- Short Squeez

- Posts

- 🍋 The Pick Is In

🍋 The Pick Is In

Plus: Gold and silver post their worst day since 1980, silver tanks 30%, Bitcoin slides below $80,000, Apollo posts 18% retail returns, and Waymo eyes a $110 billion valuation.

Together With

“My largest positions aren’t the ones I think I’m going to make the most money from. My largest positions are the ones where I don’t think I’m going to lose money.” — Joel Greenblatt

Good Morning! Friday was brutal day for markets. Gold and silver had their worst drop since 1980, with silver plunging 30%. Bitcoin slipped below $80,000 as investors weighed the metals rout and Trump’s Fed chair pick. Alphabet’s Waymo is reportedly raising $16 billion at a $110 billion valuation.

Apollo delivered an 18.3% return for individual investors last year by leaning into single-asset deals. JPMorgan is syndicating $20 billion of debt tied to the EA buyout. And investors think Meta’s AI spending may finally be paying off.

Plus: Ares and JPMorgan are backing a $525 million loan for High Line condos, GameStop’s CEO eyes a $35 billion payday, and a new iPhone feature is annoying the rich and powerful.

Equip yourself with tools that allow you to focus longer. Try FRE today.

SQUEEZ OF THE DAY

The Pick is In

On Friday, President Donald Trump officially nominated Kevin Warsh as his choice for the next Federal Reserve chair. Wall Street reacted quickly: the U.S. dollar strengthened, the Treasury yield curve steepened, and gold and silver fell as markets priced in a leader less inclined to use the Fed’s balance sheet as an easy policy tool.

If confirmed, Warsh would replace Jerome Powell in mid-May and take over a central bank under strain. Inflation has cooled but not disappeared, politics are becoming louder, and markets are hypersensitive any time the Fed chair speaks.

Warsh has long been skeptical of quantitative easing and aggressive balance-sheet expansion. After his nomination, gold and silver pulled back as the dollar strengthened, meaning investors see less appetite for reflexive money printing.

Strategists argue that Warsh’s emphasis on Fed credibility and restraint challenges the debasement narrative that has supported precious metals. If the balance sheet is no longer viewed as an automatic backstop, inflation hedges start to look less like insurance and more like a crowded trade.

The complication is that Kevin Warsh’s views have evolved throughout the years, and Wall Street isn’t sure which version they can expect. As a Fed governor from 2006 to 2011, he was among the most inflation-conscious voices on the committee, even during the financial crisis, and consistently wary of balance-sheet excess.

More recently, he has echoed Trump’s view that rates could move lower, but with a caveat: any easing should be paired with an aggressive reduction of the Fed’s roughly $6.6 trillion balance sheet. That mix supports the dollar and steepens the curve, but it also keeps rate volatility elevated.

It’s not guaranteed that Warsh will get confirmed, and even if he gets through the Senate, he won’t govern alone. Policy is set by the 12 voting members of the FOMC, and consensus takes time. Powell will step down as chair in May, but he can remain a governor until 2028, so he could stay on and influence decisions for a little while.

Takeaway: Markets see Warsh as a credibility-first Fed chair who is unlikely to lean on the balance sheet to solve every problem. While that’s modestly bullish for the dollar and long-end yields, it’s still not a green light for easy money. The real test isn’t whether Warsh is hawkish or dovish. It’s whether he can protect Fed independence while facing a White House that wants lower rates, fast.

PRESENTED BY FRE

How to Create an Edge

The best analysts aren’t just smarter, they’re better equipped. They stack tools: AI copilots, faster modeling templates, cleaner workflows; anything that reduces friction when you’re deep in an LBO model, cleaning up a deck at 1 a.m., or turning MD comments for the third time.

The same logic applies to focus. Concentration is capital.

Nicotine has long been used as a cognitive tool to stay locked in, and, like your favorite AI modeling tool, not all tools are the same. Some are simply stronger or provide more specificity than others. FRE offers a range of 3 - 15mg pouches, allowing you to customize your focus in real time.

Creating an edge means choosing the tools that help you execute when it counts.

Explore FRE, and lock in today.

HEADLINES

Top Reads

Gold and silver plunge as wild swings rock metals markets (BB)

Bitcoin dips below $78,000 as market digests silver sell-off, Trump's Fed chair pick (CNBC)

Waymo seeking about $16 billion near $110 billion valuation (YF)

Apollo returns 18% for retail clients with higher-stakes PE bets (BB)

JPMorgan starts selling a chunk of $20 billion EA buyout debt (BB)

Meta has been spending like crazy on AI. It’s actually paying off (WSJ)

Ares, JPMorgan lead $525 million loan for NYC High Line condos (BB)

The GameStop CEO has an audacious plan to clinch his $35 billion payday (WSJ)

Call screening is aggravating the rich and powerful (WSJ)

Nvidia CEO signals investment in OpenAI round may be largest yet (BB)

Eli Lilly plans $3.5 billion manufacturing plant in Pennsylvania to make next-generation obesity injections (CNBC)

Sandisk stock soars 7% after blowout earnings report shows overwhelming AI demand (CNBC)

Wealth inequality and the 'K-shaped' economy are more striking than ever, data shows (CNBC)

Big Food gets leaner with divestitures and breakups as consumers turn away from packaged snacks (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished lower after President Trump nominated Kevin Warsh as the next Fed chair

Treasury markets were mixed: short-dated yields eased slightly, while longer maturities softened

The U.S. dollar strengthened following the announcement

WTI crude climbed to ~$66 amid escalating U.S.–Iran tensions

Precious metals sold off sharply, with gold –9% and silver –28%, driven by dollar strength and volatility

Economic Data Highlights

PPI (Dec) signaled ongoing tariff-related pipeline pressures in goods prices

Data suggest firms are increasingly passing costs through to protect margins, supporting near-term inflation pressures

Markets remain focused on how inflation evolves alongside growth and earnings momentum

Fed & Policy Watch

Kevin Warsh brings prior Fed experience (2006–2011) and a historically hawkish stance on inflation

While previously skeptical of bond purchases and large balance sheets, his recent commentary has been more open to easing if inflation cools

Near term, the FOMC appears comfortable holding rates steady

Balance-sheet reduction could prove challenging and risks short-term market volatility

Earnings Season

Earnings remain a key focus as markets assess AI investment discipline and profit durability

Mega-cap tech guidance continues to drive dispersion, while broader earnings trends remain constructive

Looking Ahead

A potential government shutdown is approaching, though signs point to a short-lived disruption

Despite heavy headline flow, fundamentals remain supportive: steady growth and solid earnings

Movers & Shakers

(+) Verizon ($VZ) +12% after the telecommunications company announced strong subscriber growth.

(+) Sandisk ($SDNK) +7% because of a strong earnings report and AI demand.

(–) Newmont ($NEM) -11% after gold fell, and investors assess the fallout for the world’s largest gold mining company.

Prediction Markets

Private Dealmaking

Vention, a software and hardware platform for industrial automation and robotics, raised $110 million

Northwood Space, a developer of shared infrastructure for satellite backhaul, raised $100 million

Tenpoint Therapeutics, a vision-focused biotech company, raised $85 million

Mesh, a crypto payments and stablecoin infrastructure network, raised $75 million

Factify, a developer of next-generation document standards beyond PDFs, raised $73 million

Gyde, a health insurance brokerage platform, raised $60 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Humor Me

Description: A delightful blend of science, story, and practical insight into why laughter is more than just amusement. Fredrickson, an expert on positive emotions, explains how genuine humor strengthens connection, boosts creativity, improves health, and helps us stay grounded amid stress. Through research and real life examples, the book shows how intentionally cultivating laughter rewires attention, deepens relationships, and fosters wellbeing.

Book Length: 304 pages

Release Date: July 9, 2024

Ideal For: Creativity seekers, relationship builders, leaders, and anyone who wants a research backed case for bringing more laughter into everyday life.

“Humor is the emotion that invites connection, presence, and joy into the ordinary.”

DAILY VISUAL

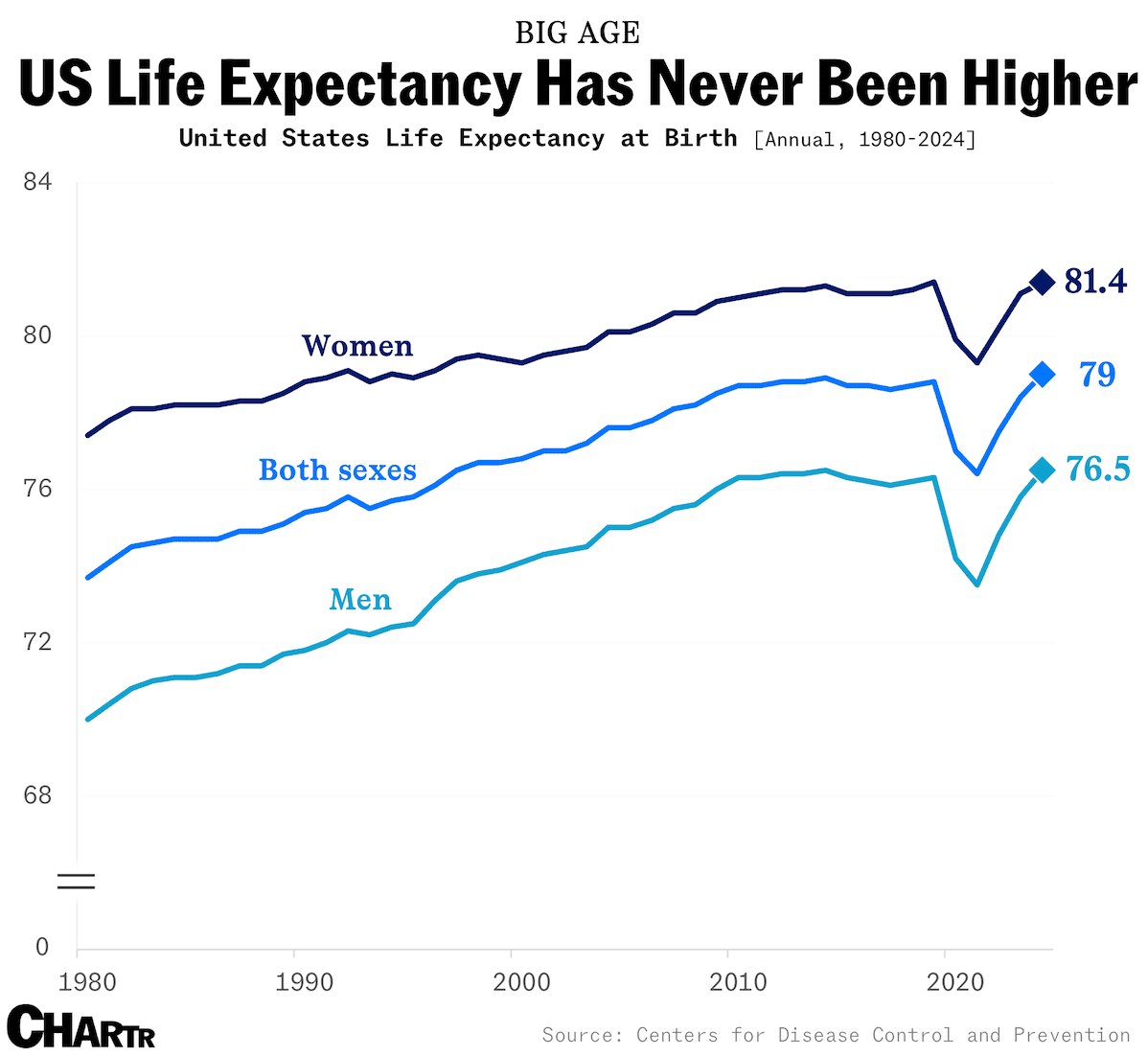

Life Expectancy Hits 79

Source: Chartr

PRESENTED BY MACABACUS

Retire the FINAL_final_v7 Deck

There are two kinds of “final” decks: the ones you send, and the ones you keep fixing.

If yours is living somewhere around FINAL_final_v7, you are not alone. Every edit introduces drift: a slightly different font, a chart that nudges off-grid, and bullets that break. Multiply that across 60 plus slides and it turns into late-night cleanup right before the deck goes upstairs.

Deck Check by Macabacus runs a fast quality pass across your pitchbooks, CIMs, and client decks to flag formatting, alignment, branding, and consistency issues, so “final” can actually mean final.

Retire the FINAL_final.

DAILY ACUMEN

Preference Falsification

Economist Timur Kuran introduced "preference falsification," the gap between what people say they want and what they actually want. Surveys said nobody wanted SUVs. The market revealed otherwise.

Your stated preferences are performances for others. Your revealed preferences, what you actually do with time and money, are truth. Everyone says they value health, but revealed preference shows they value convenience more.

This applies to you too. You say you want to start a company but spend evenings watching Netflix. You say relationships matter but never initiate plans. You say you want to write but haven't opened the document in weeks.

Watch behavior, not words. Yours included. You are what you do, not what you say you'll do.

ENLIGHTENMENT

Short Squeez Picks

How to speak with confidence when you’re put on the spot

There’s a limit on how many calories humans can burn

Setting limits for twentysomethings

How to improve public speaking skills

The relationship between happiness and intelligence

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply