- Short Squeez

- Posts

- 🍋 Miami Overtakes NYC?

🍋 Miami Overtakes NYC?

Why Ken Griffin thinks Miami could overtake NYC as the world's financial capital, plus wholesale prices dropped to its lowest since April 2020.

Together With

“I want tension in my business. Tension creates change.” — Ken Griffin

Good Morning! OpenAI is trying to poach Google workers with $10M pay packages. SpaceX got the green light to resume launches - and an IPO for Starlink might come as soon as 2024. Wholesale prices dropped the most since April 2020, thanks to oil prices plummeting. Microsoft dropped its first custom AI chip, cloud CPU. And Juul is making a comeback, raising $1.3 billion in funding.

Today’s edition is brought to you by hear.com - the device ushering in a new era of hearing clarity.

SQUEEZ OF THE DAY

Miami Overtakes NYC?

Find someone who loves you as much as Ken Griffin loves Miami.

Ken Griffin, the founder of Citadel, set up shop in Miami during the pandemic. And now he's warning that NYC might need to watch its throne as the world’s financial capital - Miami is eyeing that crown.

Some people refer to Miami as "Wall Street South," but Griffin's hinting at a future where New York might be renamed "Brickell Bay North" in 50 years.

Griffin might be a little biased since he grew up in South Florida. But out of the 158 Wall Street firms that have left NYC since the pandemic, 56 decided to head to the Sunshine State. And a total of $1 trillion in AUM has left the Big Apple since 2020.

Why the Miami migration? Blame it on the perks – a friendlier business environment, lower taxes, better weather and cheaper mansions. But don't get it wrong, Griffin is still bullish on NYC. He's laying the groundwork for a skyscraper on Park Ave for Citadel, set to be even taller than the Empire State Building by 2032.

Takeaway: Ken Griffin says NYC is still “an epicenter of thoughtful people passionately engaged in their careers” - and we agree. It’s going to take a lot more than a few major firms to undo decades, if not centuries of Wall Street history. But Miami’s ascent is pretty impressive - the city played 2nd or 3rd fiddle in finance until very recently.

CAPITAL PULSE

Markets Rundown

Stocks closed higher led by Target’s strong earnings.

Movers & Shakers

(+) Target ($TGT) +18% after the retailer posted a big earnings beat.

(+) Expedia ($EXPE) +6% after ValueAct Capital Management acquired a stake in the online travel company.

(–) Energizer ($ENRR) -7% after the battery maker received a downgrade by JPMorgan.

Private Dealmaking

Urbanic, a London-based fashion brand, raised $150 million

VectorY Therapeutics, an antibody therapies developer, raised $138 million

Blockchain.com, a digital assets platform, raised $110 million

Petvisor, a veterinary management platform, raised $100 million

Imprint, a credit card startup, raised $75 million

Puzzle, a generative AI platform, raised $30 million

For more PE & VC deals, subscribe to Buysiders.

SPONSORED BY HEAR.COM

A New Standard For Hearing Clarity

Discover unparalleled speech clarity with advanced, state-of-the-art hearing aids. Immerse yourself fully in crystal-clear sound, with features like Bluetooth and smartphone connectivity.

Thanks to the world's first dual processing system, you can now enjoy clear speech with minimum background distractions in even the noisiest environments.

Take comfort in knowing that you're choosing a hearing aid that people genuinely enjoy wearing.

HEADLINES

Top Reads

Regulators defend new banking rules in Senate testimony (Axios)

Goldman discusses bigger bonuses for top traders (Reuters)

Ken Griffin says WFH may fuel corporate job cuts (BB)

Goldman CEO predecessor Blankfein talks careers as analysts compete (Reuters)

JPMorgan, Apollo reimagine wealth management with tokenization (Axios)

Payments app war drags banks into discomfort zone (Reuters)

Cathie Wood is still all-in on Bitcoin (YF)

Citi begins layoffs in Jane Fraser’s overhaul (CNBC)

Private equity pay gains to slow (WSJ)

Goldman doesn’t see rate cut until Q4 2024 (YF)

BOOK OF THE DAY

Winner Sells All

For years, Walmart and Amazon operated in separate spheres—one a massive brick-and-mortar retailer, the other an online giant. But in 2016, Walmart aggressively moved into the world of e-commerce, while Amazon made big bets in physical retail.

The resulting rivalry is a bare-knuckle power struggle as each titan tries to outmaneuver the other to become the biggest omnichannel retailer in the world.

As the two mega-corporations have consolidated power, troubling consequences have also emerged—for consumers and small merchants faced with fewer buying and selling options, and for millions of workers paid meager wages for demanding and sometimes dangerous work.

Winner Sells All is a tale of disruption and big money moves, with legendary executives and fearless entrepreneurs in a battle—between rival corporations and sometimes even within the same company—to invent the future and cement their own legacies.

Veteran journalist Jason Del Rey chronicles the defining business clash of this generation—a war waged for our loyalty and our wallets, with hundreds of billions of dollars at stake and millions of jobs on the line.

As both companies continue to expand their empires into new industries, Winner Sells All reveals how this battle will change the ways we shop, live, and work—for decades to come.

“A riveting investigation of the no-holds-barred battle between Amazon and Walmart to become the king of commerce.”

ENLIGHTENMENT

Short Squeez Picks

6 hacks to look and feel more confident at work

4 small changes to banish winter sadness

Adam Grant on the 3 biggest challenges facing workers right now

Why successful companies and leaders pass the grandma test

What nobody tells you about getting rich

DAILY VISUAL

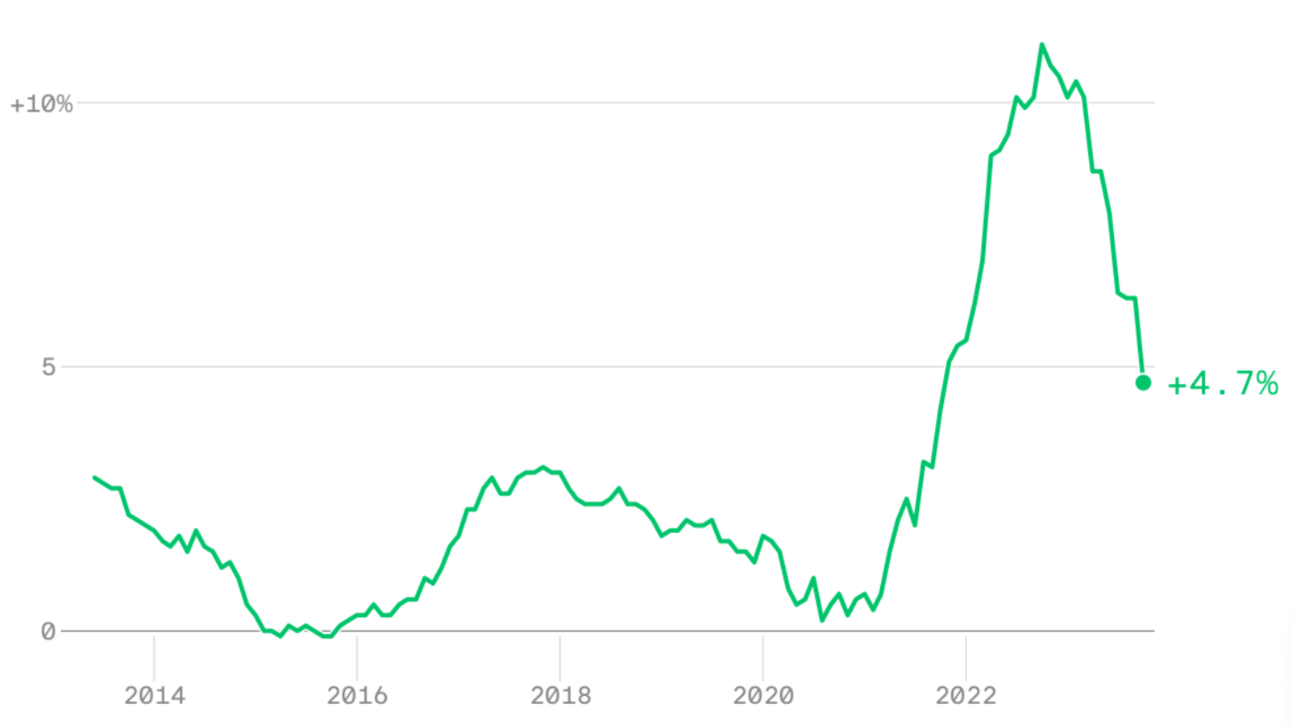

UK CPI Finally Cools

Annual change in UK Consumer Price Index

Source: Axios

SPONSORED BY ECKARD

Eckard Helps Investors Build And Protect Wealth

Looking to generate passive income where you can get 16%+ or better returns?

Eckard presents an investment avenue that turns traditional real estate on its head!

Invest in Mineral Rights:

Own the Hidden Treasure: Mineral rights grant you exclusive ownership of subsurface minerals. It's like real estate, but underground.

Consistent Passive Royalties: Once onboard, you're poised to receive monthly passive royalties, reaching heights of over 20%!

Eckard's Expertise: Rest easy knowing Eckard manages everything, allowing you to reap the rewards. Their state-of-the-art app ensures you have complete visibility, transparency, and access to your investments, anytime, anywhere.

Ready to Revolutionize Your Investment Strategy?

Fill out this form and step into the future of passive income with Eckard.

DAILY ACUMEN

Superlinear Returns

"One of the most important things I didn't understand about the world when I was a child is the degree to which the returns for performance are superlinear.

Teachers and coaches implicitly told us the returns were linear. "You get out," I heard a thousand times, "what you put in." They meant well, but this is rarely true. If your product is only half as good as your competitor's, you don't get half as many customers. You get no customers, and you go out of business.

It's obviously true that the returns for performance are superlinear in business. Some think this is a flaw of capitalism, and that if we changed the rules, it would stop being true. But superlinear returns for performance are a feature of the world, not an artifact of rules we've invented.

We see the same pattern in fame, power, military victories, knowledge, and even benefit to humanity. In all of these, the rich get richer.

You can't understand the world without understanding the concept of superlinear returns. And if you're ambitious you definitely should, because this will be the wave you surf on."

Source: Paul Graham

HEARD AROUND THE STREET

Wall Street Corner

Top 5 Fat Finger Mistakes in History

Gone are the days when investment bankers made deals like the Wolf of Wall Street, screaming at each other on the phone.

Instead, Wall Street has turned to Microsoft Excel and, with it, fat finger mistakes that can cost companies and investors millions of dollars. Here are our top 5 Fat Finger Mistakes.

5. Bank of America - 2006 ($50 Million)

Not the largest by sheer volume, but a BofA trader definitely got fired when a rugby ball tossed across the bullpen landed on a keyboard, executing a $50 million erroneous trade.

4. University of Arizona - 2023 ($240 million)

It looks like either the intern or famous alumnus Gronk is running the budget/cooking the books at the University of Arizona. This week, the university’s president admitted that their financial model miscalculated the Athletics Dept budget by $240 million. They thought they had 156 days of cash on hand, but they only have 97 - and will have to start making cuts to sports.

3. Lazard - 2016 ($400 million)

We all know Lazard analysts are sleep-deprived. But one of them made a massive blunder during SolarCity’s $2.6 billion sale to Tesla in 2016. The bank made an error in its DCF analysis discounting the value of SolarCity by $400 million.

2. Citi - 2020 ($900 Million)

Citi was trying to make an interest payment to the lenders of cosmetics company Revlon in 2020. But they accidentally sent over a whopping $900 million. Citi blamed it on an operational error. Here’s where it gets real crazy - the judge sided with the lenders arguing that they were justified to believe it was a legitimate payment. Revlon didn’t have to pay Citi back - until a federal appeals court overturned the decision 2 years later.

1. Deutsche Bank - 2015 ($6 Billion)

When the Deutsche recruiter tells you they love giving responsibility to juniors, don’t just take their word for it. A junior trader on the FX team accidentally sent a $6 billion payment to a hedge fund client. His manager was on holiday, and the trade just had “too many zeroes” - so you can definitely blame it on the fat fingers.

JOB BOARD

Featured Jobs

TheGuarantors - Head of Finance - New York, NY

ResortPass - VP - New York, NY

BBC - Director, Finance - New York, NY

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply