- Short Squeez

- Posts

- 🍋 Megafunds Begging For Your Money

🍋 Megafunds Begging For Your Money

Plus: Evercore's secondaries team on a generational run, China bans influencers without diplomas, Solomon says AI won’t be a job killer, and KDP raising $7B from Apollo and KKR.

Together With

“Doing nothing is often the hardest, most courageous thing an investor can do.” — Howard Marks

Good morning! Evercore’s secondaries team is on a generational run, advising on roughly half of all secondary transactions and generating more than $350 million in fees on over $75 billion in volume over the past year.

Goldman CEO David Solomon says AI won’t destroy human jobs: “Yes, job functions will change…but I’m excited about it.” Amazon plans to cut up to 10% of its 350,000 corporate staff. Keurig Dr Pepper is raising $7 billion from Apollo and KKR to fund its JDE Peet’s acquisition, and regional lender Huntington is acquiring Cadence Bank in a $7.4 billion deal.

Plus: Elon Musk could walk if shareholders reject his $1 trillion pay package, JPMorgan is offering staff an AI chatbot to write performance reviews, China bans influencers without diplomas, and Lululemon partners with NFL to launch officially licensed apparel for all 32 teams.

Purpose-built, auditable AI that fits the nuance of your investment research process. Try Portrait today.

SQUEEZ OF THE DAY

Megafunds Begging For Your Money

For years, firms like Blackstone and Apollo wouldn’t even take a multi-millionaire investor’s calls. If you asked your private banker about investing, they’d tell you the fund was oversubscribed or the minimum check size is $10 million. The exclusivity was the point and was supposed to be a huge value-add.

Now those same firms are running national TV ads, sponsoring Formula 1 teams, and flooding advisers’ inboxes with sales pitches.

Their new gold rush is America’s $13 trillion 401(k) market. After regulators cleared the way for private equity and credit funds to enter defined-contribution plans, the industry’s biggest players saw their next golden goose.

Blackstone’s Eureka! campaign channels an old Western, complete with prospectors chasing treasure, while Apollo’s What If blitz asks workers if the “old playbook” is holding them back. Carlyle and Blue Owl are chasing the same retail investors, buying logos on tennis stars and golf tournaments.

The firms that once turned investors away are now cold-calling them. Wealth managers say their inboxes have been overflowing for months. One adviser in Los Angeles said they’ve received more than 100 emails this year from Apollo, Blackstone, and KKR. Others report relentless webinar invites, LinkedIn messages, and even birthday notes.

“Based on the inbound calls and meetings, they must be having a tough time finding capital to commit,” said Thomas Van Spankeren of Rise Investments.

With institutional capital cooling after years of weaker returns and slower distributions and pension funds pulling back, Wall Street’s biggest private firms need new money to keep their machines running. Retail investors, and especially 401(k) savers, are the last untapped pool deep enough to move the needle.

Takeaway: The timing does feel a bit suspicious. With public markets near record highs and private credit showing early stress, high-fee lockups are a harder sell. But one thing is clear: even the most exclusive corners of Wall Street eventually have to chase new fees. Whether your 401(k) ends up in the mix is up to you, but the tables have definitely turned.

PRESENTED BY PORTRAIT

AI-Powered Analysts That Handle Research and Thesis Monitoring

Understanding a business means going beyond numbers: the history, competitive dynamics, and thesis signposts that matter. But building that depth takes time you don't have.

Portrait helps you go deeper, faster on every business. It's like adding an army of analysts to your team, powered by proprietary AI systems designed for research workflows.

What makes it different:

Idea generation that understands nuance and surfaces ideas that fit your mental models.

Custom reports with full auditability to rapidly build context and answer challenging questions.

Intelligent 24/7 thesis monitoring that tracks what matters to your case while filtering noise.

It’s built by former investors who understand the value of having the right information, organized the right way, at the right time. Focus on what matters. Portrait handles the rest.

Please Support Our Partners!

HEADLINES

Top Reads

Evercore's rainmaker is driving private equity's $200B boom (BB)

AI isn’t taking banking jobs, Goldman CEO says (Axios)

Huntington Bancshares to acquire Cadence Bank for $7.4 billion (CNBC)

Amazon targets as many as 30,000 corporate job cuts (CNBC)

Apollo, KKR invest $7 billion into Keurig Dr Pepper (YF)

Tesla chair warns Musk could leave if shareholders reject his $1T pay package (YF)

JPMorgan offers staff AI chatbot to help write performance reviews (FT)

Lululemon to sell NFL apparel for the first time in new Fanatics partnership (BB)

Poland signs Palantir, Anduril deals amid record army spending (BB)

Blackstone hires Apollo’s European buyout boss (FT)

U.S. companies strike $80B in mergers as Trump boosts dealmaking (FT)

Private-credit giants eye opportunity in Saudi Arabia’s liquidity squeeze (BB)

Saudi Arabia set to become a global AI and data-center hub, says Groq CEO (CNBC)

Wall Street zeros in on Big Tech capex as OpenAI spending spree intensifies (CNBC)

AI-hiring startup Mercor raises fresh funding at $10B valuation amid talent-wars boom (CNBC)

Free Jamie Dimon and in support of lighter regulatory reins on big-bank CEOs (WSJ)

Private equity executives flock to pensions (FT)

China passes new law requiring influencers to hold professional credentials (BT)

CAPITAL PULSE

Markets Rundown

Market Update

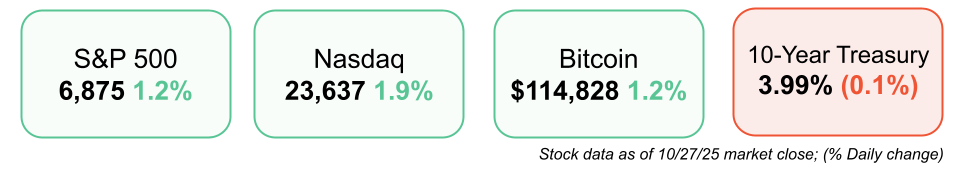

Stocks closed higher as the S&P 500 and Nasdaq hit new record highs, driven by gains in communication and technology sectors.

Trade developments were in focus, with President Trump set to meet with Asian leaders, including China’s Xi Jinping and Japan’s Sanae Takaichi, at this week’s APEC conference.

Bond yields edged lower, with the 10-year Treasury at 3.99%.

Japan’s Nikkei surged past 50,000 for the first time, leading broad gains across Asia.

The U.S. dollar weakened against major currencies.

Economic Data Highlights

Earnings season continues to beat expectations, with 84% of S&P 500 companies reporting results above estimates so far.

Earnings growth is tracking near 8.7% year-over-year, led by technology, financials, and materials sectors.

Broader market performance remains supported by diverse sector strength and resilient profitability.

The focus now shifts to Magnificent 7 earnings this week, as investors gauge the sustainability of tech-driven gains.

Reported Earnings

NXP Semiconductors (NXPI) – Delivered solid results, with strength in automotive chip demand and improving margins.

Waste Management (WM) – Reported steady revenue growth, supported by higher recycling volumes and cost control.

Earnings Today

UPS (UPS) – Focus on shipping volumes, pricing trends, and cost savings from restructuring efforts.

PayPal (PYPL) – Watch for updates on transaction growth, take rates, and progress on AI-driven fraud detection.

Visa (V) – Key to monitor consumer spending patterns and cross-border transaction momentum.

Movers & Shakers

(+) Qualcomm ($QCOM) +11% after announcing a new chip that can compete with Nvidia.

(+) Tesla ($TSLA) +4% after Cantor Fitzgerald increased its price target to $510 from $355.

(–) iRobot Corp. ($IRBT) -34% after a search for a buyer has stalled.

Prediction Markets

The Fed rate decision is tomorrow. Will they cut 25bps? (96% chance)

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Ares Management and Makorora Management bought Plymouth Industrial REIT for $2.1 billion

Seneca, a maker of firefighting drones, raised $60 million

Anrok, a sales tax compliance automation startup, raised $55 million

Spellbook, an AI contract reviewer, raised $50 million

Caracol, a developer of large-format robotics, raised $40 million

OneImaging, a radiology platform, raised $38 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

All the Cool Girls Get Fired

Description:

A bracing, candid, and empowering roadmap for turning a professional setback into a breakthrough moment. Brown and O’Neill—both once at the top of their fields and suddenly out of work—reframe getting fired as not a failure but a rite of passage. With humor, grit, and insider insight, they blend personal narrative with practical tools (think severance negotiation, reframing identity, vision-boarding your next move) to help you recalibrate your career, reclaim your value, and build a comeback that’s not just successful, but aligned.

Book Length: 288 pages

Release Date: October 14, 2025

Ideal For: Anyone who’s ever been laid off, reorganized out, or simply feels stuck in career limbo—especially professionals, creative leaders, and women ready to rewrite the narrative around job loss.

“Getting fired isn’t a shutdown—it’s the signal to pivot, rebuild, and show up on your own terms.”

DAILY VISUAL

Secondaries Booming

Source: Bloomberg

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money to Make Money

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 6–12% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

Please Support Our Partners!

DAILY ACUMEN

The Small Game

We all want to play the big game: raise capital, build empires, make headlines.

But every big game is built on a small one — a rhythm of unglamorous repetitions no one applauds.

The small game is sending one more email, showing up on time, editing the draft again.

People lose because they stop playing the small game too early.

The irony is that once you master it, the big game plays itself.

ENLIGHTENMENT

Short Squeez Picks

Why you have no energy

In times of uncertainty, Gen-Z is locked in

How to deep clean your kitchen in an hour or less

How to set up a morning routine to thrive

Do you really need a new laptop?

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply