- Short Squeez

- Posts

- 🍋 Nvidia’s Christmas Dealmaking

🍋 Nvidia’s Christmas Dealmaking

Plus: The boss who gave his employees a $240M gift, Tim Cook bullish on Nike, US banks ripping, Japan deal boom, Chipotle portions, and banker charged with insider trading.

Together With

“The seduction of pessimism is that it sounds smarter than optimism.” — Morgan Housel

Good Morning! Nike jumped after Apple CEO Tim Cook doubled his personal stake, now worth about $6 million. Investors are betting on smaller private equity funds to break the deal drought. And Chipotle won a lawsuit over portion sizes.

Citi is ramping up its Japan investment banking team as dealmaking heats up. A banker was charged in a $41 million insider trading scheme tied to leaked pharma M&A secrets, and meet the boss who gave employees a $240 million gift.

Plus: U.S. banks added $600 billion in market value as deregulation hopes grow, and the six stocks BofA says will lead the $1 trillion chip surge in 2026.

The first US derivatives marketplace for AI compute is live. Sign up here for access.

SQUEEZ OF THE DAY

Nvidia’s Christmas Dealmaking

Nvidia just pulled off its biggest deal ever. On Christmas Eve, the company agreed to pay roughly $20 billion for key assets and technology from rival AI chipmaker Groq, a full-scale talent and IP grab designed to lock down the future of AI inference.

Groq was founded by the original architects of Google’s TPU and is one of the few chip designs ever positioned as a real alternative to Nvidia’s GPUs.

The company raised $750 million just three months ago at a $6.9 billion valuation. Groq wasn’t shopping itself, Nvidia came knocking anyway.

Nvidia is buying Groq’s core assets and licensing its low-latency inference technology, while Groq’s CEO Jonathan Ross, its president, and other senior leaders are joining Nvidia outright.

Groq will technically survive as an “independent” company under a new CEO, but its most valuable pieces are now inside Nvidia’s ecosystem. This mirrors a play Nvidia has already run with smaller AI hardware startups, only at an unprecedented scale.

Inference is the next battlefield. Training built Nvidia’s dominance, but running models cheaply, quickly, and in real time is where the next war will be fought. Groq’s chips were built specifically for ultra low latency inference, exactly the workload Nvidia wants to control as AI moves from data centers into real world applications.

Jensen Huang confirmed Groq’s processors will be integrated directly into Nvidia’s AI factory architecture.

At $20 billion, this nearly triples Nvidia’s prior largest deal, Mellanox at $7 billion in 2019. Nvidia can afford it. The company ended October with $60.6 billion in cash and short term investments, giving it the firepower to buy not just competitors, but the terrain around them.

Takeaway: This wasn’t a bet on Groq’s upside. It was a preemptive strike. Nvidia is using its balance sheet to eliminate credible alternatives before they become real threats, especially in AI inference where margins and platform control are up for grabs. Calling this a licensing deal is polite. In reality, Nvidia just spent $20 billion to make sure the future of AI chips runs through Nvidia.

PRESENTED BY ORNN AI

Now You Can Trade Compute

The AI bubble has a supply chain.

Right now, that supply chain runs on GPUs, power contracts, and a web of “strategic partnerships” that often look like money doing laps. Call them circular deals, channel stuffing, or pull-forwards, it’s all noise. Very few people are digging past the headlines.

Ornn Compute Exchange does. It tracks the real compute transactions actually powering AI infrastructure.

Not press releases; real GPU trades through indices that show what AI demand looks like at the hardware level - the layer that actually matters. Once you can see the compute market, you can answer the only question that matters: is the spend real?

Ornn aggregates spot compute transactions and publishes transparent GPU indices, revealing pricing, utilization pressure, and where the market is tightening, or cracking.

The AI boom runs on GPU-hours. Ornn lets you see the meter.

HEADLINES

Top Reads

Apple CEO Tim Cook buys $3M of Nike shares (NYP)

Japan's Sapporo Holdings to sell real estate business in $3B deal with KKR and PAG (CNBC)

Citigroup to boost Japan investment banking team on deal boom (BB)

Investors bet on smaller private equity funds to break deal drought (FT)

Chipotle wins lawsuit over portion sizes (NRN)

The boss who gave his employees a $240 million gift (WSJ)

Investment banker accused of leaking pharma M&A secrets in $41m insider trading scheme (BS)

Big US banks add $600B in value as deregulation spurs gains (FT)

These 6 stocks will lead the $1 trillion chip surge in 2026, BofA says (YF)

Sanofi to acquire hepatitis B vaccine maker Dynavax for $2.2 billion (CNBC)

Free streaming service Tubi is rivaling major players for viewership (CNBC)

Luxury apartments are bringing rent down in Austin, Denver (BB)

U.S. investment firm Lindsay Goldberg prevails in German dispute (Axios)

Zombie ship shows Trump is targeting darkest corner of oil fleet (YF)

In an age of AI, this startup is betting on IRL (WSJ)

BP to sell 65% stake in $10 billion Castrol lubricants to Stonepeak (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished higher, with the S&P 500 +0.3% and Nasdaq +0.2%

December continued its strong seasonal trend, with the S&P 500 up ~1.2% MTD and on track for a third straight year of 15%+ gains

Asian markets were mostly higher overnight; European equities were little changed

Treasury yields moved modestly lower, with the 10-year ending around 4.13%

Economic Data Highlights

Initial jobless claims fell to 214K, below expectations of 231K, signaling continued labor market resilience

Consumer confidence remains subdued, with the latest reading at 89.1, well below the long-term average near 100

Asset Class & Sector Trends

International equities led global performance in 2025, with the MSCI AC World ex U.S. up 30%+, its strongest year since 2009

U.S. equities posted strong gains, logging 39 new all-time highs in 2025

In fixed income, high-yield bonds and EM debt outperformed (both +8%+), while investment-grade bonds tracked toward 7%+ returns

Looking Ahead

Historically, low consumer confidence has often preceded strong equity returns; past periods with confidence between 80–90 were followed by ~13% average S&P 500 returns over the next 12 months

With steady economic and earnings growth expected, 2026 is shaping up favorably for equities

A globally diversified, equity-tilted portfolio remains preferred versus bonds as the cycle broadens

Movers & Shakers

(+) UiPath ($PATH) +7% after the automation company will join the S&P MidCap 400.

(+) Nike ($NKE) +5% because Apple’s Tim Cook bought an additional $3M in stock.

(–) D-Wave Quantum ($QBTS) -6% after a pullback in quantum stocks.

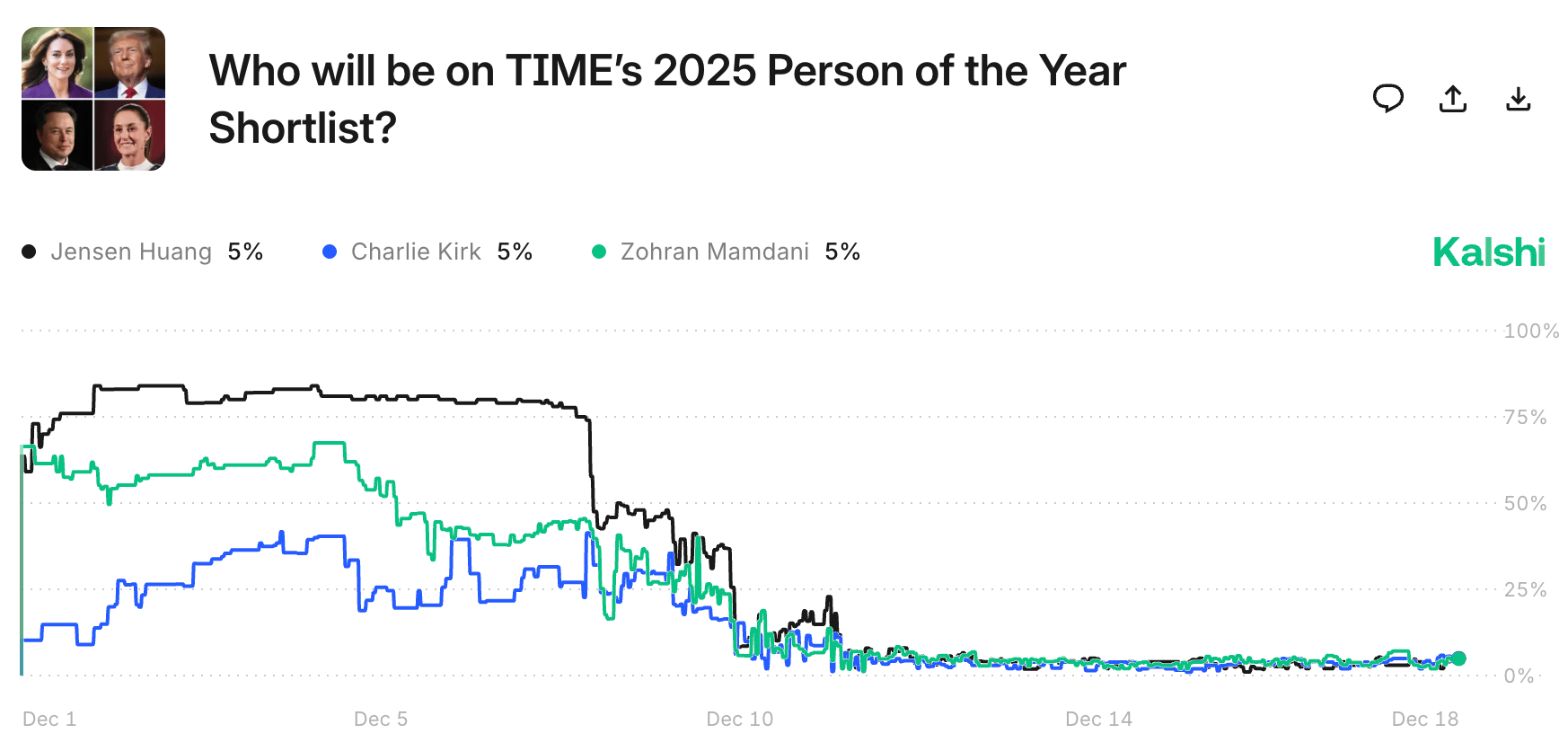

Prediction Markets

Private Dealmaking

Octane, a recreational vehicle financing platform, raised $100 million

Edison Scientific, a developer of artificial intelligence scientists for research, raised $70 million

Aeovian Pharmaceuticals, a biotech focused on cellular metabolic quality control, raised $55 million

Runware, a developer of one API for all AI, raised $50 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Art of the Good Life

Description: A crisp, incisive guide that distills timeless wisdom into 52 bite-size insights — each one a mental shift that can make daily life richer, clearer, and more purposeful. Dobelli cuts through conventional self-help fluff and cognitive blind spots, offering deceptively simple reframes and habits that sharpen judgment, enhance relationships, and build a life worth living. Think of it as a mental toolshed for thriving, not just surviving.

Book Length: 336 pages

Release Date: 2017

Ideal For: Thinkers, doers, and anyone looking for practical, idea-driven ways to rethink success, happiness, and how we spend our attention.

“The good life isn’t found — it’s constructed, one thoughtful choice at a time.”

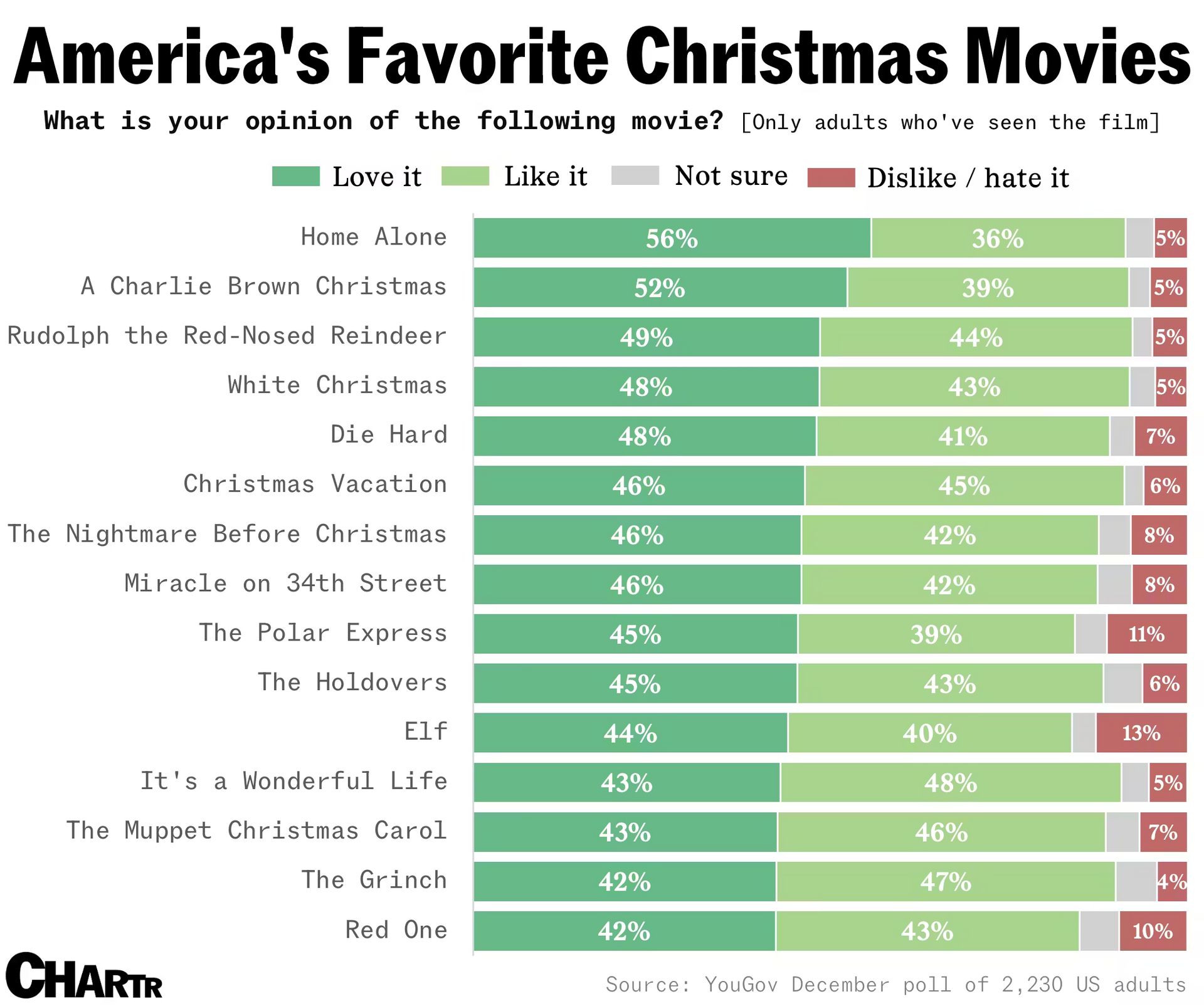

DAILY VISUAL

Home Alone Tops The Tree

Source: Chartr

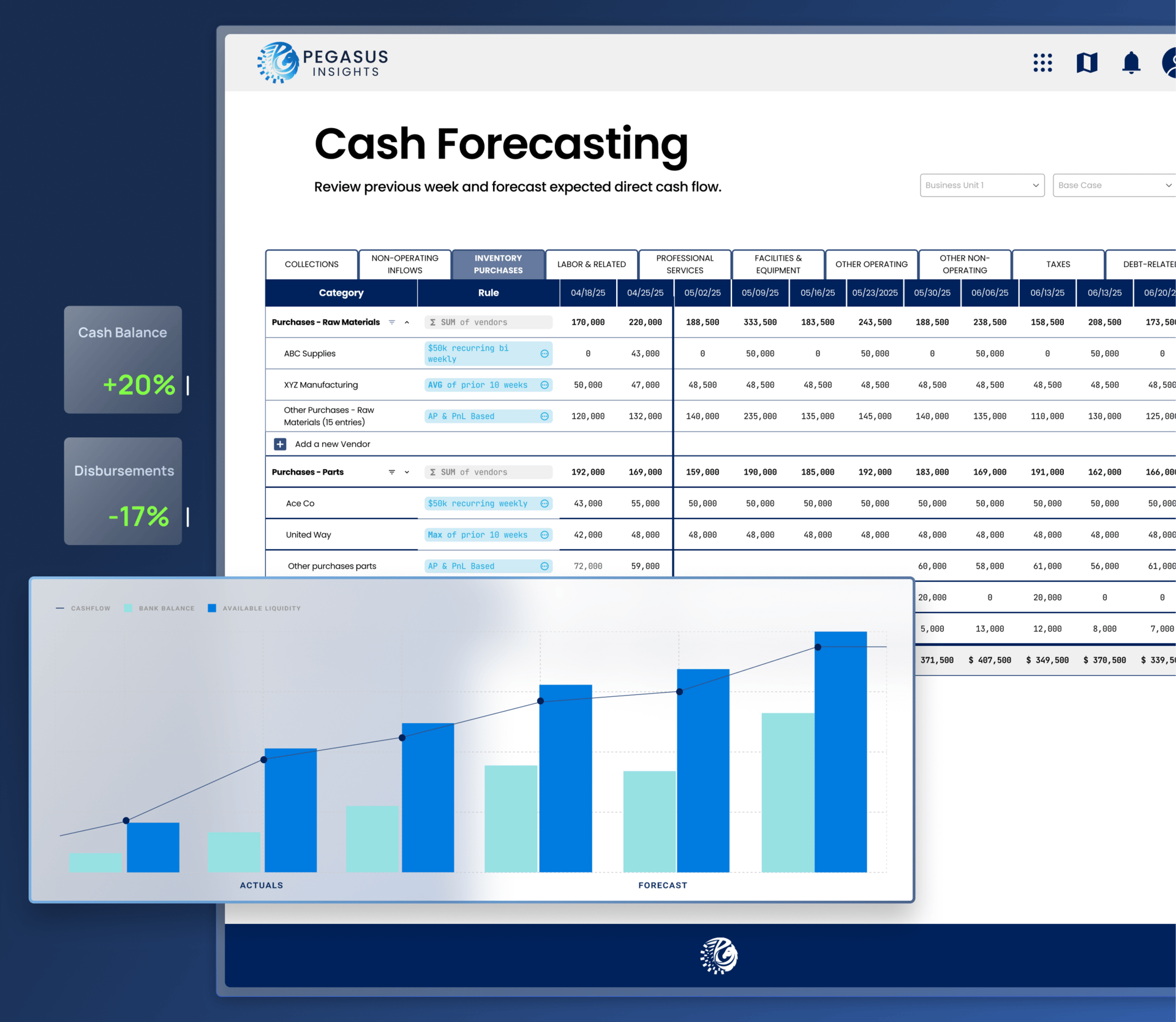

PRESENTED BY PEGASUS INSIGHTS

Cash Clarity Drives Confidence

In investor-backed companies, cash questions surface fast and, often, under pressure. Without real-time visibility into liquidity and runway, even strong finance teams struggle to respond with confidence.

Pegasus Insights is a real‑time cash and liquidity platform built by finance professionals with deep private equity experience. The platform pulls live data from your systems, consolidates cash positions, and automates forecasting so you can see working capital, liquidity trends, and variances without manual refreshes.

Pegasus Insights provides:

Daily cash visibility dashboards that consolidate balances

Automated 13‑week forecasting and scenario modeling

Working capital insights and spend analytics

Integration with ERPs and bank feeds to plug into existing workflows

For PE and VC operators evaluating portfolio finance teams, Pegasus Insights adds a layer of confidence and responsiveness by replacing manual processes with decision‑ready insight.

DAILY ACUMEN

Reflection

Benjamin Franklin asked himself two questions every evening: "What good have I done today?" and "What could I have done better?"

Ray Dalio keeps a detailed journal of his decisions and outcomes.

The U.S. military conducts "After Action Reviews" after every operation. They understand that experience alone doesn't create wisdom, reflected experience does.

Most people repeat the same patterns without pausing to extract lessons.

Schedule time for reflection. Daily, weekly, monthly. What went well? What didn't? What will you do differently?

Remember, you don't learn from experience. You learn from reflecting on it.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply