- Short Squeez

- Posts

- 🍋 The Deal Buffett Couldn’t Fix

🍋 The Deal Buffett Couldn’t Fix

Plus: TACO trade is back, Susquehanna already has ~60 traders focused on prediction markets, and Apollo co-founder's debut PE fund surpassed its $4B target.

Together With

"Our stock market dip is peanuts, that stock market is going to be doubled." — President Trump

Good Morning! Stocks bounced as the TACO trade returned after Trump signaled a Greenland deal “framework” with NATO and ruled out new Europe tariffs. Apollo co-founder Josh Harris’ 26North blew past its $4B debut PE fund target, and KKR is on track to top $20B for its Americas buyout fund.

Susquehanna has ~60 traders on prediction markets and wants more. SPACs are back, with over $2B raised this month, while quant hedge funds are off to their worst 10-day stretch since October.

Plus: “No-buy January” goes mainstream, and why discipline beats motivation every time.

mogul has built an institutional-grade real estate investment platform for retail. Browse their properties today.

SQUEEZ OF THE DAY

The Deal Buffett Couldn’t Fix

Berkshire Hathaway is taking an official step toward exiting one of Warren Buffett’s rare investment flops. According to a recent filing, new CEO Greg Abel is exploring a sale of Berkshire’s roughly 28% stake in Kraft Heinz, just weeks after officially taking over Buffett’s old job.

Berkshire helped engineer the Kraft Heinz merger in 2015, but the investment has become an outlier in its otherwise strong track record. Kraft Heinz shares are down roughly 70% since 2015, and key reasons include shifting consumer preferences, cost inflation, and weak growth across legacy brands. Dividends softened the blow a little bit, but Berkshire still recorded a $3.8 billion write-down on the stake last year.

Abel is putting his stamp on the portfolio early, and Kraft Heinz is an obvious place to start. Registering the stake gives Berkshire flexibility to reduce exposure gradually, without forcing a large block sale into the market. Analysts view the move less as a market call and more as balance-sheet housekeeping: trimming a long-running underperformer and freeing capital for higher-conviction opportunities.

The overall backdrop is not helping Kraft Heinz either. The company is exploring a breakup that would separate faster-growing sauces and condiments from slower North American staples like packaged meats and cheese. Even bulls concede near-term revenue growth remains challenged as U.S. consumers pull back and emerging markets cool, but the business continues to generate solid cash flow.

Takeaway: Buffett built his reputation by letting winners run and allowing mistakes to fade quietly, but Kraft Heinz never faded. Abel’s willingness to loosen Berkshire’s grip now is a meaningful shift: fewer legacy attachments and greater capital discipline. Even the greatest investors have flops, and what matters is knowing when it’s finally time to move on.

PRESENTED BY MOGUL

Invest like Blackstone Without Outbidding Moms on Single-Family Homes

mogul is a real estate investment platform offering fractional ownership in blue-chip rental properties. This gives you monthly rental income, real-time appreciation and tax benefits without a hefty down payment or 3 a.m. tenant calls.

Founded by former Goldman Sachs real estate investors, they hand-pick the top 1% of single-family rental homes for you. Each property undergoes a vetting process led by the aforementioned GS bankers, and they take care of the property management for you.

Here’s are some of the perks:

Tax Benefits

+7% annual yields

18.8% average annual IRR across 50+ properties*

Long story short: you can invest in institutional-quality real estate for a fraction of the usual cost and avoid the headache of property management. Plus, you don’t need to outbid moms, or Blackstone, to access this powerful investment.

HEADLINES

Top Reads

Trump says he reached Greenland deal 'framework' with NATO and will not pursue tariffs (CNBC)

Josh Harris' 26North surpass $4bn target in debut private equity fund (BS)

KKR on track to beat $20 billion target for Americas buyout fund (BB)

This dream sports-betting job comes with one little catch (WSJ)

Deal-starved SPACs flood market in 2026 following bonanza year (BB)

Quants in worst losses since October as crowded bets buckle (BB)

The Americans who are going a whole month without buying anything (WSJ)

BlackRock's Larry Fink mulls moving WEF out of Davos (BB)

Jamie Dimon says Rollout of AI may need to be slowed to 'save society' (Guardian)

Lemonade launches an insurance product for Tesla Full Self-Driving customers (TC)

Jamie Dimon on Trump immigration policy: 'I don't like what I'm seeing' (CNBC)

Private equity giant Thoma Bravo eyes software deals as shares fall (FT)

Nvidia CEO says AI needs more investment in defiance of bubble fears (WSJ)

Citi hires former Paramount executive to head media banking (WSJ)

Top JPMorgan banker sees deals glut, yet market froth worries (BB)

Amazon launching its largest-ever store (WSJ)

CAPITAL PULSE

Markets Rundown

Market Update

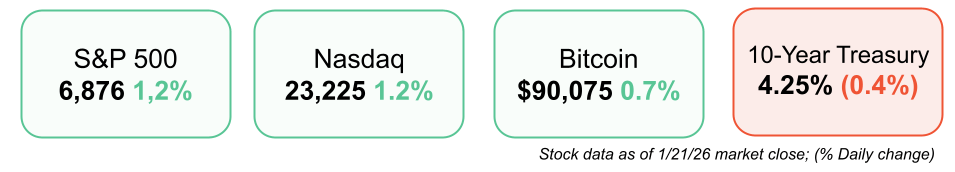

U.S. equities rebounded sharply, rising ~1.2%, after President Trump backed away from proposed tariff hikes tied to Greenland

The rally recovered more than half of Tuesday’s sell-off, the largest since last year’s tariff shock

Treasury yields fell, with the 10-year down ~4 bps, signaling a partial unwind of risk-off positioning

The U.S. dollar edged higher but remains ~0.6% lower on the week

Gold pulled back from recent highs but still finished +1.3% on the day; WTI oil held steady around $61

Geopolitics & Trade

The White House announced a “framework for a future deal” on Greenland, easing immediate tariff threats on European countries

President Trump ruled out using force and softened rhetoric following recent market volatility

Details remain limited, and markets will be watching for clarity from NATO and European counterparts on sovereignty, security, and trade implications

Policy & Legal Developments

The Supreme Court hearing on Lisa Cook’s Fed Board status began today

Several justices expressed concern that removing her could undermine Federal Reserve independence

Betting-market odds of Cook’s removal declined, reducing near-term risk of political disruption to Fed governance

A ruling against the administration could reinforce institutional protections around monetary-policy independence

Asset Class & Sentiment

Risk appetite improved, reversing part of the recent geopolitical premium

Gold remains elevated as investors hedge lingering uncertainty

Bond markets reflected easing stress after tariff de-escalation

Market focus now shifts toward follow-through on trade diplomacy, legal clarity on Fed governance, and earnings momentum

Movers & Shakers

(+) Intel ($INTC) +12% after the stock hits a 4-year high ahead of earnings.

(+) Micron ($MU) +7% because of strong tailwinds for the memory chip industry.

(–) Kraft Heinz ($KHC) -6% after Berkshire may unload 28% of its stake.

Prediction Markets

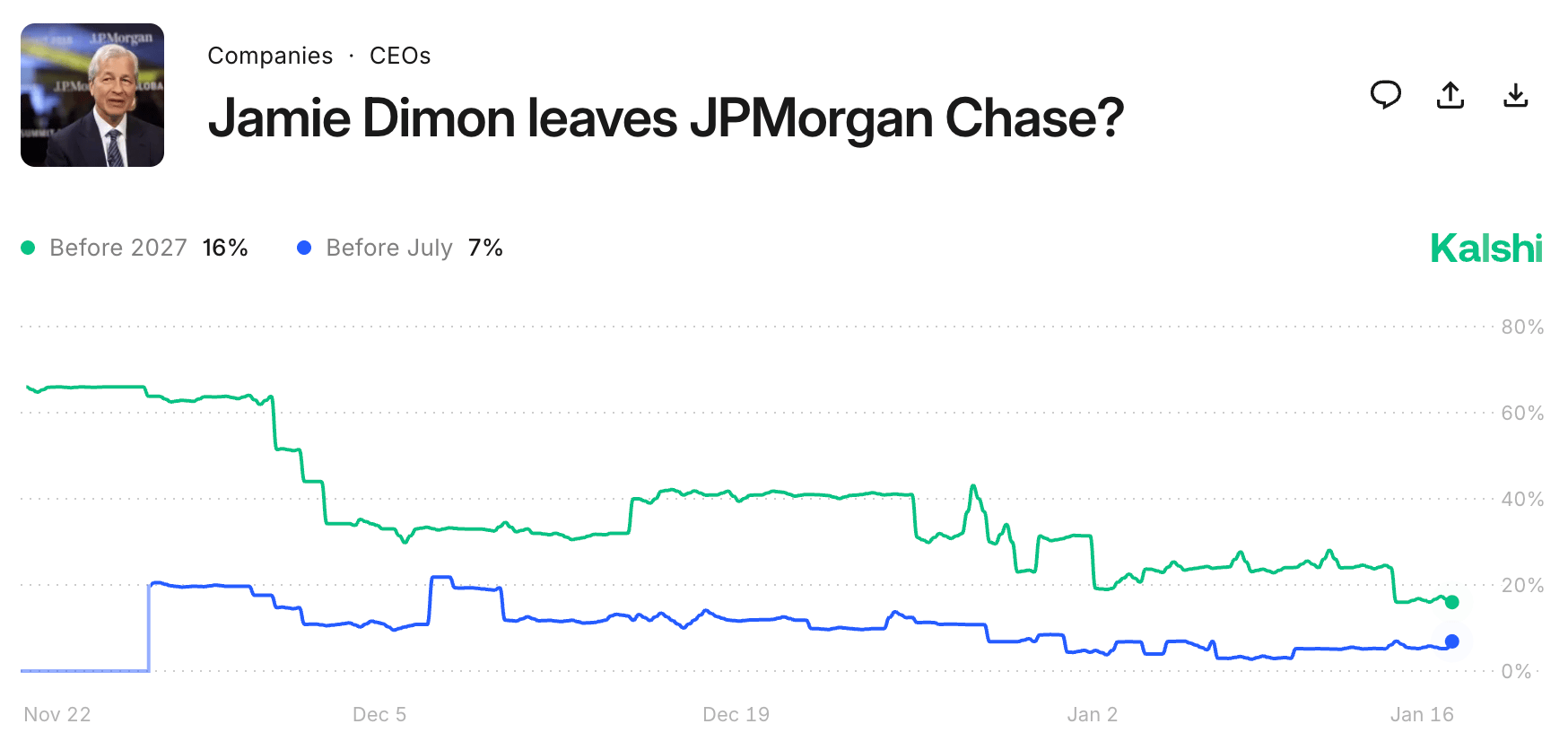

Last year saw the departure of Warren Buffett. Will this year bring Jamie Dimon’s?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Smithfield Foods acquired Nathan’s Famous, a branded hot dog and packaged foods company, for $450 million

Baseten, an AI inference platform that helps companies deploy and run production AI models, raised $300 million

OpenEvidence, an AI medical assistant designed to support doctors with clinical decision-making, raised $250 million

Preply, an online language learning marketplace that connects students with tutors, raised $150 million

Zanskar, a geothermal energy developer focused on scalable clean baseload power, raised $115 million

Zarminali Pediatrics, an operator of pediatric primary care clinics, raised $110 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Inner Entrepreneur

Description: A comprehensive, no-fluff blueprint for building a business that creates both financial freedom and personal peace. Sabatier walks through the full entrepreneurial lifecycle, from idea discovery to scaling, acquisitions, and exits, while emphasizing autonomy, leverage, and designing a business that serves your life instead of consuming it. Practical, tactical, and grounded in real operator experience, this is a playbook for building wealth without burning out.

Book Length: 416 pages

Release Date: March 11, 2025

Ideal For: Entrepreneurs, solopreneurs, side-hustlers, and anyone who wants to build income, ownership, and freedom on their own terms.

“You don’t need a bigger job, you need a business that buys back your time.”

DAILY VISUAL

America Chose Spice over Nice

Source: Chartr

PRESENTED BY ENDEX

Investment Bankers Are Training AI Models As Latest Exit Opportunity

Ex-bankers are now training Endex, the Excel agent backed by OpenAI. They’re teaching Endex’s models how Wall Street actually builds DCFs and LBOs.

Firms are leveraging AI tools as a path to streamline tasks that used to take bankers hours.

Frontier AI labs project significant improvements in Excel capabilities after the next year.

Request access to Endex or apply to join.

DAILY ACUMEN

Network Effects

When a fax machine cost $2,000, it was worthless. You owned the only one. But as more people bought fax machines, yours became valuable.

This is Metcalfe's Law: the value of a network grows exponentially with each new member. Your first fax connection was worth little. Your hundredth was worth everything.

This same math governs your life in ways you don't realize. Your first professional connection has limited value. Your hundredth creates serendipity. Your first shared meal with someone builds rapport. Your hundredth creates unbreakable bonds.

Every relationship, every skill, every habit operates on network effects. Learning Spanish is hard until suddenly you're thinking in Spanish.

Building an audience is slow until suddenly you have momentum. Creating content feels pointless until suddenly opportunities appear from everywhere.

The early phase feels like failure because linear effort produces seemingly no results. But you're not on a linear curve. You're on an exponential one, and exponentials look flat until suddenly they're vertical.

Most people quit during the flat part, right before the vertical part begins. Reid Hoffman built LinkedIn understanding this. The first million users were the hardest. The next hundred million were inevitable.

Remember, the difference between failure and success is often just staying in the game long enough for network effects to kick in.

ENLIGHTENMENT

Short Squeez Picks

How to reset your circadian rhythm

Why discipline beats motivation every single time

How to use AI to supercharge your work

Is reading a vice?

How to master zone 2 training

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply