- Short Squeez

- Posts

- 🍋 Consultants at the Gate

🍋 Consultants at the Gate

Plus: Oracle stock jumps on TikTok deal, Musk gets $139B pay restored, and Citadel posts its worst year since 2018.

Together With

“Never ask a barber if you need a haircut.” — Warren Buffett

Good Morning! Oracle jumped 7% after joining an investor group set to run TikTok’s U.S. business. North Korea just logged its biggest year ever for crypto theft. And Citadel posted its worst return since 2018 after natural-gas bets backfired.

Nine major drugmakers struck deals with Trump to lower drug prices. Elon Musk had his $139 billion 2018 pay package reinstated, pushing his net worth to $749 billion. And the DOJ released the Epstein files.

Plus: Google is rehiring former employees to bolster its AI push, Invesco unlocked a $180 million windfall after a key QQQ vote passed, and Trump suspended the U.S. green card lottery following the Brown and MIT attacks.

Looking for the perfect stocking stuffer? Try FRE, the perfect combo of taste and performance.

SQUEEZ OF THE DAY

Consultants at the Gate

Traditional consulting demand has been cooling since the pandemic peak. With AI compressing billable labor and client budgets tightening, firms like McKinsey are under pressure to find new growth levers.

After several rough years marked by layoffs across Accenture, the Big Four, and others, management consultancies are responding by becoming dealmakers.

Instead of just advising on strategy, they are increasingly buying capabilities outright, leaning into acquisitions and in-house venture arms.

There’s an irony here. Consultants spent decades charging CEOs to explain why most mergers destroy value, with plenty of slides to prove it. Now, they’re betting they can integrate better themselves.

As headcount shrinks, firms are quietly transforming through targeted acquisitions. Rather than broad, transformational M&A, most deals are small and focused, buying entry into specialized areas like life sciences, AI, enterprise software, and data platforms.

Capgemini, IBM Consulting, Accenture, and others are snapping up software tools and industry-specific platforms that can be embedded directly into client workflows.

These assets generate recurring revenue and deepen client lock-in. It’s less private equity and more acqui-hire logic: buy talent and IP that would take years to build internally.

Clients no longer just want decks. They want tools, platforms, and measurable outcomes. Building those capabilities organically takes years, while buying them is faster and allows consultancies to own execution rather than just recommend it.

Takeaway: The consulting model is shifting. Firms that once sold advice are becoming operators, software owners, and data providers. The line between consulting, tech, and investing is blurring fast, and in 2025, consultants are being forced to test their own long-held advice on themselves.

PRESENTED BY FRE

The Stocking Stuffer for High-Performers

Skip the desk accessories and generic gift baskets. Your bullpen friend needs performance gear that actually works at 2am during their third model rebuild of the night.

FRE Nicotine Pouches deliver with five strength options (3mg to 15mg), the only major brand offering the ultra-strong 15mg. Pre-Primed technology activates instantly and lasts up to an hour.

Each can holds 20 pouches versus the other guys’ 15, and compact tins fit stockings perfectly.

FRE is what you need when an associate is breathing down your neck and you need to lock-in, otherwise you won't be getting any sleep.

Please Support Our Partners!

HEADLINES

Top Reads

Oracle stock jumped 7% as cloud provider joins investor group to run TikTok's U.S. business (CNBC)

North Korea just had its biggest year ever stealing cryptocurrency (YF)

Citadel posts worst return since 2018 as natural gas bets falter (BB)

Nine of the largest pharma companies ink deals with Trump to lower drug prices (CNBC)

Google Cloud lands deal with Palo Alto Networks 'approaching $10 billion’ (YF)

Elon Musk's 2018 Tesla pay package must be restored, Delaware Supreme Court rules (CNBC)

Elon Musk’s net worth jumps to $749 billion (GB)

Epstein files released by DOJ (CNBC)

Google hires former employees in AI talent push (CNBC)

Invesco unlocks $180 million windfall after QQQ vote passes (BB)

Trump suspends US green card lottery after Brown, MIT attacks (BB)

Medtronic's diabetes management business MiniMed files for IPO (YF)

Consumer sentiment shows 'substantial decline' from last year amid higher prices, tough job market (YF)

TikTok owner ByteDance on track for $50 billion profit in 2025 (BB)

Point72 makes largest-ever bet on its star trader’s launch (BB)

At Goldman and Citadel Securities, the Santa rally has believers (BB)

CAPITAL PULSE

Markets Rundown

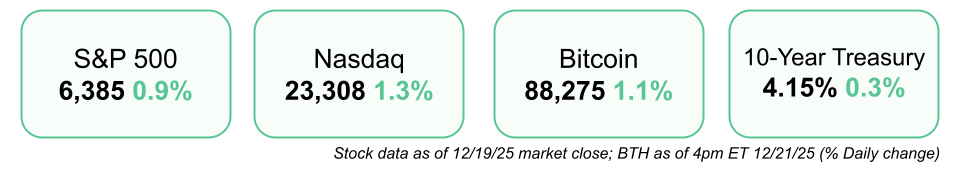

Market Update

U.S. equities closed higher across the board, extending Thursday’s gains ahead of the holiday period

Nasdaq outperformed, with S&P 500 and Dow also finishing solidly higher

Russell 2000 surged, signaling renewed strength in small caps

Treasury yields edged higher; the 10Y hovered around ~4.15%, within the year’s 4.0%–4.5% range

Sector Trends

Technology, Industrials, Healthcare led market gains

Consumer Staples and Utilities lagged as risk appetite improved

Full-year backdrop remains constructive: S&P 500 +~16% YTD, U.S. Aggregate Bond Index +~4.1% YTD

Economic & Macro Themes

Markets look toward 2026 with earnings growth expected to drive returns as valuation expansion becomes harder

All 11 S&P 500 sectors are projected to post positive earnings growth next year, with some global markets targeting double-digit EPS growth

AI investment remains a powerful but uneven force, with rising capex and debt levels likely creating clearer winners and losers

Global Markets

International equities had a strong 2025, with Germany, France, the U.K., and Japan hitting new highs

Momentum may continue in 2026, supported by eurozone growth, improving Japanese corporate profitability, and more attractive valuations versus U.S. mega-caps

Diversification remains key as U.S. market concentration stays elevated

Movers & Shakers

(+) CoreWeave ($CRWV) +23% after the cloud infrastructure technology company will work with the Department of Energy.

(+) Oracle ($ORCL) +7% because the cloud provider joined a group of investors to run TikTok's U.S. business.

(–) Nike ($NKE) -11% after the retailer posted a drop in China sales.

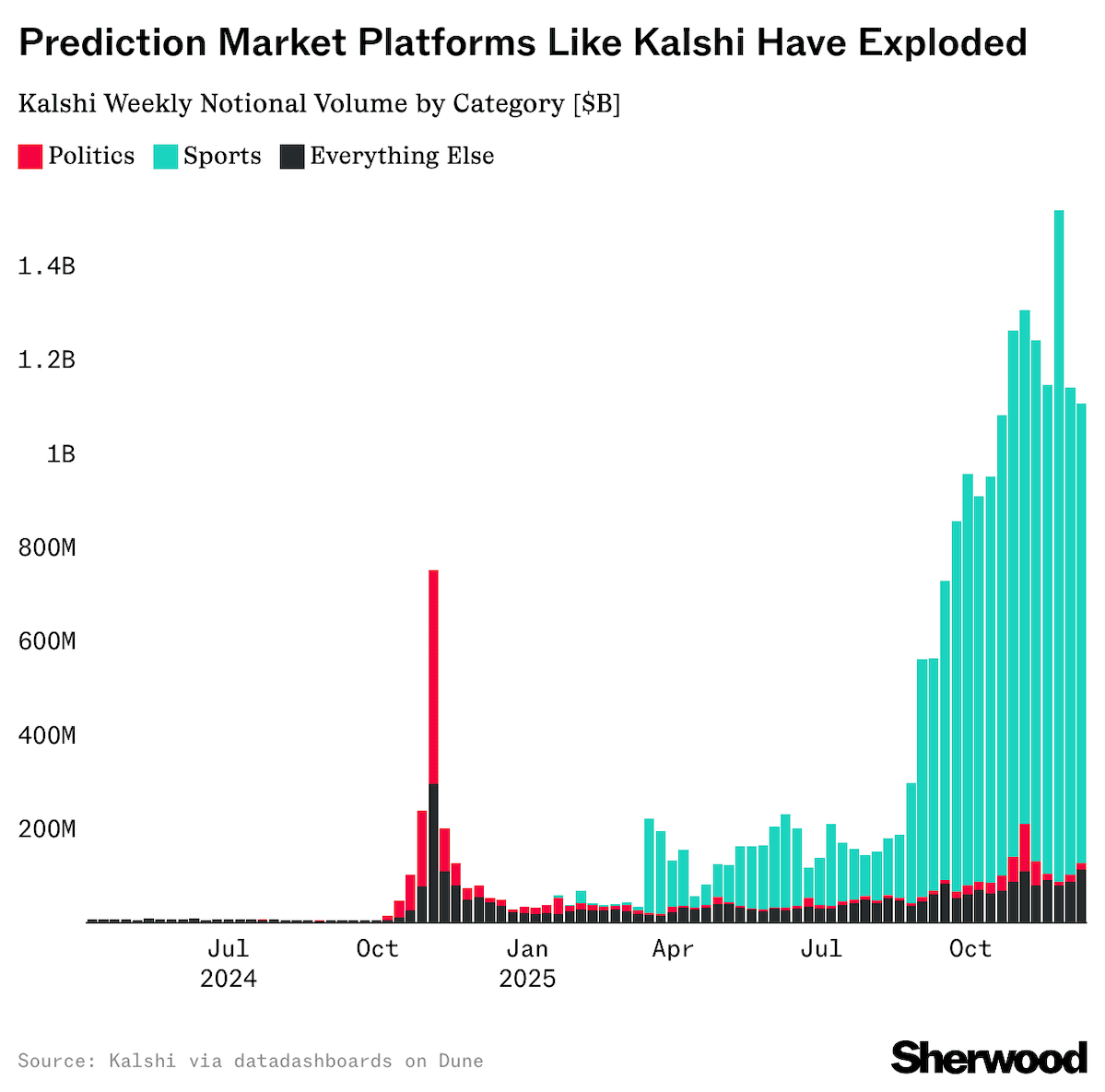

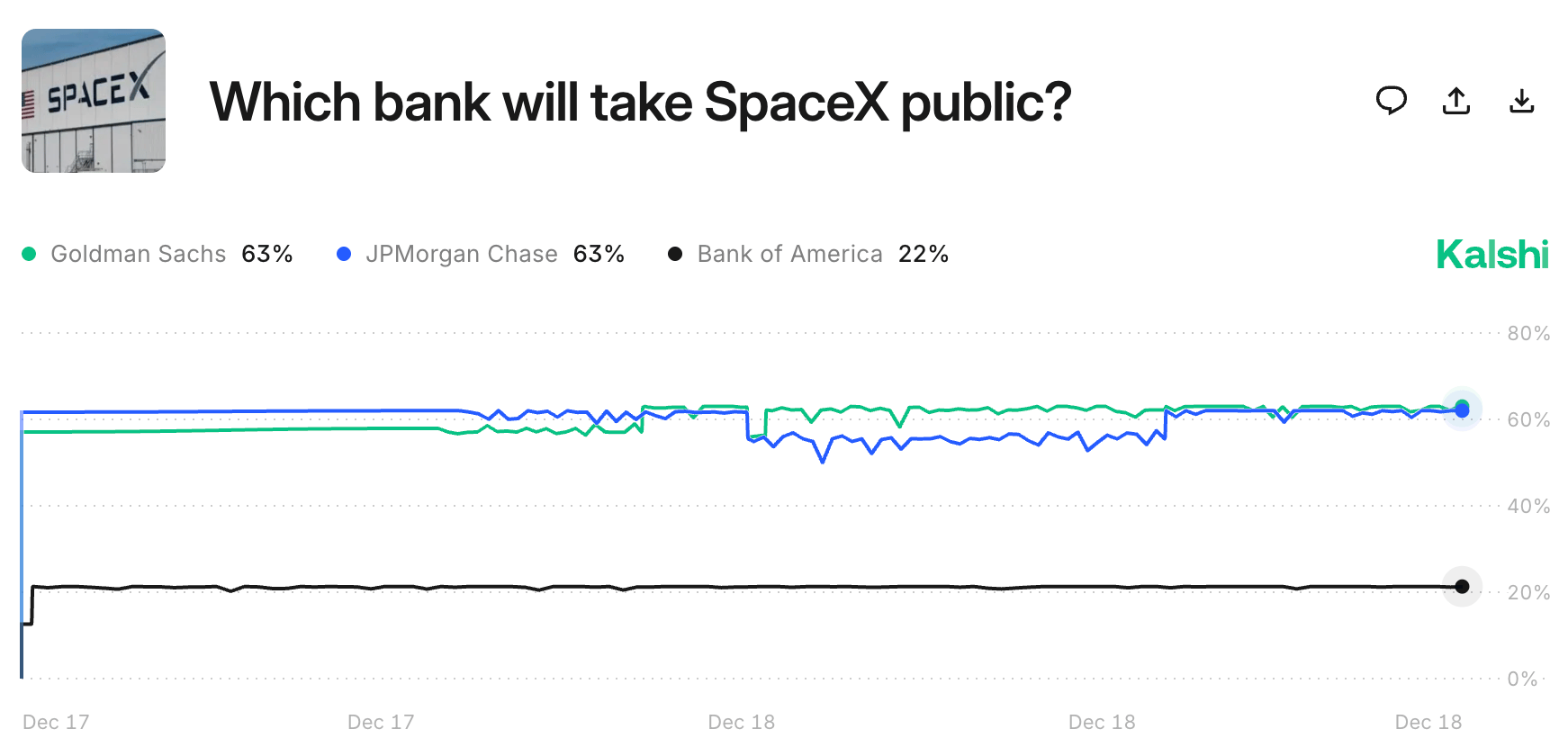

Prediction Markets

Private Dealmaking

Exein, a provider of cybersecurity solutions for connected devices, raised $118 million

2RedotPay, a stablecoin-based payments company, raised $107 million

Neural Concept, an engineering platform for product development, raised $100 million

Fuse Energy, an electricity startup, raised $70 million

Vatn Systems, a developer of autonomous underwater vehicles for naval warfare, raised $60 million

Sokin, a cross-border payments startup, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The AI Con

Description: A sharp, timely critique of the way “AI” is marketed and mythologized by powerful tech companies. Bender and Hanna cut through the hype, showing how exaggerated promises cloak data grabs, surveillance capitalism, and the erosion of human creativity — and they arm you with tools to spot, deconstruct, and resist those narratives in your work, media, and civic life. It’s part awakening, part playbook for reclaiming agency in a world awash with buzzwords.

Book Length: 288 pages

Release Date: May 13, 2025

Ideal For: Tech skeptics, policymakers, creators, journalists, and anyone who wants a clear-eyed perspective on what AI actually is — and what it isn’t.

“If you can’t see the con, you’re the con.”

DAILY VISUAL

Prediction Market Boom

PRESENTED BY YIELDCLUB

Give Yourself the Gift of Yield

The holidays are expensive. Between flights, gifts, and dinners, cash moves fast this time of year.

The problem? Most money just sits there when it’s not being spent.

Banks pay 0–4% APY. Bonds lock capital for years. Private credit ties up your cash with limited transparency.

YieldClub provides an alternative.

Earn 5–15% APY while keeping your funds fully accessible. The app connects to institutional-grade lending platforms managing $10B+ in deposits, and provides smooth deposit and withdrawal. Move your money anytime with no penalties or lockups.

Holiday spending doesn’t have to mean idle cash. Let your money work, even while you’re spending.

Please Support Our Partners!

DAILY ACUMEN

Asking for Help

In 2008, Airbnb was failing. The founders were broke, living on credit card debt, and their bookings had flatlined. In desperation, they reached out to Paul Graham at Y Combinator. Graham's advice and funding didn't just save the company, it launched a revolution.

Today, Airbnb is worth over $75 billion. But here's the thing: if Brian Chesky had been too proud to ask for help, if he'd seen asking as weakness rather than wisdom, none of it would have happened. The most successful people aren't self-made, they're help-made.

We live in a culture that glorifies independence and self-reliance, yet every major achievement in human history has been collaborative. Steve Jobs had Steve Wozniak. Bill Gates had Paul Allen. Oprah had Maya Angelou.

The myth of the lone genius is just that, a myth. Asking for help isn't admitting defeat; it's demonstrating intelligence. It shows you know your limits and value others' expertise.

Who could help you move forward today? What problem are you struggling with alone that someone else has already solved? Reach out. Ask questions. Seek mentorship.

Remember, the strongest people aren't those who do everything alone, they're those who know when to ask for help and have the courage to do it.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Denotes a Short Squeez partner post.

Reply