- Short Squeez

- Posts

- 🍋 One Last AI Deal Before the Year Ends

🍋 One Last AI Deal Before the Year Ends

Plus: Every Wall Street analyst predicting a stock rally in 2026, the barbarians are at Lululemon’s gate, and Sam Altman offers $555K salary for a Head of Preparedness.

Together With

“The most important career choice you’ll make is who you marry, not your job.” — Morgan Housel

Good morning! Every major Wall Street strategist is now calling for a stock market rally in 2026. Meanwhile, Lululemon’s founder and former CEO has launched a proxy fight to overhaul the company’s board.

Private equity dealmakers are quietly setting up trusts in South Dakota to shield carried-interest income from taxes, and Sam Altman is offering a $555,000 salary to recruit a new Head of Preparedness at OpenAI.

Plus: How profitable your $500 steak really is, why private equity still has major housecleaning to do in 2026, and five reasons investors are feeling surprisingly optimistic about the year ahead.

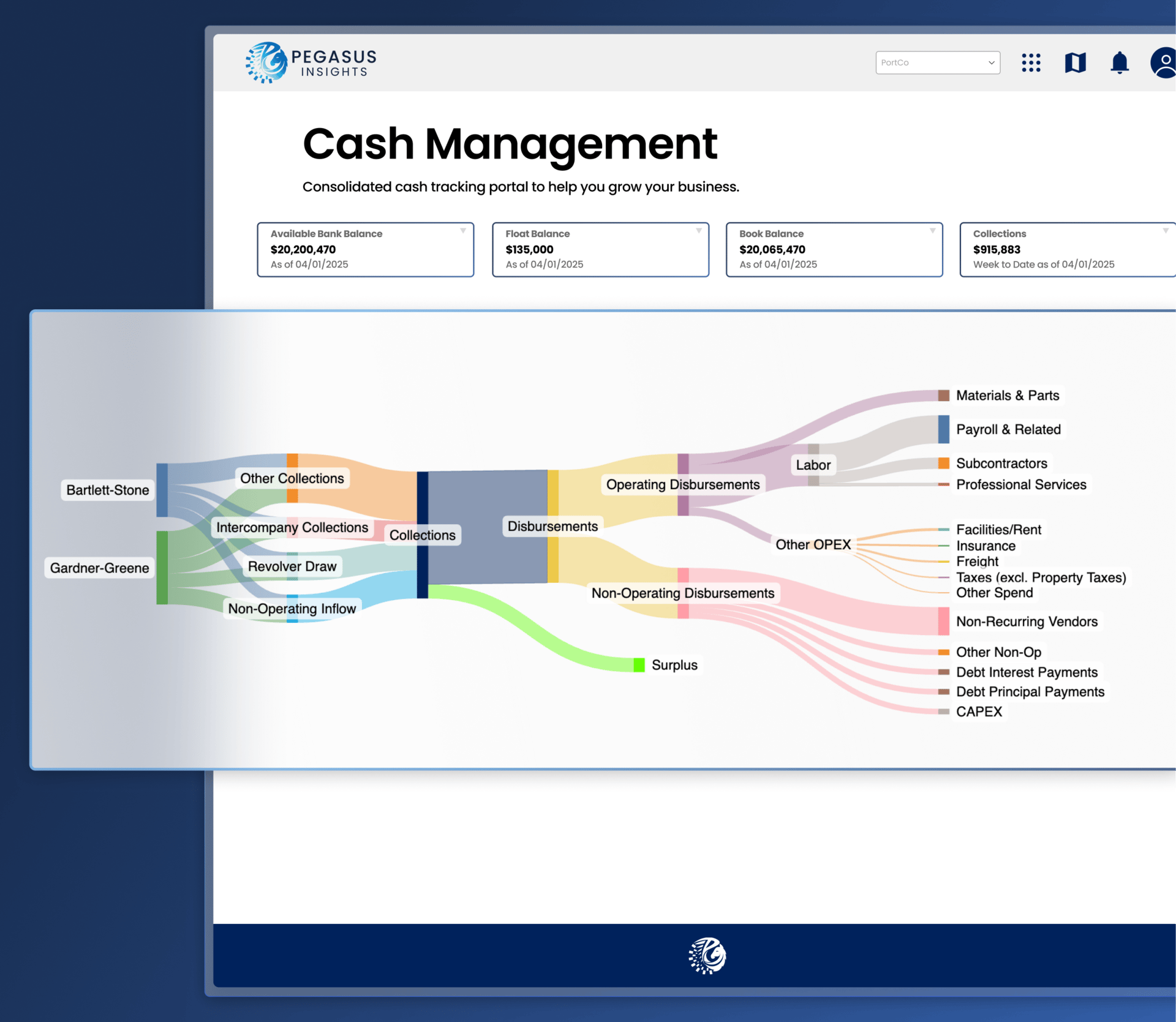

Visibility into cash, liquidity, forecasting, and working capital helps finance leaders move faster and make better decisions. See what Pegasus can do for your team.

SQUEEZ OF THE DAY

One Last AI Deal Before the Year Ends

It’s been a quiet week for dealmakers, but Masayoshi Son isn’t slowing down, announcing that SoftBank is acquiring data-center investor DigitalBridge for roughly $4 billion.

SoftBank is paying about a ~60% premium to DigitalBridge’s unaffected share price prior to takeover talks becoming public.

While DigitalBridge is often described as a data center company, it is more accurately the capital allocator behind the infrastructure. The firm has been active in digital infrastructure for over a decade and today manages ~$108 billion across data centers, fiber, towers, and edge assets.

Its portfolio includes stakes in platforms such as Switch, Vantage Data Centers, DataBank, AtlasEdge, and Yondr. If you are a hyperscaler or an AI company looking for power and racks, DigitalBridge is already your first call, and SoftBank is trying to buy the phone and overall distribution that comes with that.

The firm is led by Marc Ganzi, a longtime digital infrastructure investor who built DigitalBridge into one of the dominant independent managers in the space. Ganzi is widely credited with professionalizing the asset class and positioning the firm as the connective tissue between institutional capital and the physical backbone of the internet and cloud.

For SoftBank, this is a strategic bet on AI infrastructure rather than a short-term trade. AI demand is growing faster than data centers can be financed and built, and the real constraints are now power availability, land, and grid access.

Throughout 2025, SoftBank has been reshuffling its balance sheet to fund its AI push, including selling its entire Nvidia stake for roughly $5.8 billion. Acquiring DigitalBridge gives SoftBank immediate access to cash-flowing assets, institutional investor relationships, and influence over where AI infrastructure capital gets deployed.

SoftBank had also reportedly explored buying Switch for north of $50 billion.

Takeaway: SoftBank wants to own the land, the power, and the financing beneath the AI boom. In a world where compute is scarce and demand keeps accelerating, Son is betting that the firm controlling the capital pipeline holds the real leverage. Let’s hope this ends up better than their WeWork investment!

PRESENTED BY PEGASUS INSIGHTS

Cash Clarity Drives Confidence

In investor-backed companies, cash questions surface fast and, often, under pressure. Without real-time visibility into liquidity and runway, even strong finance teams struggle to respond with confidence.

Pegasus Insights is a real‑time cash and liquidity platform built by finance professionals with deep private equity experience. The platform pulls live data from your systems, consolidates cash positions, and automates forecasting so you can see working capital, liquidity trends, and variances without manual refreshes.

Pegasus Insights provides:

Daily cash visibility dashboards that consolidate balances

Automated 13‑week forecasting and scenario modeling

Working capital insights and spend analytics

Integration with ERPs and bank feeds to plug into existing workflows

For PE and VC operators evaluating portfolio finance teams, Pegasus Insights adds a layer of confidence and responsiveness by replacing manual processes with decision‑ready insight.

HEADLINES

Top Reads

Every Wall Street analyst now predicts a stock rally in 2026 (YF)

The barbarians are at Lululemon’s gate (CNN)

Dealmaking tops $4 trillion for only third time ever (Axios)

Starbucks doesn’t want to be on every street in NYC and LA anymore (CNN)

Sam Altman offers $555k salary to fill most daunting role in AI (Guardian)

Why private equity millionaires love South Dakota (WSJ)

Why a $500 steak dinner only yields a $25 profit (WSJ)

Private equity has more housecleaning to do in 2026 (WSJ)

5 reasons to be optimistic about the 2026 economy (BB)

Canada Pensions overseeing $1.2 trillion revamp of private equity model (BB)

Michael Burry bets he isn’t too early to go against the AI juggernaut (WSJ)

Falling price of cocaine forces drug traffickers to reuse narco-submarines (Guardian)

ETF race hits $1T at record speed with more gains coming (Fox)

Groq investor sounds alarm on data centers (Axios)

Louis Gerstner, former IBM CEO who revitalized ‘Big Blue,’ dies at 83 (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

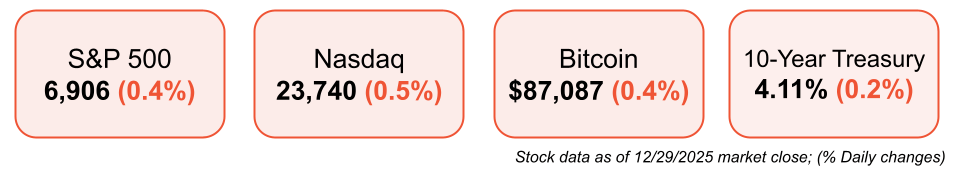

U.S. equities closed modestly lower after strong gains last week across major indexes

Defensive sectors (utilities, consumer staples) and energy outperformed; technology and consumer discretionary lagged

Asian markets were mostly lower overnight; European equities edged higher, with the Euro Stoxx 50 on track for its best year since 2003 (USD terms)

Treasury yields moved slightly lower, with the 10-year ending near 4.11%

Economic Data Highlights

Pending home sales rose to 79.2 in November, the highest level since February 2023, signaling improving housing demand

Gold fell more than 4% on the day but remains up 60%+ YTD

Currency & Global Themes

The U.S. dollar is down 9%+ YTD, on pace for its largest annual decline since 2017

A weaker dollar has boosted international returns: MSCI EAFE is up ~21% in local terms and ~32% in USD terms

Expectations for Fed rate cuts in 2026 could further narrow U.S. yield advantages, reinforcing global diversification benefits

Looking Ahead

Q3 GDP confirmed solid economic momentum, with 4.3% annualized growth and 3.5% consumer spending growth

Nonresidential investment remains a key driver, supported by strong spending on technology, software, and information processing equipment

Continued tech investment is expected to support economic growth into 2026, even as market leadership rotates

Movers & Shakers

(+) Praxis Precision Medicines ($PRAX) +13% after BTIG called the clinical-stage biopharmaceutical company a top pick for 2026.

(–) Newmont Corporation ($NEM) -6% because the price of gold and silver fell yesterday.

(–) Ultragenyx Pharmaceutical ($RARE) -42% after the company’s bone disease drug failed to reduce fracture rate.

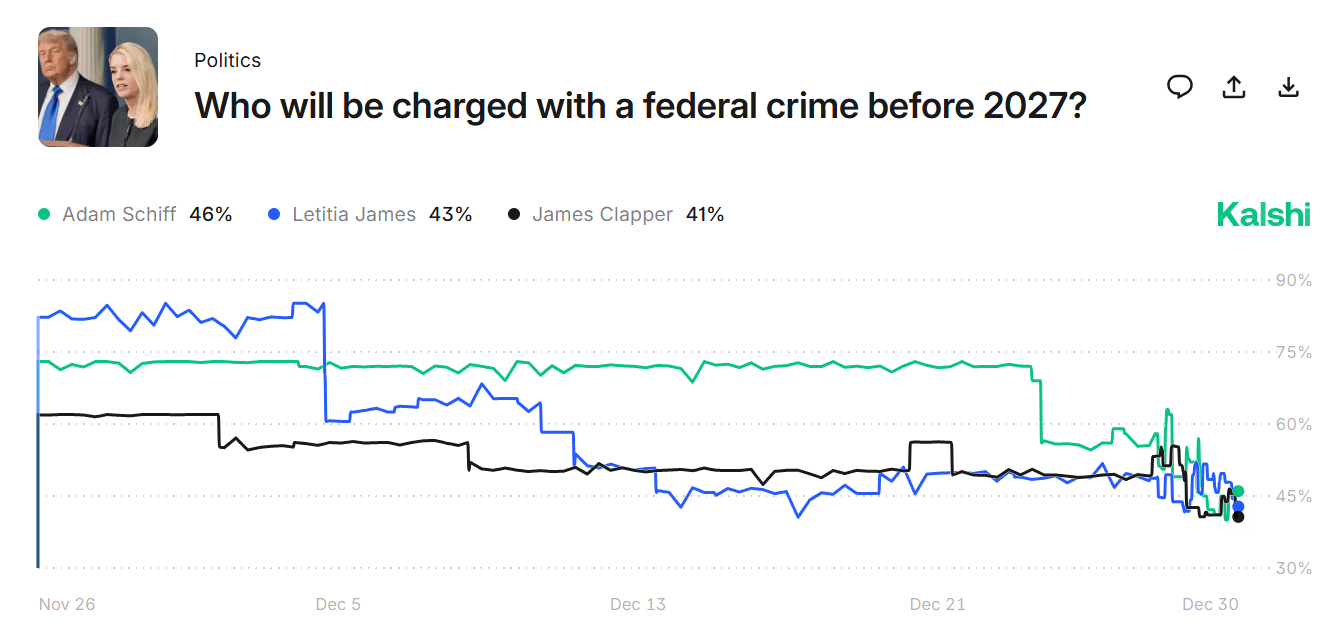

Prediction Markets

Private Dealmaking

Softbank to buy data center firm DigitalBridge for $4 billion

Titan OS, a smart TV operating system developer, raised $54 million

Medra, a platform for physical AI scientists, raised $52 million

Radial, a mental health care startup, raised $50 million

Yoodli, an AI communication role-playing platform, raised $40 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Hacking The Human Mind

Description: A smart, evidence-driven look at how the world’s most iconic brands tap into human psychology to win attention, loyalty, and preference. Shotton and Flicker reverse-engineer the behavioral science behind 17 breakout successes—showing why we pay more for bottled water, wait longer for a Guinness to taste better, or click “buy” again and again on Amazon. It’s part game-theory for marketers, part cognitive science playbook on influence.

Book Length: 224 pages

Release Date: September 30, 2025

Ideal For: Marketers, founders, strategists, and anyone who wants to understand not just what people choose, but why they do.

“The best brands don’t just sell products — they understand the mind that chooses them.”

DAILY VISUAL

Google Trends for 2025 News Topics

Source: Axios

PRESENTED BY ORNN AI

Now You Can Trade Compute

You can now trade compute with Ornn.

As AI infrastructure scales, compute prices have become increasingly volatile, yet there is no transparent market or forward curve to hedge that risk. Ornn is built to change that.

Ornn allows investors and operators to buy or sell exposure to AI compute prices without owning data centers or taking equity risk in AI companies. Contracts are structured similarly to electricity markets, enabling both hedging and speculation on AI pricing.

The platform is designed for institutional use, with market data and tools already used by top hedge funds.

Check it out today.

DAILY ACUMEN

Momentum

Newton's first law applies to more than physics: objects in motion stay in motion. This is true for your life too.

Starting is hard because you're fighting inertia. But once you're moving, continuing becomes exponentially easier. James Clear calls this "the valley of disappointment" - the period where you're working hard but seeing no results.

Most people quit here, right before the breakthrough. Bamboo shows no growth for five years while building roots, then shoots up 90 feet in six weeks.

Your efforts aren't wasted during the invisible period, they're compounding underground. Jeff Bezos didn't profit from Amazon for nearly a decade.

It took Netflix 10 years to become profitable. They understood momentum: small consistent actions create exponential results over time, but only if you don't stop.

What are you on the verge of quitting right before the breakthrough? What small action could you take today to maintain momentum?

Remember, the hardest part of any journey is the first step and the period right before success. Keep moving.

ENLIGHTENMENT

Short Squeez Picks

Does walking build muscle or burn fat?

Motivation vs. friction

3 strategies to navigate difficult leadership environments

4 Navy SEAL-approved workouts

Arthur Brooks on what people get wrong about happiness

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply