- Short Squeez

- Posts

- 🍋 Private Credit Cartel

🍋 Private Credit Cartel

Plus: Nvidia drops questionable "I’m not Enron" memo, State Street roasts JPMorgan's biggest ETF in email to clients, and macro traders on track for biggest haul in 16 years.

Together With

"If every time you lost money you just got depressed and angry and you couldn't deal with it, you'd have a very short career." — Ken Griffin

Good Morning! Nvidia is fighting to defend its market dominance as the sleeping giant in the AI race (Google) finally wakes up. Nvidia’s “I’m not Enron” memo is also raising more questions than it answered. Bitcoin is stabilizing after the worst of its selloff is seemingly over.

State Street roasted JPMorgan’s biggest ETF in an email to clients, then tried to walk it back. Consumer confidence just hit its lowest level since April. Wall Street’s macro traders are on track for their biggest haul in 16 years. And Peloton’s new AI-powered bikes and treadmills, rolled out to save the company, are off to a sluggish start.

Plus: Sellers are pulling homes off the market at the fastest pace in a decade, and how sleep deprivation rewires your brain.

Get private credit yields without private credit lockups. Earn up to 15% APY with YieldClub.

SQUEEZ OF THE DAY

Private Credit Cartel

Private credit was supposed to be the quiet corner of Wall Street, a $2 trillion shadow-lending engine that operated off-exchange and out of sight. The giants who dominate it (Apollo, Ares, BlackRock) have always preferred it that way. But now one of the most debt-burdened companies in their portfolios is blowing the whistle.

Altice USA, now rebranded as Optimum, is carrying a $26 billion debt load. And this week, it filed a federal antitrust suit accusing Apollo, Ares, and BlackRock of using a lender “cooperation agreement” to freeze the company out of the U.S. credit market unless it accepted group-approved terms.

The market reacted instantly. Optimum’s notes plunged in secondary trading. The company says the pact binds “nearly every creditor holding Optimum’s debt,” requiring two-thirds approval before anyone can engage. In its words, the group is “a classic illegal cartel” coordinating pricing and access to capital.

Optimum has been struggling for more than a year. Restructuring talks fizzled in the spring. Then this week, the company surprised lenders by prepaying its $1.9 billion 2028 term loan (the one with the toughest protections) two years early, and then immediately dropped an antitrust bomb on its biggest creditors.

Bankers say this is exactly the kind of coordination Washington has been eyeing across private credit. These aren’t niche lenders - Apollo, Ares, and BlackRock anchor the $2T industry and routinely set terms on the riskiest deals.

If Altice proves lenders dictated pricing or shut off refinancing, it could open a Pandora’s box for private credit. And even if the case goes nowhere, the market reaction told the story: one Optimum bond dropped to ~80 cents on the dollar, another into the low 60s. Investors clearly smell more than a routine borrower-lender fight.

Takeaway: If courts decide that lender “cooperation” is really cartel behavior in finance-friendly language, the private-credit universe could be headed for a regulatory reckoning. Club deals, side letters, and coordinated pricing may suddenly fall under an antitrust microscope. One way or another, this case just became required reading for every restructuring banker.

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money To Make Money

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 6–15% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

Please Support Our Partners!

HEADLINES

Top Reads

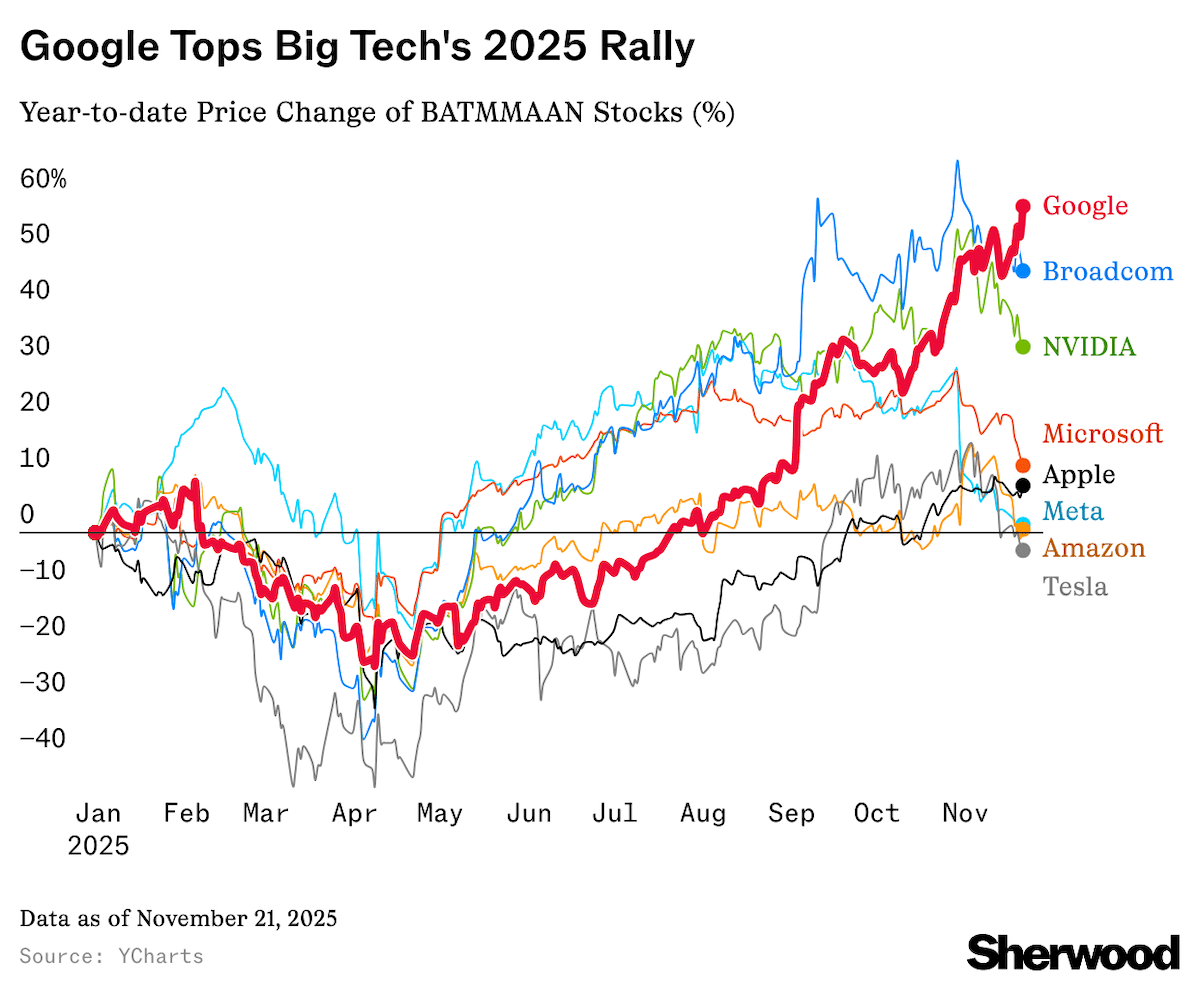

Alphabet AI chips, Gemini model position it to rival Nvidia (BB)

Google, the sleeping giant in global AI race, now fully awake (YF)

Nvidia’s ‘I’m not Enron’ memo has people asking a lot of questions (Verge)

Bitcoin recovery from worst of selloff holds, buoying traders (YF)

Peloton’s new AI-powered bikes, treadmills get off to slow start (BB)

State Street roasts JPMorgan's biggest ETF, then backtracks (BB)

Consumer confidence hits lowest point since April as job worries grow (CNBC)

Wall Street’s macro traders eye biggest haul in 16 years (BB)

Sellers are taking their homes off the market at fastest pace in a decade (CNBC)

Dow leads stocks higher as Wall Street rally continues (YF)

Gas prices fall below $3 per gallon in more than half of US states (YF)

Wall Street banks scramble to assess fallout from hack of real-estate data firm (CNN)

US retail sales rose less than forecast in September as key data returns (YF)

Private credit’s sketchy marks get warning shot from Wall Street’s top cop (BB)

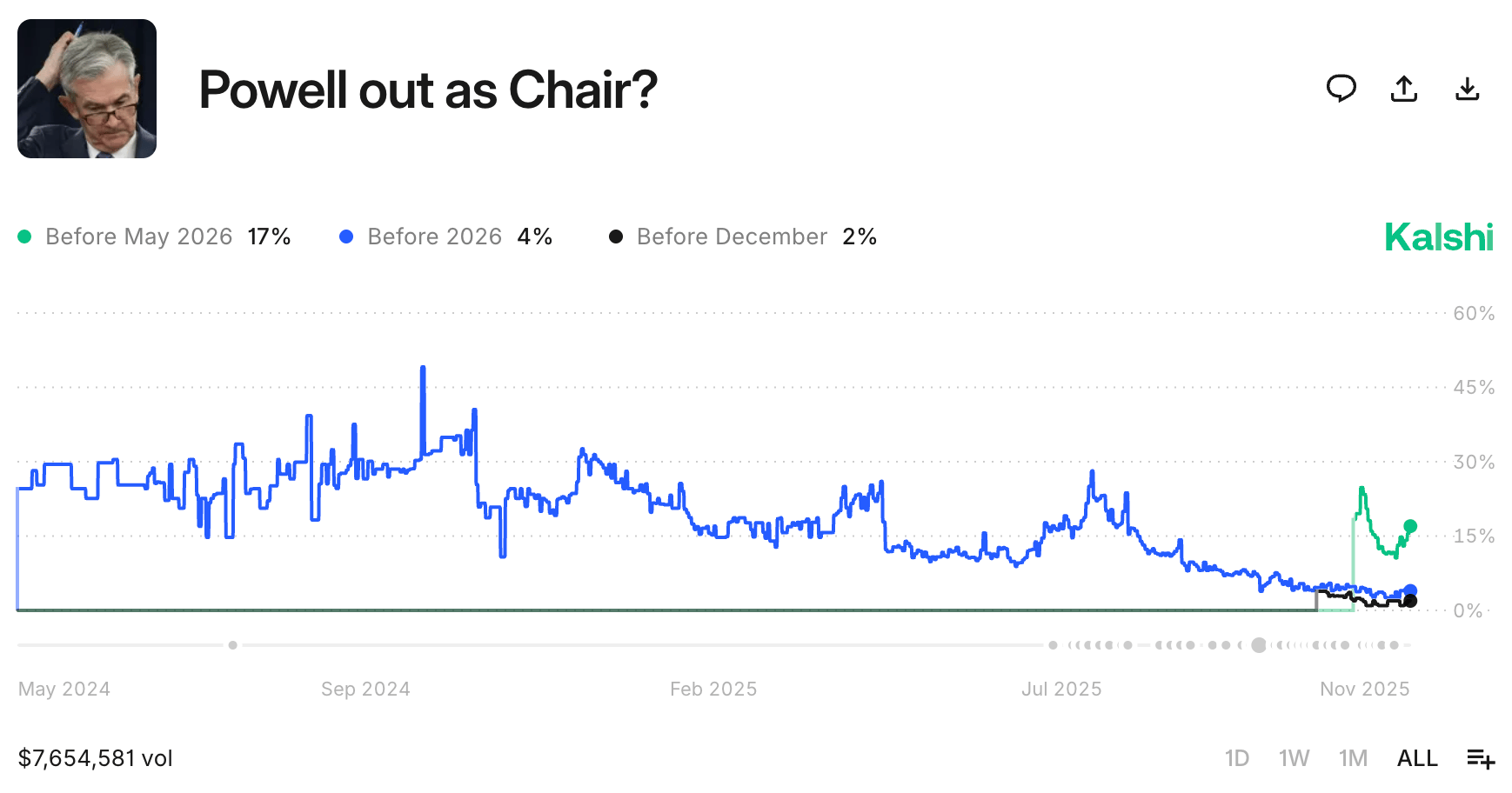

Bessent says 'good chance' Trump names new Fed chair before Christmas (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

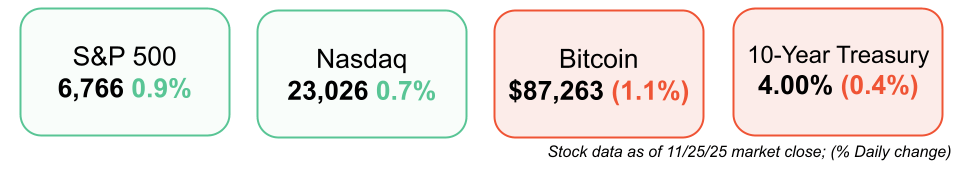

Stocks closed higher Tuesday as investor sentiment improved on reports of a potential Ukraine-Russia peace framework.

The S&P 500 and Nasdaq gained, led by strength in health care and consumer discretionary stocks, while energy and utilities lagged.

Bond yields fell, with the 10-year Treasury yield easing to 4.0%, nearing its year-to-date low.

The U.S. dollar weakened against major currencies, and WTI oil hovered near yearly lows, as optimism around peace talks reduced perceived supply risks.

European markets advanced, while Asia ended mixed overnight.

Economic Data Highlights

Producer price inflation (PPI) for September was mixed, holding steady at 2.7% year-over-year, slightly above expectations for 2.6%.

Core PPI eased to 2.6%, indicating some moderation in underlying price pressures.

Energy prices rose 3.5% year-over-year, though oil has since fallen about 6% since September.

Shelter inflation remains elevated at 3.6%, but housing-market data like the S&P Case-Shiller Index show slowing home-price gains (+1.3% YoY), suggesting relief ahead.

Markets now price an 83% chance of a December rate cut, reflecting confidence that inflation is contained.

Economic Data: Retail Sales

Retail sales rose 0.2% in September, below expectations for a 0.4% gain, following several strong months.

Auto sales were a key drag, down 0.3% month-over-month, while sales excluding autos met forecasts.

The data suggest consumers are pausing after strong spending in prior months, particularly in big-ticket categories, though overall consumption remains healthy.

Earnings Today

Deere & Co. (DE) – Watch for commentary on global agricultural demand and equipment orders.

Li Auto (LI) – Focus on delivery growth, pricing strategy, and competition in China’s EV market.

Movers & Shakers

(+) Kohl’s ($KSS) +43% after retail traders fueled a meme stock-like rally.

(+) Abercrombie & Fitch ($ANF) +38% because of strong Hollister growth, earnings beat.

(–) Nvidia ($NVDA) -3% after a report Meta will use Google AI chips.

Prediction Markets

Will we see a new Fed chair before 2026?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Parallel Web Systems, a “world wide web for AIs,” raised $100 million

Sweet Security, a runtime cloud and AI security startup, raised $75 million

Lighter, an Ethereum-based DEX and Layer 2 network, raised $68 million

Voize, a developer of AI medical scribes, raised $50 million

TRIP, a botanical beverage brand, raised $40 million

Stand, an insurer of catastrophe-exposed properties, raised $35 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Seven Rules of Trust

Description: A timely and thoughtful manifesto about trust — what it really means, how to build it, and why it matters now more than ever. Wales draws on his experience founding Wikipedia and guides readers through seven practical “rules of trust” that helped transform Wikipedia from a risky experiment into a global utility used by billions. The book argues that trust isn’t a given; it's a living asset that must be consciously cultivated.

Book Length: 240 pages

Release Date: October 28, 2025

Ideal For:

Founders, leaders, community-builders, educators, and anyone leading projects — from startups to nonprofits to social movements — who wants to build lasting institutions grounded in trust, not exploitation.

“Trust is not gold or gems; it’s living soil. If you neglect it, nothing grows — if you care for it, you can build something that lasts.”

DAILY VISUAL

Google is BACK

Source: Chartr

PRESENTED BY F2

Your MD Will Wonder Where You Found the Time

Private markets reward conviction, but building conviction takes time. Time to read the filings no one else bothers with. Time to parse data rooms and trace the footnotes. Time to assemble a credit memo that won’t merely pass your MD’s desk, but earn a nod of approval.

F2 is the AI platform that gives you that time back. Purpose-built for private credit workflows, F2 accelerates the analytical work behind every diligence process: spreading borrower financials, pulling market comps, generating covenant scenario analysis, and producing IC-ready credit memos with full source transparency. Senior team members get the analysis they need, without burning junior bandwidth.

The result? Better diligence. Faster turns. Fewer late nights.

Leading Private Credit funds are using F2 to accelerate underwriting timelines by 75%. Deploying capital faster, with more conviction.

Because in private markets, time isn’t just a constraint, it’s an advantage. And now, it’s back on your side.

Please Support Our Partners!

DAILY ACUMEN

Trivial Trap

Most people spend their lives debating the color of the bike shed while the nuclear reactor goes unbuilt. We get lost in details that make us feel smart, because small things are safe. They’re easy to understand, easy to control, and easy to win arguments about. But mastery and progress, live in the discomfort of complexity.

The truth is, our brains crave certainty. It’s less threatening to argue over font sizes than to question a flawed business model. It’s easier to fine-tune your morning routine than to reimagine your career. But the return on attention follows the same law as the return on capital: the biggest gains accrue to those willing to allocate time to what truly matters.

Train yourself to zoom out before diving in. When a discussion, task, or obsession takes hold, pause and ask: Does this move the reactor or just repaint the shed?

The world rewards those who dare to wrestle with the hard, ambiguous problems everyone else avoids, the ones too complex to summarize in a Slack thread. That’s where the real leverage lives.

ENLIGHTENMENT

Short Squeez Picks

How sleep-deprivation impacts your brain

How did we end up with performance reviews?

9 little habits that cost nothing but matter deeply

Why top leaders are ditching hustle culture

7 meeting habits that separate managers from leaders

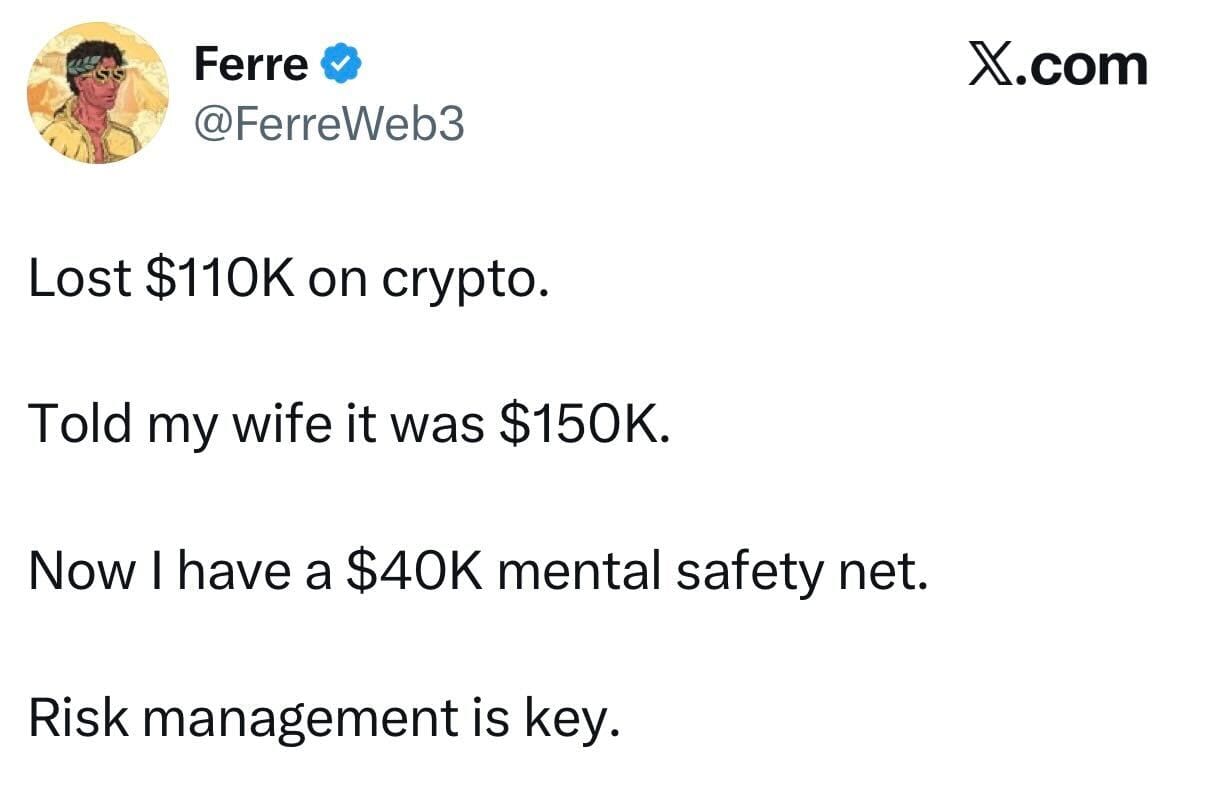

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply