- Short Squeez

- Posts

- 🍋 Silver's Short Squeeze

🍋 Silver's Short Squeeze

Plus: PE firm sitting on a big paper gain on an F1 team, YouTuber exposes Minnesota daycare fraud, Target jumped after activist stake, and family offices taking over Wall Street.

Together With

“This is not good. Silver is needed in many industrial processes” — Elon Musk (on silver prices)

Good Morning! Global dealmaking hit $4.5 trillion in the second-best year on record. Gold is heading for its strongest year since the Jimmy Carter era. And family offices are quietly becoming some of the most powerful players on Wall Street.

A private-equity firm bought an F1 team for just $200 million that’s now valued at $2.5 billion. A $400,000 shipment of lobsters vanished en route to Costco. And Target jumped after an activist investor disclosed a new stake.

Plus: Goldman’s private-credit arm is struggling to clean up bad bets, Google reveals the top trending searches of 2025, and YouTuber Nick Shirley racked up over 100 million views in two days after exposing a daycare fraud in Minnesota.

There is a new status symbol amongst the high earners. It’s called Stelrix.

SQUEEZ OF THE DAY

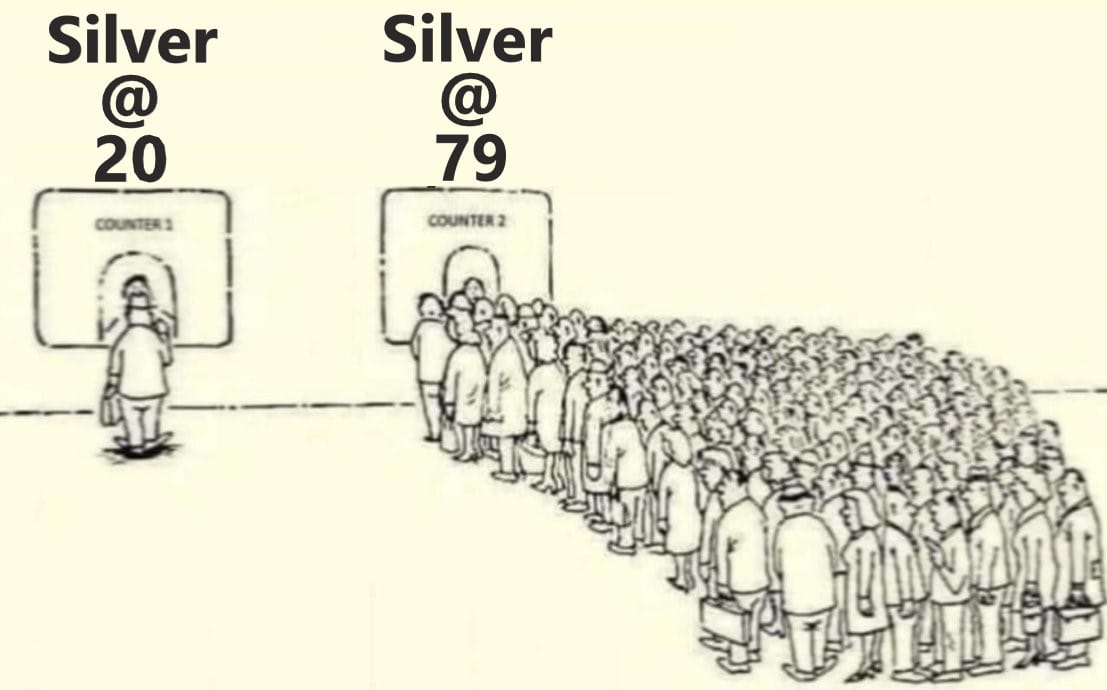

Silver’s Short Squeeze

Silver is supposed to trade like a sleepy commodity, not a meme stock. But on Friday, silver ripped nearly 10% in a single day. It’s now one of the best-performing assets of 2025, up ~35% in the past month and more than 170% over the past year.

Silver is trading near $80/oz, up from ~$29 to start 2025. An ounce of silver is now worth more than a barrel of oil.

Speculators are piling in. Rich Dad, Poor Dad author Robert Kiyosaki says the rally is just getting started and believes silver could hit $200/oz within a year.

But beyond the mooning price, Elon Musk has warned the rally may not be good news. Silver is a critical industrial metal, and the real issue is supply.

The catalyst is China. Starting January 1, 2026, Beijing will require government licenses for silver exports. Only large, state-approved producers will qualify, effectively cutting off smaller exporters. With China controlling roughly 60–70% of global silver supply, tightening exports hits global availability almost immediately.

The timing is brutal. Silver has already been in a structural deficit for five straight years, with demand exceeding supply and inventories collapsing.

The stress is amplified by leverage. Paper silver markets dwarf physical supply, with estimates putting the paper-to-physical ratio near 350-to-1. When even a small share of buyers demand real metal, prices gap violently. Add in inelastic industrial demand from solar, EVs, electronics, and data infrastructure, and the paper market is discovering it cannot absorb a physical squeeze.

Takeaway: Silver is no longer trading like a stable commodity. It’s trading like a meme stock with a supply problem. When a market is levered hundreds of times, the price does not drift but instead moves violently. This kind of silver short squeeze only shows up once a decade, and it’s happening in a metal critical to dozens of industries. Congratulations to silver longs. Condolences to the global supply chain.

PRESENTED BY STELRIX

The Financial Tool Family Offices Have Used for Decades, Now Available to You

Wealth doesn't liquidate to cover expenses. It borrows against itself.

Family offices and private banking clients have accessed capital this way for generations, using their portfolios as collateral while keeping investments intact and compounding. Traditional securities-backed lines require $100,000 minimums and weeks of underwriting, keeping this approach exclusive to institutional relationships.

Stelrix built that same infrastructure into a sleek gold card that connects directly to your existing brokerage. Your holdings stay exactly where they are, generating returns while you access spending power in real time. Limits adjust automatically based on your portfolio value, and pricing reflects actual risk rather than arbitrary credit scoring.

Manufactured by the team behind the Black Amex Centurion, the card itself signals a different approach to wealth management. Your investments continue working while you maintain flexibility for opportunities that don't wait for liquidation timelines. What you get is simple: capital access without triggering taxable events or disrupting your allocation strategy.

Join the elite. Reserve your gold card today.

HEADLINES

Top Reads

Global dealmaking hits $4.5T in second-best year on record (YF)

Tim Walz pushes back on Minnesota fraud allegations following viral daycare video (Fox)

Gold is set for its best year since Jimmy Carter was president (CNN)

Family offices have become the new power players on Wall Street (WSJ)

Private equity bought an F1 team for just $200M and it's not selling (FOS)

$400,000 lobster shipment disappears while on its way to Costco locations (Fox)

Target jumps as activist investor builds stake, increasing pressure (YF)

Goldman Sachs’s private-credit company struggles to clean up soured bets (WSJ)

Warren Buffett and private equity both love insurance, but similarities end there (WSJ)

Google reveals the top trending searches of 2025 (Fox)

Intel stock soared in 2025. 'Everything hinges' on what comes next (YF)

2025 has been a brutal year for layoffs (YF)

Oracle shares on pace for worst quarter since 2001 (CNBC)

Bitcoin miners thrive off a new side hustle: retooling their data centers for AI (WSJ)

American Airlines pilot shared screenshot of salary, and people’s jaws are on the floor (NYP)

Saudi Arabia: venture capital firms bet on M&A as listings get tougher (BB)

CAPITAL PULSE

Markets Rundown

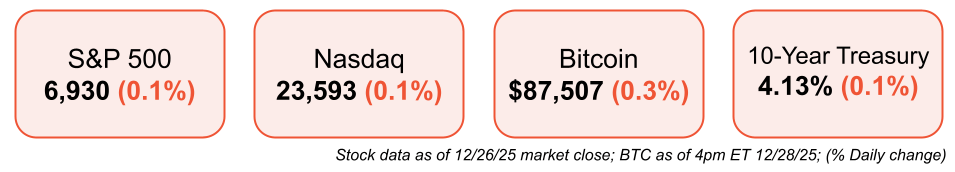

Market Update

U.S. equities were little changed amid thin holiday trading volumes

S&P 500 finished just below Wednesday’s record high; Nasdaq was flat

Russell 2000 lagged, slipping ~0.5%

Treasury yields were mixed: 2-year fell ~2 bps, while the 10-year held around 4.13%

Sector & Asset Class Trends

International markets were quiet, with several global exchanges closed for the holidays

Precious metals continued to rally; gold remains on track for its best year since 1979, supported by geopolitical tension and a weaker dollar

Volatility stayed muted, with the VIX near a 2025 low, signaling limited market concern around headlines

Energy & Geopolitics

WTI crude traded down to around $57, despite being on pace for its largest weekly gain since late October

Prices reflected mixed signals: geopolitical tensions tied to Nigeria and Venezuela offset by optimism around a potential Ukraine peace agreement and easing Russian oil sanctions

Lower oil prices continue to provide modest relief for U.S. consumers facing persistent inflation above the Fed’s 2% target

Year-in-Review Takeaways

2025 delivered strong results across asset classes for diversified investors

International equities led, with the MSCI AC World ex U.S. up 30%+, its strongest year since 2009

U.S. equities logged 39 new all-time highs, on track for a third straight year of 15%+ gains

In fixed income, high-yield bonds, EM debt (8%+), and investment-grade bonds (~7%+) all posted solid returns

Movers & Shakers

(+) Coupang ($CPNG) +6% after the online retail company's data breach was mitigated.

(+) Target ($TGT) +3% because an activist investor dialed up pressure amid declining sales.

(–) Rigetti ($RGTI) -9% after the quantum stock rally cooled.

Prediction Markets

Private Dealmaking

PsiThera, a developer of oral medicines for immunology and inflammation, raised $48 million

Kargo, an SF-based warehouse inventory tech startup, raised $42 million

Solve Intelligence, an AI platform for patents, raised $40 million

1mind, an AI sales startup, raised $30 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

How To Make a Few More Billion Dollars

Description: A candid, experience-driven playbook from a serial dealmaker who’s actually built (and bought) his way into outsized outcomes. Jacobs breaks down how real value gets created: disciplined capital allocation, picking markets with room to consolidate, operating with ruthless clarity, and knowing when to press the advantage versus when to walk. Less “motivation,” more machinery — the decisions and systems that compound into billions.

Book Length: 296 pages

Release Date: Dec 9, 2025

Ideal For: Founders, CEOs, operators, and investors who want practical frameworks for scaling businesses through execution and smart M&A.

“Billions aren’t made in ideas — they’re made in repeatable decisions.”

DAILY VISUAL

Continued Strong Foreign Demand for US Assets

Source: Apollo

PRESENTED BY ENDEX

Sam Altman: "Enterprise Will Be a Major Priority for OpenAI Next Year"

In an interview this week, Altman said 2025 was the year OpenAI's enterprise growth outpaced consumer for the first time. "The models were not robust and skilled enough for most enterprise uses," he said. "Now they're getting there.”

GPT-5.2 now scores 68% on junior IB tasks.

Wall Street is reacting fast. Firms are adopting AI tools for slides and modelling like Endex, OpenAI's Excel agent, to shift analysts from manual spreadsheet work to AI-driven modeling.

DAILY ACUMEN

Reverse Engineering Success

When Elon Musk wanted to build rockets, he didn't start from scratch.

He bought textbooks, deconstructed existing rocket designs, and figured out the cost of raw materials.

He discovered that rockets were being sold for 50 times their material cost.

This reverse engineering approach didn't just save him money, it revolutionized space travel.

Similarly, when the Beatles wanted to write hit songs, they didn't wait for inspiration.

They studied the chord progressions and structures of songs they loved, then created their own variations.

Success leaves clues everywhere, you just need to know how to find them. Stop reinventing the wheel. Study those who've achieved what you want.

What patterns do you notice? What strategies can you adapt?

Remember, innovation often isn't about creating something entirely new, it's about combining existing ideas in novel ways.

ENLIGHTENMENT

Short Squeez Picks

Try this Gen-Z spending hack

Do you know how to behave at work?

Why some leaders fail upwards

How to overcome feeling not good enough

5 types of hobbies that build self-discipline

The most critical factor for longevity

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply