- Short Squeez

- Posts

- 🍋 Pregnancy Tax

🍋 Pregnancy Tax

Plus: Stocks soared thanks to Google's rally, Larry Page becomes 2nd richest in the world, Ray Dalio thinks pod model won’t last, and Burry launches a paid newsletter.

Together With

“You're always selling. And if you don't like to sell, here's my advice: Get over it.” — Ken Griffin

Good morning! Nasdaq logged its best day since May after Google reignited the AI trade and sent chip stocks soaring. Larry Page leapfrogged Larry Ellison to become the world’s second-richest person, while Novo Nordisk cratered after its Alzheimer’s drug missed a key trial endpoint.

Trump ordered a wide-ranging "Genesis Mission" to boost AI research, Ray Dalio says the pod-shop hedge-fund model “won’t last,” and Michael Burry launched a $379-a-year newsletter that’s already pulled in 60,000+ subscribers.

Plus: Why million-dollar lawyers may be the next winners in PE’s 401(k) expansion, how Northwestern Mutual ruins college grads’ lives, and the art of being likable.

Looking for the perfect stocking stuffer? Try FRE, the perfect combo of taste and performance.

SQUEEZ OF THE DAY

Pregnancy Tax

Wall Street has another maternity-leave scandal on its hands. A former Managing Director at RBC Capital Markets is suing the bank, alleging it imposed a “pregnancy tax” that slashed bonuses for new moms and quietly pushed senior women out of the firm.

Jennifer Caruso-Jones, who spent 14 years at RBC, claims the bank’s written maternity-leave policy explicitly prorated bonuses based on time taken off (up to 16 weeks) while employees on other types of leave saw no pay cuts. After she returned from maternity leave in 2019, her comp fell more than 30% despite strong reviews.

She says she wasn’t the only one. Another female MD allegedly saw her bonus cut after each of her three maternity leaves before leaving in early 2023. And 2023 turned into a wipeout year for senior women at the firm, six of RBC’s eight female MDs left.

Overall, women held just 8 of 141 MD roles, and since 2020, only 3 of the 42 newly hired MDs were women.

Caruso-Jones says things got worse after she took a disability leave in 2022. When she returned, she claims she was excluded from meetings and client work while senior managers encouraged her to consider “the next stage” of her life, citing her young child, commute and health.

Another manager allegedly said he preferred hiring “a young guy with no family ties who can go out every night for drinks.”

She was terminated in October 2023 and offered roughly 40–42% of her earned bonus. RBC later told industry contacts she had “retired,” which she says tanked two job prospects.

Interestingly, an RBC employee told her earlier this year that the bank updated its maternity-leave policy to provide equal benefits to new parents and even hired dedicated staff for parental-leave matters.

The case is now moving forward under federal and state civil-rights laws. RBC has not responded to the allegations yet.

Takeaway: The suit comes as financial services firms face growing scrutiny over senior-level gender equity and the treatment of working parents. With most firms still reporting single-digit female MD ratios and pressure increasing from both regulators and employees… let’s hope the industry’s policies start matching the press releases.

PRESENTED BY FRE

The Stocking Stuffer for High-Performers

Skip the desk accessories and generic gift baskets. Your bullpen friend needs performance gear that actually works at 2am during their third model rebuild of the night.

FRE Nicotine Pouches deliver with five strength options (3mg to 15mg), the only major brand offering the ultra-strong 15mg. Pre-Primed technology activates instantly and lasts up to an hour.

Each can holds 20 pouches versus the other guys’ 15, and compact tins fit stockings perfectly.

FRE is what you need when an associate is breathing down your neck and you need to lock-in, otherwise you won't be getting any sleep.

Please Support Our Partners!

HEADLINES

Top Reads

Alphabet, chip stocks lead tech-fueled market rebound (WSJ)

Larry Page becomes No. 2 richest person after Alphabet rally bumps Larry Ellison (Forbes)

Novo Nordisk shares plunge after Alzheimer’s drug misses key trial target (CNBC)

Ray Dalio says the pod-shop hedge-fund model “is unlikely to last” (BB)

Michael Burry launches newsletter to outline his AI-bubble thesis after deregistering hedge fund (CNBC)

Trump ordered a wide-ranging "Genesis Mission" to boost AI research (Axios)

Next winners in PE’s 401(k) expansion: million-dollar lawyers (BB)

Northwestern Mutual employees left in ruin, debt, and with friends blocking them (Guardian)

Tesla China sales fall to a three-year low (CNBC)

DOGE agency no longer exists with eight months left on its charter (CNBC)

Alibaba debuts its main consumer-facing AI app (YF)

Morgan Stanley’s Wilson says U.S. stock pullback is nearing an end (BB)

AI-driven private-credit stress makes Blue Owl the “sum of all investor fears” (BB)

AI startups scramble for cash as burn rates surge (Axios)

India’s IPO boom accelerates as multinationals list local units (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks surged Monday, kicking off the holiday-shortened week with strong gains.

The Nasdaq jumped 2.7%, powered by a 3.5% rally in the Magnificent Seven group, while the S&P 500 gained 1.5% and the Russell 2000 rose nearly 2%.

Treasuries rallied, pushing the 10-year yield down 3 bps to 4.08%, after dovish Fed remarks supported rate-cut expectations.

The U.S. dollar was flat, while oil climbed 1.5% to $59 per barrel and gold rose to $4,130 per ounce.

Economic Data Highlights

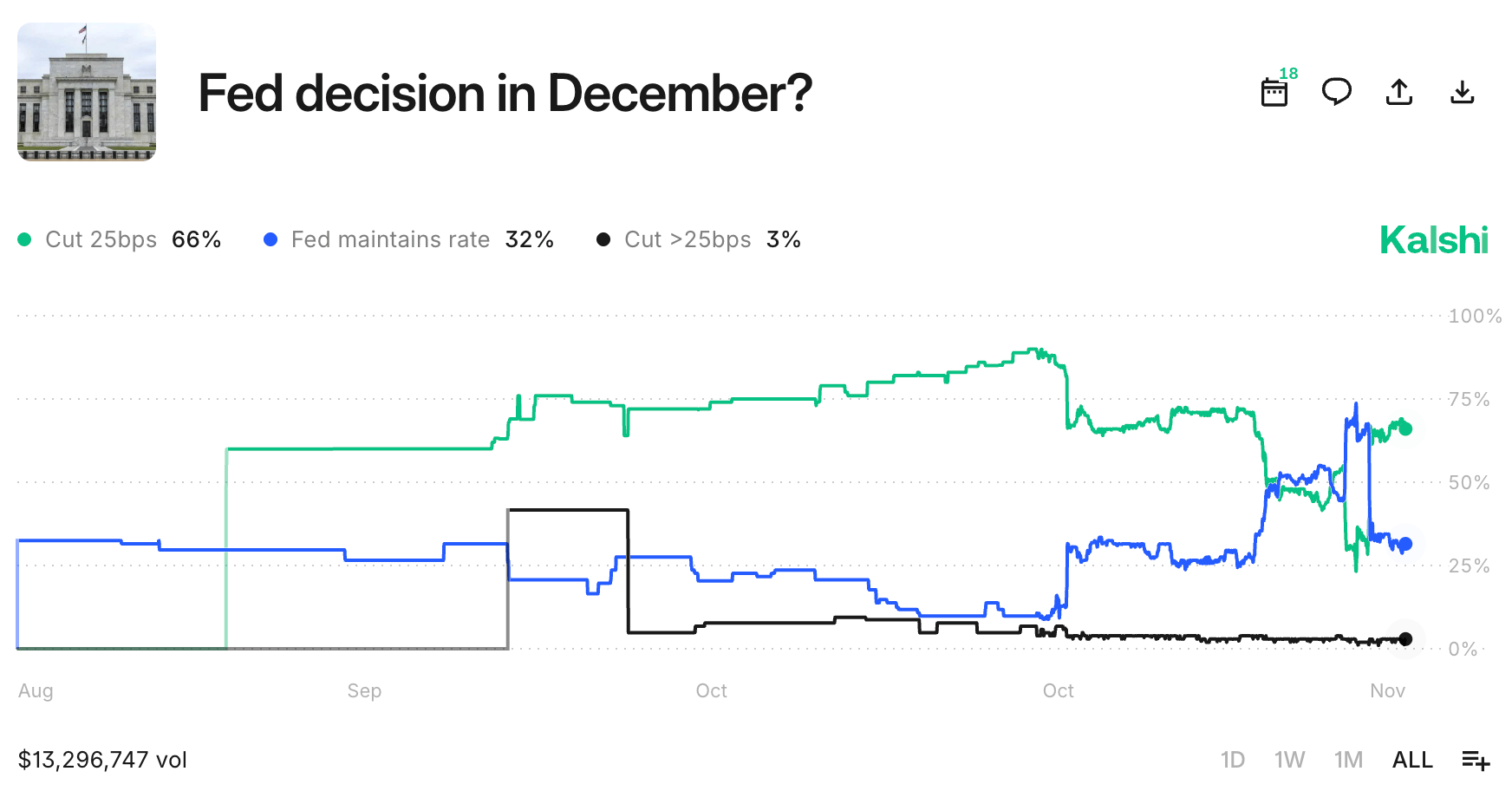

Fed commentary fueled optimism, with Governor Waller and SF Fed President Daly both signaling support for a December rate cut.

This followed similar remarks from NY Fed President Williams on Friday, lifting market-implied odds of a December cut to ~70%, up from ~35% last week.

However, FOMC minutes still show division, as “many” members were uncomfortable easing next month.

With key data like CPI and the October jobs report missing due to the shutdown, policymakers are operating with limited visibility ahead of the December 10 meeting.

Economic Indicators to Watch

September retail sales (out today) will serve as a key read on U.S. consumer demand.

Durable goods orders and the Fed’s Beige Book are due Wednesday, offering a broader view of business activity and hiring trends.

The Atlanta Fed GDPNow model currently estimates Q3 growth at 4.2%, though the economist consensus is closer to 3.0%.

Earnings Today

Alibaba (BABA) – Focus on cloud growth and margin recovery amid macro headwinds in China.

NIO (NIO) – Watch for commentary on production ramp and demand in the EV market.

Workday (WDAY) – Investors will look for strength in enterprise software demand and updated FY guidance.

Movers & Shakers

(+) Broadcom ($AVGO) +11% after investors rotated back into AI stocks.

(+) Tesla ($TSLA) +7% after Elon Musk hyped up Tesla AI chips.

(–) Novo Nordisk ($NVO) -6% after the pharmaceutical company’s Alzheimer drug failed to reach its target.

Prediction Markets

Private Dealmaking

Picnic, an online grocer, raised $706 million

X-energy, a developer of small modular reactors, raised $700 million

Alembic Technologies, a causal AI startup, raised $145 million

Valar Atomics, a nuclear gigasite developer, raised $130 million

RapidSOS, an emergency-response data platform, raised $100 million

Beacon Biosignals, a neuro-diagnostics and precision medicines developer, raised $86 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Team Intelligence

Description: A fresh look at leadership that flips the script: great teams aren’t made just by charismatic leaders—they’re built by leaders who understand how to unlock collective intelligence. Jon Levy draws on fifteen years of study across Nobel laureates, Olympians, CEOs, and astronauts to identify the habits and structures that help teams exceed the sum of their parts. He explores questions like: Why do teams full of super-stars underperform? What patterns separate teams that click and create from those that don’t?

Book Length: 256 pages

Release Date: October 7 , 2025

Ideal For: Executives, team leads, founders, coaches, and anyone committed to building teams that innovate, adapt, and excel together.

“If you want podium-level results, stop managing people and start building team intelligence.”

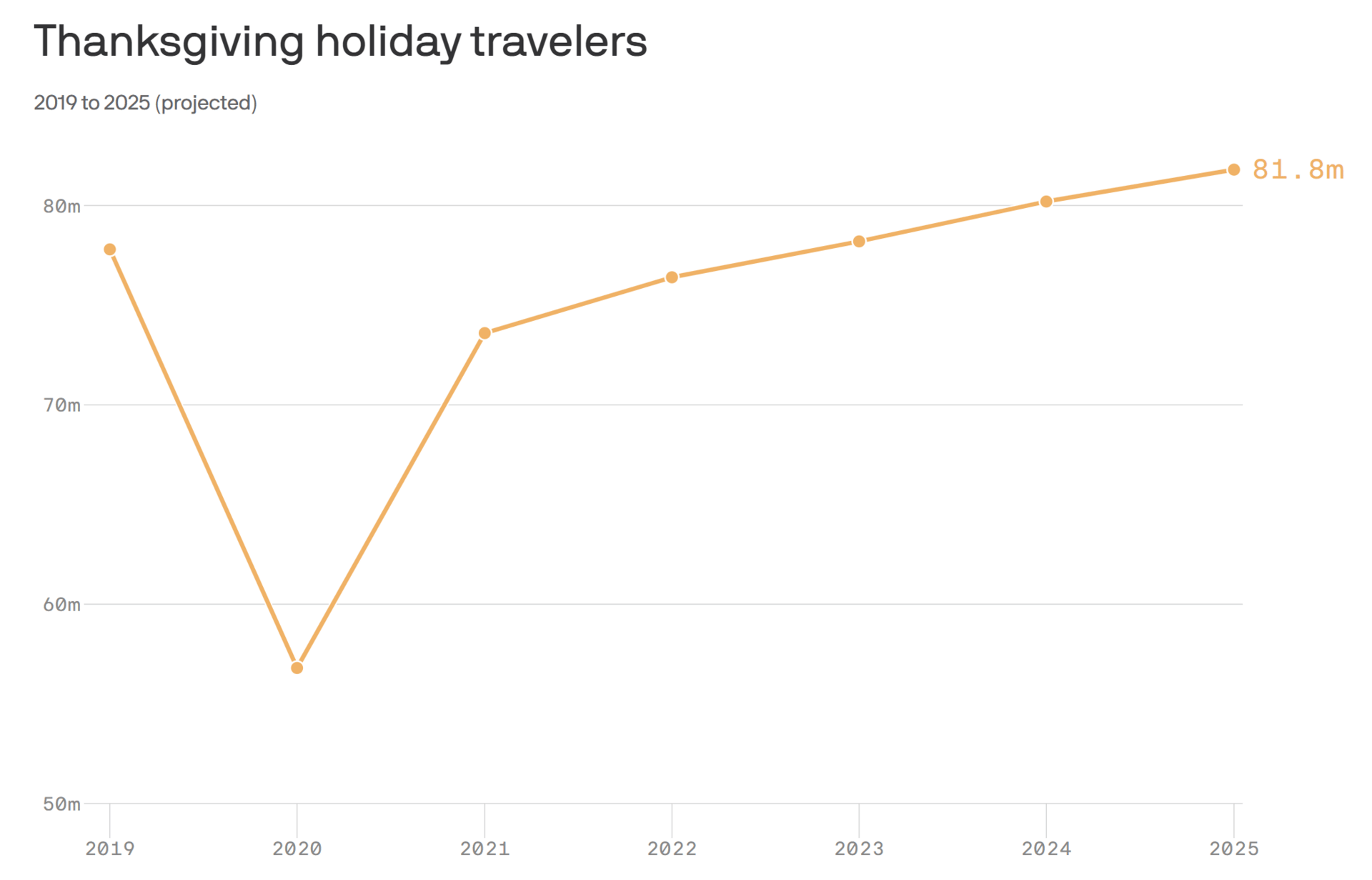

DAILY VISUAL

Record-Breaking Thanksgiving Travel Ahead

Source: Axios

PRESENTED BY BILL

State of B2B Payments Report 2025

If you're leading finance at a growing business, you're juggling a lot: fraud prevention, cash flow, operational efficiency, and trying to scale.

But, you're not alone. BILL recently surveyed more than 700 finance leaders and here's what stood out:

1 in 4 lost money to payments fraud last year

1 in 3 are bracing for cash flow challenges in the year ahead

And 88% say digital payments platforms are essential to their ability to grow

One thing was clear: finance leaders are moving away from paper-heavy processes toward smarter, more secure systems. Digital payments are no longer a nice-to-have, but a critical tool for businesses.

BILL pulled all the findings into a brand new State of B2B Payments report. If you're rethinking your payments stack or just want to see where your peers are headed, it's worth a look.

Please Support Our Partners!

DAILY ACUMEN

Failing

Pilots don’t just study how to fly. They study how to crash. Before Amelia Earhart ever set altitude records, she practiced stalls, spins, and other “failures” on purpose. When the real emergency came, she did not want to be learning under pressure.

Most of us only fail by accident. We wait for life to teach us lessons the hard way. But the smartest people, from entrepreneurs to athletes, create small, controlled failures ahead of time. They test ideas, simulate crises, and push systems to their limits.

Deliberate failure builds instinct. You learn how to recover quickly, adapt under stress, and stay calm when things fall apart. It is mental flight training: you stall the plane before it stalls you.

If you only fly on sunny days, you will panic when the storm hits. But if you have practiced falling, you will know exactly how to rise again.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply