- Short Squeez

- Posts

- 🍋 Rate Cut for Christmas

🍋 Rate Cut for Christmas

Plus: Bezos vs. Musk shifts to space data centers, Marc Rowan sees market makers coming for private credit, Oracle burns $10B on AI, PE leans on secondaries to avoid a crash.

Together With

“The best opportunities go to people whose reputation got them picked before anyone else knew the opportunity even existed.” — Shane Parrish

Good morning! Bezos and Musk are now racing to build AI data centers in space. Cobepa’s CEO says secondaries are the only thing keeping private equity from a full-blown crash. And Apollo’s Marc Rowan says traditional market makers are coming for private credit.

Nvidia denied reports that China’s DeepSeek is using its banned chips. Oracle’s earnings showed a $10 billion cash burn as AI data-center spending explodes. The U.S. Navy tapped Palantir to speed up shipbuilding, and Meta’s new AI superstars are clashing with the rest of the org.

Plus: Hong Kong bankers are being warned to clean up sloppy IPO paperwork, distressed funds are piling into bankrupt First Brands’ top-ranked loans after a selloff, and Bill Gates dropped his holiday reading list.

Sophisticated investors crave curated deal flow and low correlation to public equities. Percent provides both. Explore their private credit deals today.

SQUEEZ OF THE DAY

Rate Cut for Christmas

The Fed cut rates for the third time this year, dropping the fed funds range to 3.50%–3.75%. The move aims to support a labor market that Powell says is weaker than it looks, even as tariff-driven inflation remains elevated.

It was the most fractured Fed vote since 2019. Goolsbee and Schmid wanted no cut, Miran wanted 50 bps, and four non-voters logged “soft dissents.” Goldman Sachs said the Fed’s return to more cautious language was an effort to appease a hawkish bloc that is clearly gaining influence.

Powell also warned that the data the Fed is relying on may be overstated. The Fed now believes payrolls could be inflated by as many as 60,000 jobs per month, meaning the economy might actually be losing jobs. Inflation has ticked up again this year, but Powell said the move is almost entirely tariff-driven. Strip out tariffs, and Powell says inflation is already in the low twos.

The 43-day government shutdown has clouded the data further, and Powell said upcoming releases should be viewed “with a somewhat skeptical eye.” The Fed sees inflation cooling to 2.4% next year, but risks run both ways: employment is weaker, inflation is stickier.

Markets shrugged off the noise and ripped higher anyway. The S&P 500 closed up 0.7% and the Dow added more than 510 points. Investors also liked the Fed’s promise to keep buying billions in Treasurys to keep markets functioning smoothly.

But the message from Wall Street is clear: the cut cycle is likely done. FedWatch shows a 75.6% probability of no move in January. Powell says policy is near neutral. Goldman and Morgan Stanley say the “insurance cut” era is basically finished.

Takeaway: With Powell’s term expiring in May 2026, today’s division inside the Fed may be the preview of a much larger political realignment in monetary policy next year. The easy money era is gone, the data is suspect, the committee is fracturing, and tariffs are doing more to move inflation than monetary policy.

Powell is trying to land a plane with one engine pointing at jobs and the other pointing at politics. Markets may be celebrating the cut, but the message the Fed is probably done playing hero unless something breaks.

PRESENTED BY PERCENT

Why Private Credit Can Outperform Public Equity for Accredited Investors

Private credit offers three advantages public markets can’t match: real collateral backing principal, yields up to 20%, and access to parts of the economy stocks don’t reach.

The numbers explain why. 87% of US companies and 95% of European companies with $100 million+ in revenues are privately held. Public equity gives you access to a fraction of available opportunities.

Percent connects accredited investors to curated private credit deals with low correlation to public market volatility. The platform features opportunities with potential annualized returns up to 20%, terms as short as six months, and full transparency into underlying data.

Please Support Our Partners!

HEADLINES

Top Reads

Billionaires Jeff Bezos, Elon Musk racing to build AI data centers in space (NYP)

Buyout CEO says secondaries are preventing private equity crash (BB)

Oracle burned $10 billion as AI data center investments rise (CNBC)

Apollo’s Rowan sees market makers coming for private credit (BB)

Nvidia refutes report that China’s DeepSeek is using its banned AI chips (CNBC)

The U.S. Navy turns to Palantir as part of a push to speed shipbuilding (BB)

Meta’s new AI superstars are chafing against the rest of the company (NYT)

Hong Kong bankers warned to improve quality of IPO paperwork (FT)

Distressed funds snap up First Brands’ top loans to drive debt restructuring (WSJ)

Wall Street is hedging the AI trade in 2026 (Axios)

Senior HSBC execs hid behind co-head role, CEO says (BB)

Rivian turns to AI, autonomy as EV sales stall (CNBC)

Private equity makes its first college sports play (Axios)

Ares CEO explains why it hasn’t teamed up with traditional firms (BB)

Trump: ‘imperative’ that CNN be sold to new ownership (Hill)

Private equity may regret inviting in mom and dad (FT)

How Wall Street plans to invest for 2026 (Axios)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks rallied to new record highs Wednesday after the Fed delivered a widely expected 0.25% rate cut and signaled a more cautious stance on future policy moves.

The S&P 500 rose 0.8%, while small caps outperformed, with the Russell 2000 gaining nearly 2% on the session.

Treasury yields fell, with the 10-year yield down to 4.14%, while the U.S. dollar weakened 0.5% against major currencies.

Gold climbed nearly 1%, supported by lower rates and a softer dollar.

Overseas, Asian and European markets traded higher, reflecting improved global risk sentiment following the Fed’s dovish tone.

Economic Data Highlights

The Fed’s rate cut decision was not unanimous — two officials voted to keep rates unchanged, while one favored a deeper cut.

Chair Jerome Powell emphasized that while the Fed will likely pause in January, future hikes are “unlikely,” hinting at a bias toward easing.

The updated dot plot showed one projected rate cut in 2026 and another in 2027, though views among FOMC members remain widely split.

The Employment Cost Index showed a further cooling in wage growth last quarter, helping ease inflation concerns.

Inflation remains around 3%, above the Fed’s target, but the central bank appears increasingly confident in a soft-landing scenario.

Sector Trends

Interest-rate-sensitive sectors, including small caps, real estate, and financials, led Wednesday’s gains.

Technology continued to show resilience, while energy lagged as oil prices remained near $60 per barrel.

Earnings Today

Broadcom (AVGO) – Strong semiconductor demand and new AI chip supply agreements supported results.

Costco (COST) – Focus on membership renewal rates and core sales growth.

Lululemon (LULU) – Watch for guidance on holiday-season demand and international expansion momentum.

Movers & Shakers

(+) GE Verona ($GEV) +16% after JPMorgan raised its price target to $1,000; AI is spurring higher dividends and buybacks.

(+) American International Group ($AIG) +6% because Chubb reportedly made a takeover offer for the insurer.

(–) Dropbox ($DBX) -8% after the company’s CFO will resign.

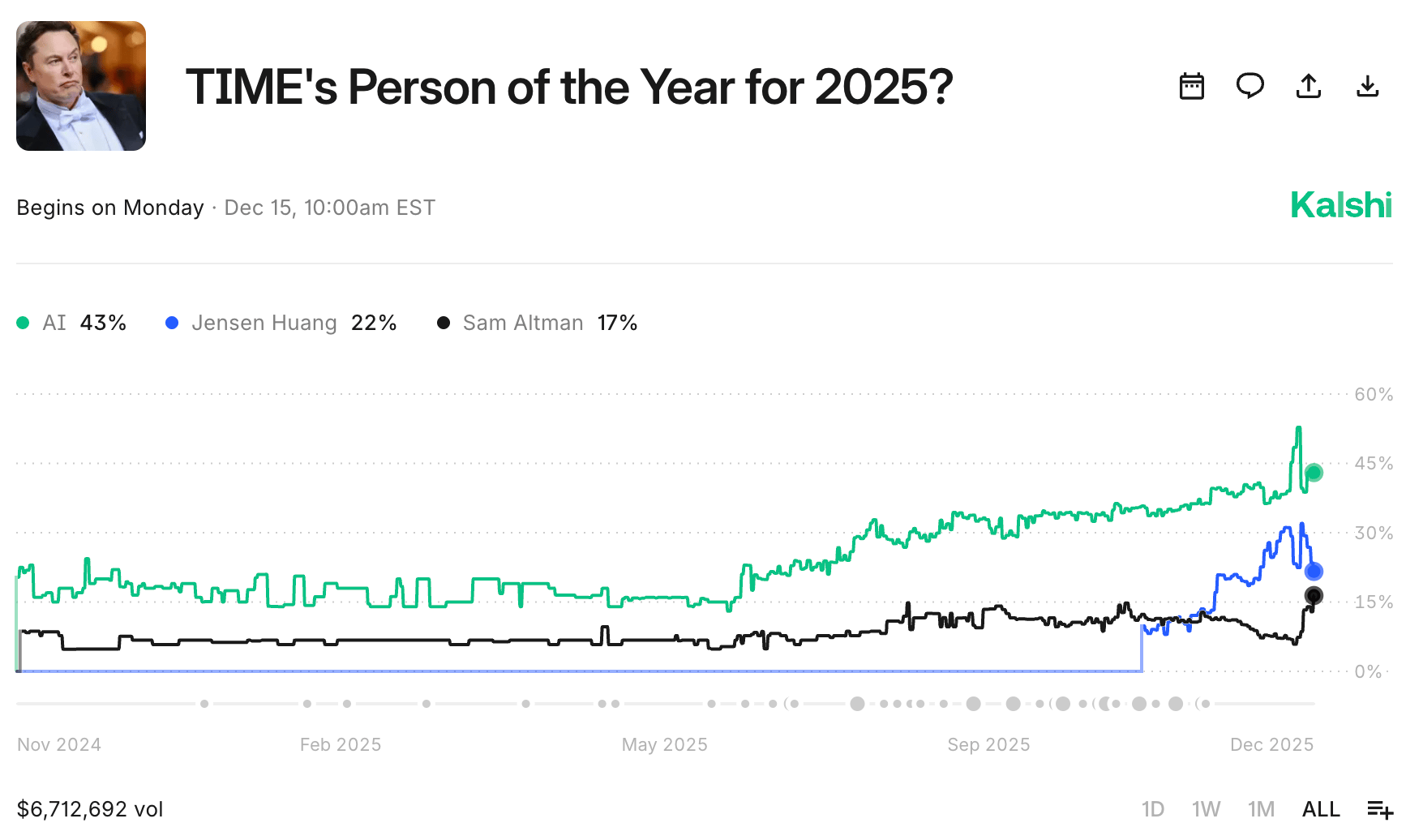

Prediction Markets

Private Dealmaking

Fervo Energy, a geothermal energy developer, raised $462 million

Fal, a generative media platform, raised $140 million

SanegeneBio, an obesity and autoimmune biotech, raised $110 million

Antares, a developer of micro nuclear reactors for defense and space applications, raised $96 million

Duve, a hotel guest management platform, raised $60 million

Hometap, a provider of home equity investment products, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Every Screen on the Planet

Description: A riveting chronicle of how the world’s most addictive algorithm became one of its most contested battlegrounds. Baker-White — a seasoned tech reporter and former lawyer — traces TikTok’s meteoric rise from a quirky video app to a geopolitical flashpoint, exposing surveillance fears, political brinksmanship, corporate survival strategies, and the global scramble to control what we see. It’s part tech history, part spy story, and a vivid look at how attention became the world’s most valuable—and controversial—commodity.

Book Length: 368 pages

Release Date: September 30, 2025

Ideal For: Tech innovators, policy wonks, investors, social-media addicts, and anyone curious about power, data, and influence in the digital age.

“Control of attention isn’t just business—it’s strategy, sovereignty, and the most consequential algorithm of our time.”

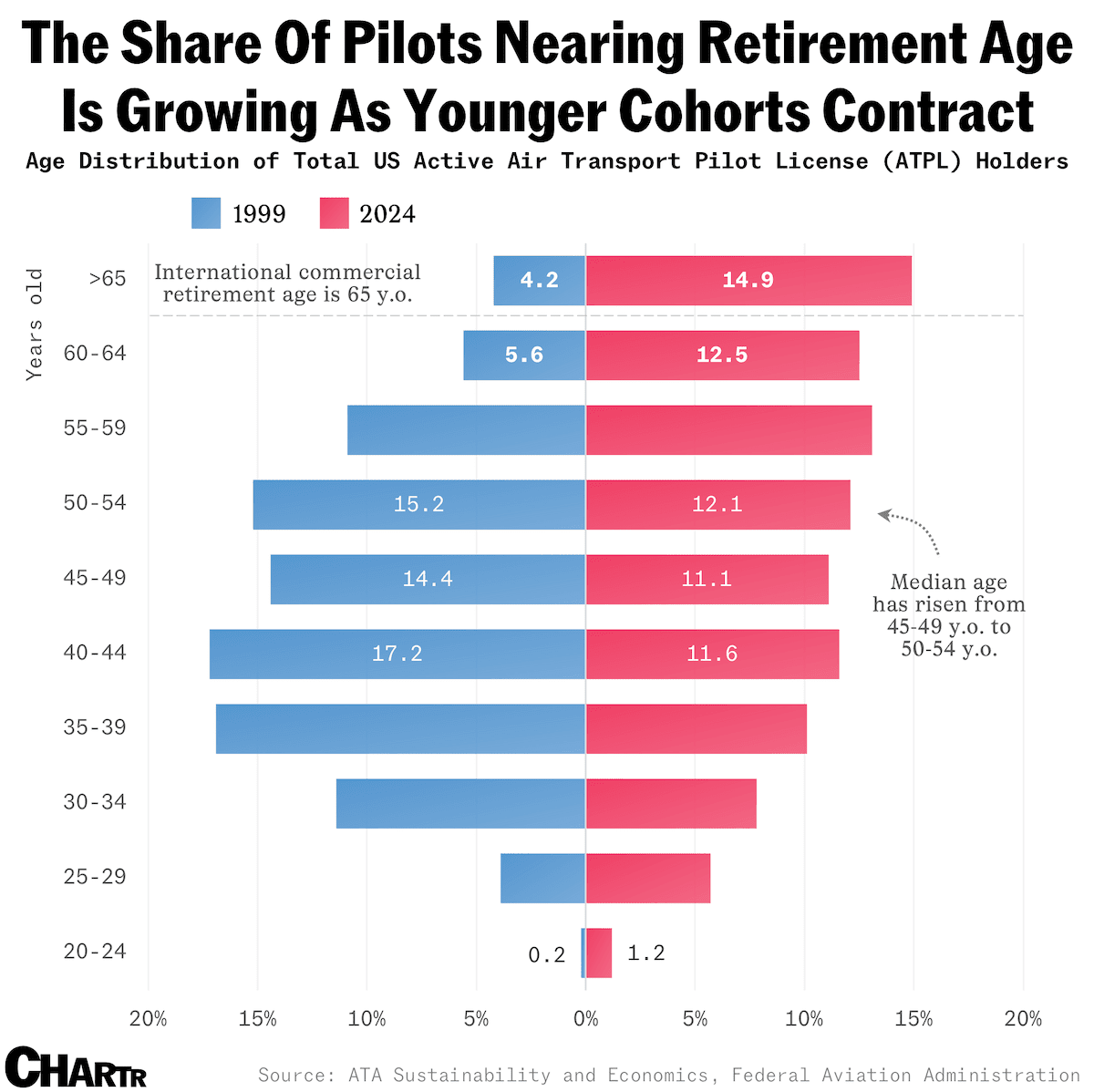

DAILY VISUAL

Pilot Shortages Expected to Get Worse

Source: Chartr

PRESENTED BY MOSAIC

The Future of Deal Modeling Starts With an Email to Mo

The world of private equity has changed with the recent launch of Mosaic Autopilot, or Mo for short.

Forward your CIM to Mosaic and receive a fully auditable, bid-ready LBO model in under 5 minutes.

The engine is deterministic, not generative, so you get 100% accurate math and full auditability, unlike the many “AI Excel co-pilots” out there.

Download to Excel with linked formulas or export to PDF in your firm’s format.

No logins or prompt engineering required. Send the file, get back a polished model. See Founder and CEO, Ian Gutwinski, introduce it here.

Please Support Our Partners!

DAILY ACUMEN

Get on Your Feet

Steve Jobs held walking meetings.

Nietzsche said, "All truly great thoughts are conceived while walking."

Charles Darwin had a daily walking route he called his "thinking path."

Walking isn't just exercise, it's fuel for creativity and problem-solving.

Studies show walking boosts creative output by 60%.

Got a problem? Take a walk. Need an idea? Take a walk.

Remember, if you're stuck in your head, get into your feet.

ENLIGHTENMENT

Short Squeez Picks

Likable people do these 4 things when talking to others

What Bill Gates recommends you read this holiday season

Is an infrared or traditional sauna better?

8 reasons why some people never progress in life

The benefits of doing planks every day

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk.

Reply