- Short Squeez

- Posts

- 🍋 The I-Banker Training for Paralympics

🍋 The I-Banker Training for Paralympics

Plus: The booming business of drinking yourself to sleep, Meta buys Manus for over $2B, Zuck's 2025 in pictures, Tesla warns on deliveries and PE resorts to selling assets to itself.

Together With

“There’s no better teacher than history in determining the future…there are answers worth billions in a $30 history book.” — Charlie Munger

Good Morning! Meta has agreed to acquire Chinese-founded AI startup Manus in a deal that could top $2.5 billion. Tech startup Hyphen is bringing AI to the lunch line, with backing from Cava and Chipotle to automate food service.

Tesla warned of a Q4 delivery drop in a rare early signal to investors. Fed minutes revealed policymakers were deeply split over the December rate cut. And private-equity firms are increasingly selling assets to themselves at a record pace as exits remain stuck.

Plus: The booming business of drinking yourself to sleep, Goldman co-leading financing for massive private power campuses in Texas to fuel the next wave of data-center growth, and why Loma Linda is America’s only true “Blue Zone.”

The first US derivatives marketplace for AI compute is live. Sign up here for access.

SQUEEZ OF THE DAY

The I-Banker Training for the Paralympics

While most investment bankers measure endurance in all-nighters, one Bank of America associate measures it in training for the Paralympics and downhill ski runs at 80 miles per hour.

Ralf Etienne, a 36-year-old investment banking associate in London, spends his weekdays building models, and his weekends flying to the Alps to train with the Swiss Paralympic ski team.

Etienne works in Bank of America’s private-equity coverage group and is chasing a spot in the Winter Paralympics for Haiti. His routine is brutal and he has left the office at 2 a.m. to catch a 6 a.m. flight to Switzerland, trained all weekend, then returned straight to his desk on Monday.

Haiti has already named him its first-ever Winter Paralympic representative, and the only remaining question is whether he qualifies in time.

Etienne path to Wall Street was anything but typical. Etienne grew up outside Port-au-Prince in Haiti and lost his leg in the 2010 earthquake after being trapped for eight hours in a collapsed building.

An American surgeon helped him get a prosthetic and pushed him to study in the U.S., and he rebuilt his life from scratch, couch-surfing through college, hustling for scholarships, and eventually earning an MBA from the University of North Carolina, before Bank of America recruited him into investment banking in 2022. Etienne even says being a Paralympian made him become a better banker.

That banking career almost derailed his Olympic bid. Changes in U.S. immigration policy raised the risk that Etienne could lose re-entry rights if he traveled abroad for competitions. So Bank of America moved him from NYC to London, keeping him employed while placing him closer to Europe’s elite training circuits. The move cost him months of training time, but it preserved both his career and his shot at the Games.

Etienne only realized qualification was truly within reach earlier this year after training alongside elite adaptive skiers. He is now racing across Europe and North America, competing in roughly ten qualifying events before March. He avoids framing himself as inspirational, instead viewing it as execution and preparation, the same mindset required to succeed in finance.

Takeaway: Ralf Etienne prides himself on being a banker who applies Wall Street’s performance culture to elite sport. From losing a leg in an earthquake, escaping Haiti, breaking into investment banking, and nearing a Paralympic appearance, his story is exceptional. Wall Street attracts driven people, but few as accomplished as Etienne.

PRESENTED BY ORNN AI

Now You Can Trade Compute

You can now trade compute with Ornn.

As AI infrastructure scales, compute prices have become increasingly volatile, yet there is no transparent market or forward curve to hedge that risk. Ornn is built to change that.

Ornn allows investors and operators to buy or sell exposure to AI compute prices without owning data centers or taking equity risk in AI companies. Contracts are structured similarly to electricity markets, enabling both hedging and speculation on AI pricing.

The platform is designed for institutional use, with market data and tools already used by top hedge funds.

Check it out today.

HEADLINES

Top Reads

Wall Street Oscars: Top Deals of 2025 (Buysiders)

Meta buys AI startup Manus for more than $2 billion (WSJ)

Goldman helps lead financing for 5-gigawatt Texas AI power sites (BB)

Tech startup Hyphen is bringing AI to the lunch line (CNBC)

Tesla previews downbeat sales numbers in unusual move (YF)

Fed minutes show officials were in tight split over December rate cut (CNBC)

Private equity firms sell assets to themselves at a record rate (FT)

The booming business of drinking yourself to sleep (WSJ)

YouTuber Nick Shirley gets FBI response to Minnesota fraud probe (Axios)

Nvidia is ending the year with deals (WSJ)

NYC subway says goodbye to MetroCard, but many riders already did (BB)

Brazil hedge funds set for first outperformance since 2022 (BB)

Mamdani to be sworn in as New York mayor in abandoned subway station (Guardian)

Silver rebounds from worst day in 4 years as wild end to year continues (CNBC)

Asia’s wealthy turn to Switzerland to park assets (FT)

SoftBank has fully funded $40 billion investment in OpenAI, sources (CNBC)

With the legendary Buffett stepping back, Berkshire Hathaway enters a new era (YF)

Mark Zuckerberg’s 2025 in 20 pictures (IG)

US tariff rates are at 80-year highs, and they're here to stay (YF)

The new billionaires of the A.I. boom (NYT)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished near flat, with the S&P 500 on track for a third straight year of 15%+ gains

Energy and communication services led modestly; most sectors were flat to slightly lower

Global markets were mixed: Asia uneven overnight; Europe mostly higher

Treasury yields edged up on the long end: 10-year ~4.12%, 2-year ~3.45%

Economic Data Highlights

Investment-grade bonds are up ~7.5% YTD, outperforming cash by ~3%—the widest gap since 2020

Bond outperformance reflects 0.75% of Fed cuts, cooling labor data, and a ~0.7% yield advantage vs cash

Housing data showed stabilization: FHFA +0.4% (Oct); Case-Shiller +0.3%, best since January

Sector Trends

Energy benefited from commodity strength; communication services also outperformed

Precious metals added to strong YTD gains: silver +8%, gold +0.4% on the day

Housing-related activity improved alongside easing mortgage rates (~6.5%, down from 7%+ early 2025)

Looking Ahead

Fed could deliver 1–2 cuts in 2026, pressuring cash returns while supporting bonds

10-year yields expected to trade 4.0%–4.5% in 2026 amid steady growth and deficit concerns

Improving housing activity may turn from a drag to a modest growth tailwind next year

Movers & Shakers

(+) AXT Inc ($AXTI) +8% after the semiconductor components maker will issue 7M shares of its new common stock.

(+) Molina Healthcare ($MOH) +2% because Michael Burry spoke highly of the insurer and compared it to Buffett's investment in Geico.

(–) OceanFirst Financial Group ($RGTQ) -45% after the regional bank will merge with Flushing Financial Corp.

Prediction Markets

10-year treasury yield gets announced today at 10am EST.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

House Rx, a developer of in-clinic specialty pharmacies, raised $55 million

Tavus, an enterprise AI agent startup, raised $40 million

Beside, a smart assistant for calls and texts, raised $32 million

Attentive.ai, an AI platform for construction, raised $31 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Plant Powered Plus

Description: A practical, science-backed guide to using plant-forward nutrition to soothe inflammation, boost gut health, and revitalize overall wellbeing. Palmer breaks down how specific foods influence our microbiome, immunity, and energy — and offers approachable meal ideas and food swaps that make healthier habits sustainable rather than overwhelming. It’s part nutrition primer, part lifestyle playbook for reclaiming your health from the inside out.

Book Length: 304 pages

Release Date: 2025

Ideal For: Health seekers, anyone struggling with chronic inflammation, cooks who want flavorful plant-based meals, and readers looking for food-first approaches to long-term wellness.

“Healing doesn’t start in the gym — it starts in the gut.”

DAILY VISUAL

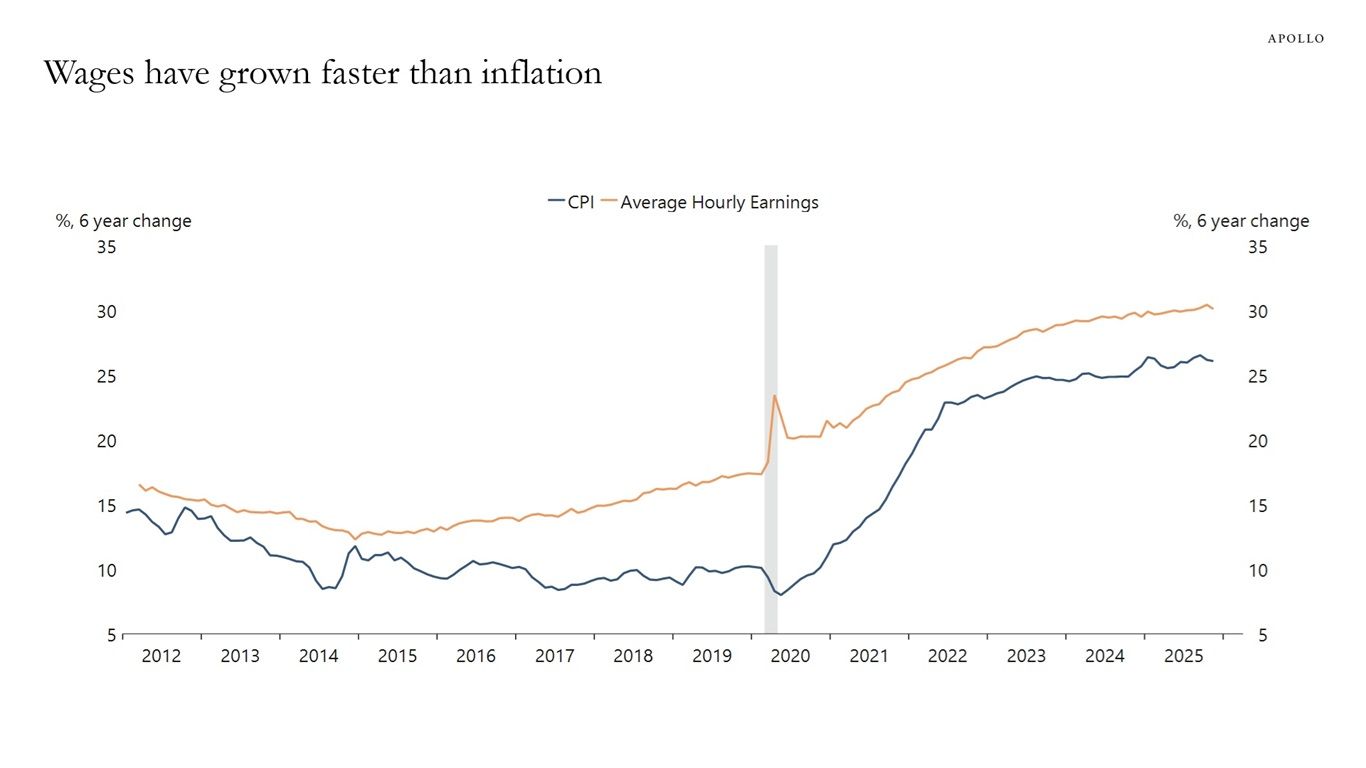

Wages Have Grown Faster Than Consumer Prices

Source: Apollo

PRESENTED BY PEGASUS INSIGHTS

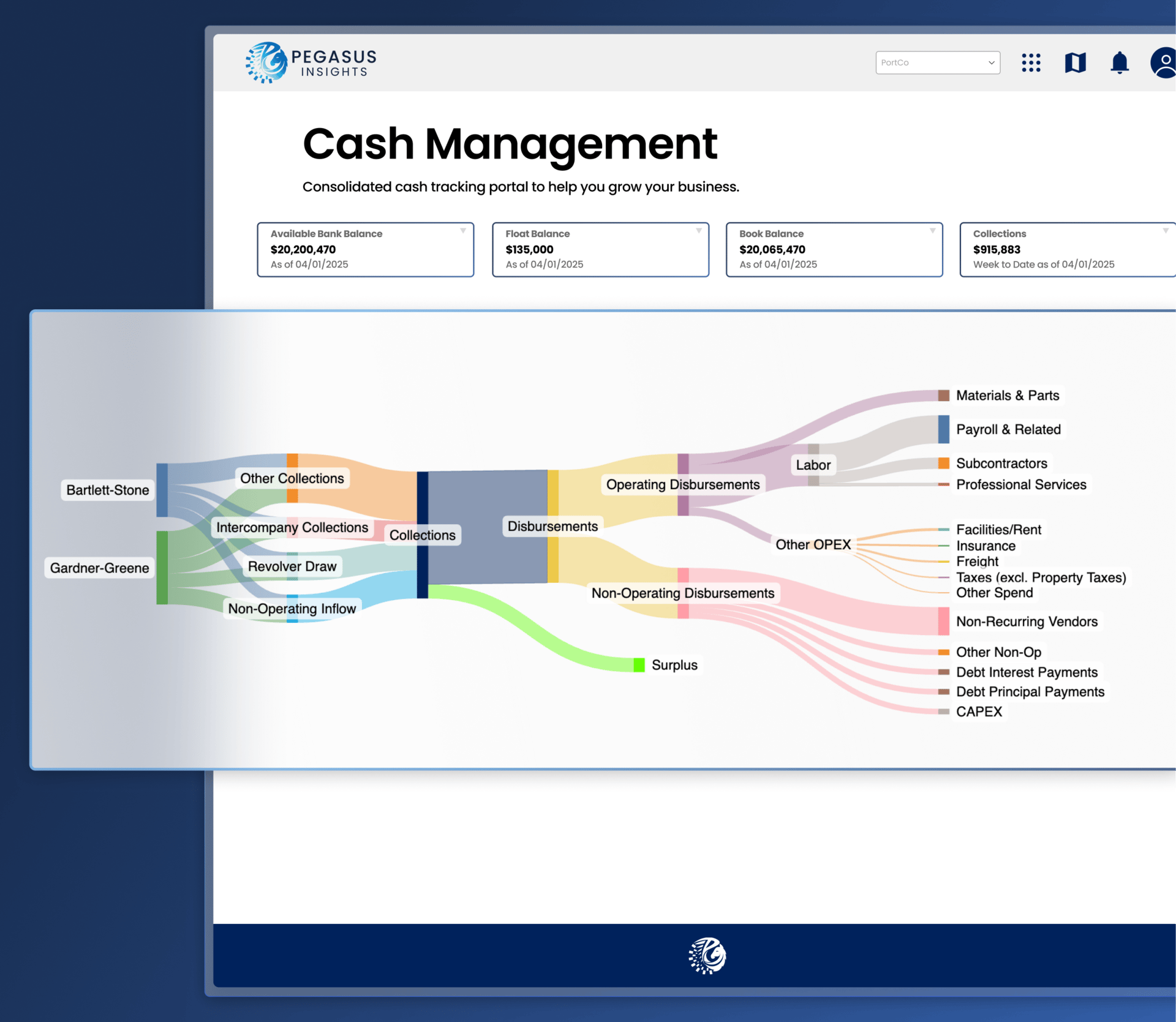

Cash Clarity Drives Confidence

In investor-backed companies, cash questions surface fast and, often, under pressure. Without real-time visibility into liquidity and runway, even strong finance teams struggle to respond with confidence.

Pegasus Insights is a real‑time cash and liquidity platform built by finance professionals with deep private equity experience. The platform pulls live data from your systems, consolidates cash positions, and automates forecasting so you can see working capital, liquidity trends, and variances without manual refreshes.

Pegasus Insights provides:

Daily cash visibility dashboards that consolidate balances

Automated 13‑week forecasting and scenario modeling

Working capital insights and spend analytics

Integration with ERPs and bank feeds to plug into existing workflows

For PE and VC operators evaluating portfolio finance teams, Pegasus Insights adds a layer of confidence and responsiveness by replacing manual processes with decision‑ready insight.

DAILY ACUMEN

Economics of Attention

Herbert Simon, Nobel Prize winner, predicted in 1971: "A wealth of information creates a poverty of attention."

He was prophetic. Today, the average person consumes 34 gigabytes of information daily - enough to overload a laptop in a week.

But information isn't like money where more is better. Past a certain point, more information makes you dumber, not smarter. It paralyzes decision-making and breeds anxiety.

Warren Buffett reads 500 pages a day but ignores 99% of available information. He's not trying to know everything, he's trying to know the right things deeply.

Your attention is finite and valuable. Tech companies know this, they employ thousands of engineers to capture it. Every notification, every autoplay video, every infinite scroll is designed to monetize your focus.

You're not the customer; your attention is the product being sold. What information are you consuming that adds zero value? What could you ignore that would make you more effective?

Remember, ignorance isn't always a weakness, strategic ignorance is a superpower.

ENLIGHTENMENT

Short Squeez Picks

How to create a 3 statement model and DCF in 10 minutes*

How to stay disciplined

Why the best leaders don’t command and control

Why is Loma Linda the only blue zone in the U.S.?

The biggest mistake bosses make when delegating

4 ways you sabotage your joy in daily life

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply