- Short Squeez

- Posts

- 🍋 Santa Claus Rally

🍋 Santa Claus Rally

Stocks just had their best month since July 2022, plus hedge funds in hot water, and how to give a killer presentation.

Together With

“No matter how great the talent or efforts, some things just take time. You can't produce a baby in one month by getting nine women pregnant." — Charlie Munger

Good Morning and Happy Friday! Tesla’s cybertruck is finally here, starting at $61k. Citadel and other hedge funds are drawing scrutiny for making similar trades - and the Supreme Court wants to limit the SEC’s power. Corporate profits popped in Q3, Jamie Dimon says to be prepared for a recession, and talking to chatbots is now a 200k/year job.

SQUEEZ OF THE DAY

Santa Claus Rally

It’s hard to believe it’s already December…but Christmas came a little bit early if you’re holding stocks.

After three straight months of losses, the Dow, S&P 500, and Nasdaq all just posted their best monthly performance since July 2022.

And the Dow even hit its 2023 high yesterday.

A key reason? Inflation is starting to cool down. Yesterday, the Personal Consumption Expenditures Index, the Fed’s favorite inflation gauge, fell to its lowest level since spring 2021.

Investors are starting to bet the Fed is done raising interest rates.

Takeaway: Investors love to call an end-of-the-year boom a Santa Claus Rally. And this was the S&P 500’s second-best November ever - behind just 2020. But it’s been a tough month for hedge funds shorting the market - they’ve lost almost $50 billion doing so.

Stock gains in November:

Roku: +75%

Coinbase: +62%

Opendoor: +58%

Block: +58%

Shopify: +54%

Datadog: +43%

Snap: +38%

Cloudflare: +36%

Palantir: +35%

Crowdstrike: +34%

Uber: +30%

Snowflake: +29%

Twilio: +26%

Doordash: +25%

Salesforce: +25%

Roblox: +24%

AMD: +23%

Etsy: +22%

Intel:… twitter.com/i/web/status/1…— Jon Erlichman (@JonErlichman)

12:23 AM • Dec 1, 2023

SPONSORED BY FLIPPA

Get Them Before They Go

These businesses are for sale on Flippa right now:

Booming Wine Making Kits Biz - $449,999

A unique Ecom business selling popular wine making kits with 5K+ 5-star product reviews. Showcasing a 15% YoY growth, a TTM revenue of $934K and an impressive 24% return customer rate. Plus, it boasts an email list of 41K subscribers.

Award-Winning Cruising Blog - $425,220

This blog has been providing cruising tips for 16 years. With 1M+ yearly page views, 78% organic traffic from US, Canada and UK, and boasting a high authority score of 35. Includes solid social following and a popular podcast.

Thinking of selling your business instead? We’ve got you. Put our valuation tool to the test, and start your exit journey with Flippa.

HEADLINES

Top Reads

Citadel, hedge funds drawing scrutiny for similar trades (BB)

Corporate profits popped in Q3, just shy of all-time peak (Axios)

Jamie Dimon says to be prepared for a recession (CNN)

Sam Altman’s interview after getting rehired as CEO of OpenAI (Verge)

Supreme Court poised to limit SEC power (CNN)

Talking to chatbots is now a $200k/year job (WSJ)

How hedge funds view the fate of king dollar (Reuters)

KKR maps growth plan tied to $2.7 billion insurance deal (WSJ)

Fintech firm SoFi set to exit crypto business (Reuters)

Can a Big Pharma ever be worth $1 trillion? (WSJ)

CAPITAL PULSE

Markets Rundown

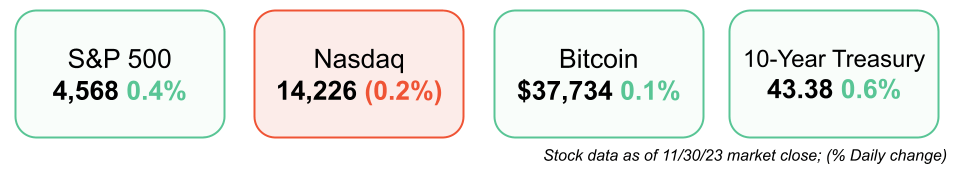

Stocks closed higher thanks to positive inflation data.

Movers & Shakers

(+) Victoria’s Secret ($VSCO) 14% after providing guidance in line with analysts’ expectations, despite steeper-than-expected loss.

(+) Salesforce ($CRM) +10% after Q3 earnings topped estimates.

(–) Pure Storage ($PSTG) -12% after posting a weak revenue outlook.

Private Dealmaking

Abbvie will buy Immunogen for more than $10 billion

Blackstone raises $2.6 billion for real estate secondaries deals

Wormhole, a blockchain messaging startup, raised $225 million

One Click LCA, a decarbonization platform, raised $44 million

Aro Biotherapeutics, a generic medicines developer, raised $41.5 million

DuploCloud, a cloud app provisioning startup, raised $32 million

BOOK OF THE DAY

Fool Me Once

Have you ever wondered why Bernie Madoff thought he could brazenly steal his clients' money? Or why investors were so easily duped by Elizabeth Holmes? Or how courageous people like Jeffrey Wigand are willing to become whistleblowers and put their careers on the line?

Fraud is everywhere, from Nigerian "princes," embezzlers, and Ponzi schemers to corporate giants like Enron and Volkswagen. And fraud is costly. Each year, consumers, small businesses, governments, and corporations lose trillions of dollars to financial crime.

We're so accustomed to hearing about fraud that our abilities to identify it and speak about it are limited.

No more. In Fool Me Once, renowned forensic accounting expert Kelly Richmond Pope shows fraud in action, uncovering what makes perps tick, victims so gullible, and whistleblowers so morally righteous, while also encouraging us to look at our own behaviors and motivations in the hope of protecting ourselves and our companies.

By the time you finish this book, you'll have a better understanding of—and perhaps even compassion for—perpetrators, a renewed connection to victims, and an appreciation for those who blow the whistle.

Filled with fascinating stories and insightful analysis, Fool Me Once will open your eyes and challenge your thinking. It will inspire you to question your own preconceived notions about fraud.

It will challenge your beliefs about yourself and other people. And it will help you understand a phenomenon that most of us fail to grasp—until it's too late.

“A riveting look at the perpetrators, victims, and whistleblowers behind financial crimes.”

DAILY VISUAL

Corporate Profits Pop in Q3

Quarterly US corporate profits

Source: Axios

PRESENTED BY MAG CAPITAL PARTNERS

Diversify Your Portfolio with Industrial Real Estate

Put low-yielding capital to work in industrial real estate that offers immediate cash flow, 20-year NNN leases and excellent inflation protections.

The American Industrial Real Estate Sector is the backbone of the US Economy:

E-Commerce and Supply Chain Demand: Onshoring and logistic shifts increase the demand for US industrial properties.

Scarce Locations: High demand meets short supply, slowing new construction and negative absorption all support ongoing investment opportunities.

Consistent and Reliable Income: Steady cash flow that is securitized by long-term leases with strong American manufacturing companies.

Click here to learn more and to connect with principals at MAG Capital Partners.

DAILY ACUMEN

Be So Good

In a world where attention is a valuable currency, standing out becomes crucial. While paying for advertising or seeking celebrity endorsements may offer short-term visibility, the recipe for genuine, organic, and enduring attraction involves a different approach.

Drawing inspiration from Steve Martin's "Be so good, they can't ignore you," the key is to create so much that your work becomes impossible to overlook. Traction, the sign that your work is making an impact, comes when you produce consistently and in high volume.

Scott Adams emphasizes the power of repetition in persuasion, highlighting the need for persistent effort. Volume adds credibility, and it's through continuous creation that improvement, attraction, and success become attainable.

The journey may include a phase of little traction, but commitment, patience, and a love for the craft are essential for emerging from it and creating work that truly resonates.

ENLIGHTENMENT

Short Squeez Picks

MIT Sloan’s 8 best books of 2023

Why natural ability can actually hold you back

How to avoid career regret in your 20s

11 secrets to feeling more positive

How to give a killer presentation

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's edition? |

Reply