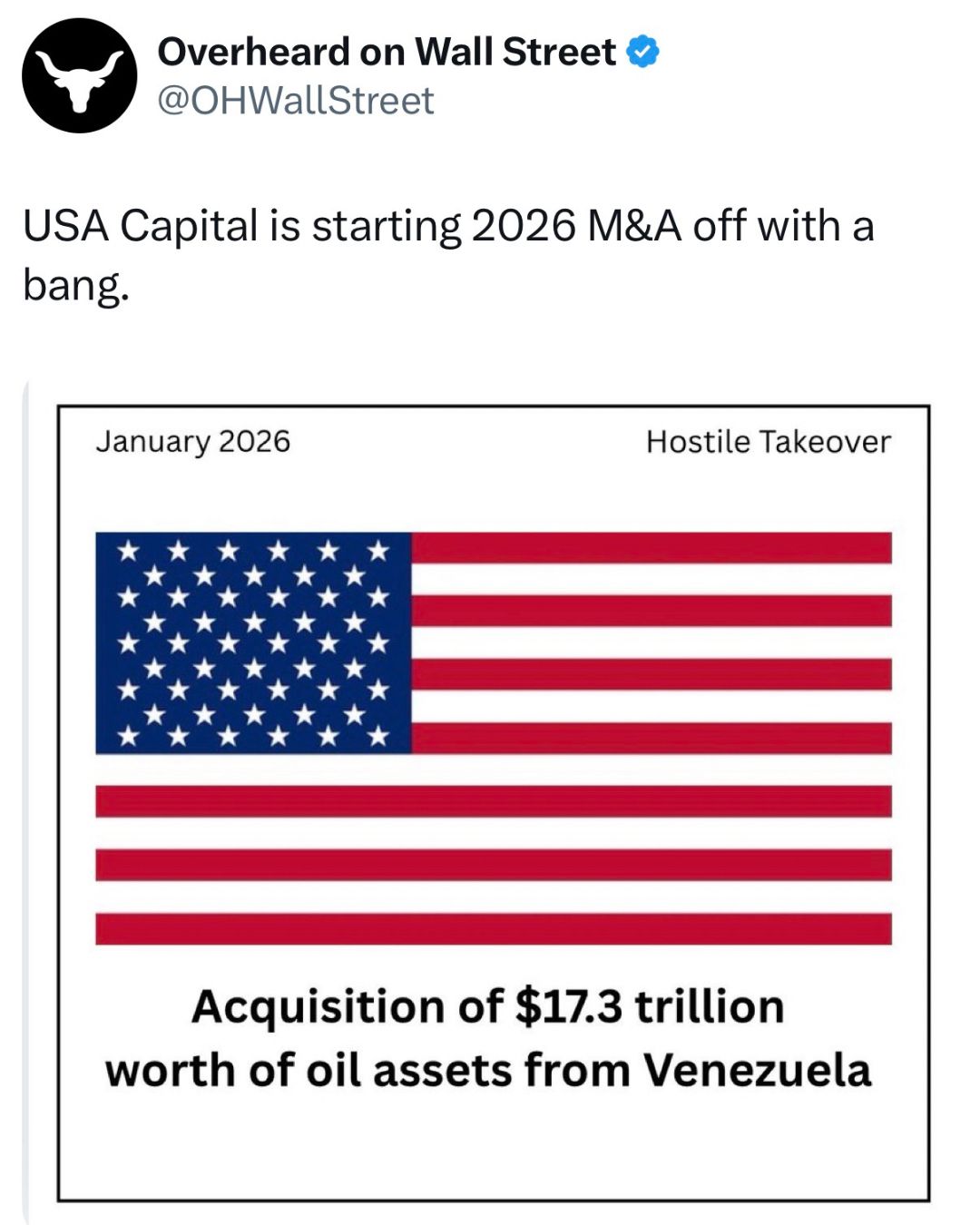

The Venezuela Trade

The capture of Venezuela’s Nicolás Maduro is already one of the biggest foreign-policy stories of the decade. Within hours, Wall Street was already modeling how to monetize it and picking the winners and losers.

Take Charles Myers, chairman of Signum Global Advisors and former head of investment advisory at Evercore. He is planning a fact-finding trip to Caracas as soon as March, alongside ~20 senior figures from hedge funds, asset managers, and the energy and defense sectors.

The group expects to meet directly with the new government, including the president, finance minister, energy minister, central bank head, and stock-exchange officials.

Venezuela has obvious draws and natural resources and sits on the world’s largest proven oil reserves ($20+ trillion of oil at current prices). The country also has massive untapped natural gas, critical minerals, and decades of underinvested infrastructure.

Myers estimates the country could see $500 billion to $750 billion in foreign investment opportunities over the next five years if a market-friendly government sticks. That would make Venezuela one of the biggest reconstruction and reopening trades anywhere on Earth.

Venezuela was economically isolated for years rather than being structurally broken. The assets are there, and the pipelines, ports, and refineries still exist. If sanctions ease and foreign capital is welcomed, reopening could happen faster than in many post-crisis countries because Venezuela already sits inside global energy and commodity supply chains.

U.S. officials are also encouraging major oil companies to help rebuild Venezuela’s energy sector, framing it as critical to getting oil “flowing the way it should.”

Chevron, currently the only U.S. oil major operating in the country, stands to benefit most, while ExxonMobil and ConocoPhillips are watching closely from the sidelines. A sustained political shift could also trigger a re-rating of Venezuela’s deeply distressed sovereign debt.

Takeaway: Venezuela has been socialist for nearly thirty years, and money isn’t flooding in tomorrow, but the roadshow has begun. Institutional capital is already positioning for what could become one of the largest resource-driven recovery stories of the decade.

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money to Make Money in the New Year

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 5–15% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

HEADLINES

Top Reads

Tesla reports annual vehicle deliveries fell for second straight year (YF)

Ken Griffin’s flagship hedge fund at Citadel rises 10.2% in volatile 2025 (CNBC)

Bridgewater, D.E. Shaw among top hedge fund gainers of 2025 (BB)

More companies staying private for longer (Apollo)

Banks notch higher fees from green bonds than fossil fuel debt (BB)

Italian pasta makers get a break from Trump tariffs (Axios)

RH, Wayfair shares rise after Trump delays furniture tariffs again (CNBC)

How Meta’s Reels became a $50 billion business (WSJ)

OpenAI aims to chip away at Apple's app store dominance (WSJ)

Man says Goldman Sachs put him through 39 one-on-one interviews (Fortune)

Is a Birkin bag a good investment? (BB)

Trump's wealth grew in 2025, but his investors took lumps (Axios)

Brooklyn Mirage owner set to sell venue to Pacha parent (BE)

A 5,000,000% return in 60 years leaves Warren Buffett’s legacy unmatched (CNBC)

Apollo to sell Coinstar to Alaska buyer, bonds set to be repaid (BB)

Cantor says closing of UBS hedge fund deal to continue into 2026 (BB)

Quiet luxury is coming for the housing market (Fortune)

The $358 billion question for the new CEO of Berkshire Hathaway (WSJ)

The year the newsletter business reached a fever pitch (WSJ)

CAPITAL PULSE

Markets Rundown

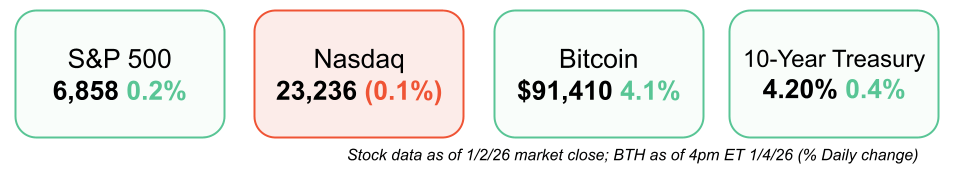

Market Update

Global equities opened 2026 mostly higher, led by Asia and U.S. small- and mid-caps

Asian markets rallied after renewed AI optimism, with several indexes hitting fresh highs

U.S. markets were mixed; semiconductor strength wasn’t enough to lift the Nasdaq

Oil moved lower following its steepest annual decline since 2020; silver extended strong momentum

Sector Trends

Pro-cyclical leadership emerged in U.S. small- and mid-cap stocks

Technology sentiment improved globally, particularly around AI developments in China

Precious metals continued to attract flows after a standout 2025

Corporate & Macro Notes

Berkshire Hathaway formally named Greg Abel as CEO, succeeding Warren Buffett

No major U.S. economic data releases on the first trading day of the year

Investor optimism carried over from a strong 2025, despite elevated valuations

Economic Data Highlights (Looking Ahead)

ISM Manufacturing (Mon); ADP payrolls, ISM Services, JOLTS, factory orders (Wed); jobless claims and productivity (Thu); jobs report and consumer sentiment (Fri)

Recent labor data show mixed signals, with unemployment at 4.6%, driven in part by rising labor force participation

Outlook

After multiple years of double-digit gains, earnings growth is expected to drive returns in 2026

AI remains a key long-term tailwind, but leadership is likely to broaden across sectors and regions

A balanced, diversified portfolio remains favored as the bull market enters its fourth year

Movers & Shakers

(+) CoreWeave ($CRWV) +11% after an Nvidia-led tech rebound lifted the AI rally.

(+) Restoration Hardware ($RH) +8% because Trump will delay tariffs on furniture.

(–) Tesla ($TSLA) -3% after the EV maker's Q4 sales fell a lot more than expected.

Prediction Markets

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Correspondent

Description: A warm, epistolary novel that traces the life of Sybil Van Antwerp through the letters she writes and receives — to friends, family, authors she admires, and even those she’s never sent. Told with quiet humor, tenderness, and insight, the story explores aging, regret, love, connection, and the power of words to shape and redeem a life.

Book Length: 304 pages

Release Date: April 29, 2025

Ideal For: Literary fiction lovers, book clubs, readers who appreciate character-driven stories about life’s second acts, and anyone who savors the beauty of language and connection.

“Life doesn’t arrive all at once — it’s delivered one letter at a time.”

DAILY VISUAL

More Companies Staying Private for Longer

Source: Apollo

PRESENTED BY FRE

Performance for the Clutch Moments

Traditional nicotine pouches cluster around 3mg to 6mg. FRE identified a segment of professionals requiring more options for the high pressure moments.

FRE provides one of the widest strength ranges available: 3mg to 15mg, with a pre-primed tech that activates on contact. Each can contains 20 pouches versus a typical 15, offering more consistent usage across long workdays.

Tobacco-free, spit-free, and engineered for professionals who need results during IC marathons, board presentations, and 2am model builds.

DAILY ACUMEN

Potential

There's a haunting question that keeps people paralyzed: "What if I'm wasting my potential?"

A Stanford graduate turns down job offers because none feel "big enough" for her talents. A musician won't release songs because they're not "masterpiece-worthy yet." A writer hoards ideas, waiting for the perfect moment to execute them brilliantly.

Meanwhile, years pass. Nothing gets created. Potential remains just that, potential. Here's the uncomfortable truth: unrealized potential is worthless.

It's a cruel comfort blanket that keeps you warm while your dreams freeze to death. The person doing mediocre work and shipping it is infinitely ahead of the "talented" person doing nothing.

Picasso created over 50,000 works in his lifetime, not all masterpieces, but all evidence of a life fully lived. Your potential doesn't care about perfection; it expires from inaction.

What project are you not starting because you're afraid it won't live up to your potential?

Remember, the graveyard is the richest place on earth, filled with books never written, businesses never started, and songs never sung. Don't let your potential die with you.

ENLIGHTENMENT

Short Squeez Picks

A reward program for the 21st century

Why you should skip Dry January

How to love learning again

Your brain changes at 9, 32, 66, and 83

Most goals fail, says financial psychologist, 4 steps to actually achieve yours

Wealthy renters are customizing their spaces, and landlords are all for it

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply