- Short Squeez

- Posts

- 🍋 Rolex vs. Watch Flippers

🍋 Rolex vs. Watch Flippers

Plus: OpenAI paying employees more than any tech startup in history, Trump admin blocks state childcare payments after MN fraud, and the world’s richest added $2.2T in 2025.

Together With

“Your edge in investing is not knowing something others don’t. It’s behaving differently than others can.” — Morgan Housel

Good Morning! OpenAI is paying more than any startup in history, with stock-based comp averaging $1.5 million per employee in 2025. The Trump admin moved to restrict state childcare payments after the Minnesota daycare fraud case. And the world’s richest added $2.2T in wealth in 2025.

“Big Short” investor Michael Burry says he’s not shorting Tesla, even after calling the stock “ridiculously overvalued.” Retail traders wrapped up one of their best years ever. And Bill Ackman warned that “no one would stay” if California moves forward with a proposed wealth tax.

Plus: The investor who left the CIA for venture capital and five ways to live a luckier life.

Download Coverd for a chance to win Super Bowl tickets.

SQUEEZ OF THE DAY

Rolex vs. Watch Flippers

Rolex finally decided to confront watch flippers, and it didn’t do it by flooding the market or cutting prices. Instead, the brand stepped in to control trust in a secondhand market riddled with counterfeits and speculation.

Three years ago, Rolex launched its Certified Pre-Owned program as the global market for used Swiss watches approached $25 billion a year.

The program is expected to generate over $500 million in sales in 2025, according to WatchCharts, and Watches of Switzerland has told investors that certified pre-owned Rolexes are now its second-biggest seller.

The economics aren’t the point. Rolex is likely only breaking even, by design. The real win is pricing power. Buyers are willing to pay roughly 28% more for a used Rolex that has been authenticated and serviced by the brand itself.

In some cases, the premium is far higher. A new GMT-Master II “Pepsi” retails for about $12,150, trades around $22,750 on resale sites, and clears closer to $26,750 when Rolex-certified.

Crucially, Rolex stays hands-off. Authorized dealers source the watches, authenticate and service them to Rolex standards, and set resale prices. Rolex just certifies authenticity and provides a two-year warranty.

Dealers keep the economics, while Rolex avoids inventory risk and sidesteps the backlash faced by brands like Audemars Piguet when they tried to control resale pricing directly.

Zoom out and the strategy becomes clear. Rolex sells roughly 1.2 million watches a year, controls about 32% of the global luxury watch market, and demand still exceeds supply. With resale prices acting as a public scoreboard, flippers and counterfeiters posed a reputational risk, one Rolex now appears to have brought back under control.

Takeaway: For luxury brands, the resale market is now too large to ignore. If buyers are willing to pay a premium for a guaranteed Rolex, they’ll likely do the same for other high-value goods like Hermès Birkin bags. Rolex has shown how it’s done: squeeze out counterfeiters, protect brand perception, and make even flippers work for you, without ever owning the inventory.

PRESENTED BY COVERD

Play Games… To See Games.

Coverd combines spending insights with reward-based mini-games. Users track purchases, play for cashback, and apply winnings toward bills or future expenses. The platform has returned $2 million to early users.

Built by former traders Albert Wang and Eric Xu, Coverd flips the traditional rewards model. Instead of earning fixed percentages that accumulate slowly, users get variable returns through gameplay; up to 100% of purchase amounts back.

They recently launched event giveaway where you can win tickets to the Super Bowl.

The Coverd Card launches early 2026 with the same interactive reward structure built into every transaction.

HEADLINES

Top Reads

OpenAI offers most generous pay in tech-startup history (WSJ)

HHS freezes all childcare funding to Minnesota, citing 'blatant fraud' (YF)

Warren Buffett era ends at Berkshire Hathaway (WSJ)

'Big Short' investor Michael Burry says he's not shorting Tesla (CNBC)

Retail investors closed out one of their best years ever (CNBC)

Bill Ackman warns ‘no one would stay’ if California implements wealth tax (NYP)

The investor that left the CIA for venture capital (WSJ)

World's richest added a record $2.2T in wealth this year (BB)

Nike shares move higher on big insider purchases (CNBC)

These stocks are the market's biggest winners and losers in 2025 (YF)

Oil heads for steepest annual loss since 2020 (YF)

China's reawakening puts Asia M&A on confident course for 2026 (BB)

Economist sees Fed surprising with three rate cuts in first half of 2026 (CNBC)

Bitcoin ends volatile year lower, but January could be 'bullish' (YF)

Trump Media to distribute digital token to shareholders; stock jumps (YF)

Gold, silver prices fall after CME raises precious metals margins again (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities slipped on the final trading day of 2025 amid low liquidity and a quiet data calendar

Despite the soft close, 2025 performance was strong: S&P 500 +16%, Nasdaq +20%, Russell 2000 +11%

Treasury yields edged higher, with the 10-year up ~4 bps following firmer labor data

Oil ended the year near $57, down roughly 20% in 2025

Economic Data Highlights

Initial jobless claims fell to 199K, among the lowest readings of the year

The four-week average remained contained near 220K, and continuing claims declined

Data continue to point to a resilient labor market heading into 2026

Sector & Asset Class Trends

Precious metals pulled back late in the year after higher margin requirements, but still posted outsized gains: gold +64% YTD, silver +145% YTD

Bond markets finished slightly weaker on the day, but delivered solid full-year returns overall

Thin trading conditions kept sector moves muted into year-end

Looking Ahead

Market liquidity is expected to improve in early 2026 as the data calendar picks up

Key releases next week include the December jobs report, ISM surveys, and consumer sentiment

Fed minutes suggest most officials expect rate cuts in 2026, though near-term policy likely hinges on upcoming labor data

Movers & Shakers

(+) Vanda Pharmaceuticals ($VNDA) +25% after the FDA approved tradipitant, a drug aimed at treating vomiting.

(+) Nike ($NKE) +4% after CEO Elliott Hill bought $1M worth of shares.

(–) Corcept Therapeutics ($CORT) -50% after the U.S. Food and Drug Administration did not approve of Corcept’s drug relacorilant.

Prediction Markets

Private Dealmaking

OnCorps AI, an agentic AI platform for fund operations, raised $55 million

Fluency, a digital advertising operating system, raised $40 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Making of a Permabear

Description: A candid, battle-tested account from one of the market’s most famous skeptics—how Grantham built his “permabear” instincts by watching bubbles form, peak, and punish believers across decades. Written with financial historian Edward Chancellor, it’s less about hot takes and more about pattern recognition: cycles, valuations, incentives, and the uncomfortable truth that long-term success often requires short-term unpopularity.

Book Length: 400 pages

Release Date: January 13, 2026

Ideal For: Long-term investors, macro obsessives, value disciples, and anyone who wants a sharper BS-detector for bubbles, narratives, and “this time is different.”

“In markets, the crowd feels safe—right up until it isn’t.”

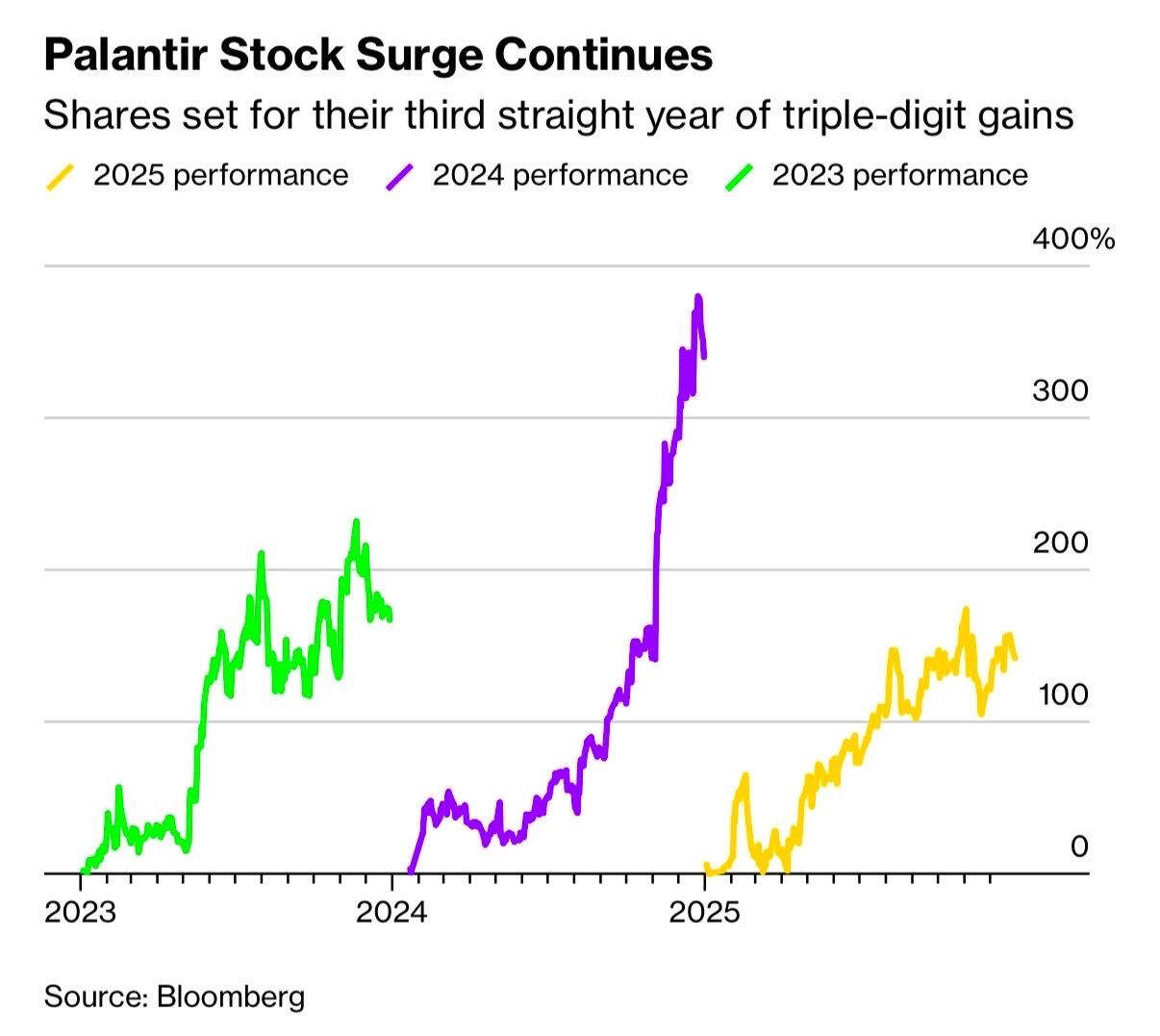

DAILY VISUAL

Palantir on a Generational Run

2023: +167%

2024: +340%

2025: +135%

PRESENTED BY MACABACUS

Pls Fix? Pls, no.

"Pls fix”

Two words that ruin dinner plans, date nights, and any hope of leaving before 9 PM.

Macabacus' Deck Check automatically proofreads your entire deck in seconds. It catches formatting, alignment, and consistency errors before your MD does.

No more late-night revisions. No more weekend “quick fixes”. Just perfect decks, built faster and on-brand.

Trusted by top investment banks and private equity firms, Deck Check keeps you one step ahead of the "Pls Fix" email.

DAILY ACUMEN

Sleep

Matthew Walker's research at Berkeley revealed something shocking: sleeping less than seven hours per night damages every aspect of human functioning. It impairs memory, creativity, immune function, emotional regulation, and decision-making.

After just one night of poor sleep, your cognitive performance drops to the level of legal intoxication. Yet we wear sleep deprivation like a badge of honor.

Arianna Huffington literally collapsed from exhaustion, breaking her cheekbone, before realizing that sacrificing sleep wasn't productive, it was destroying her.

Elite performers think differently: LeBron James sleeps 12 hours a day. Jeff Bezos prioritizes eight hours. Roger Federer gets 12.

They understand that sleep isn't downtime, it's when your brain consolidates learning, processes emotions, and repairs your body.

An hour of focused work after good sleep beats three hours of exhausted grinding.

What would change if you treated sleep as your most important meeting?

Remember, you're not cheating work by sleeping, you're cheating yourself by not sleeping.

ENLIGHTENMENT

Short Squeez Picks

3 tips on motivation from a pro athlete

5 ways to live a luckier life starting tomorrow

How to be more productive

Most top-performing adults weren’t elite specialists in childhood

How to be taken seriously

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply